Business

Business Spotlight: Increased Online Activity, Increased Concerns

These are unprecedented times for most industries in Alberta, including the IT industry. We do not hear a lot about the challenges faced by businesses that offer IT services in the wake of self-isolation and the transition to working from home. In this piece, we will discover what a local Calgary company, SysGen Solutions Group, is doing to tackle the ‘new norm’ in their daily work routine, the physical and mental support provided for their employees and their support in our community. This article will also discuss the concerns with security risks.

Since the beginning of March 2020, Statistics Canada, as part of their Canadian Perspective Survey Series reported a 29% increase in people working from home. Following that increase, we have seen a major increase in online activity, with the majority of that traffic being directed to software applications that support our work from home communication and productivity. As seen below, TrustRadius reports data on the rising software categories from the beginning of the COVID-19 outbreak to April 6th.

(Data sourced from TrustRadius on top rising software categories, April 2020)

With this rise, how does a local Alberta IT company tackle this new challenge and play its part in supporting its customers, employees and their community during the COVID-19 pandemic?

SysGen Solutions Group was founded in 1995 and is a major player in IT consulting firms across Western Canada. Over their 25 years, SysGen has been the recipient of several national and international awards, including Canada’s Top Small & Medium Employer (2017 to 2019), Alberta’s Top Employer (2017 to 2018), Profit 500 (2013 to 2017), CRN’s Top Managed Service Providers 500 (2017 to 2019), Top 100 Solution Provider in Canada from CDN (2016 to 2017), Ingram Micro Microsoft 365 Partner of the Year (2019) amongst several other accolades. Awards such as these show a true passion for their employees and their ability to drive their industry into the future.

SysGen Solutions Group was founded in 1995 and is a major player in IT consulting firms across Western Canada. Over their 25 years, SysGen has been the recipient of several national and international awards, including Canada’s Top Small & Medium Employer (2017 to 2019), Alberta’s Top Employer (2017 to 2018), Profit 500 (2013 to 2017), CRN’s Top Managed Service Providers 500 (2017 to 2019), Top 100 Solution Provider in Canada from CDN (2016 to 2017), Ingram Micro Microsoft 365 Partner of the Year (2019) amongst several other accolades. Awards such as these show a true passion for their employees and their ability to drive their industry into the future.

The president of SysGen, Ryan Richardet found himself at a crossroads before his growth at the company. Working on a MSC in cardiovascular science at the University of Calgary and being accepted into USC Medical School, he chose to rethink his passion. Ryan decided that building a great company through people was what he wanted to do; thus he continued working in business development for SysGen just under 10 years ago. Through multiple roles in the company, he was promoted by SysGen CEO Lyle Richardet from vice president to president in December of 2018.

“…the more you get better at it, the more you understand. You get excited to see other people achieve success. It’s pretty amazing” – Ryan Richardet, SysGen President

SysGen’s business model involves an array of IT services, including cybersecurity, a service that has skyrocketed in necessity during COVID-19. Like other organizations, SysGen has introduced a Work from Home (WFH) policy due to COVID-19. Traditionally, the local management team leads employees based on their office culture. Customer solutions are collaborated on as a team at SysGen and client offices. But these norms have been uprooted since COVID-19.

How has communication between you and your team been since WFH?

Ryan mentions that SysGen has implemented strong communication between all members of his team since directing the entire staff to WFH. He is happy to say that his team has greatly accepted communicating through video conferencing and messaging apps.

“…there are two sides. It’s the employee and employer relationship. I can’t even really see it that way. I’m here with everybody in the trenches and we’re all working as a team”

Virtual town halls have been useful to facilitate weekly communication to ensure employees are aware of updates at SysGen. They have been using the chat conferencing tool Microsoft Teams to ensure collaboration continues between staff and that SysGen stays true to its mission to deliver an amazing customer experience. Ryan sees it as a transformational business platform that provides many tools for people to communicate and collaborate effectively.

“I see the whole team digging in and trying to go the extra mile to make a difference right now. I’m super proud of that. I can’t be more excited about the relationship between all of us during this time.”

Community Support

SysGen has proactively supported the community for several years through SysGen Cares. This support has included offering free IT support to non-profits such as cSPACE and Downtown Vernon. Nominations were received from the community and the selected non-profit was chosen based on its application. SysGen has also worked with local sports teams to sponsor jerseys and has donated funds for trout restocking efforts with the Alberta Conservation Association. Alpine Canada is another organization SysGen works with through SyGen Cares to support their IT services and initiatives.

Recently, SysGen introduced a new initiative to help non-profits that have been hit hardest by COVID-19. This program offers a donation of up to $1,000 to a non-profit chosen by an organization that signs with SysGen for managed services. You can learn more about this initiative here.

What recommendations would you offer for those concerned about their cybersecurity during this time?

There have been recent reports of cybersecurity issues that align with the rise in online activity. Some may be aware that the popular web conferencing tool “Zoom” has been banned from educational institutions and large companies across the world due to security issues. There are also numerous other considerations about how to keep our privacy and security intact while almost a third of the population works from home.

“…we have a managed security platform to help clients establish secure technology

environments. But there are little things you can personally do right now…”

Some of the recommendations from Ryan and his team consist of conducting good internet hygiene. This can be learned through infographics and webinars offered by industry experts. SysGen will be offering a cybersecurity webinar in the coming weeks on this topic. Following that, make sure that you close programs when you’re finished using them and implement strong passwords across user accounts.

One concern is that a webcam can be accessed through viruses or malware downloaded from an unknown source. It may be a scary thought to have after spending weeks on your laptop, however, Ryan offers a simple tip: Cover your webcam when you’re not using it for video calling. You can even do this with a piece of tape. To learn more, visit SysGen’s blog for additional information on technology and IT services.

Hopes for the future?

Typically, Ryan and other team members would travel for client meetings. Now that he’s working from home, he does not miss traffic lights and congested roads. He’s looking forward to the social aspects of his position, including meetings and events with colleagues and customers. In the meantime, Ryan virtually connects with his team and clients, sometimes in a more informal way to catch up or share a funny meme. Keeping the social part of the work environment alive has a positive effect on team morale, which is important with the uncertainty in the world today.

In celebration of SysGen’s 25-year milestone, they are planning a virtual party with various events through a virtual town hall. This is where the real creative thinking begins. Ryan mentions:

“…the celebration is going to be virtual so we will have to experiment with whether it could ever replace an in-person party. We’re going to make it fun and engaging, so we’ll find out!”

If you would like to learn more about this local Alberta company, SysGen Solutions Group, visit their website or social media. Here you will find information on how to increase your internet hygiene and improve your work from home experience because it’s likely here to stay.

Website – SysGen Solutions Group – Twitter – Facebook – LinkedIn – YouTube

For more stories, visit Todayville Calgary

Business

Losses Could Reach Nearly One Billion: When Genius Failed…..Again

Illustration by Daniel Medina

By Eric Salzman

The smartest guys in the room fall for the same scam twice in less than 5 years

THE SCHEME: Fraud and Money Laundering

THE COMPANY: Stenn Technologies

Racket News is a reader-supported publication.

To receive new posts and support my work, consider becoming a free or paid subscriber.

THE NEWS: For the second time in five years, a scam involving sexing up a boring, centuries old financing business blew up in the faces of some of the world’s largest banks

You know the old saying. Fool me once, shame on you. Fool me twice…

In December, “fintech” supply chain financier Stenn Technologies and its subsidiaries Stenn Assets UK Ltd and Stenn International Ltd, collapsed, spanking investors and lenders such as Citigroup, Nexis, BNP Paribas, HSBC and private equity firm Centerbridge. Just a month prior to the blow-up, Stenn was viewed as a fintech unicorn with a robust $1 billion book of business, poised for strong growth.

As we’ve seen time and again, a unicorn can quickly die when a company’s business model screams fraud to anyone bothering to look.

Stenn Technologies claimed to use artificial intelligence and state of the art technology to analyze credit and money laundering risk in order to turn a low margin, supply chain financing business into an awesome, high return, low risk securitized product.

Here’s a quick explanation of supply chain financing:

1. A company delivers its product to a buyer and the buyer promises to pay in a few months’ time, creating an accounts receivable.

2. The company that has the accounts receivable sends it to the supply chain financier (Greensill Capital or Stenn Technologies).

3. The supply chain financier pays the company cash for the receivable minus a discount which is another business practice called factoring.

4. The buyer pays the financier the full amount of the receivable on the due date.

Supply chain financing is nothing new. It was probably around when Marco Polo set out for the Orient.

If it sounds boring, that’s because it is, or at least is supposed to be. Lex Greensill’s Greensill Capital changed that a decade ago.

Through fancy structuring, as well as four private jets, Greensill created a byzantine circular loop where money flowed around the world, much of it to Greensill favorites like steel maker Sanjeev Gupta and then back again. The operation was continuously funded by either GAM, Credit Suisse, SoftBank as well as Greensill’s own German bank, Greensill Bank AG. After a while, as more money poured into Greensill from eager investors, the company began to essentially just lend money out, mostly to Gupta while calling the transactions “future receivables.”

Greensill Capital collapsed under the weight of fraud in 2021, costing its big investors mentioned above billions. Matt reported on the story here in 2021.

Greensill’s receivable notes (the fancy structuring) were insured by a number of insurers, the biggest being Japanese insurer Tokio Marine. The insurance made investors comfortable because, if Tokio Marine insured it, the notes have to be money good, right?

Wrong.

At one point, Tokio had nearly $8 billion of exposure to Greensill deals. How insurers got comfortable with insuring receivables to a blizzard of shell companies that all seemed to point back to Gupta and Lex’s pockets is anyone’s guess, but when Tokio finally did a good look under the hood, they cried insurance fraud and Greensill came crashing down. Credit Suisse investors alone lost $10 billion.

At this point, we need to hear from Lt. Commander Montgomery Scott, better known as Scotty.

So now, we’re at the shame on you portion of the story.

Astoundingly, Stenn Technologies was able to pull off a similar scam just a couple of years later, posing as a fintech company, supposedly using the latest in technology to do global supply chain financing faster and better than everyone else in the business.

The victims are new, but given the high publicity of Greensill’s failure, you’d figure they would catch on.

According to Bloomberg News, “Stenn’s main backers were Citigroup Inc., BNP Paribas SA, Natixis and HSBC Holdings Plc while Barclays Plc, M&G Plc and Goldman Sachs Group also backed the transaction.”

Private equity firm Centerbridge invested $50 million in capital and valued the company at $900 million in 2022.

In 2022, TechCrunch described the secret sauce that Stenn was supposedly using to bring a 13th century business into the modern age.

Stenn — which applies big data analytics, taking a few datapoints about a business (the main two being what money it has coming in and going out based on invoices) and matching them up against an algorithm that takes some 1,000 other factors into account to determine its eligibility for a loan of up to $10 million; and on the other side taps a network of institutions and other big lenders to provide the capital for that financing.

Perhaps this multi-factor algorithm was super cool when they showed it to investors and lending partners. The only problem was Stenn, in the words of a business crime attorney who spoke to Bloomberg, “has all the hallmarks of both fraud and money laundering.”

Greensill might have been a bit hard to figure out with large, respected insurance companies insuring their notes.

But anyone who took the time to investigate Stenn Technologies by simply looking at the data they pumped out to investors weekly would have seen the scheme for what it was.

While it appears the previously mentioned institutional investors didn’t bother to investigate, Bloomberg did and the results were darkly hilarious.

Some of Stenn’s biggest suppliers were tiny companies in Thailand and Hong Kong with little in common yet corporate filings for all of them list the same Russian name as a backer. One in Singapore was accused by the U.S. of enabling payments to Russian naval intelligence and sanctioned in August. Tracing a group owned by another Russian investor that was supposedly shipping millions of dollars of goods to corporations in Switzerland and Canada led to a derelict Prague building with boarded-up windows.

Bloomberg contacted the largest 50 firms that were supposedly the buyers for what Stenn’s suppliers produced, and the bulk had no idea who Stenn Technologies or these suppliers were! A spokesman for Edion Corp., one of the biggest electronics retailers in Japan, told Bloomberg, “we have absolutely no knowledge of this matter. We really have no idea what it’s about.”

Essentially, the data produced by Stenn highlighted thousands of bogus transactions on a weekly basis to investors, lying about who was paying and who was receiving billions of dollars of funds. According to Bloomberg, investors received these details with the name of the suppliers and buyers included. Therefore, at any time, investors could have done a sanity check on these obscure suppliers to see who they were, or in this case, weren’t.

HSBC finally caught up to what Stenn was doing. Again from the Bloomberg report:

HSBC triggered Stenn’s downfall when it lodged an application to the UK courts, alleging that its officials had uncovered ‘deeply troubling issues on a large scale.’ The

invoices at the heart of the deal weren’t ‘genuine debts’ and payments to suppliers weren’t coming from ‘blue-chip companies’ but from bogus firms with similar names, according to the complaint filed by the London-based bank.

Investors are facing a potential loss of $200 million, although it could be a lot more as $978 million in invoiced-financed notes are outstanding, Bloomberg reports.

There is a bright side to Stenn’s collapse though. A senior trade finance official told The Sunday Times:

“The saving grace here is at least it’s smaller than Greensill.”

Well played.

Racket News is a reader-supported publication.

To receive new posts and support my work, consider becoming a free or paid subscriber.

Banks

TD Bank Account Closures Expose Chinese Hybrid Warfare Threat

From the Frontier Centre for Public Policy

Scott McGregor warns that Chinese hybrid warfare is no longer hypothetical—it’s unfolding in Canada now. TD Bank’s closure of CCP-linked accounts highlights the rising infiltration of financial interests. From cyberattacks to guanxi-driven influence, Canada’s institutions face a systemic threat. As banks sound the alarm, Ottawa dithers. McGregor calls for urgent, whole-of-society action before foreign interference further erodes our sovereignty.

Chinese hybrid warfare isn’t coming. It’s here. And Canada’s response has been dangerously complacent

The recent revelation by The Globe and Mail that TD Bank has closed accounts linked to pro-China groups—including those associated with former Liberal MP Han Dong—should not be dismissed as routine risk management. Rather, it is a visible sign of a much deeper and more insidious campaign: a hybrid war being waged by the Chinese Communist Party (CCP) across Canada’s political, economic and digital spheres.

TD Bank’s move—reportedly driven by “reputational risk” and concerns over foreign interference—marks a rare, public signal from the private sector. Politically exposed persons (PEPs), a term used in banking and intelligence circles to denote individuals vulnerable to corruption or manipulation, were reportedly among those flagged. When a leading Canadian bank takes action while the government remains hesitant, it suggests the threat is no longer theoretical. It is here.

Hybrid warfare refers to the use of non-military tools—such as cyberattacks, financial manipulation, political influence and disinformation—to erode a nation’s sovereignty and resilience from within. In The Mosaic Effect: How the Chinese Communist Party Started a Hybrid War in America’s Backyard, co-authored with Ina Mitchell, we detailed how the CCP has developed a complex and opaque architecture of influence within Canadian institutions. What we’re seeing now is the slow unravelling of that system, one bank record at a time.

Financial manipulation is a key component of this strategy. CCP-linked actors often use opaque payment systems—such as WeChat Pay, UnionPay or cryptocurrency—to move money outside traditional compliance structures. These platforms facilitate the unchecked flow of funds into Canadian sectors like real estate, academia and infrastructure, many of which are tied to national security and economic competitiveness.

Layered into this is China’s corporate-social credit system. While framed as a financial scoring tool, it also functions as a mechanism of political control, compelling Chinese firms and individuals—even abroad—to align with party objectives. In this context, there is no such thing as a genuinely independent Chinese company.

Complementing these structural tools is guanxi—a Chinese system of interpersonal networks and mutual obligations. Though rooted in trust, guanxi can be repurposed to quietly influence decision-makers, bypass oversight and secure insider deals. In the wrong hands, it becomes an informal channel of foreign control.

Meanwhile, Canada continues to face escalating cyberattacks linked to the Chinese state. These operations have targeted government agencies and private firms, stealing sensitive data, compromising infrastructure and undermining public confidence. These are not isolated intrusions—they are part of a broader effort to weaken Canada’s digital, economic and democratic institutions.

The TD Bank decision should be seen as a bellwether. Financial institutions are increasingly on the front lines of this undeclared conflict. Their actions raise an urgent question: if private-sector actors recognize the risk, why hasn’t the federal government acted more decisively?

The issue of Chinese interference has made headlines in recent years, from allegations of election meddling to intimidation of diaspora communities. TD’s decision adds a new financial layer to this growing concern.

Canada cannot afford to respond with fragmented, reactive policies. What’s needed is a whole-of-society response: new legislation to address foreign interference, strengthened compliance frameworks in finance and technology, and a clear-eyed recognition that hybrid warfare is already being waged on Canadian soil.

The CCP’s strategy is long-term, multidimensional and calculated. It blends political leverage, economic subversion, transnational organized crime and cyber operations. Canada must respond with equal sophistication, coordination and resolve.

The mosaic of influence isn’t forming. It’s already here. Recognizing the full picture is no longer optional. Canadians must demand transparency, accountability and action before more of our institutions fall under foreign control.

Scott McGregor is a defence and intelligence veteran, co-author of The Mosaic Effect: How the Chinese Communist Party Started a Hybrid War in America’s Backyard, and the managing partner of Close Hold Intelligence Consulting Ltd. He is a senior security adviser to the Council on Countering Hybrid Warfare and a former intelligence adviser to the RCMP and the B.C. Attorney General. He writes for the Frontier Centre for Public Policy.

-

Alberta21 hours ago

Alberta21 hours agoNew Alberta Election Act bans electronic vote counting machines, lowers threshold for recalls and petitions

-

Alberta20 hours ago

Alberta20 hours agoHours after Liberal election win, Alberta Prosperity Project drumming up interest in referendum

-

Alberta1 day ago

Alberta1 day agoPremier Danielle Smith responds to election of Liberal government

-

Automotive2 days ago

Automotive2 days agoMajor automakers push congress to block California’s 2035 EV mandate

-

Banks21 hours ago

Banks21 hours agoTD Bank Account Closures Expose Chinese Hybrid Warfare Threat

-

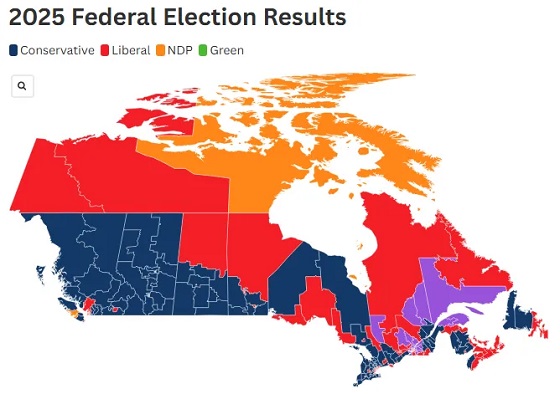

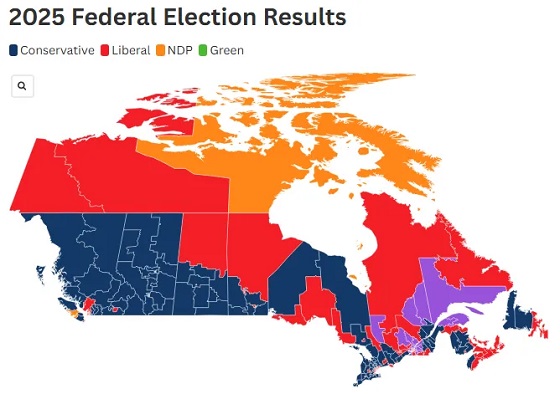

2025 Federal Election21 hours ago

2025 Federal Election21 hours agoPost election…the chips fell where they fell

-

Mental Health2 days ago

Mental Health2 days agoSuspect who killed 11 in Vancouver festival attack ID’d

-

Alberta12 hours ago

Alberta12 hours agoPremier Danielle Smith hints Alberta may begin ‘path’ toward greater autonomy after Mark Carney’s win