Economy

There’s no free lunch.. But an O’Toole Conservative Government will pay for half of yours

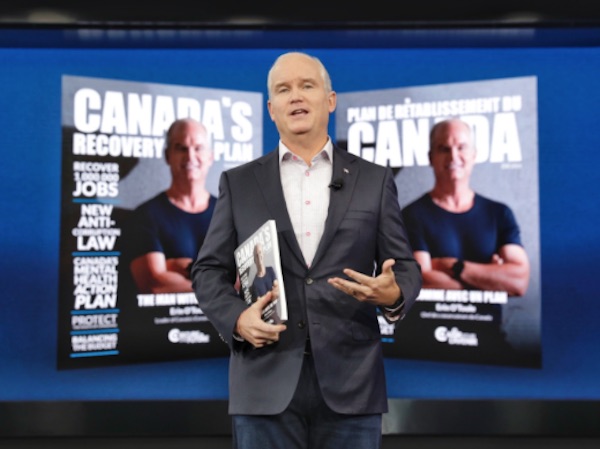

News Release from The Conservative Party of Canada

Hon. Erin O’Toole, Leader of Canada’s Conservatives, released his plan to introduce a Dine and Discover program to support the tourism and hospitality sectors.

“The COVID-19 pandemic has had a disastrous effect on Canada’s tourism and hospitality sectors,” said O’Toole. “A Conservative government will act quickly to recover the one million jobs lost during the pandemic and help these businesses get back on their feet.”

Through Canada’s Recovery Plan, a Conservative government will introduce a Dine and Discover program to encourage Canadians to support these hard-hit sectors. This initiative will:

- Provide a 50 per cent rebate for food and non-alcoholic drinks purchased for dine-in from Monday to Wednesday for one month, once it is safe to do so, pumping nearly $1 billion into these sectors.

- Launch the Explore and Support Canada initiative with a 15 per cent tax credit for vacation expenses of up to $1,000 per person to encourage Canadians to vacation in Canada in 2022, helping the tourism sector get back on its feet.

- Eliminate the Liberal escalator tax on alcohol.

“We will help Canadians deal with the rising cost of living, while supporting those who work in our hospitality sector,” said O’Toole.

If you don’t care about securing support for Canada’s tourism and hospitality sectors, you have three parties to choose from in this election. If you do, then there is only one choice – Canada’s Conservatives.

Backgrounder

To get Canadians back to work, the federal government needs to focus on helping the hardest-hit sectors, including the hospitality and tourism sectors. To support these sectors, Canada’s Conservatives will introduce a new Dine and Discover program.

“Dine”: Restaurant refund initiative

Once it is safe to do so, Canada’s Conservatives will support the recovery of the restaurant sector by providing a 50 per cent rebate for food and non-alcoholic drinks purchased for dine-in service from Monday to Wednesday.

Modelled on a similar program in the United Kingdom, this initiative will encourage Canadians to get back into restaurants on days of the week when restaurants tend to have excess capacity.

The customer will immediately receive the rebate, which will appear directly on the bill. Businesses will receive their rebate from the Canada Revenue Agency (CRA) within days of submitting the claim through a CRA portal similar, to that used for emergency business supports.

There will be no limit on the number of times that an individual customer may use the program, but the program would cover a maximum meal cost of $35 per patron per visit. The program will apply to a wide range of establishments, including but not limited to restaurants, pubs, bars, coffee shops, and canteens.

This will support workers by injecting nearly $1 billion into the restaurant, hospitality, and tourism industries.

“Discover”: Explore and Support Canada initiative

Canada’s Conservatives will establish an Explore and Support Canada initiative to encourage Canadians to support the recovery of the Canadian tourism and hospitality sectors. Conservatives will create a refundable 15 per cent tax credit for vacation expenses of up to $1,000 per person for Canadians to vacation in Canada in 2022.

For a couple, this would mean savings of up to $300 on their next family trip if they vacation in Canada.

Eligible expenses would include:

- Accommodations, including hotels, motels, and other short-term rentals;

- Restaurant meals, including delivery fees and tips;

- Entry fees to attractions, parks, cultural events, museums, festivals, sporting events, and other attractions; and

- Travel, including car rentals, RV rentals, bus rides, taxi rides, airfare, tolls, and parking.

This program will benefit Canadian workers in hotels, restaurants, airlines, festivals, museums, and a wide range of businesses in the tourism and hospitality industries.

This will support workers by injecting over $1.5 billion into these sectors.

Quick Facts:

- Restaurants employ 1.2 million Canadians and contribute $95 billion to GDP.

- The Canadian tourism industry supports 1.8 million jobs and contributes $102 billion to GDP.

- About 533,000 workers in the tourism industry lost their jobs in 2020.

Business

Nearly One-Quarter of Consumer-Goods Firms Preparing to Exit Canada, Industry CEO Warns Parliament

Standing Committee on Industry and Technology hears stark testimony that rising costs and stalled investment are pushing companies out of the Canadian market.

There’s a number that should stop this country cold: twenty-three percent. That is the share of companies in one of Canada’s essential manufacturing and consumer-goods sectors now preparing to withdraw products from the Canadian market or exit entirely within the next two years. And this wasn’t whispered at a business luncheon or buried in a consultancy memo. It was delivered straight to Parliament, at the House of Commons Standing Committee on Industry and Technology, during its study on Canada’s underlying productivity gaps and capital outflow.

Michael Graydon, the CEO of Food, Health & Consumer Products of Canada, didn’t hedge or soften the message. He told MPs, “23% of our members expect to exit products from the Canadian marketplace within the next two years, because the cost of doing business here has just become unsustainable.”

Unsustainable. That’s the word he used. And when the people who actually make things in this country start using that word, you should pay attention. These aren’t fringe players or hypothetical startups. These are firms that supply the goods Canadians buy every single day, and they’re looking at their balance sheets, their regulatory burdens, the delays in getting anything approved or built, and concluding that Canada simply doesn’t work for them anymore.

What makes this more troubling is the timing. Canada’s investment levels have been falling for years, even as the United States and other competitors race ahead. Businesses aren’t reinvesting in machinery or technology at the rate they once did. They’re not modernizing their operations here. They’re putting expansion plans on hold or shifting them to jurisdictions that move faster, cost less and offer clearer rules. That’s not ideology; it’s arithmetic. If it costs more to operate here, if it takes longer to get a permit, and if supply chains back up because ports and rail lines are jammed, investors will choose the place that doesn’t make growth a bureaucratic mountain climb.

Graydon raised another point that ought to concern anyone who cares about domestic production. Canada’s agrifood sector recorded a sixty-billion-dollar trade surplus last year, one of the brightest spots in the national economy, but according to him that potential is being “diluted by fragmented interprovincial trade and logistics bottlenecks.” The ports, the rail corridors, the entire transport network—choke points everywhere. And you can’t build a productive economy on choke points. Companies can’t scale, can’t guarantee delivery, can’t justify the costs. So they leave.

This twenty-three percent figure is the clearest evidence yet that the problem isn’t theoretical. It’s not something for think-tank panels or academic papers. It is happening at the level that matters most: the decision whether to continue doing business in Canada or move operations somewhere more predictable. And once those decisions are made, they’re very hard to reverse. Capital doesn’t boomerang back out of patriotism. It goes where it can earn a return.

For years, Canadian policymakers have talked about productivity as if it were a moral failing of workers or a mystical national characteristic. It’s neither. Productivity comes from investment—real money poured into equipment, technology, training and expansion. When investment stalls, productivity collapses. And when a quarter of firms in a major sector are already planning their exit, you are not looking at a temporary dip. You are looking at a structural rejection of the business environment itself.

The fact that executives are now openly warning Parliament that they cannot afford to stay is a moment of clarity. It is also a test. Either this country becomes a place where people can build things again—quickly, affordably, competitively—or it continues down the path that leads to empty factories, hollowed-out supply chains and consumers who wonder why the shelves look thinner every year.

Twenty-three percent is not just a statistic. It’s the sound of a warning bell ringing at full volume. The only question now is whether anyone in charge hears it.

Business

Climate Climbdown: Sacrificing the Canadian Economy for Net-Zero Goals Others Are Abandoning

By Gwyn Morgan

Canada has spent the past decade pursuing climate policies that promised environmental transformation but delivered economic decline. Ottawa’s fixation on net-zero targets – first under Justin Trudeau and now under Prime Minister Mark Carney – has meant staggering public expenditures, resource project cancellations and rising energy costs, all while failing to

reduce the country’s dependence on fossil fuels. Now, as key international actors reassess the net-zero doctrine, Canada stands increasingly alone in imposing heavy burdens for negligible gains.

The Trudeau government launched its agenda in 2015 by signing the Paris Climate Agreement aimed at limiting the forecast increase in global average temperature to 1.5°C by the end of the century. It followed the next year with the Pan-Canadian Framework on Clean Growth and Climate Change that imposed more than 50 measures on the economy, key among them a

carbon “pricing” regime – Liberal-speak for taxes on every Canadian citizen and industry. Then came the 2030 Emissions Reduction Plan, committing Canada to cut greenhouse gas emissions to 40 percent below 2005 levels by 2030, and to achieve net-zero by 2050. And then the “On-Farm Climate Action Fund,” the “Green and Inclusive Community Buildings Program” and the “Green Municipal Fund.”

It’s a staggering list of nation-impoverishing subsidies, taxes and restrictions, made worse by regulatory measures that hammered the energy industry. The Trudeau government cancelled the fully-permitted Northern Gateway pipeline, killing more than $1 billion in private investment and stranding hundreds of billions of dollars’ worth of crude oil in the ground. The

Energy East project collapsed after Ottawa declined to challenge Quebec’s political obstruction, cutting off a route that could have supplied Atlantic refineries and European markets. Natural gas developers fared no better: 11 of 12 proposed liquefied natural gas export terminals were abandoned amid federal regulatory delays and policy uncertainty. Only a single LNG project in Kitimat, B.C., survived.

None of this has had the desired effect. Between Trudeau’s election in 2015 and 2023, fossil fuels’ share of Canada’s energy supply actually increased from 75 to 77 percent. As for saving the world, or even making some contribution towards doing so, Canada contributes just 1.5 percent of global GHG emissions. If our emissions went to zero tomorrow, the emissions

growth from China and India would make that up in just a few weeks.

And this green fixation has been massively expensive. Two newly released studies by the Fraser Institute found that Ottawa and the four biggest provinces have either spent or foregone a mind-numbing $158 billion to create just 68,000 “clean” jobs – an eye-watering cost of over $2.3 million per job “created”. At that, the green economy’s share of GDP crept up only 0.3

percentage points.

The rest of the world is waking up to this folly. A decade after the Paris Agreement, over 81 percent of the world’s energy still comes from fossil fuels. Environmental statistician and author Bjorn Lomborg points out that achieving global net-zero by 2050 would require removing the equivalent of the combined emissions of China and the United States in each of the next five

years. “This puts us in the realm of science fiction,” he wrote recently.

In July, the U.S. Department of Energy released a major assessment assembled by a team of highly credible climate scientists which asserted that “CO 2 -induced warming appears to be less damaging economically than commonly believed,” and that aggressive mitigation policies might be “more detrimental than beneficial.” The report found no evidence of rising frequency or severity of hurricanes, floods, droughts or tornadoes in U.S. historical data, while noting that U.S. emissions reductions would have “undetectably small impacts” on global temperatures in any case.

U.S. Energy Secretary Chris Wright welcomed the findings, noting that improving living standards depends on reliable, affordable energy. The same day, the Environmental Protection Agency proposed rescinding the 2009 “endangerment finding” that had designated CO₂ and other GHGs as “pollutants.” It had led to sweeping restrictions on oil and gas development and fuelled policies that the current administration estimates cost the U.S. economy at least US$1 trillion in lost growth.

Even long-time climate alarmists are backtracking. Ted Nordhaus, a prominent American critic, recently acknowledged that the dire global warming scenarios used by the Intergovernmental Panel on Climate Change rely on implausible combinations of rapid population growth, strong economic expansion and stagnant technology. Economic growth typically reduces population increases and accelerates technological improvement, he pointed out, meaning emissions trends will likely be lower than predicted. Even Bill Gates has tempered his outlook, writing that climate change will not be “cataclysmic,” and that although it will hurt the poor, “it will not be the only or even the biggest threat to their lives and welfare.” Poverty and disease pose far greater threats and resources, he wrote, should be focused where they can do the most good now.

Yet Ottawa remains unmoved. Prime Minister Carney’s latest budget raises industrial carbon taxes to as much as $170 per tonne by 2030, increasing the competitive disadvantage of Canadian industries in a time of weak productivity and declining investment. These taxes will not measurably alter global emissions, but they will deepen Canada’s economic malaise and

push production – and emissions – toward jurisdictions with more lax standards. As others retreat from net-zero delusions, Canada moves further offside global energy policy trends – extending our country’s sad decline.

The original, full-length version of this article was recently published in C2C Journal.

Gwyn Morgan is a retired business leader who has been a director of five global corporations.

-

Alberta1 day ago

Alberta1 day agoNational Crisis Approaching Due To The Carney Government’s Centrally Planned Green Economy

-

Alberta1 day ago

Alberta1 day agoAlberta Offers Enormous Advantages for AI Data Centres

-

Alberta1 day ago

Alberta1 day agoCalgary mayor should retain ‘blanket rezoning’ for sake of Calgarian families

-

Bruce Dowbiggin1 day ago

Bruce Dowbiggin1 day agoSports 50/50 Draws: Make Sure You Read The Small Print

-

COVID-191 day ago

COVID-191 day agoNew report warns Ottawa’s ‘nudge’ unit erodes democracy and public trust

-

Carbon Tax13 hours ago

Carbon Tax13 hours agoCarney fails to undo Trudeau’s devastating energy policies

-

Censorship Industrial Complex1 day ago

Censorship Industrial Complex1 day agoQuebec City faces lawsuit after cancelling Christian event over “controversial” artist

-

espionage2 days ago

espionage2 days agoTrump says release the Epstein files