Energy

It’s time to get excited about the great Canadian LNG opportunity

By Stewart Muir

By Stewart Muir

Canada has a rare window to join the big leagues of LNG exporters—Qatar, Australia, and the United States are not waiting around, and neither should we.

I sometimes catch myself staring out over the waters of British Columbia’s coastline — so calm, so vast, so brimming with unspoken opportunity — and I can’t help but wonder how anyone could fail to notice the promise that Liquefied Natural Gas (LNG) represents for our nation’s future. This country sits atop some of the largest gas reserves on Earth, and we have two coasts eager to connect our product to global markets.

I’m a quietly enthusiastic type by nature, and I don’t often indulge in the “I-told-you-so” routine, but whenever I encounter someone who just hasn’t cottoned on to the excitement around LNG, I feel compelled to stage a gentle intervention.

In my day-to-day role as CEO of Resource Works, I work with communities from Fort St. John to Kitimat, and beyond. Let me assure you, if you want to see Canadians at work, proud of their craft, and eyeing a brighter future, you’ll find them along the pipeline routes and port terminals that are part of our budding LNG industry. And they’re just as commonly found in Vancouver, Victoria and the other cities, just harder to spot with no blue coveralls.

I’ve been following the natural gas story in British Columbia for more than a quarter of a century, going back to my days in the media field. As an editor at The Vancouver Sun, I created the paper’s first-ever energy beat after we noticed something big was stirring in the North East gas fields. It turned out to be an industry animated by regulatory innovation, rich geology, ambitious investors, and some of the most capable people you’ll ever meet.

When talk of LNG exports began to stir in 2011, I dove in with both feet. Over the past 15 years, I’ve followed the LNG file across Canada, around the world, and deep into the heart of British Columbia.

Along the way, I’ve met First Nations chiefs who proudly showed me the schools and businesses they built through new partnerships. I’ve also sat down with those who remain skeptical and had honest, sometimes searching conversations. I’ve learned something from all of them. This is an industry that, at its best, brings people together to solve problems, create opportunity, and build a future worth caring about.

Why am I still so enthused after all these years? LNG is not a flash in the pan, for starters. Through cyclical ups and downs—natural phenomena in any commodity game—international forecasts consistently show that LNG demand won’t be evaporating tomorrow or, quite likely, for several tomorrows yet. The International Energy Agency, the Canada Energy Regulator, and even the U.S. Energy Information Administration all point to steady growth in global LNG trade.

On top of that, if you follow the money, you’ll see billions of dollars flowing into new regasification terminals and record orders for LNG carriers. I may be old-fashioned, but I’ve always found that when so many investors plunk down their capital in one place, it’s seldom a fluke. The world has more than 700 LNG ships plying the seas these days, and hundreds more under construction. That’s not a small bit of confidence.

And let’s talk local: from where I sit, Canada’s jobs outlook tied to LNG looks like a real tonic for communities seeking new opportunities. Construction alone can employ entire regions. Then come the careers that last decades—plant operators, engineers, port and shipping managers, the works. It’s the sort of diversified prosperity that a resource economy yearns for.

We’ve even seen First Nations communities take equity stakes in major LNG projects, forging new partnerships that benefit everyone involved. That’s the model of inclusive economic development that Canadians like to talk about. It’s called walking the walk.

Those voices of skepticism — bless their hearts — sometimes say, “But what about price volatility? The commodity cycles? Are we sure this is sustainable?” Truthfully, no commodity is immune to upswings and downswings. But open a newspaper — digitally or in paper form, your choice— and you’ll find that countries all over the world are expanding their LNG-import infrastructure. Many of them, especially in Asia and Europe, see Canada as a steady, well-regulated, and (importantly) speedy supplier.

Yes, “speedy” might be an odd descriptor for us easygoing Canadians, but let’s not overlook that a West Coast port is only about eight or nine sailing days from major Asian markets, versus more than 20 from the U.S. Gulf Coast. You’d think we’d have lines of ships lined up right now, just for that advantage.

There’s another subtlety that some folks overlook. Right now, much of our gas still flows to the United States, often at discounted prices, only to be converted into LNG down there and sold globally at a premium. If that doesn’t make you shake your head in wonder, I’m not sure what will. Canadians have every reason to want to keep some of that up-chain value right here at home, funneling more of that revenue into local jobs and public coffers. That’s exactly the sort of well-to-customer supply chain we’re poised to build.

And if you’re still not impressed, consider the big jolt to GDP whenever a massive energy project crosses the finish line. Look no further than the Trans Mountain pipeline expansion: once it was substantially complete last year, the national GDP got a measurable jolt. It’s extremely rare that a single anything shows up that way. Now, with the first shipment of Canadian LNG preparing to leave Kitimat in the coming weeks, we can expect a repeat performance. It’s the real economic equivalent of an encore, if you will. And who doesn’t love an encore that boosts paycheques and government revenues?

Canadians may be known worldwide for politeness and hockey, but let’s not forget that boldness is also in our national DNA. Building a robust LNG sector that ties Western and Eastern Canada to major global markets is about as bold an economic strategy as we could pursue right now. Some might call it visionary, others might say it’s just common sense in a world that still demands substantial amounts of energy. Either way, Canada has a rare window to join the big leagues of LNG exporters—Qatar, Australia, and the United States are not waiting around, and neither should we.

At the end of the day, seeing Canadians capture more of the value from our natural resources rather than shipping it across the border at a discount is, for me, both pragmatic and patriotic. It’s the kind of deal that makes you wonder why anyone would hesitate. Perhaps that hesitation is just a bump in the road of public discourse—something we can gently, politely, and persistently overcome.

I, for one, am excited for the first shipment of LNG out of Canada’s West Coast, due any week now. A top executive with the project once whispered to me that the maiden cargo would be worth $100 million, but lately I’m hearing a single shipload is now probably worth double that.

So yes, I’m looking forward to the day when it’s not just a handful of tankers leaving our ports, but a regular fleet serving global customers. It will lift up the whole country, just as it has contributed to America’s tearaway economy in recent years and elevated Qatar from desert outpost to World Cup host nation.

Soon, maybe all the doubters will have recognized the obvious — and joined the rest of us on the bandwagon with front-row seats to Canada’s LNG future. Sure, I’m biased, but only because the facts keep reinforcing that this sector is poised to do a world of good for Canadians from coast to coast.

Alberta

Nuclear is the only real way to keep the lights on in Alberta

GE-Hitachi small modular nuclear reactor concept

This article supplied by Troy Media.

By Doug Firby

By Doug Firby

Nuclear power is the best bet for Alberta but time is running out

Alberta needs nuclear power—and fast. While much of the world, including provinces like Ontario, has spent decades building reactors, Alberta remains stuck in neutral, still debating whether the technology is even worth considering.

Affordability and Utilities Minister Nathan Neudorf recently admitted as much.

“We still have an entire legislative and regulatory framework to establish to allow for this novel—as in new—type of generation to happen within the province of Alberta,” Neudorf told the Canadian Press. And now, the province wants to take a full year to gauge public appetite for nuclear power.

Oh my God. Can we not just get on with it?

Here’s the reality. More than a century ago, the province opted for the cheapest form of electricity—coal-fired generation— because Alberta had lots of it. As environmental and health concerns mounted, the province turned to natural gas to fire its generators.

Natural gas is still a fossil fuel—cleaner than coal, but far from perfect. And while renewables like wind and solar don’t have fuel costs, their output isn’t always reliable. That’s why natural gas is still needed to fill the gaps— especially when demand peaks or the wind isn’t blowing. Because it’s often the last generator brought online when renewables fall short, it sets the market price. That’s what drives electricity costs higher—even if most of the power is coming from renewables.

And speaking of renewables, Alberta has smothered a growing industry with strict limitations on where wind and solar farms can operate. According to the Pembina Institute, since October 2023, 11 gigawatts worth of wind, solar and energy storage projects have been withdrawn from the provincial grid operator’s connection queue—more than the province’s average total power demand.

Meanwhile, electricity consumption is expected to soar. The province is chasing $100 billion in data centre investment—facilities that require massive amounts of electricity to run and cool.

So, add it up: Gas-fueled generation is not seen as a good long-term bet, wind and solar has run into a regulatory brick wall, the province’s hydro potential would be hugely expensive (and environmentally complex) to develop, the population of the province has soared past five million and growing, and with the growth in EVs and the rise of more electrical home heating and cooling, we are headed toward the “electrification of everything.”

Why are we taking a year to find out whether Albertans support nuclear power? And what happens if they say no?

Now let’s also face some facts about nuclear. It’s a highly regulated industry—and rightly so— and even then, it has had its share of safety incidents. Chernobyl. Fukushima. Three Mile Island. Because of that, it can take years to move from proposals to construction. And with regulations constantly evolving, the cost of building nuclear plants often exceeds initial estimates.

Ontario’s experience is a cautionary tale. Over two decades, as Ontario Hydro built 20 reactors, it faced repeated cost overruns, missed deadlines and declining performance. By 1999, Ontario Hydro’s debt stood at $38.1 billion. Its assets? Just $17.2 billion. The government was left with a $20.9 billion stranded debt.

Thankfully, with thoughtful execution, Alberta could avoid many of the teething problems Ontario encountered as it nurtured then-nascent nuclear technology. For one, Premier Danielle Smith is rightly seeking proposals from the private sector and will only consider establishing a Crown corporation if private proposals don’t meet the province’s needs. Private sector investment drove the explosive growth in renewables (until the province brought it to a halt with new restrictions); potentially, the same could be true for nuclear.

Alberta can also benefit from decades of global experience with nuclear power. There’s no need to reinvent the wheel. Among the more promising developments are SMRs—small modular reactors. These typically produce 300 megawatts or less and can be factory-built, then transported to site. Like prefabricated homes, they offer streamlined construction, better scalability and the ability to be integrated into multi-unit facilities as demand grows.

This could be especially valuable if Alberta succeeds in attracting those power-hungry data centres.

Cost isn’t the only consideration. Water use and nuclear waste transport must also be managed carefully. But there are compelling reasons to pursue nuclear—and to lift the restrictions on renewables while we’re at it. Not the least of these is its zero emissions.

Now, we need to get going. In the most optimistic forecasts, the first nuclear reactor is at least a decade away. By then, our demands for electricity will have grown substantially, barring some sort of unforeseen breakthrough in efficiency.

You don’t have to love nuclear power. You just have to recognize the truth: Alberta needs to prepare for it now.

Doug Firby is an award-winning editorial writer with over four decades of experience working for newspapers, magazines and online publications in Ontario and western Canada. Previously, he served as Editorial Page Editor at the Calgary Herald.

Troy Media empowers Canadian community news outlets by providing independent, insightful analysis and commentary. Our mission is to support local media in helping Canadians stay informed and engaged by delivering reliable content that strengthens community connections and deepens understanding across the country.

Economy

Oil prices fall under pressure as global supply surges

This article supplied by Troy Media.

OPEC output, weak demand and global politics are flooding the market. Experts warn an oil supply glut could hit by 2026

Global oil markets are bracing for a long-term downturn, driven by rising supply, softening demand and mounting economic headwinds.

Brent crude closed Friday at US$66.68 per barrel, down 76 cents or 1.1 per cent. West Texas Intermediate dropped 89 cents to US$62.68, a 1.4

per cent decline. While markets initially hoped an interest rate cut by the U.S. Federal Reserve might boost consumption, oversupply concerns have taken the wheel.

The International Energy Agency now projects a market surplus of 3.3 million barrels per day (bpd) by 2026 if current policies remain in place. Global supply is expected to rise by 2.7 million bpd in 2025 and another 2.1 million in 2026, while demand will grow by just 700,000 bpd annually.

The U.S. Energy Information Administration echoes the concern. Its latest ShortTerm Energy Outlook forecasts global petroleum and other liquid fuels production to average 105.5 million bpd in 2025, climbing to 106.6 million bpd in 2026. Consumption will lag at 103.8 million and 105.1 million bpd, respectively.

Adding to the unease, U.S. distillate stockpiles—diesel, jet fuel and other products held in storage— unexpectedly rose by four million barrels,

suggesting that more fuel is going unused and demand is starting to stall.

Beyond market fundamentals, some of the bearish pressure is also political. OPEC, the Organization of the Petroleum Exporting Countries, is increasing production—partly shielded by U.S. President Donald Trump’s push for lower domestic fuel prices, a priority that influences how much pressure Washington applies to oil-producing nations.

The White House has made clear it wants energy affordability, giving oil producers the political cover to keep pumping without fear of retaliation.

Geopolitical dynamics are compounding the supply picture. A recent thaw in U.S.–China relations reduced the likelihood of secondary sanctions over Chinese imports of Russian crude. Trump and Chinese President Xi Jinping are expected to meet at the upcoming Asia-Pacific Economic Cooperation summit at the end of October.

Markets took comfort in Trump’s silence on Chinese oil purchases, seeing it as a signal that confrontation is off the table, at least for now.

India continues to buy Russian oil, and the European Union’s latest sanctions package lacks the strength to provoke a firmer U.S. response. Together, these factors are helping keep Russian barrels in global circulation.

Elsewhere, Iraq appears close to resuming crude exports from its Kurdistan region to Turkey, adding yet another stream of supply to an already saturated market.

On top of all this, the upcoming refinery turnaround season—a routine drop in crude demand as refineries shut down for maintenance—will temporarily reduce consumption even further.

In short, all the major levers are pulling in the same direction: lower prices.

And while that may seem like good news for consumers, the ripple effects are far more serious. Canadians may welcome cheaper gas in the near term, but the implications go far beyond the pump.

A prolonged downturn could hit investment in Alberta’s oil sands, Newfoundland and Labrador’s offshore sector, and Saskatchewan’s oil-producing regions—each of them key drivers of provincial revenue and the Canadian economy. Lower prices mean reduced royalties, which fund everything from health care to infrastructure.

Non-renewable resource revenues—primarily from oil and gas—remain a significant source of income for these provinces. In Alberta, they are forecast to account for roughly 21.5 per cent of total government revenue in 2025–26. In Newfoundland and Labrador, oil royalties alone are projected to contribute about 15 per cent of the province’s revenue. Even in Saskatchewan, where potash and uranium also play a role, oil and gas revenues make up a substantial share of the 12.8 per cent of income tied to non-renewable resources.

These figures underscore just how exposed provincial finances remain to global oil price movements.

That pullback in investment could also slow hiring and capital spending, with ripple effects across energy-dependent regions. Pension funds and institutional investors with heavy exposure to oil and gas may feel the sting as well.

At the national level, the consequences could be far-reaching. Canada’s oil and gas extraction sector alone accounts for about 3.2 per cent of GDP, according to the Canadian Association of Petroleum Producers. Broader estimates that include investment, supply chains and related industries place the sector’s total contribution at around 6.4 per cent, based on previous Canadian Energy Centre analysis.

Lower crude prices tend to weaken the Canadian dollar, slow investment in big projects, and cut into export earnings. That can drag down GDP growth, shrink government revenues, and affect job markets even outside the oil patch.

In a country where energy exports still drive much of the economy, a prolonged slump could have wide-reaching fiscal and economic consequences.

Investors, governments and energy workers alike should brace for impact—the oil market isn’t just cooling, it’s being flooded.

Toronto-based Rashid Husain Syed is a highly regarded analyst specializing in energy and politics, particularly in the Middle East. In addition to his contributions to local and international newspapers, Rashid frequently lends his expertise as a speaker at global conferences. Organizations such as the Department of Energy in Washington and the International Energy Agency in Paris have sought his insights on global energy matters.

Troy Media empowers Canadian community news outlets by providing independent, insightful analysis and commentary. Our mission is to support local media in helping Canadians stay informed and engaged by delivering reliable content that strengthens community connections and deepens understanding across the country

-

Business13 hours ago

Business13 hours agoOver $2B California Solar Plant Built To Last, Now Closing Over Inefficiency

-

Autism2 days ago

Autism2 days agoAutism – what we know

-

Alberta2 days ago

Alberta2 days agoFederal policies continue to block oil pipelines

-

espionage1 day ago

espionage1 day agoCanada Under Siege: Sparking a National Dialogue on Security and Corruption

-

Business12 hours ago

Business12 hours agoWEF has a plan to overhaul the global financial system by monetizing nature

-

Business14 hours ago

Business14 hours agoThe Leaked Conversation at the heart of the federal Gun Buyback Boondoggle

-

Business1 day ago

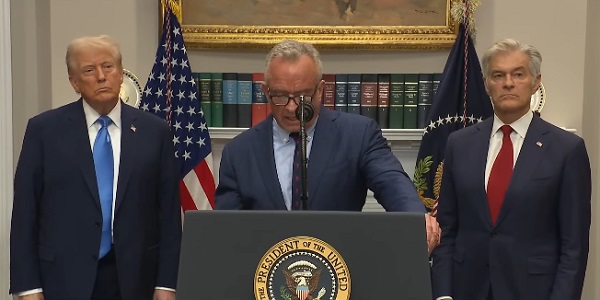

Business1 day agoGoogle Admits Biden White House Pressured Content Removal, Promises to Restore Banned YouTube Accounts

-

Opinion12 hours ago

Opinion12 hours agoThe City of Red Deer’s financial mess – KPMG report outlines failure of council to control spending