Alberta

Alberta’s emergency grid alert underscores vital role diverse energy mix plays in Canada

From the Canadian Energy Centre

By Cody Ciona

After a major cold spell affected the capacity of Alberta’s power grid to provide electricity, experts weigh in on the need for multiple sources of energy

The crucial need for Canada to have a flexible and diverse energy grid was given a practical demonstration this past weekend as frigid winter temperatures in Alberta prompted a grid emergency.

With temperatures in some places dropping to almost –50C with the wind chill, provincial officials issued an emergency alert asking Albertans to immediately reduce electricity usage, with the grid approaching maximum capacity during peak hours.

With wind and solar assets unable to contribute power and the unexpected shutdown of two natural gas plants, Albertans faced the possibility of rolling blackouts in dangerously cold conditions.

A day after the emergency, the Alberta Electric System Operator (AESO) thanked Albertans who responded quickly to reduce the demand load.

“This is an example of why we need to ensure that we have sufficient dispatchable, dependable generation available to us as a province to meet what is always our most challenging time, which is those cold, dark winter nights,” Michael Law, CEO of AESO, told the Calgary Herald.

The prospect of failure in the worst possible circumstances prompted energy analysts to highlight the critical need for a diverse and flexible energy grid.

“You could have had 50,000 megawatts, all the solar farms and wind farms in the world located in Alberta, and it still wouldn’t have come anywhere close to closing that gap,” University of Alberta economics professor Andrew Leach told CBC News.

Wind and solar can be major contributors to the grid when conditions allow, but when the sun goes down and the wind stops, base load power sources like natural gas reliably protect the system.

Leach said system operators need to plan for supply to manage adverse weather conditions to ensure the reliability of the grid.

“Whether it’s natural gas, nuclear, import capacity, battery storage, etc., geothermal, there’s nobody that’s arguing against that.”

With policymakers pushing for more electrification, University of Alberta industrial engineering professor Tim Weis said Alberta isn’t alone in the need for resilient and stable power supply.

“I think we need to wrestle with that and realize that we are moving into a world where there’s going to be more electrical demands on the system,” he told Global News.

“We are moving into a new world. We’re not the only ones facing some of these challenges. I think we’re a little bit behind responding in terms of dispatchable demand and allowing consumers the opportunity to automatically respond to some of these things.”

As the federal government aims to decarbonize Canada’s electricity generation by 2035 with sweeping regulations, flexibility for some jurisdictions is a key factor that needs to be addressed, said University of Calgary associate professor of economics Blake Shaffer.

“I do think that this shows us that no amount of renewables would push us to have solved that winter peak on Saturday,” he told CTV Calgary.

“And that means flexibility to have a gas fleet, for example, that is capable of being there for a few hours for a few days, maybe a few weeks a year. And we need the technical and economic setup to make that worth their while to be there,” Shaffer said.

“We saw this cold weather coming, everybody was preparing for it. The wind forecast was out a week ago we saw there was going to be no wind. Thankfully, the gas thermal fleet performed amazingly well.”

Natural gas generation was able to backstop the reduction in renewable power, said ARC Energy Research Institute executive director Jackie Forrest.

“The system delivered during the deep freeze this past weekend… so reliably that no one even noticed… I have long argued that gaseous fuels are needed in the mix for energy transition and the need to become cleaner; this is why,” said Forrest on X, formerly known as Twitter.

According to Forrest’s colleague, energy economist Peter Tertzakian, Alberta’s oil sands industry also plays a big role in power generation in the province with the prominence of natural gas-powered cogeneration facilities.

“The power that’s generated in this province during this cold spell, about 40 per cent of it comes from cogeneration. The bulk of which comes from the oil sands and all their big generators which have surplus electricity that they feed into the grid,” said Tertzakian on ARC Energy Institute’s latest podcast.

“I think it’s important to understand that any policies that affect oil sands also affect the electricity grid.”

Alberta

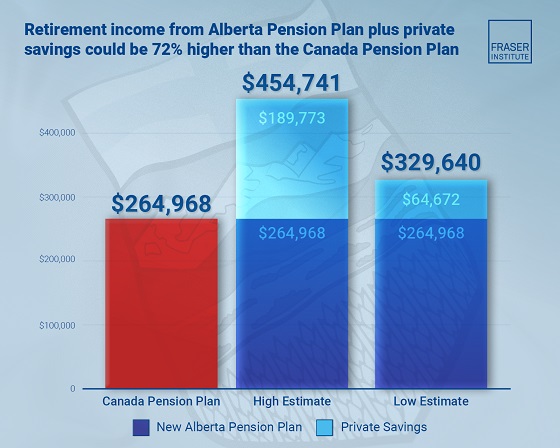

Median workers in Alberta could receive 72% more under Alberta Pension Plan compared to Canada Pension Plan

From the Fraser Institute

By Tegan Hill and Joel Emes

Moving from the CPP to a provincial pension plan would generate savings for Albertans in the form of lower contribution rates (which could be used to increase private retirement savings while receiving the same pension benefits as the CPP under the new provincial pension), finds a new study published today by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“Due to Alberta’s comparatively high rates of employment, higher average incomes, and younger population, Albertans would pay a lower contribution rate through a separate provincial pension plan while receiving the same benefits as under the CPP,” said Tegan Hill, director of Alberta policy at the Fraser Institute and co-author of Illustrating the Potential of an Alberta Pension Plan.

Assuming Albertans invested the savings from moving to a provincial pension plan into a private retirement account, and assuming a contribution rate of 5.85 per cent, workers earning the median income in Alberta ($53,061 in 2025) could accrue a stream of retirement payments totalling $454,741 (pre-tax)—a 71.6 per cent increase from their stream of CPP payments ($264,968).

Put differently, under the CPP, a median worker receives a total of $264,968 in retirement income over their life. If an Alberta worker saved the difference between what they pay now into the CPP and what they would pay into a new provincial plan, the income they would receive in retirement increases. If the contribution rate for the new provincial plan was 5.85 per cent—the lower of the available estimates—the increase in retirement income would total $189,773 (or an increase of 71.6 per cent).

If the contribution rate for a new Alberta pension plan was 8.21 per cent—the higher of the available estimates—a median Alberta worker would still receive an additional $64,672 in retirement income over their life, a marked increase of 24.4 per cent compared to the CPP alone.

Put differently, assuming a contribution rate of 8.21 per cent, Albertan workers earning the median income could accrue a stream of retirement payments totaling $329,640 (pre-tax) under a provincial pension plan—a 24.4 per cent increase from their stream of CPP payments.

“While the full costs and benefits of a provincial pension plan must be considered, its clear that Albertans could benefit from higher retirement payments under a provincial pension plan, compared to the CPP,” Hill said.

Illustrating the Potential of an Alberta Pension Plan

- Due to Alberta’s comparatively high rates of employment, higher average incomes, and younger population, Albertans would pay a lower contribution rate with a separate provincial pension plan, compared with the CPP, while receiving the same benefits as under the CPP.

- Put differently, moving from the CPP to a provincial pension plan would generate savings for Albertans, which could be used to increase private retirement income. This essay assesses the potential savings for Albertans of moving to a provincial pension plan. It also estimates an Albertan’s potential increase in total retirement income, if those savings were invested in a private account.

- Depending on the contribution rate used for an Alberta pension plan (APP), ranging from 5.85 to 8.2 percent, an individual earning the CPP’s yearly maximum pensionable earnings ($71,300 in 2025), would accrue a stream of retirement payments under the total APP (APP plus private retirement savings), yielding a total retirement income of between $429,524 and $584,235. This would be 22.9 to 67.1 percent higher, respectively, than their stream of CPP payments ($349,545).

- An individual earning the median income in Alberta ($53,061 in 2025), would accrue a stream of retirement payments under the total APP (APP plus private retirement savings), yielding a total retirement income of between $329,640 and $454,741, which is between 24.4 percent to 71.6 percent higher, respectively, than their stream of CPP payments ($264,968).

Joel Emes

Alberta

Alberta ban on men in women’s sports doesn’t apply to athletes from other provinces

From LifeSiteNews

Alberta’s Fairness and Safety in Sport Act bans transgender males from women’s sports within the province but cannot regulate out-of-province transgender athletes.

Alberta’s ban on gender-confused males competing in women’s sports will not apply to out-of-province athletes.

In an interview posted July 12 by the Canadian Press, Alberta Tourism and Sport Minister Andrew Boitchenko revealed that Alberta does not have the jurisdiction to regulate out-of-province, gender-confused males from competing against female athletes.

“We don’t have authority to regulate athletes from different jurisdictions,” he said in an interview.

Ministry spokeswoman Vanessa Gomez further explained that while Alberta passed legislation to protect women within their province, outside sporting organizations are bound by federal or international guidelines.

As a result, Albertan female athletes will be spared from competing against men during provincial competition but must face male competitors during inter-provincial events.

In December, Alberta passed the Fairness and Safety in Sport Act to prevent biological men who claim to be women from competing in women’s sports. The legislation will take effect on September 1 and will apply to all school boards, universities, as well as provincial sports organizations.

The move comes after studies have repeatedly revealed what almost everyone already knew was true, namely, that males have a considerable advantage over women in athletics.

Indeed, a recent study published in Sports Medicine found that a year of “transgender” hormone drugs results in “very modest changes” in the inherent strength advantages of men.

Additionally, male athletes competing in women’s sports are known to be violent, especially toward female athletes who oppose their dominance in women’s sports.

Last August, Albertan male powerlifter “Anne” Andres was suspended for six months after a slew of death threats and harassments against his female competitors.

In February, Andres ranted about why men should be able to compete in women’s competitions, calling for “the Ontario lifter” who opposes this, apparently referring to powerlifter April Hutchinson, to “die painfully.”

Interestingly, while Andres was suspended for six months for issuing death threats, Hutchinson was suspended for two years after publicly condemning him for stealing victories from women and then mocking his female competitors on social media. Her suspension was later reduced to a year.

-

Addictions1 day ago

Addictions1 day agoWhy B.C.’s new witnessed dosing guidelines are built to fail

-

Frontier Centre for Public Policy2 days ago

Frontier Centre for Public Policy2 days agoCanada’s New Border Bill Spies On You, Not The Bad Guys

-

Business1 day ago

Business1 day agoCarney Liberals quietly award Pfizer, Moderna nearly $400 million for new COVID shot contracts

-

Business1 day ago

Business1 day agoMark Carney’s Fiscal Fantasy Will Bankrupt Canada

-

Energy2 days ago

Energy2 days agoCNN’s Shock Climate Polling Data Reinforces Trump’s Energy Agenda

-

COVID-1924 hours ago

COVID-1924 hours agoTrump DOJ dismisses charges against doctor who issued fake COVID passports

-

Entertainment2 days ago

Entertainment2 days agoStudy finds 99% of late-night TV guests in 2025 have been liberal

-

Opinion1 day ago

Opinion1 day agoPreston Manning: Three Wise Men from the East, Again