Energy

Next federal government should close widening gap between Canadian and U.S. energy policy

From the Fraser Institute

After accounting for backup, energy storage and associated indirect costs—estimated solar power costs skyrocket from US$36 per megawatt hour (MWh) to as high as US$1,548, and wind generation costs increase from US$40 to up to US$504 per MWh.

At a recent energy conference in Houston, U.S. Energy Secretary Chris Wright said the Trump administration will end the Biden administration’s “irrational, quasi-religious policies on climate change that imposed endless sacrifices on our citizens.” He added that “Natural gas is responsible for 43 per cent of U.S. electricity production,” and beyond the obvious scale and cost problems, there’s “simply no physical way that wind, solar and batteries could replace the myriad uses of natural gas.”

In other words, as a federal election looms, once again the United States is diverging from Canada when it comes to energy policy.

Indeed, wind power is particularly unattractive to Wright because of its “incredibly high prices,” “incredibly huge investment” and “large footprint on the local communities,” which make it unattractive to people living nearby. Globally, Wright observes, “Natural gas currently supplies 25 per cent of raw energy globally, before it is converted into electricity or some other use. Wind and solar only supply about 3 per cent.”

And he’s right. Renewables are likely unable, physically or economically, to replace natural gas power production to meet current or future needs for affordable, abundant and reliable energy.

In a recent study published by the Fraser Institute, for example, we observed that meeting Canada’s predicted electricity demand through 2050 using only wind power (with natural gas discouraged under current Canadian climate policies) would require the construction of approximately 575 wind-power installations, each the size of Quebec’s Seigneurie de Beaupré wind farm, over 25 years. However, with a construction timeline of two years per project, this would equate to 1,150 construction years. This would also require more than one million hectares of land—an area nearly 14.5 times the size of Calgary.

Solar power did not fare much better. According to the study, to meet Canada’s predicted electricity demand through 2050 with solar-power generation would require the construction of 840 solar-power generation stations the size of Alberta’s Travers Solar Project. At a two-year construction time per facility, this adds up to 1,680 construction years to accomplish.

And at what cost? While proponents often claim that wind and solar sources are cheaper than fossil fuels, they ignore the costs of maintaining backup power to counter the unreliability of wind and solar power generation. A recent study published in Energy, a peer-reviewed energy and engineering journal, found that—after accounting for backup, energy storage and associated indirect costs—estimated solar power costs skyrocket from US$36 per megawatt hour (MWh) to as high as US$1,548, and wind generation costs increase from US$40 to up to US$504 per MWh.

The outlook for Canada’s switch to renewables is also dire. TD Bank estimated that replacing existing gas generators with renewables (such as solar and wind) in Ontario could increase average electricity costs by 20 per cent by 2035 (compared to 2021 costs). In Alberta, electricity prices would increase by up to 66 per cent by 2035 compared to a scenario without changes.

Under Canada’s current greenhouse gas (GHG) regulatory regime, natural gas is heavily disfavoured as a potential fuel for electricity production. The Trudeau government’s Clean Electricity Regulations (CER) would begin curtailing the use of natural gas beginning in 2035, leading largely to a cessation of natural gas power generation by 2050. Under CER and Ottawa’s “net-zero 2050” GHG emission framework, Canada will be wedded to a quixotic mission to displace affordable reliable natural gas power-generation with expensive unreliable renewables that are likely unable to meet expected future electricity demand.

With a federal election looming, Canada’s policymakers should pay attention to new U.S. energy policy on natural gas, and pull back from our headlong rush into renewable power. To avoid calamity, the next federal government should scrap the Trudeau-era CER and reconsider the entire “net-zero 2050” agenda.

Alberta

Alberta’s grand bargain with Canada includes a new pipeline to Prince Rupert

From Resource Now

Alberta renews call for West Coast oil pipeline amid shifting federal, geopolitical dynamics.

Just six months ago, talk of resurrecting some version of the Northern Gateway pipeline would have been unthinkable. But with the election of Donald Trump in the U.S. and Mark Carney in Canada, it’s now thinkable.

In fact, Alberta Premier Danielle Smith seems to be making Northern Gateway 2.0 a top priority and a condition for Alberta staying within the Canadian confederation and supporting Mark Carney’s vision of making Canada an Energy superpower. Thanks to Donald Trump threatening Canadian sovereignty and its economy, there has been a noticeable zeitgeist shift in Canada. There is growing support for the idea of leveraging Canada’s natural resources and diversifying export markets to make it less vulnerable to an unpredictable southern neighbour.

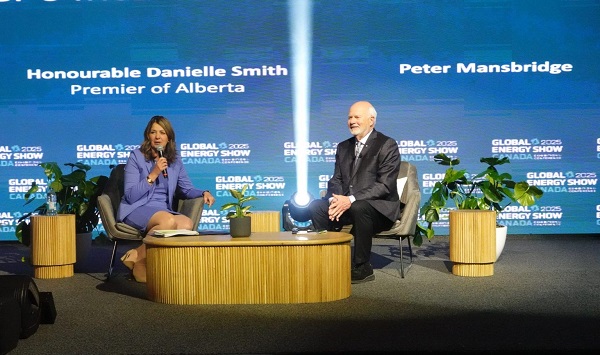

“I think the world has changed dramatically since Donald Trump got elected in November,” Smith said at a keynote address Wednesday at the Global Energy Show Canada in Calgary. “I think that’s changed the national conversation.” Smith said she has been encouraged by the tack Carney has taken since being elected Prime Minister, and hopes to see real action from Ottawa in the coming months to address what Smith said is serious encumbrances to Alberta’s oil sector, including Bill C-69, an oil and gas emissions cap and a West Coast tanker oil ban. “I’m going to give him some time to work with us and I’m going to be optimistic,” Smith said. Removing the West Coast moratorium on oil tankers would be the first step needed to building a new oil pipeline line from Alberta to Prince Rupert. “We cannot build a pipeline to the west coast if there is a tanker ban,” Smith said. The next step would be getting First Nations on board. “Indigenous peoples have been shut out of the energy economy for generations, and we are now putting them at the heart of it,” Smith said.

Alberta currently produces about 4.3 million barrels of oil per day. Had the Northern Gateway, Keystone XL and Energy East pipelines been built, Alberta could now be producing and exporting an additional 2.5 million barrels of oil per day. The original Northern Gateway Pipeline — killed outright by the Justin Trudeau government — would have terminated in Kitimat. Smith is now talking about a pipeline that would terminate in Prince Rupert. This may obviate some of the concerns that Kitimat posed with oil tankers negotiating Douglas Channel, and their potential impacts on the marine environment.

One of the biggest hurdles to a pipeline to Prince Rupert may be B.C. Premier David Eby. The B.C. NDP government has a history of opposing oil pipelines with tooth and nail. Asked in a fireside chat by Peter Mansbridge how she would get around the B.C. problem, Smith confidently said: “I’ll convince David Eby.”

“I’m sensitive to the issues that were raised before,” she added. One of those concerns was emissions. But the Alberta government and oil industry has struck a grand bargain with Ottawa: pipelines for emissions abatement through carbon capture and storage.

The industry and government propose multi-billion investments in CCUS. The Pathways Alliance project alone represents an investment of $10 to $20 billion. Smith noted that there is no economic value in pumping CO2 underground. It only becomes economically viable if the tradeoff is greater production and export capacity for Alberta oil. “If you couple it with a million-barrel-per-day pipeline, well that allows you $20 billion worth of revenue year after year,” she said. “All of a sudden a $20 billion cost to have to decarbonize, it looks a lot more attractive when you have a new source of revenue.” When asked about the Prince Rupert pipeline proposal, Eby has responded that there is currently no proponent, and that it is therefore a bridge to cross when there is actually a proposal. “I think what I’ve heard Premier Eby say is that there is no project and no proponent,” Smith said. “Well, that’s my job. There will be soon. “We’re working very hard on being able to get industry players to realize this time may be different.” “We’re working on getting a proponent and route.”

At a number of sessions during the conference, Mansbridge has repeatedly asked speakers about the Alberta secession movement, and whether it might scare off investment capital. Alberta has been using the threat of secession as a threat if Ottawa does not address some of the province’s long-standing grievances. Smith said she hopes Carney takes it seriously. “I hope the prime minister doesn’t want to test it,” Smith said during a scrum with reporters. “I take it seriously. I have never seen separatist sentiment be as high as it is now. “I’ve also seen it dissipate when Ottawa addresses the concerns Alberta has.” She added that, if Carney wants a true nation-building project to fast-track, she can’t think of a better one than a new West Coast pipeline. “I can’t imagine that there will be another project on the national list that will generate as much revenue, as much GDP, as many high paying jobs as a bitumen pipeline to the coast.”

Canadian Energy Centre

Cross-Canada economic benefits of the proposed Northern Gateway Pipeline project

From the Canadian Energy Centre

Billions in government revenue and thousands of jobs across provinces

Announced in 2006, the Northern Gateway project would have built twin pipelines between Bruderheim, Alta. and a marine terminal at Kitimat, B.C.

One pipeline would export 525,000 barrels per day of heavy oil from Alberta to tidewater markets. The other would import 193,000 barrels per day of condensate to Alberta to dilute heavy oil for pipeline transportation.

The project would have generated significant economic benefits across Canada.

The following projections are drawn from the report Public Interest Benefits of the Northern Gateway Project (Wright Mansell Research Ltd., July 2012), which was submitted as reply evidence during the regulatory process.

Financial figures have been adjusted to 2025 dollars using the Bank of Canada’s Inflation Calculator, with $1.00 in 2012 equivalent to $1.34 in 2025.

Total Government Revenue by Region

Between 2019 and 2048, a period encompassing both construction and operations, the Northern Gateway project was projected to generate the following total government revenues by region (direct, indirect and induced):

British Columbia

- Provincial government revenue: $11.5 billion

- Federal government revenue: $8.9 billion

- Total: $20.4 billion

Alberta

- Provincial government revenue: $49.4 billion

- Federal government revenue: $41.5 billion

- Total: $90.9 billion

Ontario

- Provincial government revenue: $1.7 billion

- Federal government revenue: $2.7 billion

- Total: $4.4 billion

Quebec

- Provincial government revenue: $746 million

- Federal government revenue: $541 million

- Total: $1.29 billion

Saskatchewan

- Provincial government revenue: $6.9 billion

- Federal government revenue: $4.4 billion

- Total: $11.3 billion

Other

- Provincial government revenue: $1.9 billion

- Federal government revenue: $1.4 billion

- Total: $3.3 billion

Canada

- Provincial government revenue: $72.1 billion

- Federal government revenue: $59.4 billion

- Total: $131.7 billion

Annual Government Revenue by Region

Over the period 2019 and 2048, the Northern Gateway project was projected to generate the following annual government revenues by region (direct, indirect and induced):

British Columbia

- Provincial government revenue: $340 million

- Federal government revenue: $261 million

- Total: $601 million per year

Alberta

- Provincial government revenue: $1.5 billion

- Federal government revenue: $1.2 billion

- Total: $2.7 billion per year

Ontario

- Provincial government revenue: $51 million

- Federal government revenue: $79 million

- Total: $130 million per year

Quebec

- Provincial government revenue: $21 million

- Federal government revenue: $16 million

- Total: $37 million per year

Saskatchewan

- Provincial government revenue: $204 million

- Federal government revenue: $129 million

- Total: $333 million per year

Other

- Provincial government revenue: $58 million

- Federal government revenue: $40 million

- Total: $98 million per year

Canada

- Provincial government revenue: $2.1 billion

- Federal government revenue: $1.7 billion

- Total: $3.8 billion per year

Employment by Region

Over the period 2019 to 2048, the Northern Gateway Pipeline was projected to generate the following direct, indirect and induced full-time equivalent (FTE) jobs by region:

British Columbia

- Annual average: 7,736

- Total over the period: 224,344

Alberta

- Annual average: 11,798

- Total over the period: 342,142

Ontario

- Annual average: 3,061

- Total over the period: 88,769

Quebec

- Annual average: 1,003

- Total over the period: 29,087

Saskatchewan

- Annual average: 2,127

- Total over the period: 61,683

Other

- Annual average: 953

- Total over the period: 27,637

Canada

- Annual average: 26,678

- Total over the period: 773,662

-

Crime1 day ago

Crime1 day agoHow Chinese State-Linked Networks Replaced the Medellín Model with Global Logistics and Political Protection

-

Aristotle Foundation2 days ago

Aristotle Foundation2 days agoWe need an immigration policy that will serve all Canadians

-

Addictions2 days ago

Addictions2 days agoNew RCMP program steering opioid addicted towards treatment and recovery

-

Business1 day ago

Business1 day agoNatural gas pipeline ownership spreads across 36 First Nations in B.C.

-

Business14 hours ago

Business14 hours agoEU investigates major pornographic site over failure to protect children

-

Courageous Discourse1 day ago

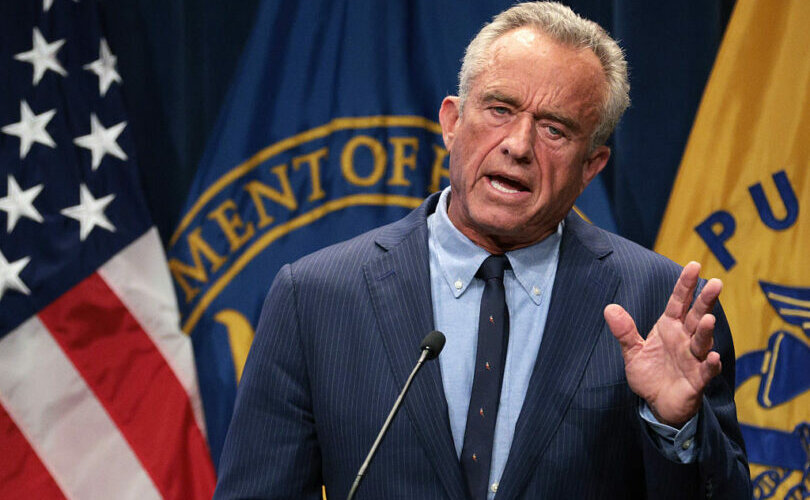

Courageous Discourse1 day agoHealthcare Blockbuster – RFK Jr removes all 17 members of CDC Vaccine Advisory Panel!

-

Health1 day ago

Health1 day agoRFK Jr. purges CDC vaccine panel, citing decades of ‘skewed science’

-

Censorship Industrial Complex1 day ago

Censorship Industrial Complex1 day agoConservatives slam Liberal bill to allow police to search through Canadians’ mail