Business

Companies Scrambling To Respond To Trump’s ‘Beautiful’ Tariff Hikes

From the Daily Caller News Foundation

From the Daily Caller News Foundation

By Adam Pack

Companies are scrambling to respond to President-elect Donald Trump’s “beautiful” tariff proposals that his administration may seek to enact early in his second term.

Proactive steps that companies are taking to evade anticipated price increases include stockpiling inventory in U.S. warehouses and weighing whether they need to completely eliminate China from their supply chains and raise the price of imported goods affected by tariff hikes, whose costs will be passed onto consumers.

Free-trade skeptics are touting companies’ anticipatory actions as delivering a clear sign that Trump’s proposed tariff hikes are already achieving their intended effect of pressuring retailers to eliminate China from their supply chains. However, some policy experts are warning that higher tariffs will be a regressive tax for America’s lower and middle-income families and make inflation worse, according to retailers and economists who spoke to the Daily Caller News Foundation.

On the campaign trail, Trump proposed a universal tariff of up to 20% on all imports coming into the U.S. and a 60% or higher tariff on all imports from China. Trump is considering Robert Lighthizer, the former U.S. trade representative during his administration’s first term who is well-known for favoring high tariffs, to serve as his second administration’s trade czar, the Wall Street Journal first reported.

PRESIDENT TRUMP: "The word tariff to me is a very beautiful word because it can save our country, truly… I saved our steel industries by putting tariffs on steel that China came in and dumped… They had committees that were put in charge of what to do with the money. We were… pic.twitter.com/jj88zenMRP

— Trump War Room (@TrumpWarRoom) October 2, 2024

‘Mitigation Strategies To Lessen The Impact’

Companies are taking preemptive measures, such as stockpiling goods in U.S. warehouses, to work proactively against anticipated price increases that higher tariffs would inflict, Jonathan Gold, vice president of supply chains and customs policy for the National Retail Federation, told the DCNF during an interview.

“They’re looking at different mitigation strategies to lessen the impact that they might feel from the tariffs,” Gold told the DCNF. “One of those strategies is to start looking at potentially bringing in cargo, bringing products earlier to get ahead of potential tariffs that Trump might put in place.”

Importing goods into the U.S. ahead of schedule leads to additional costs for retailers that will likely be passed onto consumers, but waiting to import goods from China after a 60% or higher tariff on Chinese imports goes into effect would be substantially more expensive, according to Gold.

A recent NRF study projected that Trump’s proposed tariff hikes on consumer products would cost American consumers an additional $46 billion to $78 billion a year.

“A tariff is a tax paid by the U.S. importer, not a foreign country or the exporter,” Gold said in a press release accompanying the study. “This tax ultimately comes out of consumers’ pockets through higher prices.”

Decoupling From China

Part of the rationale behind Trump’s tariff proposals is to force manufacturing jobs to return to the United States and pressure companies to completely eliminate China from their supply chains, according to Mark DiPlacido, policy advisor at American Compass.

“I hope in addition to stockpiling, they’re also looking at actually moving their supply chains out of China and ideally back to the United States,” DiPlacido told the DCNF.

“For a long time, the framing has been what is best for just increasing trade flows, regardless of the direction those flows are going. What that’s resulted in for the last 25 years is a flow of manufacturing, a flow of factories and a flow of jobs, especially solid middle class jobs out of the United States and across the world,” DiPlacido added.

But completely shifting production outside of China is not feasible for some retailers even if companies have taken further steps to diversify their supply chain for the past decade, according to Gold.

“It takes a while to make those shifts and not everyone is able to do that, Gold acknowledged. “Nobody has the [production] capacity that China does. Trying to find that within multiple countries is a challenge. And it’s not just the capacity, but the skilled workforce as well.”

In addition, companies who move production out of China to avoid a 60% tariff on imported goods from the nation could still get hit by a 20% across the board tariff if they move their supply chain to countries other than the United States, Gold and several economists told the DCNF.

“They’re talking about tariffs on imports for which there’s not a domestic producer to switch to,” Clark Packard, a research fellow on trade policy at the CATO institute, told the DCNF in an interview. “For example, we don’t make coffee in the United States, so why are we going to impose a tariff on coffee?”

“Who are we trying to protect?” he added.

Some economists are also pessimistic that the president-elect’s planned tariff hikes will ultimately bring jobs that moved overseas to cheaper labor markets back to the United States.

“What we actually saw from the 2018-2019 trade war was a decrease in manufacturing output and employment because of the tariffs,” Erica York, senior economist and research director of the Tax Foundation’s Center for Federal Tax Policy, told the DCNF in an interview. “It played out just like every economist predicted: higher costs for U.S. consumers, reduced output, reduced incomes for American workers, foreign retaliation that’s harmful.”

The president-elect’s proposed tariff hikes could also eliminate more jobs than those saved or created as a result of protecting domestic industries, such as the U.S. steel or solar manufacturing industries, that may benefit from higher tariffs on foreign competitors, Packard told the DCNF.

“It’s disproportionate — the cost that is passed onto the broader economy to protect a very small slice of U.S. employment,” Packard said. Trump’s 25% tariff on imported steel enacted during his first administration slightly increased employment in the U.S. steel industry, but each job that was maintained or created came at a cost of roughly $650,000 that likely killed jobs in other sectors forced to buy more expensive steel, according to Packard.

‘Bipartisan Recognition’

Despite tariffs’ potential to force companies to raise the price of goods they import into the United States, DiPlacido defended Trump’s proposed tariff hikes as essential to eliminating U.S. dependence on China for a variety of strategic goods and consumer products.

“We need to be able to manufacture a broad range of goods in the United States. And we need the job security and the economic security that a strong manufacturing industrial base provides,” DiPlacido said. “That’s going to be important to any future conflict or emergency that the United States may have with China or with anyone else.”

DiPlacido, citing Trump’s dominant electoral performance, also believes Trump has the “mandate” to carry out the tariff proposals he floated during the campaign.

“There’s a sort of a bipartisan recognition of the problem. Even the Biden administration kept almost all of Trump’s tariffs in place,” DiPlacido told the DCNF. “I think he has the political mandate, and that’s often a harder thing to get.”

However, some economists are questioning whether the thousands of dollars of projected costs that American families would be forced to pay as a result of these tariff hikes could create political backlash that has so far failed to materialize against Trump and Biden’s relatively similar trade policies.

“Voters were rightly pretty upset about price increases and inflation,” Packard told the DCNF. “We’re talking about utilizing a tool in tariffs that will increase relative prices.”

“Tariffs as a whole are a regressive tax,” Gold told the DCNF. “They certainly hit low and middle income consumers the hardest.”

Retailers are forecasting a decrease in demand for consumer products as a result of Trump’s tariff proposals, according to Gold.

The incoming Senate Republican leader has also notably criticized Trump’s proposed tariff hikes.

“I get concerned when I hear we just want to uniformly impose a 10% or 20% tariff on everything that comes into the United States,” Republican South Dakota Sen. John Thune, Senate GOP leader, said in August during a panel on agriculture policy in his home state. “Generally, that’s a recipe for increased inflation.”

Banks

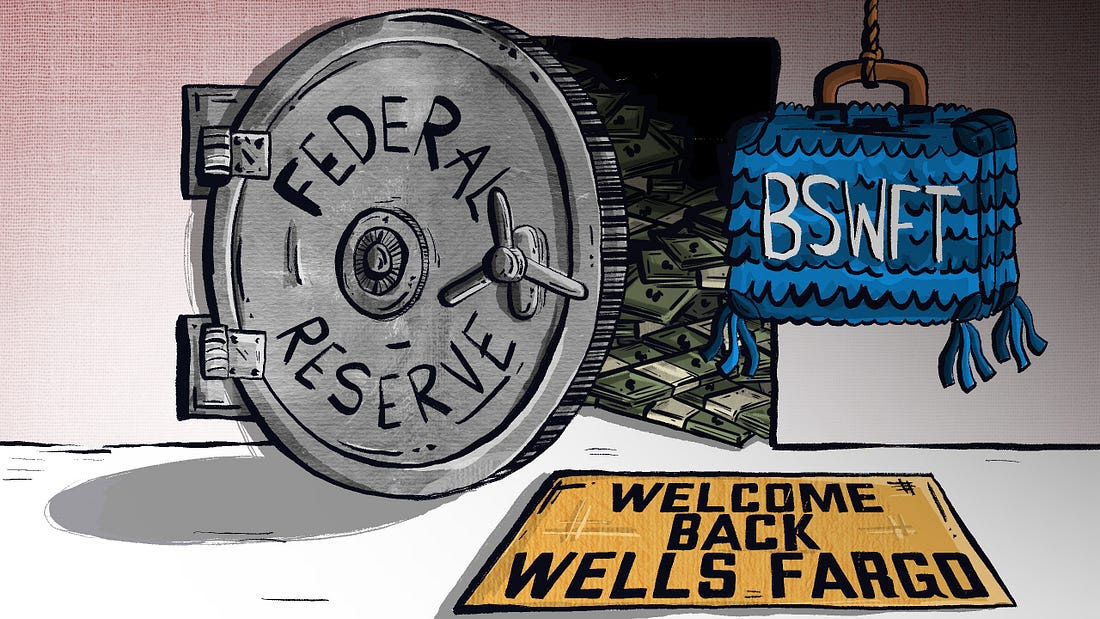

Welcome Back, Wells Fargo!

Racket News

Racket News

By Eric Salzman

The heavyweight champion of financial crime gets seemingly its millionth chance to show it’s reformed

The past two decades have been tough ones for Wells Fargo and the many victims of its sprawling crime wave. While the banking industry is full of scammers, Wells took turning time honored street-hustles into multi-billion dollar white-collar hustles to a new level.

The Federal Reserve announced last month that Wells Fargo is no longer subject to the asset growth restriction the Fed finally enforced in 2018 after multiple scandals. This was a major enforcement action that prohibited Wells from growing existing loan portfolios, purchasing other bank branches or entering into any new activities that would result in their asset base growing.

Upon hearing the news that Wells was being released from the Fed’s penalty box, my mind turned to this pivotal moment in the classic movie “Slapshot.”

Here are some of Wells Fargo’s lowlights both before and after the Fed’s enforcement action:

- December 2022: Wells Fargo paid more than $2 billion to consumers and $1.7 billion in civil penalties after the Consumer Financial Protection Bureau (CFPB) found mismanagement — including illegal fees and interest charges — in several of its biggest product lines, such as auto loans, mortgages, and deposit accounts.

- September 2021: Wells Fargo paid $72.6 million to the Justice Department for overcharging foreign exchange customers from 2010-2017.

- February 2020: Wells Fargo paid $3 billion to settle criminal and civil investigations by the Justice Department and SEC into its aggressive sales practices between 2002 and 2016. About $500 million was eventually distributed to investors.

- January 2020: The Office of the Comptroller of the Currency (OCC) banned two senior executives, former CEO John Stumpf and ex-Head of Community Bank Carrie Tolstedt, from the banking industry. Stumpf and Tolstedt also incurred civil penalties of $17.5 million and $17 million.

- August 2018: The Justice Department levied a $2.09 billion fine on Wells Fargo for its actions during the subprime mortgage crisis, particularly its mortgage lending practices between 2005 and 2007.

- April 2018: Federal regulators at the CFPB and OCC examined Wells’ auto loan insurance and mortgage lending practices and ordered the bank to pay $1 billion in damages.

- February 2018: The aforementioned Fed enforcement action. In addition to the asset growth restriction, Wells was ordered to replace three directors.

- October 2017: Wells Fargo admitted wrongdoing after 110,000 clients were fined for missing a mortgage payment deadline — delays for which the bank was ultimately deemed at fault.

- July 2017: As many as 570,000 Wells Fargo customers were wrongly charged for auto insurance on car loans after the bank failed to verify whether those customers already had existing insurance. As a result, up to 20,000 customers may have defaulted on car loans.

- September 2016: Wells Fargo acknowledged its employees had created 1.5 million deposit accounts and 565,000 credit card accounts between 2002 and 2016 that “may not have been authorized by consumers,” according to CFPB. As a result, the lender was forced to pay $185 million in damages to the CFPB, OCC, and City and County of Los Angeles.

Additionally, somehow in 2023 Wells even managed to drop $1 billion in a civil settlement with shareholders for overstating their progress in complying with their 2018 agreement with the Fed to clean themselves up!

I imagine if Wells were in any other business, it wouldn’t be allowed to continue. But Wells is part of the “Too Big to Fail” club. Taking away its federal banking charter would be too disruptive for the financial markets, so instead they got what ended up being a seven-year growth ban. Not exactly rough justice.

While not the biggest settlement, my favorite Wells scam was the 2021 settlement of the seven-year pilfering operation, ripping off corporate customers’ foreign exchange transactions.

Like many banks, Wells Fargo offers its corporate clients with global operations foreign exchange (FX) services. For example, if a company is based in the U.S. but has extensive dealings in Canada, it may receive payments in Canadian dollars (CAD) that need to be exchanged for U.S. dollars (USD) and vice versa. Wells, like many banks, has foreign exchange specialists who do these conversions. Ideally, the banks optimize their clients’ revenue and decrease risk, in return for a markup fee, or “spread.”

There’s a lot of trust involved with this activity as the corporate customers generally have little idea where FX is trading minute by minute, nor do they know what time of day the actual orders for FX transactions — commonly called “BSwifts” — come in. For an unscrupulous bank, it’s a license to steal, which is exactly what Wells did.

According to the complaint, Wells regularly marked up transactions at higher spreads than what was agreed upon. This was just one of the variety of naughty schemes Wells used to clobber their customers. My two favorites were “The Big Figure Trick” and the “BSwift Pinata.”

The Big Figure Trick

Let’s say a client needs to sell USD for CAD, and that the $1 USD is worth $1.32 CAD. In banking parlance, the 32 cents is called the “Big Figure.” Wells would buy the CAD at $1.32 for $1 USD and then transpose the actual exchange rate on the customer statement from $1.32 to $1.23. If the customer didn’t notice, Wells would pocket the difference. On a transaction where the client is buying 5 million CAD with USD, the ill-gotten gain for Wells would be about $277,000 USD!

Conversely, if the customer did notice the difference, Wells would just blame it on the grunts in its operational back office, saying they accidentally transposed the number and “correct” the transaction. From the complaint, here is some give and take between two Wells FX specialists:

“You can play the transposition error game if you get called out.” Another FX sales specialist noted to a colleague about a previous transaction that a customer “didn’t flinch at the big fig the other day. Want to take a bit more?”

The BSwift Piñata

The way this hustle would work is, let’s say the Wells corporate customer was receiving payment from one of their Canadian clients. The Canadian client’s bank would send a BSwift message to Wells. The Wells client was in the dark about the U.S. dollar-Canadian dollar exchange rate because it had no idea what time of day the message arrived. Wells took advantage of that by purchasing U.S. dollars for Canadian dollars first. For simplicity, think of the U.S. dollar-Canadian dollar exchange rate as a widget that Wells bought for $1. If the widget increased in value, say to $1.10 during the day, Wells would sell the widget they purchased for $1 to the client for $1.10 and pocket 10 cents. If the price of the widget Wells bought for $1 fell to 95 cents, Wells would just give up their $1 purchase to the client, plus whatever markup they agreed to.

Heads, Wells wins. Tails, client loses.

The complaint notes that a Wells FX specialist wrote that he:

“Bumped spreads up a pinch,” that “these clients who are in the mode of just processing wires will most likely not notice this slight change in pricing” and that it “could have a very quick positive impact on revenue without a lot of risk.”

Talk about a boiler room operation. Personally, I think calling what you are doing to a client a “piñata” should have easily put Wells in the Fed’s penalty box another 5 years at least!

Wells has been released from the Fed’s 2018 enforcement order. I would like to think they have learned their lesson and are reformed, but I would lay good odds against it. A leopard can’t change its spots.

Racket News is a reader-supported publication.

Consider becoming a free or paid subscriber.

Alberta

Pierre Poilievre – Per Capita, Hardisty, Alberta Is the Most Important Little Town In Canada

From Pierre Poilievre

-

Business2 days ago

Business2 days agoOttawa Funded the China Ferry Deal—Then Pretended to Oppose It

-

MAiD2 days ago

MAiD2 days agoCanada’s euthanasia regime is not health care, but a death machine for the unwanted

-

Business2 days ago

Business2 days agoWorld Economic Forum Aims to Repair Relations with Schwab

-

Alberta2 days ago

Alberta2 days agoAlberta’s government is investing $5 million to help launch the world’s first direct air capture centre at Innisfail

-

Business2 days ago

Business2 days agoMunicipal government per-person spending in Canada hit near record levels

-

Business2 days ago

Business2 days agoA new federal bureaucracy will not deliver the affordable housing Canadians need

-

Business2 days ago

Business2 days agoRFK Jr. says Hep B vaccine is linked to 1,135% higher autism rate

-

Business2 days ago

Business2 days agoElon Musk slams Trump’s ‘Big Beautiful Bill,’ calls for new political party