From Danielle Smith

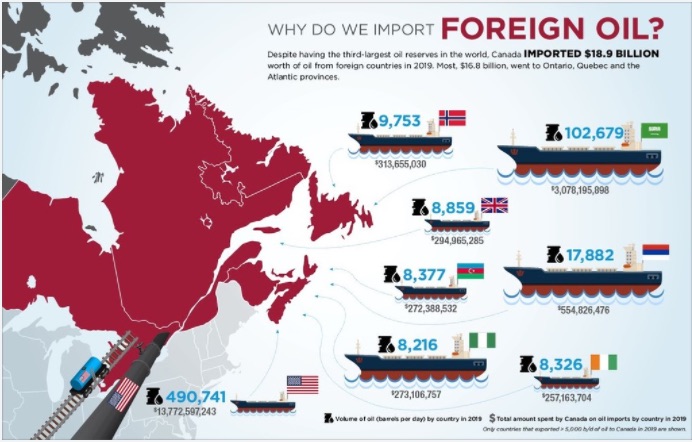

I read an infographic that said Canada has bought $13 billion worth of petroleum products from Russia since 2000 – we buy from them at a rate of $550 million a year. What the hell are we doing?

The situation for Ukraine looks very grave indeed. Most commentators thought Vladimir Putin was going to “liberate” the two Russia friendly break off republics of Donetsk and Luhansk. What a surprise to the world to find Russian soldiers in Kyiv among other incursions.

It is pretty clear the Russian leader intends to take all of Ukraine.

But we also must not be naïve about Putin’s aspirations. A Polish friend of mine – who remembers watching Russian tanks roll into her town outside her street when she was seven years old – is under no illusions about how far Putin intends to go.

She fully expects Belarus, Lithuania, Latvia, Estonia, Kazakhstan and possibly Moldova to be next. She believes Putin wants to assemble the Soviet Union 2.0, with the ultimate aim of controlling the energy supply to the rest of the world.

So how does this play out?

Just like you I’ve been trying to sort through the conflicting media coverage to find out what is really going on. If indeed there are Ukraine substates that genuinely want to be independent, I don’t have a particular problem with that. As I said in a Locals post, post WWII the powers that be made a lot of blunders redrawing the map of Europe and the Middle East, cramming people together under a national flag even if they hated each other, so perhaps some aspirations for independence are legitimate. But it’s clear that Putin’s aspiration goes far beyond Crimea, Donetsk and Luhansk. It appears now that he wants the whole thing. But why?

First off, though it’s sad to say, there hasn’t been much honest reporting about Ukraine and Russia starting in the Trump years so almost everything you read will be through the lens of people who hate Trump (who clearly understood Putin’s strength and saw no need to antagonize him) and Biden (whose family had strange dealings in Ukraine no one wants to talk about).

In addition there is so much propaganda floating around the web I’d be reluctant to retweet any stories of “bravery” unless they’ve been verified. Here’s a good summary of the lies so far: The Ghost of Kiev, the woman with the sunflower seeds, footage of things being shot down or blown up – so far most of these stories are outright falsehoods or images from video games or prior conflicts. The “Russian Warship Go Fuck Yourself” holdouts was partly true: yes they said it, but they didn’t die in a missile attack. They were all apprehended and taken alive.

So know that you have to read everything knowing that the writer is trying to manipulate you. I’m just trying to figure out what is actually going on. It’s not easy.

To that end…

The mainstream view as reported on BBC, is that Russia feels threatened by a modern Ukraine and irrationally believes it has been taken over by extremists and Nazis. I guess calling one’s political opponents “Nazis” is the new all-purpose smear being used by Russian Presidents and Canadian Prime Ministers alike to justify war measures. In any case, this analysis left me unsatisfied as it seemed a bit shallow and one-sided like so much of MSM these days.

Social media isn’t doing much better, and the commentariat seems to think this is the time to practice their best pop culture zingers. It’s kind of humiliating to read this piece that calls out the Harry Potter references, the self-care links and the demands to “deplatform” Russia: “If the West saw Ukraine and its cause as truly important, something worth paying a price to assist, they would sanction Russia’s energy sector. But they do not (even the Globalist American Empire must sometimes face reality). So instead, we get a parade of symbolic sanctions, passive-aggressive gestures of anger and hostility. In fact, the tactics the GAE uses against Russia — social ostracisim, deplatforming, and performative public condemnation — are the same feminine tools that it uses domestically to ruins the lives of people who use a politically incorrect word or donate to the wrong protest.” Ouch.

Here’s a video from a podcaster imbedded in Kyiv who says openly, “you’ll probably think I’m a Russian stooge” so he may indeed be a Russian stooge, but he explains why he thinks Russia (so far) has been restrained in its attack. He believes Ukrainians are fleeing because Ukraine President Volodymyr Zelensky is endangering them, by putting Kalashnikovs in the hands of untrained civilians who are going to be killed when confronted by professional Russian soldiers, and mandating military service for every man aged 18 to 60. He does not believe the Russians intend to cause mass casualties or destruction, but that they will kill if someone is pointing a gun at them, which will allow more reports depicting Putin’s viciousness.

He also explains how important Kyiv is to the Russian foundational story. As far as Putin is concerned, Ukraine is Russia, and he expected to be treated as a liberator when he arrived. He also outlined the different military tactics of Russia to explain why the West is saying that Russia is losing. When the US enters a country they do scorched earth and blow everything up – roads, bridges, electrical grids, water plants and so on. The fact that Putin is not doing that is being perceived as weakness. But if Putin wants Ukraine to be part of Russia permanently, it would make no sense to destroy everything. That doesn’t engender good feelings. Putin wants a puppet regime in Ukraine friendly to Russia’s interests – he doesn’t want to raze the joint or blow it smithereens.

Finally, this piece helped put a lot into perspective for me. “Ukraine’s Deadly Gamble” by Lee Smith has the ring of truth about it. He depicts it thus: “…(T)he Ukrainians made a geopolitical blunder that statesmen will study for years to come: A buffer state had staked its future on a distant power that had simply seen it as an instrument to annoy its powerful neighbor with no attachment to any larger strategic concept that it was willing to support.” They were a pawn in the game to help discredit Trump with the Russian collusion story, then when Trump started poking around to find out what the Bidens were up to in Ukraine, they played a willing role to aid his impeachment. Now they find out the Americans just aren’t that into them after all.

In the end, mid-size powers sleeping next to giants have to realize that their continued ability to remain independent is measured by whether they are perceived as antagonistic to the giant’s interests. If the situation was reversed – if Canada started cozying up to Russia and helping to sabotage US presidents to curry favour with Russia – I don’t think it would go well for us either. Maybe not full scale invasion, but the Americans hold life or death power over our economy so it wouldn’t be a wise move. Sad that regular citizens become the collateral damage in the decisions of their elected leaders. But that’s why elections matter.

If Canada was a serious grown-up country with a serious grown-up leader we’d be able to say “we can help” without being laughed off the world stage. We can help, in a very practical way. We can help wean the world off Russian oil and natural gas. We could ask Quebec to stop thinking only about itself for a change and reverse its announced ban on oil and natural gas extraction. Trudeau could declare multiple projects in the global interest and work with First Nations partners to complete Transmountain Pipeline and build Northern Gateway, work with Biden to build Keystone XL and with the provinces of QB and NB to build Energy East. He would use his powers under the Constitution to tell Quebec they can not block LNG Export from Saguenay, and he’d post a sentry of protectors for Coastal Gas Link to make sure it gets completed too.But look at this silliness: “despite the fact that 18 LNG export terminals have been proposed in Canada over the years, and 24 long-term LNG export licenses have been granted since 2011, a grand total of zero have been built.” We have failed the world with Trudeau’s anti-carbon-dioxide obsession. Let’s not forget it.

Canada is key to energy security and affordability for North America and our European allies, and we could hit Russia where it hurts. If we wanted to be a meaningful player on the international stage we would embrace it.

Instead we have a federal Environment Minister who made his name scaling the CN Tower and Ralph Klein’s house to oppose fossil fuels, and we’ve joined the Build Back Better brigade pretending the world can survive on wind turbines and solar panels alone.

Canada is not a serious place and our friends in Eastern Europe are now paying the price for it. Such a tragedy.

For more from Daniel Smith

| Locals.com: Join the Daily Dialogue Locals.com – go to https://daniellesmith.locals.com (Warning: it is a US platform and charges its subscription fees in US dollars. They charge a modest fee to join to keep the trolls away.) I keep it as low as they allow at $2 a month or you can $20 for an annual subscription.

Book Me: I am happy to do moderating and speaking engagements. My fee is $500. You can book me by emailing [email protected].

Donate Online: If you like what you see and want me to continue doing this, please feel free to donate through my website: https://daniellesmith.ca/support

Donate by Etransfer: If you prefer to etransfer, send to [email protected]

Donate by Mail: Send to the PO Box below.

Subscribe to my Free Weekly Newsletter: Subscribe to this newsletter by going online to http://daniellesmith.ca. I’ve been told by more than a few people that the newsletter is ending up blocked by your mail system. I’ll make it password protected to cut down on the trolls.

See Previous Newsletters Online: Go to https://daniellesmith.ca/newsletterarchives and enter password Liberty. |

|

Related