Fraser Institute

Bill Maher is right about Canadian health care

From the Fraser Institute

Recently, popular American comedian and talk show host, Bill Maher, took aim at some of Canada’s public policy failings in one of his monologues. In entertaining fashion, Maher highlighted our high housing costs, unemployment rates and “vaunted” health-care system.

Indeed, citing work published by the Fraser Institute, he explained that after adjusting for age, Canada spends 13.3 per cent of our economy on health care (2020), the highest level of spending by a developed country with universal coverage that year. And that Canada has some of the poorest access to timely appointments with family doctors when compared to our peers.

Unfortunately, while that’s where his segment on health care ended, the bad news for the Canadian system doesn’t stop there.

On top of Canada continuing to be one of the most expensive universal health-care systems in the world, we get little in return when it comes to both available medical resources and wait times. For example, among high-income countries with universal health care, Canada has some of the lowest numbers of physicians, hospital beds, MRI machines and CT scanners.

And in Canada, only 38 per cent of patients report seeing a specialist within four weeks (compared to 69 per cent in the Netherlands) and only 62 per cent report receiving non-emergency surgery within four months (compared to 99 per cent in Germany).

Unfortunately, wait times in Canada aren’t simply long compared to other countries, they’re the longest they’ve ever been. Last year the median wait for a Canadian patient seeking non-emergency care reached 27.7 weeks—nearly three times longer than the 9.3 week-wait Canadians experienced three decades ago.

This raises the obvious question. How do other countries outperform Canada’s health-care system while also often spending less as a share of their economies? In short, their approach to universal health care, and in particular their relationship with the private sector, departs drastically from the approach here at home.

Australia, for example, partners with private hospitals to deliver the majority (58.6 per cent) of all non-emergency surgeries within its universal health-care system. Australia also spends less of its total economy (i.e. GDP) on health care but outperforms Canada on every measure of timely care.

Even with restrictions on the private sector, Canada has some limited experience that should encourage policymakers to embrace greater private-sector involvement. Saskatchewan, for example, contracted with private surgical clinics starting in 2010 to deliver publicly-funded services as part of a four-year initiative to reduce wait times, which were among the longest in the country. Between 2010 and 2014, wait times in the province fell from 26.5 weeks to 14.2 weeks. After the initiative ended, the province’s wait times began to grow.

More recently, Quebec, which has some of the shortest wait times for medical services in the country, contracts out one out of every six day-surgeries to private clinics within the publicly-funded health-care system.

Maher’s monologue, which was viewed by millions online, highlighted the key failings of Canada’s health-care system. If policymakers in Ottawa and the provinces want to fix Canadian health care, they must learn from other countries that deliver universal health-care at the same or even lower cost, often with better access and results for patients.

Author:

Automotive

Federal government should swiftly axe foolish EV mandate

From the Fraser Institute

Two recent events exemplify the fundamental irrationality that is Canada’s electric vehicle (EV) policy.

First, the Carney government re-committed to Justin Trudeau’s EV transition mandate that by 2035 all (that’s 100 per cent) of new car sales in Canada consist of “zero emission vehicles” including battery EVs, plug-in hybrid EVs and fuel-cell powered vehicles (which are virtually non-existent in today’s market). This policy has been a foolish idea since inception. The mass of car-buyers in Canada showed little desire to buy them in 2022, when the government announced the plan, and they still don’t want them.

Second, President Trump’s “Big Beautiful” budget bill has slashed taxpayer subsidies for buying new and used EVs, ended federal support for EV charging stations, and limited the ability of states to use fuel standards to force EVs onto the sales lot. Of course, Canada should not craft policy to simply match U.S. policy, but in light of policy changes south of the border Canadian policymakers would be wise to give their own EV policies a rethink.

And in this case, a rethink—that is, scrapping Ottawa’s mandate—would only benefit most Canadians. Indeed, most Canadians disapprove of the mandate; most do not want to buy EVs; most can’t afford to buy EVs (which are more expensive than traditional internal combustion vehicles and more expensive to insure and repair); and if they do manage to swing the cost of an EV, most will likely find it difficult to find public charging stations.

Also, consider this. Globally, the mining sector likely lacks the ability to keep up with the supply of metals needed to produce EVs and satisfy government mandates like we have in Canada, potentially further driving up production costs and ultimately sticker prices.

Finally, if you’re worried about losing the climate and environmental benefits of an EV transition, you should, well, not worry that much. The benefits of vehicle electrification for climate/environmental risk reduction have been oversold. In some circumstances EVs can help reduce GHG emissions—in others, they can make them worse. It depends on the fuel used to generate electricity used to charge them. And EVs have environmental negatives of their own—their fancy tires cause a lot of fine particulate pollution, one of the more harmful types of air pollution that can affect our health. And when they burst into flames (which they do with disturbing regularity) they spew toxic metals and plastics into the air with abandon.

So, to sum up in point form. Prime Minister Carney’s government has re-upped its commitment to the Trudeau-era 2035 EV mandate even while Canadians have shown for years that most don’t want to buy them. EVs don’t provide meaningful environmental benefits. They represent the worst of public policy (picking winning or losing technologies in mass markets). They are unjust (tax-robbing people who can’t afford them to subsidize those who can). And taxpayer-funded “investments” in EVs and EV-battery technology will likely be wasted in light of the diminishing U.S. market for Canadian EV tech.

If ever there was a policy so justifiably axed on its failed merits, it’s Ottawa’s EV mandate. Hopefully, the pragmatists we’ve heard much about since Carney’s election victory will acknowledge EV reality.

Fraser Institute

Before Trudeau average annual immigration was 617,800. Under Trudeau number skyrocketted to 1.4 million annually

From the Fraser Institute

By Jock Finlayson and Steven Globerman

From 2000 to 2015, annual immigration averaged 617,800 immigrants, compared to a more than doubling to 1.4 million annually from 2016 to

2024 (excluding 2020), according to a new study published by the Fraser Institute, an independent non-partisan Canadian think-tank.

“Over the past decade, Canada’s immigration numbers have skyrocketed, most starkly since 2021,” said Jock Finlayson, senior fellow at the Fraser Institute and co-author of Canada’s Changing Immigration Patterns, 2000–2024.

The study finds from 2000 to 2015, immigration (including temporary foreign workers and international students) grew on average by 3.5 per cent per year. However, from 2016 to 2024 (excluding 2020) immigration grew annually at 21.3 per cent—more than six times the 2000-2015 pace.

The sharp rise in recent years reflects both planned increases in permanent immigrant inflows as well as unprecedented and largely unplanned growth in the numbers of temporary foreign workers, international students, and asylum seekers. For example, in 2024 alone, 485,600 permanent immigrants entered Canada, along with 518,200 international students and nearly one million (912,900) temporary foreign workers.

However, due to concerns about the impact of unprecedented in-migration on housing affordability, employment opportunities (or lack thereof), access to health care and other issues, late last year the federal government unveiled plans to substantially reduce immigration levels over the 2025-27 period, affecting permanent immigrants, international students, and other temporary visa holders.

The composition of immigration also changed dramatically during this period. From 2000 to 2015, the average share of total immigrants in the permanent category was 42.1 per cent while the non-permanent share (mainly international students and temporary workers) was 57.9 per cent. From 2016 to 2024 (excluding Covid 2020), permanent immigrants averaged 27.7 per cent of total in-migration versus 72.3 per cent for non-permanent.

“We’re in the midst of a housing crisis in Canada, and the unfortunate truth is we lack the necessary infrastructure to accommodate immigration at the 2022-24 rate,” said Steven Globerman, senior fellow at the Fraser Institute and study co-author.

“While the reductions announced late last year have been confirmed by the new government, the levels of immigration over the next two year will still be well above historic benchmarks.”

This study is the first in a series of papers from the authors on immigration.

Canada’s Changing Immigration Patterns, 2000—2024

- Immigration, after 2000 and especially after 2015, is characterized by substantial increases in the absolute number of immigrants admitted, as well the share admitted as temporary foreign workers and international students.

- For example, from 2000 to 2015, the total number of immigrants increased at a simple average annual rate of 4% compared to 15% from 2016 to 2024. As well, permanent admissions as a share of total admissions declined by .83 percentage points per year from 2000 to 2015 and by 1.1 percentage points per year from 2016 to 2024.

- These recent developments reflect changes in government policy. In particular, the International Mobility Program (IMP) of 2014 enabled Canadian employers to bring in greater numbers of temporary workers from abroad to fill lower-paying jobs.

- The Advisory Council on Economic Growth appointed by the Trudeau government in early 2016 recommended substantial increases in permanent immigration, as well as in the number of international students who would become eligible for permanent status after acquiring Canadian educational credentials. The Trudeau government enthusiastically embraced the recommendation.

- Recent immigrants to Canada seem better equipped to participate in the labour market than earlier cohorts. For example, over the period from 2011 to 2021, the percentage of established immigrants with a bachelor’s degree or higher increased, and the vast majority of admitted immigrants speak at least one of the official languages. Moreover, recent immigrants enjoy higher employment rates than did earlier cohorts.

- Nevertheless, public concern about the impact of increased immigration—primarily on the affordability of housing—has led the federal government to reduce planned levels of future immigration substantially.

Steven Globerman

-

Indigenous2 days ago

Indigenous2 days agoInternal emails show Canadian gov’t doubted ‘mass graves’ narrative but went along with it

-

Bruce Dowbiggin2 days ago

Bruce Dowbiggin2 days agoEau Canada! Join Us In An Inclusive New National Anthem

-

Crime2 days ago

Crime2 days agoEyebrows Raise as Karoline Leavitt Answers Tough Questions About Epstein

-

Business2 days ago

Business2 days agoCarney’s new agenda faces old Canadian problems

-

Alberta2 days ago

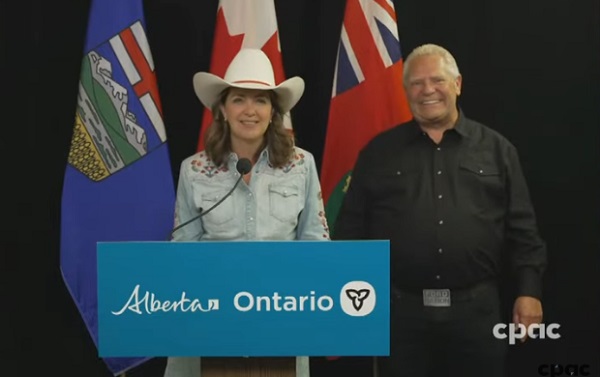

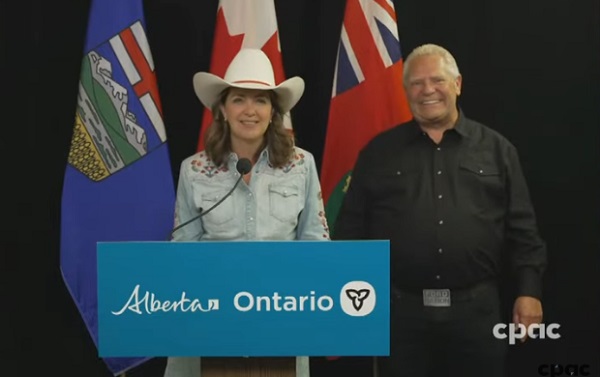

Alberta2 days agoAlberta and Ontario sign agreements to drive oil and gas pipelines, energy corridors, and repeal investment blocking federal policies

-

Alberta2 days ago

Alberta2 days agoCOWBOY UP! Pierre Poilievre Promises to Fight for Oil and Gas, a Stronger Military and the Interests of Western Canada

-

Crime1 day ago

Crime1 day ago“This is a total fucking disaster”

-

International2 days ago

International2 days agoChicago suburb purchases childhood home of Pope Leo XIV