Alberta

Alberta takes decisive action to get more oil to market

February 19, 2019

A historic rail deal between Canadian Pacific Railway, Canadian National Railway and the Government of Alberta means all Albertans will get a better price for our energy resources.

This strategic investment by the Alberta government will see an estimated 4,400 rail cars move up to 120,000 barrels per day by 2020. Albertans can look forward to seeing rail cars transport Alberta oil as early as July 2019.

This is another part of our Made-in-Alberta energy strategy – building on Alberta’s energy strengths to get more value from our resources and create more jobs.

“Each and every Albertan owns our energy resources and deserves to get top dollar for them. We are taking decisive actions to protect people and to protect our natural inheritance. When challenges are placed in front of us, we overcome them. I’m going to keep working every day to fight for a better future for every person who calls Alberta home.”

In 2018, Premier Notley laid out short, medium and long-term plans to get top dollar for Alberta’s energy resources. In the short term, the province temporarily curtailed oil production to address the storage glut. Over the long-term, the Premier continues to fight for pipelines and today’s rail deal means Alberta can expand take-away capacity over the medium term.

This investment in increased rail capacity totals about $3.7 billion. With the anticipated commercial revenue and increased royalty and tax revenues, the province anticipates generating approximately $5.9 billion over the next three years.

The Government of Alberta will purchase crude oil from producers and load it onto the rail cars at onloading facilities across the province. The crude oil will then be shipped to market. These actions will help industry including small producers who may not have the ability to take this action on their own.

In developing its Crude-by-Rail strategy, the Alberta government has also taken care to ensure that additional rail cars carrying oil will have no impact on the shipments of agricultural products.

Quick facts

- $3.7B investment provides Albertans with $5.9B in revenues over three years.

- Approximately US$4 per barrel reduction projected in differential between West Texas Intermediate and Western Canadian Select from early 2020 to late 2021.

- Additional 120,000 barrels a day of rail capacity is anticipated by 2020.

- 4,400 rail cars will be used to transport oil. The first complement of rail cars are expected to start transporting Alberta oil in July 2019.

- Rail cars include DOT-117J and DOT-117R models, which meet all current safety standards outlined by Transport Canada.

Alberta

Alberta’s carbon diet – how to lose megatonnes in just three short decades

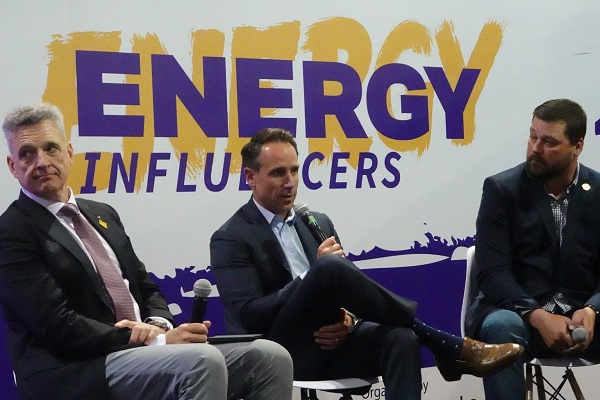

Carl Marcotte, Candu Energy, Scott Henuset, Energy Alberta, and William McLeod

From Resource Works

Solving emissions problem is turning Alberta into a clean-tech powerhouse.

While oil, gas and pipelines took up a lot of oxygen at last week’s Global Energy Canada Show in Calgary, there was also a considerable focus on clean energy, clean-tech and decarbonization.

Alberta’s very survival in a decarbonizing world depends on innovation, best practices and regulations that will allow it to continue to produce oil and gas while trying to meet net zero targets that, like a mirage, appear to move further away the closer we get to them. Necessity being the mother of invention, Wild Rose Country has become rather inventive. It has become something of a clean-tech powerhouse and, as a result, has made some notable progress in its emissions intensity. Alberta’s industrial carbon tax, in place since 2007, and which hit $95 per tonne in 2025, has been used to fund emissions abatement technology and innovation through the Technology Innovation and Emissions Reduction (TIER) program.

According to the Government of Alberta, the province has, to date, achieved:

- an 8.7% decline in overall emissions since 2015;

- a 52% decline in methane emissions since 2014;

- a 26% decline in oil sands emissions intensity since 2012; and

- 15 million tonnes of CO2 sequestered through carbon capture and storage.

The Pembina Institute, it is worth noting, has taken issue with some of Alberta’s reporting. Based on the federal National Inventory Report, Alberta’s methane emissions have declined by 35% between 2014 and 2023, not 52%.

Information sessions at last week’s conference covered topics like geothermal energy, lithium extraction, methane emissions detection and reduction technology, low-carbon hydrogen production and use, carbon capture and storage, and nuclear power. Alberta’s contributions to the energy transition and decarbonization is, I think, a bit of an untold story.

In the case of carbon capture utilization and storage (CCUS), it’s a story that some environmentalists don’t want to hear, and don’t want anyone else to hear. In 2023, Greenpeace and two other environmental NGOs filed a complaint with the Competition Bureau against the Pathways Alliance, saying its claims of potential emissions reduction through CCUS constituted greenwashing. The Trudeau government responded with an anti-greenwashing bill — C-59 — that puts companies at risk of fines for making claims on emission reductions that are not backed by “adequate and proper” testing and evidence. Basically, companies will need to show their homework before making claims on climate benefits or risk hefty fines.”Some of the things that I’ve said would be illegal for my companies to say under the existing law because it would be called greenwashing,” Premier Danielle Smith said at last week ‘s conference. Green fundamentalists don’t want to hear about climate benefits, if it involves things like carbon capture, which they view as extending the lifetime of fossil fuels. Maybe they didn’t get the memo from the Intergovernmental Panel on Climate Change (IPCC) Working Group 3, which last year pronounced in a special report that carbon sequestration is “unavoidable if net zero CO2 or GHG emissions are to be achieved.”

Alberta’s oil and gas industry understands full well there is a big target on their backs: the oil sands. This energy intensive form of extracting oil generated 86.5 million million tonnes of CO2 equivalent (CO2e) in 2023, according to the Alberta government. That accounts for 33% of Alberta’s total GHG emissions, and is getting perilously close to the federal government’s emission’s cap for oil and gas.

Alberta ingenuity and innovation in extracting oil from sand led Canada to become the world’s fourth largest oil producer, with huge economic benefits for Canada. Alberta is now applying that ingenuity to try to shrink its GHG profile. Alberta has had some of the largest emissions reductions in the power generation sector in Canada recently, thanks to the phasing out of coal power.

Last year, it retired its last coal power plant, meaning the province reached its goal of phasing out coal six years ahead of federal and provincial targets of 2030. As a result, emissions from Alberta’s electricity sector declined 54% between 2015 and 2023, according to the Alberta government. It accomplished this by investing in wind and solar power, backed by firm natural gas power. Alberta now has about twice the amount of installed wind power as B.C. Alberta also reached methane emission reduction targets ahead of schedule. The Alberta government reports a 52% decline in methane intensity between 2014 and 2023, exceeding the target of a 45% decrease by 2025.

According to a recent S&P Global report, the GHG intensity of Alberta’s oil sands has declined 23% since 2009. And since 2019, S&P reports, the pace of oil sands emissions growth has slowed, with a 3% increase in emissions since 2019, despite a 9% growth in oil and gas production. Alberta’s challenge is that, as long as it plans to increase oil and gas production — and it does — reducing its emissions is like draining a bathtub while the faucet is still on. While emissions intensity may go down, absolute emissions could still grow with production growth, and Danielle Smith would like to see Alberta’s oil production double. So, some pretty big gains will be needed if Alberta is to achieve the dual goal of increasing oil production while trying to bring its emissions intensity down to zero by 2050. The only way to do that is through large-scale CCUS, and Alberta has become a global leader in its deployment. Thanks to CCUS, Alberta is poised to become a leading producer of blue hydrogen, ammonia and other “net-zero chemicals.” Through CCUS initiatives like the Alberta Carbon Trunk Line and the Shell Quest CCS project, Alberta has already sequestered 13.5 million tonnes of CO2, according to Emissions Reduction Alberta.

The Pathways Alliance — a consortium of Alberta’s biggest oil producers — propose a $10 billion to $20 billion investment that includes a large scale-up of CCUS, to decarbonize oil sands production and Alberta’s petrochemical industry. According to Natural Resources Canada, the estimated sequestration of the Pathways project would be 13.9 Mt CO2 captured by 2030 — 4.2 MT per year — and 62 Mt per year by 2050. A buildout of CCUS infrastructure in Alberta’s refining and petrochemical complex in the Edmonton area would capture CO2 from gas combustion. “That then puts them on the road to net-zero aviation fuels, net-zero chemicals, what-have-you,” Chris Bataille, adjunct research fellow at Columbia University’s Center on Global Energy Policy, told me. “If you look at this as a transition, it’s a necessary thing to do, and we have the right geology for it, and these companies know how to do this kind of thing.”

In addition to CCUS, Alberta also now plans to become a nuclear power producer. A company called Energy Alberta plans to deploy existing Canadian nuclear technology — the CANDU reactor. It proposes to build a 1,000 megawatt twin CANDU MONARK reactor north of Peace River, Alberta. It is now in the early stage of a federal Impact Assessment process. If the federal Liberal government is serious about achieving its ambitious climate policy objectives, it needs to either help Alberta with its ambitious decarbonization efforts, which would include some major federal subsidies, or just get out of its way and let Alberta do what it does best, which is innovate.

Alberta

Unified message for Ottawa: Premier Danielle Smith and Premier Scott Moe call for change to federal policies

United in call for change: Joint statement |

“Wednesday, Alberta’s and Saskatchewan’s governments came together in Lloydminster to make a unified call for national change.

“Together, we call for an end to all federal interference in the development of provincial resources by:

- repealing or overhauling the Impact Assessment Act to respect provincial jurisdiction and eliminate barriers to nation-building resource development and transportation projects;

- eliminating the proposed oil and gas emissions cap;

- scrapping the Clean Electricity Regulations;

- lifting the oil tanker ban off the northern west coast;

- abandoning the net-zero vehicle mandate; and

- repealing any federal law or regulation that purports to regulate industrial carbon emissions, plastics or the commercial free speech of energy companies.

“The federal government must remove the barriers it created and fix the federal project approval processes so that private sector proponents have the confidence to invest.

“Starting with additional oil and gas pipeline access to tidewater on the west coast, our provinces must also see guaranteed corridor and port-to-port access to tidewater off the Pacific, Arctic and Atlantic coasts. This is critical for the international export of oil, gas, critical minerals, agricultural and forestry products, and other resources. Accessing world prices for our resources will benefit all Canadians, including our First Nations partners.

“Canada is facing a trade war on two fronts. The People’s Republic of China’s ‘anti-discrimination’ tariffs imposed on Canadian agri-food products have significant impacts on the West. We continue to call on the federal government to prioritize work towards the removal of Chinese tariffs. Recently announced tariff increases, on top of pre-existing tariffs, by the United States on Canadian steel and aluminum products are deeply concerning. We urge the Prime Minister to continue his work with the U.S. administration to seek the removal of all tariffs currently being imposed by the U.S. on Canada.

“Alberta and Saskatchewan agree that the federal government must change its policies if it is to reach its stated goal of becoming a global energy superpower and having the strongest economy in the G7. We need to have a federal government that works with, rather than against, the economic interests of Alberta and Saskatchewan. Making these changes will demonstrate the new Prime Minister’s commitment to doing so. Together, we will continue to fight to deliver on the immense potential of our provinces for the benefit of the people of Saskatchewan and Alberta.”

-

Alberta2 days ago

Alberta2 days agoCalls for a new pipeline to the coast are only getting louder

-

Business2 days ago

Business2 days agoCanada’s economic pain could be a blessing in disguise

-

Censorship Industrial Complex2 days ago

Censorship Industrial Complex2 days agoJordan Peterson reveals DEI ‘expert’ serving as his ‘re-education coach’ for opposing LGBT agenda

-

Alberta1 day ago

Alberta1 day agoUnified message for Ottawa: Premier Danielle Smith and Premier Scott Moe call for change to federal policies

-

Education2 days ago

Education2 days agoStudents can’t use AI to cheat on standardized tests

-

International2 days ago

International2 days agoTrump puts new price tag on Canada joining “Golden Dome”

-

Economy1 day ago

Economy1 day agoOttawa’s muddy energy policy leaves more questions than answers

-

Business2 days ago

Business2 days agoRhetoric—not evidence—continues to dominate climate debate and policy