Economy

3 billion a week! Bank of Canada buying bonds at same rate as federal government overspending

Business

Capital Flight Signals No Confidence In Carney’s Agenda

From the Frontier Centre for Public Policy

By Jay Goldberg

Between bad trade calls and looming deficits, Canada is driving money out just when it needs it most

Canadians voted for relative continuity in April, but investors voted with their wallets, moving $124 billion out of the country.

According to the National Bank, Canadian investors purchased approximately $124 billion in American securities between February and July of this year. At the same time, foreign investment in Canada dropped sharply, leaving the country with a serious hole in its capital base.

As Warren Lovely of National Bank put it, “with non-resident investors aloof and Canadians adding foreign assets, the country has suffered a major capital drain”—one he called “unprecedented.”

Why is this happening?

One reason is trade. Canada adopted one of the most aggressive responses to U.S. President Donald Trump’s tariff agenda. Former prime minister Justin Trudeau imposed retaliatory tariffs on the United States and escalated tensions further by targeting goods covered under the Canada–United States–Mexico Agreement (CUSMA), something even the Trump administration avoided.

The result was punishing. Washington slapped a 35 per cent tariff on non-CUSMA Canadian goods, far higher than the 25 per cent rate applied to Mexico. That made Canadian exports less competitive and unattractive to U.S. consumers. The effects rippled through industries like autos, agriculture and steel, sectors that rely heavily on access to U.S. markets. Canadian producers suddenly found themselves priced out, and investors took note.

Recognizing the damage, Prime Minister Mark Carney rolled back all retaliatory tariffs on CUSMA-covered goods this summer in hopes of cooling tensions. Yet the 35 per cent tariff on non-CUSMA Canadian exports remains, among the highest the U.S. applies to any trading partner.

Investors saw the writing on the wall. They understood Trudeau’s strategy had soured relations with Trump and that, given Canada’s reliance on U.S. trade, the United States would inevitably come out on top. Parking capital in U.S. securities looked far safer than betting on Canada’s economy under a government playing a weak hand.

The trade story alone explains much of the exodus, but fiscal policy is another concern. Interim Parliamentary Budget Officer Jason Jacques recently called Ottawa’s approach “stupefying” and warned that Canada risks a 1990s-style fiscal crisis if spending isn’t brought under control. During the 1990s, ballooning deficits forced deep program cuts and painful tax hikes. Interest rates soared, Canada’s debt was downgraded and Ottawa nearly lost control of its finances. Investors are seeing warning signs that history could repeat itself.

After months of delay, Canadians finally saw a federal budget on Nov. 4. Jacques had already projected a deficit of $68.5 billion when he warned the outlook was “unsustainable.” National Bank now suggests the shortfall could exceed $100 billion. And that doesn’t include Carney’s campaign promises, such as higher defence spending, which could add tens of billions more.

Deficits of that scale matter. They can drive up borrowing costs, leave less room for social spending and undermine confidence in the country’s long-term fiscal stability. For investors managing pensions, RRSPs or business portfolios, Canada’s balance sheet now looks shaky compared to a U.S. economy offering both scale and relative stability.

Add in high taxes, heavy regulation and interprovincial trade barriers, and the picture grows bleaker. Despite decades of promises, barriers between provinces still make it difficult for Canadian businesses to trade freely within their own country. From differing trucking regulations to restrictions on alcohol distribution, these long-standing inefficiencies eat away at productivity. When combined with federal tax and regulatory burdens, the environment for growth becomes even more hostile.

The Carney government needs to take this unprecedented capital drain seriously. Investors are not acting on a whim. They are responding to structural problems—ill-advised trade actions, runaway federal spending and persistent barriers to growth—that Ottawa has yet to fix.

In the short term, that means striking a deal with Washington to lower tariffs and restore confidence that Canada can maintain stable access to U.S. markets. It also means resisting the urge to spend Canada into deeper deficits when warning lights are already flashing red. Over the long term, Ottawa must finally tackle high taxes, cut red tape and eliminate the bureaucratic obstacles that stand in the way of economic growth.

Capital has choices. Right now, it is voting with its feet, and with its dollars, and heading south. If Canada wants that capital to come home, the government will have to earn it back.

Jay Goldberg is a fellow with the Frontier Centre for Public Policy.

Economy

The True Cost of Mark Carney’s Ineffective Green Energy Sinkhole

From Energy Now

By Ron Wallace

The Carney government has continued to express an openness to new oil export pipelines while maintaining its commitment to long-standing clean energy ambitions associated with emissions reductions. Hence their assertions that any potential revival of projects such as Keystone XL would have to be accompanied by the production of “decarbonized” oil. Reflecting this stance, Energy and Natural Resources Minister Tim Hodgson recently reaffirmed his governments’ position that Canada is seeking to be a leader in the production of “affordable, low-carbon energy” by introducing a new $3.4 million investment into carbon dioxide removal (CDR) ventures to support Canada’s low-carbon energy goals.

However, on the vital issue of a proposed emissions cap for Canadian oil and gas production, it is regrettable that Prime Minister Carney’s stance remains unclear despite significant evidence that the policy would have material negative effects on the Canadian, particularly the western, economy. Notably, the House Environment Committee that has recently reviewed the issue appear to be in favour of the policy despite reports that warn of the cap’s material economic impact.

Along with its 2030 Emissions Reduction Plan, and the expected release of its climate competitiveness strategy along with the federal budget, it may be timely to review Canada’s historical progress for emissions targets and importantly to assess what these policies have cost Canadians.

In 2015 the Trudeau Liberal government agreed to adopt targets under the Kyoto Protocol that committed Canada to reducing total emissions to 5 per cent below 1990 levels. However, a recent audit from the Commissioner of the Environment’s Office indicates that the federal government is set to miss its 2030 target to cut carbon emissions by 40 per cent below 2005 levels by 2030. That 2025 report concluded that in the past 20 years the only significant drops in emissions came during the 2008 financial crisis and the COVID-19 pandemic. Obviously, those events did not reflect any effects of Canadian emissions reduction policies.

In appearing before the House of Commons Standing Committee on Environment and Sustainable Development (ENVI) Commissioner DeMarco concluded that while Canada’s emissions in 2023 were 694 mega tonnes, or 8.5% lower than 2005, they were still 14% higher than 1990. Clearly, Canada is not on track to meet its 2030 target to reduce emissions by 40–45% below 2005. In short, Canada has never met a single national emissions target set since 1992.

While Carney’s vision is for Canada to become an “energy superpower” Alberta Premier Danielle Smith has maintained that changes are needed to a suite of federal legislation that has effectively blocked private sector investment. Those concerns have been validated by the actions of major crude oil pipeline operators like Enbridge Inc. as they re-direct significant investment away from Canada and into the United States.

The policies that the Carney government has inherited include legislative initiatives such as Bill C-69 designed to restructure environmental assessments and “modernize” the National Energy Board (now the Canada Energy Regulator- CER), Bill C-48 that banned oil tankers off B.C.’s northwest coast, proposed regulations for targeted emissions caps, fuel standards and unattainable mandates for zero-emission vehicles by 2035.

Canadians might be right to ask about the cost of these policies. In a recent report, the Fraser Institute assessed the costs of successive Liberal governments efforts to pivot to green industrial policies to control emissions through massive spending programs, along with changes to regulatory standards designed to constrain traditional energy sources. The inescapable conclusion is that the Federal government’s “green shift” by which the federal government has sought to shape industrial outcomes has not only imposed high, unrecoverable costs but has delivered minimal economic payoff while failing to meet even the minimal objectives to reduce emissions.

The Fraser Institute noted that while Federal spending on the green economy surged from $600 million in 2014/15 to $23 billion in 2024/25, a nearly 40-fold increase, the green economy’s share of GDP rose only marginally from 3.1% in 2014 to 3.6% in 2023, according to Statistics Canada. Moreover, promised “green jobs” have not materialized at scale while traditional energy sectors vital to the Canadian GDP have been actively constrained.

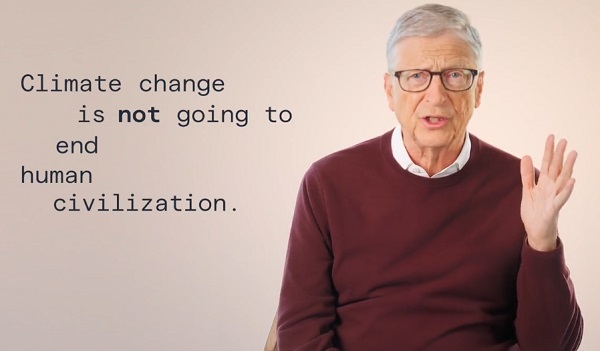

Amidst these dismal facts, released immediately prior to yet another COP30 Climate Conference to be held in Belém, Brazil, Bill Gates has delivered an essay “A New Approach For the World’s Climate Strategy,” that asserted that the “doomsday view of climate change” is “wrong” noting that such predictions that “cataclysmic climate change will decimate civilization” are misplaced. Gates asserts that climate activists have placed too much focus “on near-term emissions goals” and that this effort is “diverting resources from the most effective things we should be doing to improve life in a warming world.” Noted critic Roger Pielke commented that Gates’ essay is “a welcome contribution to a growing chorus of climate realism and energy pragmatism”.

These developments indicate that the Canadian government is not only out of touch with understanding the disastrous economic consequences of its climate policies but reflects a growing consensus that these policies have not, and will not, achieve their intended aims.

If Canada is to achieve energy superpower status it must acknowledge that while material changes to simplify and make more predictable Canadian regulatory project approval processes are necessary, they alone will ultimately be insufficient. What is needed is a complete re-assessment of climate policies and emissions strategies that accept “energy pragmatism” in ways that focus on adaptation. Carney’s One Canadian Economy Act has been designed to circumvent Canada’s regulatory bottlenecks with determinations of the “national interest” made in Ottawa as vetted by a new Major Projects Office. It won’t work.

Dr. Ron Wallace is a retired former member of the National Energy Board.

-

Business2 days ago

Business2 days agoCarney government should retire misleading ‘G7’ talking point on economic growth

-

Censorship Industrial Complex2 days ago

Censorship Industrial Complex2 days agoPro-freedom group warns Liberal bill could secretly cut off Canadians’ internet access

-

Brownstone Institute1 day ago

Brownstone Institute1 day agoBizarre Decisions about Nicotine Pouches Lead to the Wrong Products on Shelves

-

Alberta2 days ago

Alberta2 days agoCanada’s heavy oil finds new fans as global demand rises

-

Bruce Dowbiggin2 days ago

Bruce Dowbiggin2 days agoA Story So Good Not Even The Elbows Up Crew Could Ruin It

-

Daily Caller2 days ago

Daily Caller2 days agoNigeria Would Welcome US Intervention In Massacre Of Christians By Islamic Terror Groups

-

Addictions2 days ago

Addictions2 days agoThe War on Commonsense Nicotine Regulation

-

Automotive2 days ago

Automotive2 days agoCanada’s EV experiment has FAILED