Business

Canadian farm producing consumable crickets lays off two-thirds of its employees

From LifeSiteNews

The workforce reduction at a London, Ontario, facility that received $8.5 million in government funding appears to be a sign that Canadians do not have an appetite for bugs.

It appears Canadians’ taste for eating food made from bugs is not in high demand after news broke that a farm given millions by the federal government to raise crickets for “human and pet consumption” laid off two-thirds of its staff.

The cricket farm in London, Ontario, run by the Aspire Food Group just broke ground on a new 150,000-square-foot facility last year. The company said it was cutting shifts and going from 150 workers to 50.

In comments made to the trade news outlet AgFunderNews, company CEO David Rosenberg said the layoffs are due to making “improvements to its manufacturing system.”

The fact the company is already cutting costs in dramatic fashion comes only a short time after Canada’s federal government under Prime Minister Justin Trudeau contributed $8.5 million to it in 2022.

The cricket farm when fully operational can make 13 million kilograms of crickets for “human and pet consumption.”

It was given widespread coverage several years ago by Canada’s state-funded CBC, which billed it as the “world’s largest cricket production facility.”

Aspire’s pitch that its food had a lower environmental footprint than protein from cattle or pigs was in lockstep with the radical environmental goals of the Trudeau government as one of the reasons it landed a large grant.

According to AgFunderNews, only a year ago Aspire claimed its factory would be working at 100 percent by the start of 2024.

“We have significant contractual commitments for the majority of our production and expect 100% will be sold within the year,” former CEO Mohammed Ashour told AgFunderNews in March 2023.

Groups such as the Canadian Taxpayers Federation (CTF) blasted the federal government for subsidizing companies that make food out of crickets for human consumption, saying it amounts to giving Canadians “their ‘let them eat crickets’ moment.”

Both crickets and mealworms in recent years have been promoted by global elites as a source of protein that they say could replace beef or pork, and which can also be used in a variety of foods.

Indeed, the Great Reset of Klaus Schwab and his World Economic Forum (WEF) has as part of its agenda the promotion of eating bugs to replace beef, pork, and other meats that they say have high “carbon” footprints.

Conservative Party says layoffs at bug factory show ‘Canadians will not eat bugs’

The Conservative Party of Canada in an email to members said that the news regarding Aspire cutting most of its staff is proof that Canadians “will not eat bugs.”

“Justin Trudeau bet $9 million of your money on edible BUGS! He wants Canadians to own nothing, be happy, and eat crickets,” the party said in the email.

“But his bet failed. The company he invested YOUR tax dollars in has dramatically cut production and fired two-thirds of their staff. Turns out, Canadians don’t want to eat bugs.”

In 2022, Conservative MP Leslyn Lewis blasted the current cancel-culture crusade against red meat by pushing bugs as a source of food and the Trudeau government for funding bug factories.

The Trudeau government has implemented many policies that align with the WEF’s so-called “climate change” agenda, including a punishing carbon tax, and attacks on the nation’s oil and gas industries.

According to records, since 2018, a total of $420,023 has been spent on helping multiple food companies that make human bug food.

At the same time, the Trudeau government has begun to attack Canadian farmers by pushing forth an agenda that would force them to reduce the amount of nitrogen-based fertilizer. This could have a large negative impact on the growing of feed for cattle as well as food for human consumption.

Aspire is not the only factory in Canada breeding bugs to turn them into food for both human and animal consumption. The CTF listed all of the cricket processing companies that receive corporate welfare.

Dr. Joseph Mercola, in a blog posted by LifeSiteNews, documented how Schwab’s Great Reset agenda looks to force the world’s population to, by pressuring local governments, make people “consider eating bugs and weeds and drink ‘reclaimed’ sewage.”

Business

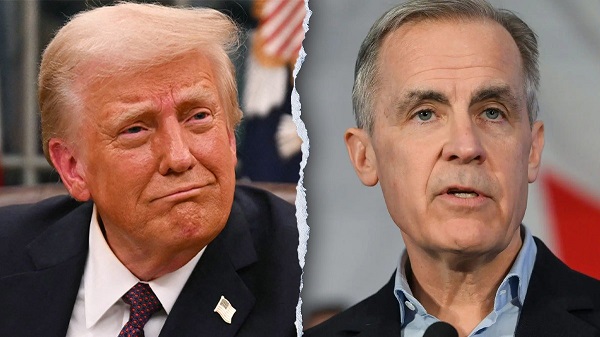

Carney’s Bungling of the Tariff Issue Requires a Reset in Canada’s Approach to Trump

Rank and file Americans are best positioned to insist upon a relaxation of Mr. Trump’s tariff policies – that populist base which Mr. Carney neither understands nor respects but whom the President cannot afford to ignore or alienate if he wishes to retain their political support.

By now it is becoming apparent that Mark Carney’s government is seriously bungling Canada’s response to U.S. President Donald Trump’s tariff initiatives. By ill-advisedly imposing counter-tariffs only to withdraw them later, Ottawa temporarily played with “elbows up” – only to learn that, as in hockey, pursuing such a strategy in the absence of a strong offence simply draws penalties and gives the other side a manpower advantage.

As the list of Mr. Carney’s missteps on the tariff file grows – costing Canadians jobs, incomes, and increases in prices – surely it is becoming clear that a fundamental reset is required in Canada’s approach to Mr. Trump and his tariff initiatives if their negative consequences for both Canada and the U.S. are to be overcome.

So what and where is the reset button that could be pushed to redress those initiatives? Who is in the best position to push it, and when is the best opportunity to do so?

That button is not to be found in Washington or on Wall Street, but rather among those to whom Mr. Trump made a promise – time and time again – namely, the American people. “We’re going to get the prices down. We have to get them down. It’s too much. Groceries, cars, everything. We’re going to get the prices down,” he declared repeatedly throughout the 2024 presidential election campaign.

That was the promise. But the current reality is price increases for Americans on food, energy, furniture, and paper products, as well as projected increases in the cost of homes, industrial structures, and public infrastructure as tariffs on steel, aluminum, softwood lumber and timber take their toll. In other words, the reality is not a decrease but an increase in the cost of living for millions of American consumers and voters.

Who then is best positioned to insist upon a relaxation of Mr. Trump’s tariff policies? Not Mr. Carney and his officials, nor even the traditional Washington influencers, but those rank-and-file Americans comprising the massive populist wave that put Mr. Trump in the White House for a second time – that populist base which Mr. Carney neither understands nor respects but whom the President cannot afford to ignore or alienate if he wishes to retain their political support.

So when will be the first real opportunity for Mr. Trump’s core constituency to speak to him effectively – through their votes – about modifying his approach to tariffs? It will be in the months running up to the midterm congressional elections in November, 2026, in which the 435 seats of the House of Representatives and, more crucially, the 35 seats in the US Senate, will be up for election.

Most of those Republican candidates standing for election will want to be pro-Trump to retain hardcore Republican voters, but they will also want to be anti-tariff to secure the support of voters suffering from tariff-induced price increases. How can they be both? By being fully supportive of Mr. Trump’s war on illegal drugs and migrants, bloated bureaucracies, and the mis-management of government finances, while at the same time campaigning as “tariff modifiers”. By asking voters to send them to Washington to support Mr. Trump but to remove the price-increasing-sting of his tariff policies through the negotiation of “reciprocity agreements” with major US trading partners to achieve that objective – just as former president William McKinley, whom Mr. Trump professes to admire, did many years ago.

The election of just a few tariff-moderating Republicans to the U.S. Senate in 2026, to be present when the tariff bill embodying Mr. Trump’s policies eventually gets to that chamber, will do more to improve tariff-disrupting Canada-U.S. trade relations than the ineffectual efforts of those like Mr. Carney who seek to get to Mr. Trump by traditional elite-to-elite negotiating practices.

Getting to Mr. Trump on the tariff issue through his own populist base raises some obvious questions. Which U.S. states, for example, are experiencing the greatest price increases as a result of the tariff wars, and of those, which offer the greatest opportunities to nominate and elect tariff-modifying Republicans to the Senate? Where in the U.S., at the state or national level, are there the beginnings of a grassroots tariff-modification movement, and how might such a movement be encouraged and supported by Canadians as well as Americans.

Americans of course have a vested interest in securing research-informed answers to such questions. But so do Canadians. More on these questions and answers shortly. They are the keys to achieving the desire of the vast majority of rank and file citizens on both sides of the border for a restoration of amicable economic and social relations between our two countries.

Subscribe to Preston’s Substack.

For the full experience, upgrade your subscription.

Business

Labour disputes loom large over Canadian economy

From the Fraser Institute

By Fred McMahon

With labour disputes on the rise, Team Canada faces our greatest economic challenges in decades. It’s a bad look when team members jump the bench for the walk-out/lock-out penalty box—elbows up on the team, not on the ice.

Economic difficulties have escalated in recent years—miserable productivity growth, COVID and its inflation-drenched recovery, the uninvited U.S. trade war, and a government spending spree that left Canada deeply in debt and exacerbated all other difficulties.

Over the same period, labour disputes grew. Hours lost to disputes have been trending down for decades, but up since 2015. For the nine preceding years, the average hours lost annually was 224,000; for the nine years since, it’s been 190,000, but increasing over the years. In 2016, 74,000 hours were lost compared to 362,900 hours in 2023 and 293,600 last year.

Ironically, work stoppages typically occur only if they can wreck havoc on the Canadian economy. They hit sectors where customers and clients have little or no alternative. When customers have choices, they’ll walk away from a shutdown supplier. That encourages workers and businesses to figure out a solution before a strike.

Disputes in transportation and government services are particularly damaging. When Air Canada grounds flights, people and businesses already have tickets and plans. Options are limited and pricey. There is only one Port of Montreal. If it shuts down, there are no other Ports of Montreal. Cargo diversion is, well, limited and pricey. When government employees go on strike, people can’t turn to another government for service.

In 2023 and 2024, Canada suffered 62 transportation such work stoppages, including at the ports of Montreal and Vancouver, Canada’s two largest railways, and the St. Lawrence Seaway.

More disputes are on the way. Canada Post workers recently walked off the job hours after the federal government announced a major move from door-to-door delivery to community mailboxes. In British Columbia, civil servants are on the picket line. Public service unions are preparing to fight efforts to bring federal finances under control. And Air Canada and its flight attendants are now in arbitration after attendants rejected Air Canada’s most recent offer by 99.1 per cent.

As Keith Creel, CEO of Canadian Pacific Kansas City, wrote: “Canada’s message to the world is not one of efficiency, affordability and reliability. Lately, and repeatedly, it’s been the opposite: Disruptions. Delays. Diversions.” This is not a good for Team Canada when Canada needs new investment and entrepreneurship.

Everyone involved in a labour dispute loses. That means Canada losses. Air Canada says its recent strike, three-days long, cost the company $375 million. Employees and customers lose through foregone pay.

More than half a million passengers were directly affected, piling up the losses. Worse is the ripple affect on those not directly affected. When any part of the transportation network is impaired, business and people suffer. The economy is further damaged as investors become skittish about Canadian uncertainty, exacerbating economic difficulties.

Things may get worse. Canada’s economy is shrinking due to the trade war and our own economic mismanagement. That means there’s less stuff to go around. People’s pay on average has to shrink. The economy is not producing enough for everyone to make up “lost wages.” If all wages go up, the economy doesn’t magically start producing more. Instead, money buys less, inflation grows, economic damage intensifies, and there’s even less stuff to go around.

Resentment deepens as workers fight each other over the limited supply of stuff. Those who win make those who lose pay a disproportionate slice of the cost.

Three ways could eliminate or reduce these costs. One is to end unionization in government and essential services. Let the market decide wages. If pay is too low, employees leave for other opportunities, forcing employers to up pay. Another is to incentivize unions to resolve disputes before strikes, for example, by allowing replacement workers. The third is requiring mandatory arbitration, which has an admirable record in Canada of resolving disputes. Legislation should take into account reasonable complaints, whether employers or workers are favoured, and address them.

If Canada’s employers and unions can’t get their act together, only action will avoid dead-loss damage to the Canadian economy, leaving the rest of us as drive-by victims of labour bickering.

-

National17 hours ago

National17 hours agoCanada’s birth rate plummets to an all-time low

-

Fraser Institute1 day ago

Fraser Institute1 day agoAboriginal rights now more constitutionally powerful than any Charter right

-

Agriculture1 day ago

Agriculture1 day agoCarney’s nation-building plan forgets food

-

Business19 hours ago

Business19 hours agoElon Musk announces ‘Grokipedia’ project after Tucker Carlson highlights Wikipedia bias

-

Alberta1 day ago

Alberta1 day agoAlberta puts pressure on the federal government’s euthanasia regime

-

Crime17 hours ago

Crime17 hours agoPierre Poilievre says Christians may be ‘number one’ target of hate violence in Canada

-

Red Deer18 hours ago

Red Deer18 hours agoThe City or Red Deer Financial Troubles: The Role of Good Governance, Effective Policies and Key Performance Metrics.

-

Business2 days ago

Business2 days agoDemocracy Watch Drops a Bomb on Parliament Hill