Energy

A carbon tax by any other name

From Canadians for Affordable Energy

Written By Dan McTeague

It turns out that the story circulating last week from The Toronto Star that the Liberals were considering a “rebranding” of their Carbon Taxation program was true. On Wednesday the Liberals announced that the previously known “Climate Action Incentive Payment,” will now be referred to as the “Canada Carbon Rebate.” This was done “in an attempt to tackle what it calls confusion and misconceptions about the scheme.”

According to Liberal Minister Seamus O’Regan “If we can speak the language that people speak, because people say the words ‘carbon,’ they say the words, ‘rebate,’ right? And if we can speak that language, that’s important, so people understand what’s going on here.”

The Liberals seem to actually believe that the problem Canadians have with the carbon tax, and their growing support for Pierre Poilievre’s Conservatives to “Axe the Tax,” has simply been a matter of Canadians not “understand[ing] what is going on.”

The implication, of course, is that Canadians aren’t really struggling to pay their bills, feed their families and heat their homes right now. That their lives haven’t gotten more expensive overall as the cost of fuel has risen steadily.

That they’re just confused by poor branding — probably some high-priced marketing firm’s fault, really — and that once Trudeau & Co. find the right words, people will finally be happy to pay the tax, and be grateful to get some of their money back, since doing so will — somehow — save the planet.

Which is ridiculous.

It’s worth pointing out that this isn’t even the first time Trudeau’s carbon tax has been rebranded. You might recall that prior to 2018, the scheme was referred to as “carbon pricing” or simply the “carbon tax.” If you look back at Hansard records — the records of Parliamentary debate — you can see that in October 2018, Liberal MPs began referring to the scheme as a ‘price on pollution.’ Of course, calling carbon dioxide, a gas on which all life on earth depends, “pollution” was an obvious attempt to justify taxing Canadians for it.

But no matter what they call the thing, they are determined not to let it go.

Recent polls have indicated that the carbon tax is losing support from Canadians. A Nanos poll showed nearly half of Canadians think the carbon tax is ineffective; another poll indicates most Canadians want it reduced or killed altogether.

So why are the Liberals clinging so desperately to this tax that Canadians don’t support? Going so far as to rebrand, reframe, recommunicate rather than scrap it?

I might start to sound like a broken record here, but the only way to understand the context of the carbon tax, the second carbon tax (the Clean Fuel Standard,) an emissions cap, electric vehicle mandates and on and on, is to recognize that they are all components of the insane Net-Zero-by-2050 scheme dreamed up by Justin Trudeau and his UN and World Economic Forum cronies.

A carbon tax is simply one of the pillars of their Net Zero Agenda which they contend will enable Canada to achieve this nebulous goal of Net Zero emissions by 2050.

Though apparently to achieve it, the tax will need to get progressively more punishing. On April 1 the carbon tax goes up another $15, to $80 per ton, and will continue to rise yearly until it hits $170 a ton in 2030. Canadians are already feeling the pinch and it is hard to imagine it getting worse. But Liberals aren’t concerned with the struggles of everyday people and that is the reality. This has become a communications issue to them, not an existential one.

As to the new name itself, the Trudeau Liberals love to pay lip service to their rebate scheme and claim that Canadians are getting back more than they pay. But as we well know even the Independent Parliamentary Budget Officer found that, contrary to what their talking point, a substantial majority of households are paying more in carbon taxes than they get back.

Their communications plan too is so unhinged that they are pitching the carbon tax as an affordability measure designed to help struggling Canadians. Of course this begs the question: If Canadians are getting back more than they pay in carbon taxes, why take the money in the first place?

The rubber is hitting the road and Canadians have had enough. No matter what it’s called, the carbon tax has made our lives worse.

That will continue to be true, no matter what they call it.

Dan McTeague is President of Canadians for Affordable Energy

Canadian Energy Centre

Cross-Canada economic benefits of the proposed Northern Gateway Pipeline project

From the Canadian Energy Centre

Billions in government revenue and thousands of jobs across provinces

Announced in 2006, the Northern Gateway project would have built twin pipelines between Bruderheim, Alta. and a marine terminal at Kitimat, B.C.

One pipeline would export 525,000 barrels per day of heavy oil from Alberta to tidewater markets. The other would import 193,000 barrels per day of condensate to Alberta to dilute heavy oil for pipeline transportation.

The project would have generated significant economic benefits across Canada.

The following projections are drawn from the report Public Interest Benefits of the Northern Gateway Project (Wright Mansell Research Ltd., July 2012), which was submitted as reply evidence during the regulatory process.

Financial figures have been adjusted to 2025 dollars using the Bank of Canada’s Inflation Calculator, with $1.00 in 2012 equivalent to $1.34 in 2025.

Total Government Revenue by Region

Between 2019 and 2048, a period encompassing both construction and operations, the Northern Gateway project was projected to generate the following total government revenues by region (direct, indirect and induced):

British Columbia

- Provincial government revenue: $11.5 billion

- Federal government revenue: $8.9 billion

- Total: $20.4 billion

Alberta

- Provincial government revenue: $49.4 billion

- Federal government revenue: $41.5 billion

- Total: $90.9 billion

Ontario

- Provincial government revenue: $1.7 billion

- Federal government revenue: $2.7 billion

- Total: $4.4 billion

Quebec

- Provincial government revenue: $746 million

- Federal government revenue: $541 million

- Total: $1.29 billion

Saskatchewan

- Provincial government revenue: $6.9 billion

- Federal government revenue: $4.4 billion

- Total: $11.3 billion

Other

- Provincial government revenue: $1.9 billion

- Federal government revenue: $1.4 billion

- Total: $3.3 billion

Canada

- Provincial government revenue: $72.1 billion

- Federal government revenue: $59.4 billion

- Total: $131.7 billion

Annual Government Revenue by Region

Over the period 2019 and 2048, the Northern Gateway project was projected to generate the following annual government revenues by region (direct, indirect and induced):

British Columbia

- Provincial government revenue: $340 million

- Federal government revenue: $261 million

- Total: $601 million per year

Alberta

- Provincial government revenue: $1.5 billion

- Federal government revenue: $1.2 billion

- Total: $2.7 billion per year

Ontario

- Provincial government revenue: $51 million

- Federal government revenue: $79 million

- Total: $130 million per year

Quebec

- Provincial government revenue: $21 million

- Federal government revenue: $16 million

- Total: $37 million per year

Saskatchewan

- Provincial government revenue: $204 million

- Federal government revenue: $129 million

- Total: $333 million per year

Other

- Provincial government revenue: $58 million

- Federal government revenue: $40 million

- Total: $98 million per year

Canada

- Provincial government revenue: $2.1 billion

- Federal government revenue: $1.7 billion

- Total: $3.8 billion per year

Employment by Region

Over the period 2019 to 2048, the Northern Gateway Pipeline was projected to generate the following direct, indirect and induced full-time equivalent (FTE) jobs by region:

British Columbia

- Annual average: 7,736

- Total over the period: 224,344

Alberta

- Annual average: 11,798

- Total over the period: 342,142

Ontario

- Annual average: 3,061

- Total over the period: 88,769

Quebec

- Annual average: 1,003

- Total over the period: 29,087

Saskatchewan

- Annual average: 2,127

- Total over the period: 61,683

Other

- Annual average: 953

- Total over the period: 27,637

Canada

- Annual average: 26,678

- Total over the period: 773,662

Alberta

Albertans need clarity on prime minister’s incoherent energy policy

From the Fraser Institute

By Tegan Hill

The new government under Prime Minister Mark Carney recently delivered its throne speech, which set out the government’s priorities for the coming term. Unfortunately, on energy policy, Albertans are still waiting for clarity.

Prime Minister Carney’s position on energy policy has been confusing, to say the least. On the campaign trail, he promised to keep Trudeau’s arbitrary emissions cap for the oil and gas sector, and Bill C-69 (which opponents call the “no more pipelines act”). Then, two weeks ago, he said his government will “change things at the federal level that need to be changed in order for projects to move forward,” adding he may eventually scrap both the emissions cap and Bill C-69.

His recent cabinet appointments further muddied his government’s position. On one hand, he appointed Tim Hodgson as the new minister of Energy and Natural Resources. Hodgson has called energy “Canada’s superpower” and promised to support oil and pipelines, and fix the mistrust that’s been built up over the past decade between Alberta and Ottawa. His appointment gave hope to some that Carney may have a new approach to revitalize Canada’s oil and gas sector.

On the other hand, he appointed Julie Dabrusin as the new minister of Environment and Climate Change. Dabrusin was the parliamentary secretary to the two previous environment ministers (Jonathan Wilkinson and Steven Guilbeault) who opposed several pipeline developments and were instrumental in introducing the oil and gas emissions cap, among other measures designed to restrict traditional energy development.

To confuse matters further, Guilbeault, who remains in Carney’s cabinet albeit in a diminished role, dismissed the need for additional pipeline infrastructure less than 48 hours after Carney expressed conditional support for new pipelines.

The throne speech was an opportunity to finally provide clarity to Canadians—and specifically Albertans—about the future of Canada’s energy industry. During her first meeting with Prime Minister Carney, Premier Danielle Smith outlined Alberta’s demands, which include scrapping the emissions cap, Bill C-69 and Bill C-48, which bans most oil tankers loading or unloading anywhere on British Columbia’s north coast (Smith also wants Ottawa to support an oil pipeline to B.C.’s coast). But again, the throne speech provided no clarity on any of these items. Instead, it contained vague platitudes including promises to “identify and catalyse projects of national significance” and “enable Canada to become the world’s leading energy superpower in both clean and conventional energy.”

Until the Carney government provides a clear plan to address the roadblocks facing Canada’s energy industry, private investment will remain on the sidelines, or worse, flow to other countries. Put simply, time is up. Albertans—and Canadians—need clarity. No more flip flopping and no more platitudes.

-

Crime1 day ago

Crime1 day agoHow Chinese State-Linked Networks Replaced the Medellín Model with Global Logistics and Political Protection

-

Addictions1 day ago

Addictions1 day agoNew RCMP program steering opioid addicted towards treatment and recovery

-

Aristotle Foundation1 day ago

Aristotle Foundation1 day agoWe need an immigration policy that will serve all Canadians

-

Business1 day ago

Business1 day agoNatural gas pipeline ownership spreads across 36 First Nations in B.C.

-

Courageous Discourse1 day ago

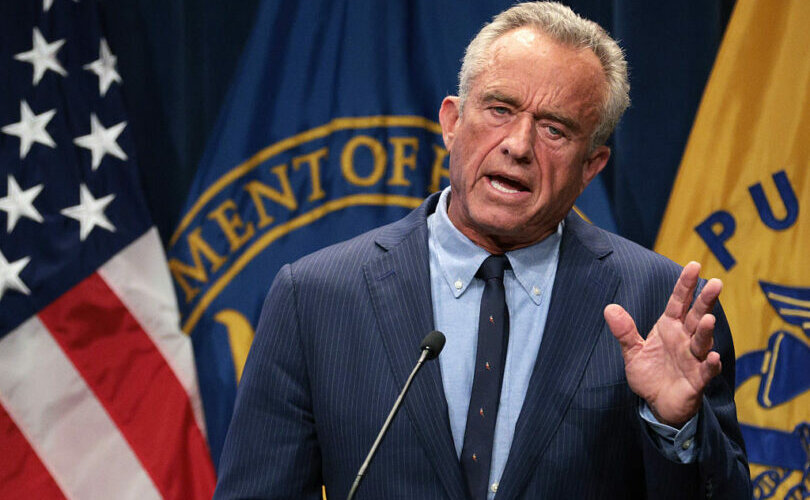

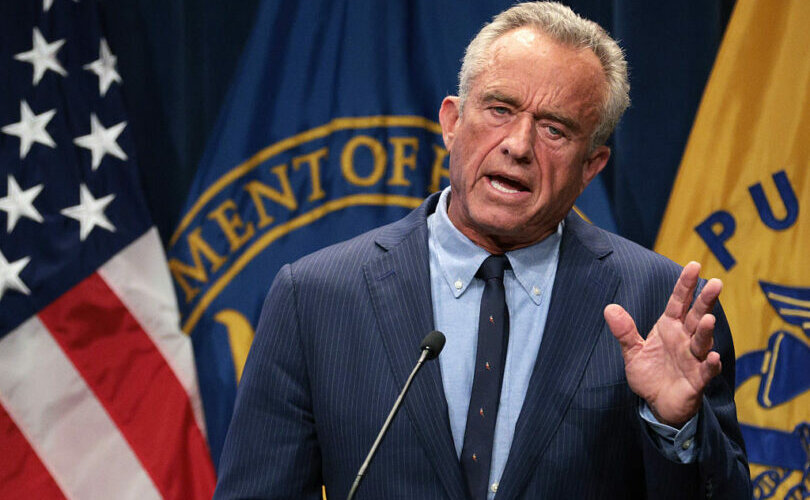

Courageous Discourse1 day agoHealthcare Blockbuster – RFK Jr removes all 17 members of CDC Vaccine Advisory Panel!

-

Business8 hours ago

Business8 hours agoEU investigates major pornographic site over failure to protect children

-

Health22 hours ago

Health22 hours agoRFK Jr. purges CDC vaccine panel, citing decades of ‘skewed science’

-

Censorship Industrial Complex1 day ago

Censorship Industrial Complex1 day agoAlberta senator wants to revive lapsed Trudeau internet censorship bill