Banks

Canada is preparing to launch ‘open banking.’ Here’s what that means

From LifeSiteNews

By David James

The experience with open banking so far suggests that the benefits are mostly exaggerated and that, while it does not necessarily increase the risk of fraud, it does not eliminate it either. It just shifts the dangers elsewhere.

The Canadian government is setting the stage to bring in what is termed “open banking.”

It is described as a “secure way” for customers to share their financial data with financial technology companies (fintechs or fintech apps). The holders of the account do not have to provide their online banking usernames and passwords. Instead, the data is shared by the customer’s bank with the fintech company, or app, through an online channel.

Open banking is often contrasted with what is called screen scraping, which is when the third party is provided with the online banking username and password, enabling them to log in directly to the bank account as if they were the customer.

Open banking has been adopted by 68 countries, including the United Kingdom and Australia. The U.S. Congress passed the necessary legislation to set it up in 2010, but it was not until last October that the Consumer Financial Protection Bureau (CFPB) issued a proposed rule necessary for implementation.

The experience with open banking so far suggests that the benefits are mostly exaggerated and that, while it does not necessarily increase the risk of fraud, it does not eliminate it either. It just shifts the dangers elsewhere.

The greatest peril is fraudulent account linking: unauthorized connections between customer accounts and third-party applications. This can be done by linking the victim’s financial account to an app controlled by the fraudster, allowing unauthorized access to the person’s funds. Or, the fraudster’s financial account can be linked to a victim’s third-party app, allowing scammers to transfer funds into their account. Substantial sums of money can be stolen before the victim becomes aware of the breach.

Such risks are commonplace in the digital banking environment. For instance, in Australia, according to the Australian Bureau of Statistics, credit card fraud affected 8.7 per cent of the population in 2022-23. The average amount stolen, however, was only $A200 and only 18 per cent had more than $A1000 taken. With open banking, if there is a breach, any sums stolen are likely to be much larger.

Neither is there any reason to think open banking is completely secure just because customers do not reveal their username and password. The Australian Banking Association warned that, after cyberattacks on the government medical insurer Medibank and telco Optus, “the engagement of a third party standing in the shoes of the customer … introduces a range of new risks for which banks may need to develop specific scam, fraud and cyber mitigation tools.”

According to research by financial advisory company Konsentus, the adoption of open banking has been strongest in Asia. In the U.S., customers have a strong attraction to credit cards and the rewards on offer. That is expected to represent a big barrier to take up. In Britain participation has “plateaued,” according to The Open Banking Impact Report (OBI report).

What are the advantages of open banking? According to the OBI report open banking has become a “critical component of cloud accounting” in Britain, which is helping smaller businesses track their financial positions more accurately. It is claimed that giving more entities access to customers’ financial data also increases competition.

Open banking is supposedly more efficient. The fintech company Gocardless contends that: “bank-to-bank payments are fully integrated and use a digital pull-based mechanism, where the merchant requests payment. In contrast, manual bank payments or card payments require the customer to send the payment to the business. Bank-to-bank payments tend to have lower failure rates compared to credit/debit card methods. Thus, businesses spend less time chasing missed payments.”

Another more doubtful claim is that open banking will make things easier for lenders. Abhigyan Shrivastava, leader in banking and technology transformation for Bendigo and Adelaide Bank writes that open banking is: “set to have a significant impact on lending transformation in Australia… with increased competition, personalized lending products, and more efficient lending processes.”

There is little reason, however, to think that better exposure to borrowers’ data will make any difference to lending practices. It will still be a matter of borrowers being able to provide enough collateral to qualify for a loan and to demonstrate they have sufficient income to pay the interest. In other words, banking as usual.

What is most likely is that the benefits of the initiative will primarily go to the banks and financial technology companies. That these entities argue, unconvincingly, that open banking is more “customer-centric” rouses the suspicion that ordinary customers will ultimately gain little.

Banks

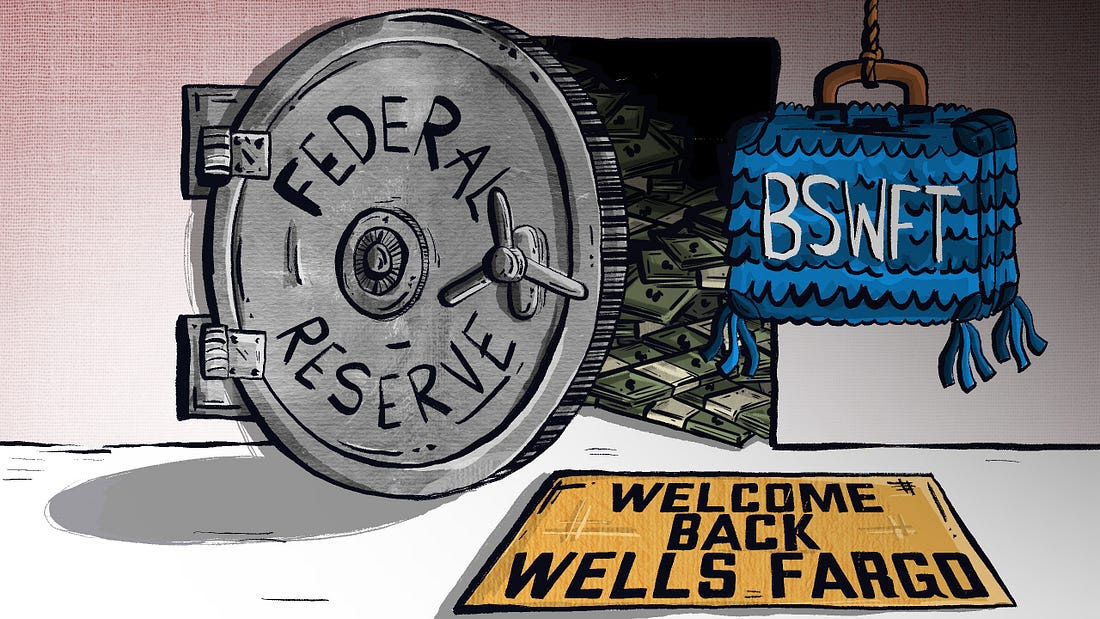

Welcome Back, Wells Fargo!

Racket News

Racket News

By Eric Salzman

The heavyweight champion of financial crime gets seemingly its millionth chance to show it’s reformed

The past two decades have been tough ones for Wells Fargo and the many victims of its sprawling crime wave. While the banking industry is full of scammers, Wells took turning time honored street-hustles into multi-billion dollar white-collar hustles to a new level.

The Federal Reserve announced last month that Wells Fargo is no longer subject to the asset growth restriction the Fed finally enforced in 2018 after multiple scandals. This was a major enforcement action that prohibited Wells from growing existing loan portfolios, purchasing other bank branches or entering into any new activities that would result in their asset base growing.

Upon hearing the news that Wells was being released from the Fed’s penalty box, my mind turned to this pivotal moment in the classic movie “Slapshot.”

Here are some of Wells Fargo’s lowlights both before and after the Fed’s enforcement action:

- December 2022: Wells Fargo paid more than $2 billion to consumers and $1.7 billion in civil penalties after the Consumer Financial Protection Bureau (CFPB) found mismanagement — including illegal fees and interest charges — in several of its biggest product lines, such as auto loans, mortgages, and deposit accounts.

- September 2021: Wells Fargo paid $72.6 million to the Justice Department for overcharging foreign exchange customers from 2010-2017.

- February 2020: Wells Fargo paid $3 billion to settle criminal and civil investigations by the Justice Department and SEC into its aggressive sales practices between 2002 and 2016. About $500 million was eventually distributed to investors.

- January 2020: The Office of the Comptroller of the Currency (OCC) banned two senior executives, former CEO John Stumpf and ex-Head of Community Bank Carrie Tolstedt, from the banking industry. Stumpf and Tolstedt also incurred civil penalties of $17.5 million and $17 million.

- August 2018: The Justice Department levied a $2.09 billion fine on Wells Fargo for its actions during the subprime mortgage crisis, particularly its mortgage lending practices between 2005 and 2007.

- April 2018: Federal regulators at the CFPB and OCC examined Wells’ auto loan insurance and mortgage lending practices and ordered the bank to pay $1 billion in damages.

- February 2018: The aforementioned Fed enforcement action. In addition to the asset growth restriction, Wells was ordered to replace three directors.

- October 2017: Wells Fargo admitted wrongdoing after 110,000 clients were fined for missing a mortgage payment deadline — delays for which the bank was ultimately deemed at fault.

- July 2017: As many as 570,000 Wells Fargo customers were wrongly charged for auto insurance on car loans after the bank failed to verify whether those customers already had existing insurance. As a result, up to 20,000 customers may have defaulted on car loans.

- September 2016: Wells Fargo acknowledged its employees had created 1.5 million deposit accounts and 565,000 credit card accounts between 2002 and 2016 that “may not have been authorized by consumers,” according to CFPB. As a result, the lender was forced to pay $185 million in damages to the CFPB, OCC, and City and County of Los Angeles.

Additionally, somehow in 2023 Wells even managed to drop $1 billion in a civil settlement with shareholders for overstating their progress in complying with their 2018 agreement with the Fed to clean themselves up!

I imagine if Wells were in any other business, it wouldn’t be allowed to continue. But Wells is part of the “Too Big to Fail” club. Taking away its federal banking charter would be too disruptive for the financial markets, so instead they got what ended up being a seven-year growth ban. Not exactly rough justice.

While not the biggest settlement, my favorite Wells scam was the 2021 settlement of the seven-year pilfering operation, ripping off corporate customers’ foreign exchange transactions.

Like many banks, Wells Fargo offers its corporate clients with global operations foreign exchange (FX) services. For example, if a company is based in the U.S. but has extensive dealings in Canada, it may receive payments in Canadian dollars (CAD) that need to be exchanged for U.S. dollars (USD) and vice versa. Wells, like many banks, has foreign exchange specialists who do these conversions. Ideally, the banks optimize their clients’ revenue and decrease risk, in return for a markup fee, or “spread.”

There’s a lot of trust involved with this activity as the corporate customers generally have little idea where FX is trading minute by minute, nor do they know what time of day the actual orders for FX transactions — commonly called “BSwifts” — come in. For an unscrupulous bank, it’s a license to steal, which is exactly what Wells did.

According to the complaint, Wells regularly marked up transactions at higher spreads than what was agreed upon. This was just one of the variety of naughty schemes Wells used to clobber their customers. My two favorites were “The Big Figure Trick” and the “BSwift Pinata.”

The Big Figure Trick

Let’s say a client needs to sell USD for CAD, and that the $1 USD is worth $1.32 CAD. In banking parlance, the 32 cents is called the “Big Figure.” Wells would buy the CAD at $1.32 for $1 USD and then transpose the actual exchange rate on the customer statement from $1.32 to $1.23. If the customer didn’t notice, Wells would pocket the difference. On a transaction where the client is buying 5 million CAD with USD, the ill-gotten gain for Wells would be about $277,000 USD!

Conversely, if the customer did notice the difference, Wells would just blame it on the grunts in its operational back office, saying they accidentally transposed the number and “correct” the transaction. From the complaint, here is some give and take between two Wells FX specialists:

“You can play the transposition error game if you get called out.” Another FX sales specialist noted to a colleague about a previous transaction that a customer “didn’t flinch at the big fig the other day. Want to take a bit more?”

The BSwift Piñata

The way this hustle would work is, let’s say the Wells corporate customer was receiving payment from one of their Canadian clients. The Canadian client’s bank would send a BSwift message to Wells. The Wells client was in the dark about the U.S. dollar-Canadian dollar exchange rate because it had no idea what time of day the message arrived. Wells took advantage of that by purchasing U.S. dollars for Canadian dollars first. For simplicity, think of the U.S. dollar-Canadian dollar exchange rate as a widget that Wells bought for $1. If the widget increased in value, say to $1.10 during the day, Wells would sell the widget they purchased for $1 to the client for $1.10 and pocket 10 cents. If the price of the widget Wells bought for $1 fell to 95 cents, Wells would just give up their $1 purchase to the client, plus whatever markup they agreed to.

Heads, Wells wins. Tails, client loses.

The complaint notes that a Wells FX specialist wrote that he:

“Bumped spreads up a pinch,” that “these clients who are in the mode of just processing wires will most likely not notice this slight change in pricing” and that it “could have a very quick positive impact on revenue without a lot of risk.”

Talk about a boiler room operation. Personally, I think calling what you are doing to a client a “piñata” should have easily put Wells in the Fed’s penalty box another 5 years at least!

Wells has been released from the Fed’s 2018 enforcement order. I would like to think they have learned their lesson and are reformed, but I would lay good odds against it. A leopard can’t change its spots.

Racket News is a reader-supported publication.

Consider becoming a free or paid subscriber.

Banks

Scrapping net-zero commitments step in right direction for Canadian Pension Plan

From the Fraser Institute

By Matthew Lau

And in January, all of Canada’s six largest banks quit the Net-Zero Banking Alliance, an alliance formerly led by Mark Carney (before he resigned to run for leadership of the Liberal Party) that aimed to align banking activities with net-zero emissions by 2050.

The Canada Pension Plan Investment Board (CPPIB) has cancelled its commitment, established just three years ago, to transition to net-zero emissions by 2050. According to the CPPIB, “Forcing alignment with rigid milestones could lead to investment decisions that are misaligned with our investment strategy.”

This latest development is good news. The CPPIB, which invest the funds Canadians contribute to the Canada Pension Plan (CPP), has a fiduciary duty to Canadians who are forced to pay into the CPP and who rely on it for retirement income. The CPPIB’s objective should not be climate activism or other environmental or social concerns, but risk-adjusted financial returns. And as noted in a broad literature review by Steven Globerman, senior fellow at the Fraser Institute, there’s a lack of consistent evidence that pursuing ESG (environmental, social and governance) objectives helps improve financial returns.

Indeed, as economist John Cochrane pointed out, it’s logically impossible for ESG investing to achieve social or environmental goals while also improving financial returns. That’s because investors push for these goals by supplying firms aligned with these goals with cheaper capital. But cheaper capital for the firm is equivalent to lower returns for the investor. Therefore, “if you don’t lose money on ESG investing, ESG investing doesn’t work,” Cochrane explained. “Take your pick.”

The CPPIB is not alone among financial institutions abandoning environmental objectives in recent months. In April, Canada’s largest company by market capitalization, RBC, announced it will cancel its sustainable finance targets and reduce its environmental disclosures due to new federal rules around how companies make claims about their environmental performance.

And in January, all of Canada’s six largest banks quit the Net-Zero Banking Alliance, an alliance formerly led by Mark Carney (before he resigned to run for leadership of the Liberal Party) that aimed to align banking activities with net-zero emissions by 2050. Shortly before Canada’s six largest banks quit the initiative, the six largest U.S. banks did the same.

There’s a second potential benefit to the CPPIB cancelling its net-zero commitment. Now, perhaps with the net-zero objective out of the way, the CPPIB can rein in some of the administrative and management expenses associated with pursuing net-zero.

As Andrew Coyne noted in a recent commentary, the CPPIB has become bloated in the past two decades. Before 2006, the CPP invested passively, which meant it invested Canadians’ money in a way that tracked market indexes. But since switching to active investing, which includes picking stocks and other strategies, the CPPIB ballooned from 150 employees and total costs of $118 million to more than 2,100 employees and total expenses (before taxes and financing) of more than $6 billion.

This administrative ballooning took place well before the rise of environmentally-themed investing or the CPPIB’s announcement of net-zero targets, but the net-zero targets didn’t help. And as Coyne noted, the CPPIB’s active investment strategy in general has not improved financial returns either.

On the contrary, since switching to active investing the CPPIB has underperformed the index to a cumulative tune of about $70 billion, or nearly one-tenth of its current fund size. “The fund’s managers,” Coyne concluded, “have spent nearly two decades and a total of $53-billion trying to beat the market, only to produce a fund that is nearly 10-per-cent smaller than it would be had they just heaved darts at the listings.”

Scrapping net-zero commitments won’t turn that awful track record around overnight. But it’s finally a step in the right direction.

-

Business2 days ago

Business2 days agoRFK Jr. says Hep B vaccine is linked to 1,135% higher autism rate

-

Alberta1 day ago

Alberta1 day agoAlberta Provincial Police – New chief of Independent Agency Police Service

-

Business1 day ago

Business1 day agoWhy it’s time to repeal the oil tanker ban on B.C.’s north coast

-

Energy1 day ago

Energy1 day agoIf Canada Wants to be the World’s Energy Partner, We Need to Act Like It

-

Alberta1 day ago

Alberta1 day agoPierre Poilievre – Per Capita, Hardisty, Alberta Is the Most Important Little Town In Canada

-

International1 day ago

International1 day agoCBS settles with Trump over doctored 60 Minutes Harris interview

-

Aristotle Foundation2 days ago

Aristotle Foundation2 days agoHow Vimy Ridge Shaped Canada

-

Alberta1 day ago

Alberta1 day agoAlberta uncorks new rules for liquor and cannabis