Economy

Solar and Wind Power Are Expensive

From the Fraser Institute

Politicians—supported by powerful green energy interests and credulous journalists—keep gaslighting voters claiming green energy is cheaper than fossil fuels.

Global evidence is clear: Adding more solar and wind to the energy supply pushes up the price of electricity for consumers and businesses. Families in Ontario know this already from their bitter experience: from 2005, the Ontario government began phasing out coal energy and dived headlong into subsidizing wind and solar generation.

Those green policies led to a sharp hike in electricity prices. From 2005 to 2020 the average, inflation-adjusted cost of electricity doubled from 7.7 cents to 15.3 cents. Since 2019 the Ontario government has subsidized these high costs through a slew of programs like the “Renewable Cost Shift”, lowering the direct pain to ratepayers but simply moving the increasing costs onto the government coffers. Today, this policy costs Ontario more than $6 billion annually, four-times what was being spent in 2018.

A relatively small amount of wind energy costs Ontarians over a billion dollars each year. One peer-reviewed study finds that the economic costs of wind are at least three times their benefits. Only the owners of wind power make any money, whereas the “losers are primarily the electricity consumers followed by the governments.”

Yet, politicians—supported by powerful green energy interests and credulous journalists—keep gaslighting voters claiming green energy is cheaper than fossil fuels.

They argue fundamentally that the green transition is not just cheap but even that it makes money, because wind and solar are cheaper than fossil fuels.

At best, this is only true when the sun is shining and the wind is blowing. At all other times, their cost is significantly higher. Modern societies need around-the-clock power. The intermittency of solar and wind energy means backup is required, often delivered by fossil fuels. That means citizens end up paying for two power systems: renewables and their backup. Moreover, much more transmission is needed to ensure wind and solar reach users, and backup fossil fuels, as they are used less, have even fewer hours to earn back their capital costs. Both increase costs further.

This intermittency can be huge, as when solar power in the Yukon delivered a massive 150 times more electricity to the grid in May 2022 than it did in December 2022. It is also the reason that the real energy costs of solar and wind are far higher than green campaigners claim. Just look around the world to see how that plays out.

One study shows that in China, when including the cost of backup power, the real cost of solar power becomes twice as high as that of coal. Similarly, a peer-reviewed study of Germany and Texas shows that the real costs of solar and wind are many times more expensive than fossil fuels. Germany, the U.K., Spain, and Denmark, all of which increasingly rely on solar and wind power, have some of the world’s most expensive electricity.

Source: IEA.org energy prices data set

This is borne out by the actual costs paid across the world. The International Energy Agency’s latest data from nearly 70 countries from 2022 shows a clear correlation between more solar and wind and higher average household and business energy prices. In a country with little or no solar and wind, the average electricity cost is about 16 cents per kilowatt-hour. For every 10 per cent increase in solar and wind share, the electricity cost increases by nearly 8 cents per kWh. The results are substantially similar for 2019, before the impacts of Covid and the Ukraine war.

In Germany, electricity costs 43 cents per kWh—much more than twice the Canadian cost, and more than three-times the Chinese price. Germany has installed so much solar and wind that on sunny and windy days, renewable energy satisfies close to 70 per cent of Germany’s needs—a fact the press eagerly reports. But the press hardly mentions dark and still days, when these renewables deliver almost nothing. Twice in the past couple of months, when it was cloudy and nearly windless, solar and wind delivered less than 4 per cent of the daily power Germany needed.

Current battery technology is insufficient. Germany’s entire battery storage runs out in about 20 minutes. That leaves more than 23 hours of energy powered mostly by fossil fuels. Last month, with cloudy skies and nearly no wind, Germany faced the costliest power prices since the energy crisis caused by Russia’s invasion of Ukraine in 2022, with wholesale prices reaching a staggering $1.40 per kWh.

Canada is blessed with plentiful hydro, powering 58 per cent of its electricity. This means that there has been less drive to develop wind and solar, which deliver just 7 per cent. But the urge to virtue signal remains. Indeed, the federal government’s 2023 vision for the electricity system declares that shifting away from fossil fuels is a “scientific and moral imperative” and “the greatest economic opportunity of our lifetime”.

Yet the biggest take-away from the global evidence is that among all the nations in the world—many with very big, green ambitions—there is not one that gets much of its power from solar and wind and has low electricity costs. The lower-right of the chart is simply empty.

Instead, there are plenty of nations with lots of green energy and exorbitantly high costs.

Business

Sluggish homebuilding will have far-reaching effects on Canada’s economy

From the Fraser Institute

At a time when Canadians are grappling with epic housing supply and affordability challenges, the data show that homebuilding continues to come up short in some parts of the country including in several metro regions where most newcomers to Canada settle.

In both the Greater Toronto area and Metro Vancouver, housing starts have languished below levels needed to close the supply gaps that have opened up since 2019. In fact, the last 12-18 months have seen many planned development projects in Ontario and British Columbia delayed or cancelled outright amid a glut of new unsold condominium units and a sharp drop in population growth stemming from shifts in federal immigration policy.

At the same time, residential real estate sales have also been sluggish in some parts of the country. A fall-off in real estate transactions tends to have a lagged negative effect on construction investment—declining home sales today translate into fewer housing starts in the future.

While Prime Minister Carney’s Liberal government has pledged to double the pace of homebuilding, the on-the-ground reality points to stagnant or dwindling housing starts in many communities, particularly in Ontario and B.C. In July, the Canada Mortgage and Housing Corporation (CMHC) revised down its national forecast for housing starts over 2025/26, notwithstanding the intense political focus on boosting supply.

A slowdown in residential construction not only affects demand for services provided by homebuilders, it also has wider economic consequences owing to the size and reach of residential construction and the closely linked real estate sector. Overall, construction represents almost 8 per cent of Canada’s economy. If we exclude government-driven industries such as education, health care and social services, construction provides employment for more than one in 10 private-sector workers. Most of these jobs involve homebuilding, home renovation, and real estate sales and development.

As such, the economic consequences of declining housing starts are far-reaching and include reduced demand for goods and services produced by suppliers to the homebuilding industry, lower tax revenues for all levels of government, and slower economic growth. The weakness in residential investment has been a key factor pushing the Canadian economy close to recession in 2025.

Moreover, according to Statistics Canada, the value of GDP (in current dollars) directly attributable to housing reached $238 billion last year, up slightly from 2023 but less than in 2021 and 2022. Among the provinces, Ontario and B.C. have seen significant declines in residential construction GDP since 2022. This pattern is likely to persist into 2026.

Statistics Canada also estimates housing-related activity supported some 1.2 million jobs in 2024. This figure captures both the direct and indirect employment effects of residential construction and housing-related real estate activity. Approximately three-fifths of jobs tied to housing are “direct,” with the rest found in sectors—such as architecture, engineering, hardware and furniture stores, and lumber manufacturing—which supply the construction business or are otherwise affected by activity in the residential building and real estate industries.

Spending on homebuilding, home renovation and residential real estate transactions (added together) represents a substantial slice of Canada’s $3.3 trillion economy. This important sector sustains more than one million jobs, a figure that partly reflects the relatively labour-intensive nature of construction and some of the other industries related to homebuilding. Clearly, Canada’s economy will struggle to rebound from the doldrums of 2025 without a meaningful turnaround in homebuilding.

Alberta

How economic corridors could shape a stronger Canadian future

Ship containers are stacked at the Panama Canal Balboa port in Panama City, Saturday, Sept. 20, 2025. The Panama Canals is one of the most significant trade infrastructure projects ever built. CP Images photo

From the Canadian Energy Centre

Q&A with Gary Mar, CEO of the Canada West Foundation

Building a stronger Canadian economy depends as much on how we move goods as on what we produce.

Gary Mar, CEO of the Canada West Foundation, says economic corridors — the networks that connect producers, ports and markets — are central to the nation-building projects Canada hopes to realize.

He spoke with CEC about how these corridors work and what needs to change to make more of them a reality.

CEC: What is an economic corridor, and how does it function?

Gary Mar: An economic corridor is a major artery connecting economic actors within a larger system.

Consider the road, rail and pipeline infrastructure connecting B.C. to the rest of Western Canada. This infrastructure is an important economic corridor facilitating the movement of goods, services and people within the country, but it’s also part of the economic corridor connecting western producers and Asian markets.

Economic corridors primarily consist of physical infrastructure and often combine different modes of transportation and facilities to assist the movement of many kinds of goods.

They also include social infrastructure such as policies that facilitate the easy movement of goods like trade agreements and standardized truck weights.

The fundamental purpose of an economic corridor is to make it easier to transport goods. Ultimately, if you can’t move it, you can’t sell it. And if you can’t sell it, you can’t grow your economy.

CEC: Which resources make the strongest case for transport through economic corridors, and why?

Gary Mar: Economic corridors usually move many different types of goods.

Bulk commodities are particularly dependent on economic corridors because of the large volumes that need to be transported.

Some of Canada’s most valuable commodities include oil and gas, agricultural commodities such as wheat and canola, and minerals such as potash.

CEC: How are the benefits of an economic corridor measured?

Gary Mar: The benefits of economic corridors are often measured via trade flows.

For example, the upcoming Roberts Bank Terminal 2 in the Port of Vancouver will increase container trade capacity on Canada’s west coast by more than 30 per cent, enabling the trade of $100 billion in goods annually, primarily to Asian markets.

Corridors can also help make Canadian goods more competitive, increasing profits and market share across numerous industries. Corridors can also decrease the costs of imported goods for Canadian consumers.

For example, after the completion of the Trans Mountain Expansion in May 2024 the price differential between Western Canada Select and West Texas Intermediate narrowed by about US$8 per barrel in part due to increased competition for Canadian oil.

This boosted total industry profits by about 10 per cent, and increased corporate tax revenues to provincial and federal governments by about $3 billion in the pipeline’s first year of operation.

CEC: Where are the most successful examples of these around the world?

Gary Mar: That depends how you define success. The economic corridors transporting the highest value of goods are those used by global superpowers, such as the NAFTA highway that facilitates trade across Canada, the United States and Mexico.

The Suez and Panama canals are two of the most significant trade infrastructure projects ever built, facilitating 12 per cent and five per cent of global trade, respectively. Their success is based on their unique geography.

Canada’s Asia-Pacific Gateway, a coordinated system of ports, rail lines, roads, and border crossings, primarily in B.C., was a highly successful initiative that contributed to a 48 per cent increase in merchandise trade with Asia from $44 million in 2006 to $65 million in 2015.

China’s Belt and Road initiative to develop trade infrastructure in other countries is already transforming global trade. But the project is as much about extending Chinese influence as it is about delivering economic returns.

Piles of coal awaiting export and gantry cranes used to load and unload containers onto and from cargo ships are seen at Deltaport, in Tsawwassen, B.C., on Monday, September 9, 2024. CP Images photo

CEC: What would need to change in Canada in terms of legislation or regulation to make more economic corridors a reality?

Gary Mar: A major regulatory component of economic corridors is eliminating trade barriers.

The federal Free Trade and Labour Mobility in Canada Act is a good start, but more needs to be done at the provincial level to facilitate more internal trade.

Other barriers require coordinated regulatory action, such as harmonizing weight restrictions and road bans to streamline trucking.

By taking a systems-level perspective – convening a national forum where Canadian governments consistently engage on supply chains and trade corridors – we can identify bottlenecks and friction points in our existing transportation networks, and which investments would deliver the greatest return on investment.

-

Business2 days ago

Business2 days agoCarney shrugs off debt problem with more borrowing

-

Alberta2 days ago

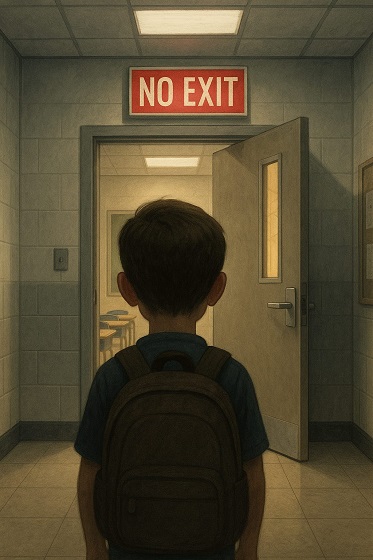

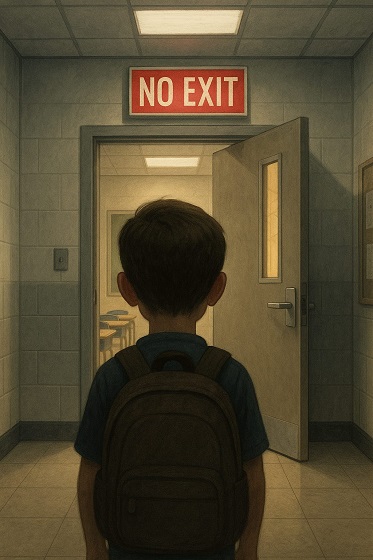

Alberta2 days agoWhen Teachers Say Your Child Has Nowhere Else to Go

-

Automotive2 days ago

Automotive2 days agoThe high price of green virtue

-

Addictions2 days ago

Addictions2 days agoCanada is divided on the drug crisis—so are its doctors

-

Bruce Dowbiggin2 days ago

Bruce Dowbiggin2 days agoMaintenance Mania: Since When Did Pro Athletes Get So Fragile?

-

Daily Caller2 days ago

Daily Caller2 days agoProtesters Storm Elite Climate Summit In Chaotic Scene

-

MAiD2 days ago

MAiD2 days agoQuebec has the highest euthanasia rate in the world at 7.4% of total deaths

-

National1 day ago

National1 day agoConservative bill would increase penalties for attacks on places of worship in Canada