Business

Federal fiscal anchor gives appearance of prudence, fails to back it up

From the Fraser Institute

By Jake Fuss and Grady Munro

The Parliamentary Budget Officer (PBO)—which acts as the federal fiscal watchdog—released a new report highlighting concerns with the Carney government’s fiscal plan. Key among these concerns is the fact that the government’s promise to balance its “operating budget” does not actually ensure the nation’s finances are sustainable. Instead, the plan to balance the operating budget by 2028/29 gives the appearance of fiscal prudence, but allows the government to continue running large deficits and borrow more money.

First, what’s the new government’s fiscal plan?

While the Carney government has chosen to delay releasing a budget until the fall—leaving Canadians and parliamentarians in the dark about the state of government finances and where we’re headed—the Liberal platform and throne speech lay out the plan in broad strokes.

The Carney government plans to introduce a new framework that splits federal spending into two separate budgets: The operating budget and the capital budget. The operating budget will include “day-to-day” spending (e.g. government salaries, cash transfers to provinces and individuals, etc.) while the capital budget will include spending on “anything that builds an asset.” Within this framework, the government has set itself an objective—also called a ‘fiscal anchor’—to balance the operating budget over the next three years.

Fiscal anchors help guide policy on government spending, taxes and borrowing, and are intended to prevent government finances from deteriorating while ensuring that debt is sustainable for future generations. The previous federal government made a habit of violating its own fiscal anchors—to the detriment of national finances—but the Carney government has promised a “very different approach” to fiscal policy.

The PBO’s new report highlights two critical concerns with this new approach to finances. First, the federal government has not yet defined what “operating” spending is and what “capital” spending is. Therefore, it’s difficult to know whether any new spending policies—such as the recently announced increase in defence spending—will hurt efforts to achieve the government’s goal of balancing the operating budget and how much overall debt will be accumulated. In other words, the government’s plan to split the budget in two simply muddies the waters and makes it harder to evaluate federal finances.

The PBO’s second, and more alarming, concern is that even if the government achieves its goal to balance the operating budget, federal finances may still continue to deteriorate and debt may rise at an unsustainable rate (growing faster than the economy).

While the Liberal election platform does outline a fiscal path that appears to balance the operating budget by 2028/29, this path also includes higher deficits and more borrowing than the previous government’s plan once you factor in capital spending. Specifically, the Carney government plans to run overall deficits over the next four years that are a combined $93.4 billion more than was previously planned in last year’s fall economic statement. This means that rather than the “very different approach” that Canadians have been promised, the Carney government may continue (or even worsen) the same costly habits of endless borrowing and rising debt.

The PBO is right to call out the major transparency issues with the Carney government’s new budget framework and fiscal anchor. While the devil will be in the details of the government’s fiscal plan, and we won’t know those details until it releases a budget, the government’s new fiscal anchor gives the appearance of prudence without the substance to back it up.

Business

Trump reins in oil markets with one Truth Social post

Quick Hit:

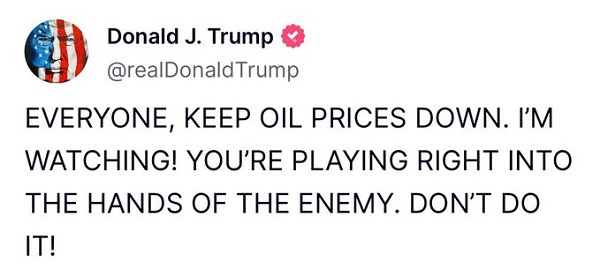

President Trump on Monday warned oil producers not to raise prices in the wake of U.S. strikes on Iranian nuclear facilities, cautioning that a spike would benefit America’s enemies. “EVERYONE, KEEP OIL PRICES DOWN. I’M WATCHING!”

Key Details:

-

Trump posted on Truth Social: “YOU’RE PLAYING RIGHT INTO THE HANDS OF THE ENEMY. DON’T DO IT!”

-

Oil prices fell after the post, with Brent Crude and West Texas Intermediate both slipping by about one percent following earlier gains driven by Middle East tensions.

-

In a follow-up message, Trump told the Department of Energy: “DRILL, BABY, DRILL!!! And I mean NOW!!!”

— Rapid Response 47 (@RapidResponse47) June 23, 2025

Diving Deeper:

President Donald Trump issued a blunt warning to oil producers Monday morning following a weekend of U.S. military action against Iran, urging them to keep prices under control amid rising geopolitical tensions. His message, posted on Truth Social, was clear and emphatic: “EVERYONE, KEEP OIL PRICES DOWN. I’M WATCHING! YOU’RE PLAYING RIGHT INTO THE HANDS OF THE ENEMY. DON’T DO IT!”

The timing of the post was significant. Over the weekend, U.S. forces struck three major Iranian nuclear facilities—Fordow, Natanz, and Isfahan—in a bold escalation that raised fears of a broader regional conflict and potential threats to global energy infrastructure. Initial market reactions were swift, with Brent Crude jumping over 5 percent and briefly breaking above $81 a barrel. West Texas Intermediate followed, climbing to its highest level since January.

However, after Trump’s post circulated Monday, both benchmarks began to pull back, each falling by about one percent. Traders appeared to interpret Trump’s comments as a call for restraint, especially as domestic producers weigh output decisions amid a softening price environment and a looser global supply picture.

While Trump didn’t name names, his message seemed clearly aimed at American oil companies, some of which have recently floated the possibility of scaling back production due to lower margins. Meanwhile, OPEC+ continues its efforts to bring previously curtailed output back online, further complicating the global supply-demand dynamic.

In a second post, Trump added: “To The Department of Energy: DRILL, BABY, DRILL!!! And I mean NOW!!!”

Despite the military flare-up, markets have largely stabilized, suggesting that investors are waiting to see how Iran will respond. Tehran’s parliament has called for the closure of the Strait of Hormuz, a critical chokepoint for global oil shipping, but such a move would require the approval of Iran’s Supreme National Security Council and Ayatollah Ali Khamenei.

For now, traders appear cautious but unconvinced that supply routes will be disrupted in the immediate term. Trump, however, has made it clear that if oil producers try to capitalize on the crisis by raising prices, he’ll be watching—and he won’t be quiet.

Banks

Scrapping net-zero commitments step in right direction for Canadian Pension Plan

From the Fraser Institute

By Matthew Lau

And in January, all of Canada’s six largest banks quit the Net-Zero Banking Alliance, an alliance formerly led by Mark Carney (before he resigned to run for leadership of the Liberal Party) that aimed to align banking activities with net-zero emissions by 2050.

The Canada Pension Plan Investment Board (CPPIB) has cancelled its commitment, established just three years ago, to transition to net-zero emissions by 2050. According to the CPPIB, “Forcing alignment with rigid milestones could lead to investment decisions that are misaligned with our investment strategy.”

This latest development is good news. The CPPIB, which invest the funds Canadians contribute to the Canada Pension Plan (CPP), has a fiduciary duty to Canadians who are forced to pay into the CPP and who rely on it for retirement income. The CPPIB’s objective should not be climate activism or other environmental or social concerns, but risk-adjusted financial returns. And as noted in a broad literature review by Steven Globerman, senior fellow at the Fraser Institute, there’s a lack of consistent evidence that pursuing ESG (environmental, social and governance) objectives helps improve financial returns.

Indeed, as economist John Cochrane pointed out, it’s logically impossible for ESG investing to achieve social or environmental goals while also improving financial returns. That’s because investors push for these goals by supplying firms aligned with these goals with cheaper capital. But cheaper capital for the firm is equivalent to lower returns for the investor. Therefore, “if you don’t lose money on ESG investing, ESG investing doesn’t work,” Cochrane explained. “Take your pick.”

The CPPIB is not alone among financial institutions abandoning environmental objectives in recent months. In April, Canada’s largest company by market capitalization, RBC, announced it will cancel its sustainable finance targets and reduce its environmental disclosures due to new federal rules around how companies make claims about their environmental performance.

And in January, all of Canada’s six largest banks quit the Net-Zero Banking Alliance, an alliance formerly led by Mark Carney (before he resigned to run for leadership of the Liberal Party) that aimed to align banking activities with net-zero emissions by 2050. Shortly before Canada’s six largest banks quit the initiative, the six largest U.S. banks did the same.

There’s a second potential benefit to the CPPIB cancelling its net-zero commitment. Now, perhaps with the net-zero objective out of the way, the CPPIB can rein in some of the administrative and management expenses associated with pursuing net-zero.

As Andrew Coyne noted in a recent commentary, the CPPIB has become bloated in the past two decades. Before 2006, the CPP invested passively, which meant it invested Canadians’ money in a way that tracked market indexes. But since switching to active investing, which includes picking stocks and other strategies, the CPPIB ballooned from 150 employees and total costs of $118 million to more than 2,100 employees and total expenses (before taxes and financing) of more than $6 billion.

This administrative ballooning took place well before the rise of environmentally-themed investing or the CPPIB’s announcement of net-zero targets, but the net-zero targets didn’t help. And as Coyne noted, the CPPIB’s active investment strategy in general has not improved financial returns either.

On the contrary, since switching to active investing the CPPIB has underperformed the index to a cumulative tune of about $70 billion, or nearly one-tenth of its current fund size. “The fund’s managers,” Coyne concluded, “have spent nearly two decades and a total of $53-billion trying to beat the market, only to produce a fund that is nearly 10-per-cent smaller than it would be had they just heaved darts at the listings.”

Scrapping net-zero commitments won’t turn that awful track record around overnight. But it’s finally a step in the right direction.

-

Alberta1 day ago

Alberta1 day agoCalls for a new pipeline to the coast are only getting louder

-

Alberta1 day ago

Alberta1 day agoAlberta pro-life group says health officials admit many babies are left to die after failed abortions

-

espionage1 day ago

espionage1 day agoFrom Sidewinder to P.E.I.: Are Canada’s Political Elites Benefiting from Beijing’s Real Estate Reach?

-

Business1 day ago

Business1 day agoCanada’s economic pain could be a blessing in disguise

-

Business1 day ago

Business1 day agoRhetoric—not evidence—continues to dominate climate debate and policy

-

Energy1 day ago

Energy1 day agoEnergy Policies Based on Reality, Not Ideology, are Needed to Attract Canadian ‘Superpower’ Level Investment – Ron Wallace

-

Business2 days ago

Business2 days agoHigh Taxes Hobble Canadian NHL Teams In Race For Top Players

-

conflict1 day ago

conflict1 day agoU.S. cities on high alert after U.S. bombs Iran