Business

The Passage of Bill C-5 Leaves the Conventional Energy Sector With as Many Questions as Answers

From Energy Now

By Jim Warren

Living with uncertainty can be worse than getting the bad news.

It’s been six months since Justin Trudeau resigned. Yet here we are little to no wiser about what Prime Minister Carney has in store for the oil and gas sector in the West. If Ottawa truly intends to pave the way for new pipelines, great! If not, it’s better to know now so we can get on with Plan B.

Those optimistic people who breathed a sigh of relief when the Building Canada Act (Bill C-5) became law are still at risk of disappointment. Bill C-5 might indeed herald a brighter future for Canadian gas and petroleum. But it’s also possible it will do nothing at all for the conventional energy sector.

The new law purports to be all about getting big development projects, that are in the national interest, more promptly approved than was the case when approvals were adjudicated under the auspices of the Impact Assessment Act (Bill C-69) and the tanker moratorium (Bill C-48).

Section 4 of the Building Canada Act states that its purpose “is to enhance Canada’s prosperity, national security, economic security, national defence and national autonomy by ensuring that projects, that are in the national interest, are advanced through an accelerated process that enhances regulatory certainty and investor confidence, while protecting the environment and respecting the rights of Indigenous peoples.”

Cabinet will have the final say on which projects will be considered for fast-tracked evaluation. Those lucky enough to be chosen are placed in Schedule 1. A project isn’t even in the game if it is not named and briefly described in Schedule 1.

The Act describes Schedule 1 as a list of projects seeking final approval. Providing the necessary information to appear on Schedule 1 seems pretty straightforward. Cabinet-anointed projects need only provide their name and the location of their principal activities and a brief description of what they intend to do. It almost seems too simple for projects purporting to advance critical national interests.

One of the big sticklers is that the Act is frustratingly opaque when it comes to specifically identifying what constitutes a national interest project (NIP). Subsection 5(6) provides a list of five conditions or goals that Cabinet might find relevant for the elevation of a project to Schedule 1. It doesn’t say a project has to meet all or any of those conditions—just that acceptable projects could include one or more of them. The wording is vague enough to suggest a project could include none of them, or include something nobody has thought of yet.

When deciding whether a project will be one of the lucky winners, the Act says Cabinet may consider any factor it considers relevant, “including the extent to which the project can:

(a) strengthen Canada’s autonomy, resilience and security;

(b) provide economic or other benefits to Canada;

(c) have a high likelihood of successful execution;

(d) advance the interests of Indigenous peoples; and

(e) contribute to clean growth and to meeting Canada’s objectives with respect to climate change.”

Smith makes the case

You certainly can’t fault Alberta Premier Danielle Smith for thinking a bid to get a million barrels per day Northern Gateway 2.0 onto Schedule 1 might succeed. The project clearly checks four of the five boxes, assuming they actually count. The new pipeline combined with plans for massive projects like the Pathways Alliance carbon sequestration initiative in the oil sands meets the contribution to climate change mitigation objective.

Check item “e”.

Speaking at Calgary’s Global Energy Show in early June, Smith explained a new million BPD oil pipeline running from Alberta to Prince Rupert has the potential to generate up to $20 billion in annual revenues. According to Smith, those new revenues will help make decarbonization projects like the Pathways Alliance plan feasible. Additionally, the new revenues will contribute to economic benefits for all Canadians, enhancing our ability to cope with the effects of US tariffs.

Check item “b”.

Alberta has taken significant steps to support First Nations participation in economically significant projects. Smith proudly points to the Alberta Indigenous Opportunities Corporation (AIOC) as an existing mechanism that will ensure Indigenous groups have a beneficial stake in energy projects and new pipelines.

Check item “d”.

No less important are the benefits the new pipeline will offer when it comes to Canada’s resilience as a resource exporting nation. Northern Gateway 2.0 will provide an outlet for exports to new international customers—as opposed to our heavy reliance on a single customer for almost all of our oil. If this doesn’t satisfy the goals stated in item “a” from the list, “strengthen Canada’s autonomy, resilience and security,” nothing can.

Check item “a”.

The likelihood that the project will succeed (as per item “c”) is a bit of a Catch-22. If the project is approved for Schedule 1, its chances for success are potentially good. If it is excluded they could be bleak.

Check “maybe” for item “c”

Assuming the federal government was being sincere when listing the five goals identified in Subsection 5(6,), getting industry players to sign on to the proposal is probably the most significant barrier to success.

This time might be different

Smith has said government and industry are, “working hard on being able to get industry players, private sector players, to realize this time might be different.” She’s optimistic that a private proponent or a consortium of companies will emerge to make a bid for approval.

Again, assuming the government is sincere about goals laid down 5 (6), the second most significant barrier is probably BC Premier David Eby’s, opposition to Northern Gateway 2.0.

The Building Canada Act is mute with respect to overriding the objections of a province to a project.

Smith recalls that Alberta was able to overcome opposition from the Government of British Columbia and obtain its approval for the original Northern Gateway project. She is confident that negotiations and common sense will prove successful this time around.

Danielle Smith doesn’t have stars in her eyes with respect to the chances for success. She simply recognizes what appears to be the opening of a window of opportunity. Considering the dearth of alternative options at the moment it makes sense to see if it’s real. If the opportunity proves illusive there are supporters of the oil industry in the West who will simply move on to Plan B. That option could include focusing Albertans’ disappointment and attention on the upcoming separation referendum.

It’s not the Cabinet who decides, it’s the PM and the PMO

Much of the foregoing assessment could be moot should Cabinet determine a new export pipeline is a bad idea. Unfortunately, there is cause to worry that if a proposal is made, it won’t be approved. Last week, for example, the Liberal government doubled down on one of its least successful, most impractical green transition initiatives – the EV mandate.

Mark Carney’s new environment and climate change minister, Julie Dabrusin, embarrassed herself in Question Period last week, by refusing to admit to any of the well-documented defects in the government’s handling of the Electric Vehicle and EV battery file. Bankrupt battery makers, Canadians’ reluctance to purchase EVs, and auto makers’ warnings about plant closures and huge job losses come to mind. Dabrusin appeared oblivious to any problems in these areas.

Julie Dabrusin isn’t the only climate-alarmed fanatic in cabinet, Steven Guilbeault is still there. Furthermore, most members of the current Liberal caucus are veterans of the Justin Trudeau caucus. These are the same people who backed the Liberals’ ten-year assault on conventional energy. The current Liberal cabinet and caucus are potentially just as environmentally pure as Justin’s. If so, they could prove reluctant to approve any new pipelines or override the tanker ban.

Some political commentators have expressed alarm over the powers Bill C-5 grants to Cabinet. The official decision making process grants the minister selected to oversee the Building Canada Act authority to make recommendations to Cabinet for which proposals should be advanced to Schedule 1. But, Cabinet is empowered to confirm or reject the proposals. Similarly, the minister responsible gets to provide Cabinet with recommendations for the final approval or rejection of projects listed in

Schedule 1. But, again Cabinet gets to accept or reject the recommendations.

The fact that these decisions can be made in the absence of parliamentary debate and media scrutiny has been cause for further alarm.

On the other hand, it appears opposition amendments approved by the House may have remedied some of the concerns about transparency. Omissions from the Bill such as the lack of transparency around conflicts of interest have been addressed. And, there will apparently be an effort to clarify exactly what the criteria for project approval actually are.

Nevertheless, efforts to lift the veil on the realities of government decision making may not count for much. Democracy at the federal level has long been eroded by the growing power of the Prime Minister’s Office (PMO). It is unlikely that the minister in charge of the Act or Cabinet members will do anything that runs contrary to the wishes of the PMO. Defy this rule and risk being booted from Cabinet. Protest too much and the prime minister could refuse to sign your nomination papers for the next federal election.

In the final analysis, the success or failure of a proposal for a new export pipeline touching on tidewater, will depend on what Mark Carney really wants. And who knows what that might be?

Business

Trump reins in oil markets with one Truth Social post

Quick Hit:

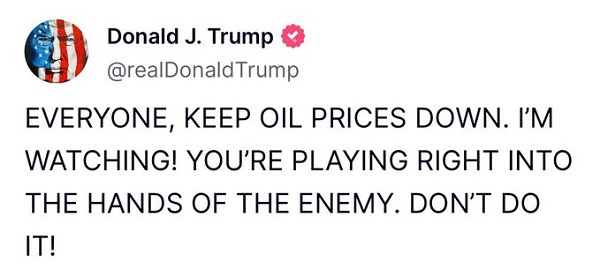

President Trump on Monday warned oil producers not to raise prices in the wake of U.S. strikes on Iranian nuclear facilities, cautioning that a spike would benefit America’s enemies. “EVERYONE, KEEP OIL PRICES DOWN. I’M WATCHING!”

Key Details:

-

Trump posted on Truth Social: “YOU’RE PLAYING RIGHT INTO THE HANDS OF THE ENEMY. DON’T DO IT!”

-

Oil prices fell after the post, with Brent Crude and West Texas Intermediate both slipping by about one percent following earlier gains driven by Middle East tensions.

-

In a follow-up message, Trump told the Department of Energy: “DRILL, BABY, DRILL!!! And I mean NOW!!!”

— Rapid Response 47 (@RapidResponse47) June 23, 2025

Diving Deeper:

President Donald Trump issued a blunt warning to oil producers Monday morning following a weekend of U.S. military action against Iran, urging them to keep prices under control amid rising geopolitical tensions. His message, posted on Truth Social, was clear and emphatic: “EVERYONE, KEEP OIL PRICES DOWN. I’M WATCHING! YOU’RE PLAYING RIGHT INTO THE HANDS OF THE ENEMY. DON’T DO IT!”

The timing of the post was significant. Over the weekend, U.S. forces struck three major Iranian nuclear facilities—Fordow, Natanz, and Isfahan—in a bold escalation that raised fears of a broader regional conflict and potential threats to global energy infrastructure. Initial market reactions were swift, with Brent Crude jumping over 5 percent and briefly breaking above $81 a barrel. West Texas Intermediate followed, climbing to its highest level since January.

However, after Trump’s post circulated Monday, both benchmarks began to pull back, each falling by about one percent. Traders appeared to interpret Trump’s comments as a call for restraint, especially as domestic producers weigh output decisions amid a softening price environment and a looser global supply picture.

While Trump didn’t name names, his message seemed clearly aimed at American oil companies, some of which have recently floated the possibility of scaling back production due to lower margins. Meanwhile, OPEC+ continues its efforts to bring previously curtailed output back online, further complicating the global supply-demand dynamic.

In a second post, Trump added: “To The Department of Energy: DRILL, BABY, DRILL!!! And I mean NOW!!!”

Despite the military flare-up, markets have largely stabilized, suggesting that investors are waiting to see how Iran will respond. Tehran’s parliament has called for the closure of the Strait of Hormuz, a critical chokepoint for global oil shipping, but such a move would require the approval of Iran’s Supreme National Security Council and Ayatollah Ali Khamenei.

For now, traders appear cautious but unconvinced that supply routes will be disrupted in the immediate term. Trump, however, has made it clear that if oil producers try to capitalize on the crisis by raising prices, he’ll be watching—and he won’t be quiet.

Banks

Scrapping net-zero commitments step in right direction for Canadian Pension Plan

From the Fraser Institute

By Matthew Lau

And in January, all of Canada’s six largest banks quit the Net-Zero Banking Alliance, an alliance formerly led by Mark Carney (before he resigned to run for leadership of the Liberal Party) that aimed to align banking activities with net-zero emissions by 2050.

The Canada Pension Plan Investment Board (CPPIB) has cancelled its commitment, established just three years ago, to transition to net-zero emissions by 2050. According to the CPPIB, “Forcing alignment with rigid milestones could lead to investment decisions that are misaligned with our investment strategy.”

This latest development is good news. The CPPIB, which invest the funds Canadians contribute to the Canada Pension Plan (CPP), has a fiduciary duty to Canadians who are forced to pay into the CPP and who rely on it for retirement income. The CPPIB’s objective should not be climate activism or other environmental or social concerns, but risk-adjusted financial returns. And as noted in a broad literature review by Steven Globerman, senior fellow at the Fraser Institute, there’s a lack of consistent evidence that pursuing ESG (environmental, social and governance) objectives helps improve financial returns.

Indeed, as economist John Cochrane pointed out, it’s logically impossible for ESG investing to achieve social or environmental goals while also improving financial returns. That’s because investors push for these goals by supplying firms aligned with these goals with cheaper capital. But cheaper capital for the firm is equivalent to lower returns for the investor. Therefore, “if you don’t lose money on ESG investing, ESG investing doesn’t work,” Cochrane explained. “Take your pick.”

The CPPIB is not alone among financial institutions abandoning environmental objectives in recent months. In April, Canada’s largest company by market capitalization, RBC, announced it will cancel its sustainable finance targets and reduce its environmental disclosures due to new federal rules around how companies make claims about their environmental performance.

And in January, all of Canada’s six largest banks quit the Net-Zero Banking Alliance, an alliance formerly led by Mark Carney (before he resigned to run for leadership of the Liberal Party) that aimed to align banking activities with net-zero emissions by 2050. Shortly before Canada’s six largest banks quit the initiative, the six largest U.S. banks did the same.

There’s a second potential benefit to the CPPIB cancelling its net-zero commitment. Now, perhaps with the net-zero objective out of the way, the CPPIB can rein in some of the administrative and management expenses associated with pursuing net-zero.

As Andrew Coyne noted in a recent commentary, the CPPIB has become bloated in the past two decades. Before 2006, the CPP invested passively, which meant it invested Canadians’ money in a way that tracked market indexes. But since switching to active investing, which includes picking stocks and other strategies, the CPPIB ballooned from 150 employees and total costs of $118 million to more than 2,100 employees and total expenses (before taxes and financing) of more than $6 billion.

This administrative ballooning took place well before the rise of environmentally-themed investing or the CPPIB’s announcement of net-zero targets, but the net-zero targets didn’t help. And as Coyne noted, the CPPIB’s active investment strategy in general has not improved financial returns either.

On the contrary, since switching to active investing the CPPIB has underperformed the index to a cumulative tune of about $70 billion, or nearly one-tenth of its current fund size. “The fund’s managers,” Coyne concluded, “have spent nearly two decades and a total of $53-billion trying to beat the market, only to produce a fund that is nearly 10-per-cent smaller than it would be had they just heaved darts at the listings.”

Scrapping net-zero commitments won’t turn that awful track record around overnight. But it’s finally a step in the right direction.

-

Alberta1 day ago

Alberta1 day agoCalls for a new pipeline to the coast are only getting louder

-

Alberta1 day ago

Alberta1 day agoAlberta pro-life group says health officials admit many babies are left to die after failed abortions

-

Business1 day ago

Business1 day agoCanada’s economic pain could be a blessing in disguise

-

espionage1 day ago

espionage1 day agoFrom Sidewinder to P.E.I.: Are Canada’s Political Elites Benefiting from Beijing’s Real Estate Reach?

-

Business1 day ago

Business1 day agoRhetoric—not evidence—continues to dominate climate debate and policy

-

Energy1 day ago

Energy1 day agoEnergy Policies Based on Reality, Not Ideology, are Needed to Attract Canadian ‘Superpower’ Level Investment – Ron Wallace

-

Business2 days ago

Business2 days agoHigh Taxes Hobble Canadian NHL Teams In Race For Top Players

-

conflict1 day ago

conflict1 day agoU.S. cities on high alert after U.S. bombs Iran