Business

The Problem of Corporate Tax Rate Hikes

Why it’s nearly impossible to avoid causing more harm than good

Are Canadian corporations paying their share? Well, what is their share? And before we go there, just how much are Canadian corporations paying?

According to Statistics Canada, in the second quarter of 2024 the federal government received $221 billion from all income tax revenues (excluding CPP and QPP). Provincial governments took in another $104 billion, and local (municipal) governments got $21 billion. Using those numbers, we can (loosely) estimate that all levels of government raise somewhere around $1.38 trillion annually.

The Audit is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

If you’re curious (and I know you are), that means taxes cost each man, woman, and child in Canada $33,782 each year. Trust me: I feel your pain.

Based on Statistics Canada data from 2022 (the latest comparable data available), we can also say that roughly ten percent of those total revenues come from corporate taxes at both the federal and provincial levels.

Keep that 10:90 corporate-to-personal tax revenue ratio in mind. Because what if raising the corporate tax rate by, say, five percent ends up driving businesses to lay off even one percent of workers? Sure, you’ll take in an extra $7 billion in corporate taxes, but you might well lose the $12 billion in personal income taxes those laid-off workers would have paid.

How Much Should Corporations Pay?

Ok. So how should we calculate a business’s fair share? Arguably, a single dollar’s worth of business activity is actually taxed over and over again:

- When a corporation earns revenue, it’s taxed on its profits.

- Any remaining profit may be distributed to shareholders in the form of dividends. Shareholders, of course, will pay income tax on those dividends.

- Corporations pass on part of the tax burden to consumers through higher prices. When consumers pay those higher prices, a part of every dollar they spend is indirectly taxed through the corporation’s price adjustments.

- Employee wages paid from after-tax corporate profits are taxed yet again.

- Shareholders may eventually realize capital gains when they sell their shares. These gains are, naturally, also taxed.

I guess the ideal system would identify a corporate tax rate that takes all those layers into account to ensure that no single individual’s labor and contribution should carry an unreasonable burden. I’ll leave figuring out how to build such a system to smart people.

Does “Soaking Rich Corporations” Actually Work?

Do higher corporate taxes actually improve the lives of Canadians? Spoiler alert: it’s complicated.

Government policy choices generally come with consequences. From time to time, those will include actual solutions for serious problems. But they usually leave their mark in places of which lawmakers were initially barely aware existed.

Here’s where we get to explore some of those unintended consequences by comparing economic performance between provinces with varying corporate tax rates. Do higher rates discourage business investment leading to lower employment, economic activity, and incoming tax revenues? In other words, do tax rate increases always make financial sense?

To answer those questions, I compared each province’s large business tax rate with four economic measures:

- Gross domestic product per capita

- Business gross fixed capital formation (GFCF – the money businesses invest in capital improvements: the higher the GFCF, the more confidence businesses have in their long-term success)

- Private sector employment rate

- My own composite economic index (see this post)

Using four measures rather than just one or two gives us many more data points which reduces the likelihood that we’re looking at random statistical relationships. Here are the current provincial corporate tax rates for large businesses:

If we find a significant negative correlation between, say, higher tax rates and outcomes for all four of those measures, then we’d have evidence that higher rates are likely to have a negative impact on the economy (and on the human beings who live within that economy). If, on the other hand, there’s a positive correlation, then it’s possible higher taxes are not harmful.

When I ran the numbers, I found that the GDP per capita has a strong negative correlation with higher tax rates (meaning, the higher the tax rate, the lower the GDP). GFCF per capita and the private sector employment rate both had moderately negative correlations with higher taxes, and my own composite economic index had a weak negative correlation. Those results, taken together, strongly suggest that higher corporate tax rates are indeed harmful for a province’s overall economic health.

Here’s a scatter plot that illustrates the relationship between tax rates and the combined outcome scores:

Alberta, with the lowest tax rate also has the best outcomes. PEI, along with New Brunswick and Nova Scotia, share the high-tax-poor-outcome corner.

I guess the bottom line coming out of all this is that the “rich corporations aren’t paying their share” claim isn’t at all simple. To be taken seriously, you’d need to account for:

- The true second-order costs that higher corporate taxes can impose on consumers, investors, and workers.

- The strong possibility that higher corporate taxes might cause more harm to economies than they’re worth.

- The strong possibility that extra revenues might just end up being dumped into the general pool of toxic government waste.

Or, in other words, smart policy choices require good data.

The Audit is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Business

Carney’s European pivot could quietly reshape Canada’s sovereignty

This article supplied by Troy Media.

Canadians must consider how closer EU ties could erode national control and economic sovereignty

As Prime Minister Mark Carney attempts to deepen Canada’s relationship with the European Union and other supranational institutions, Canadians should be asking a hard question: how much of our national independence are we prepared to give away? If you want a glimpse of what happens when a country loses control over its currency, trade and democratic accountability, you need only look to Bulgaria.

On June 8, 2025, thousands of Bulgarians took to the streets in front of the country’s National Bank. Their message was clear: they want to keep the lev and stop the forced adoption of the euro, scheduled for Jan. 1, 2026.

Bulgaria, a southeastern European country and EU member since 2007, is preparing to join the eurozone—a bloc of 20 countries that share the euro as a common currency. The move would bind Bulgaria to the economic decisions of the European Central Bank, replacing its national currency with one managed from Brussels and Frankfurt.

The protest movement is a vivid example of the tensions that arise when national identity collides with centralized policy-making. It was organized by Vazrazdane, a nationalist, eurosceptic political party that has gained support by opposing what it sees as the erosion of Bulgarian sovereignty through European integration. Similar demonstrations took place in cities across the country.

At the heart of the unrest is a call for democratic accountability. Vazrazdane leader Konstantin Kostadinov appealed directly to EU leaders, arguing that Bulgarians should not be forced into the eurozone without a public vote. He noted that in Italy, referendums on the euro were allowed with support from less than one per cent of citizens, while in Bulgaria, more than 10 per cent calling for a referendum have been ignored.

Protesters warned that abandoning the lev without a public vote would amount to a betrayal of democracy. “If there is no lev, there is no Bulgaria,” some chanted. For them, the lev is not just a currency: it is a symbol of national independence.

Their fears are not unfounded. Across the eurozone, several countries have experienced higher prices and reduced purchasing power after adopting the euro. The loss of domestic control over monetary policy has led to economic decisions being dictated from afar. Inflation, declining living standards and external dependency are real concerns.

Canada is not Bulgaria. But it is not immune to the same dynamics. Through trade agreements, regulatory convergence and global commitments, Canada has already surrendered meaningful control over its economy and borders. Canadians rarely debate these trade-offs publicly, and almost never vote on them directly.

Carney, a former central banker with deep ties to global finance, has made clear his intention to align more closely with the European Union on economic and security matters. While partnership is not inherently wrong, it must come with strong democratic oversight. Canadians should not allow fundamental shifts in sovereignty to be handed off quietly to international bodies or technocratic elites.

What’s happening in Bulgaria is not just about the euro—it’s about a people demanding the right to chart their own course. Canadians should take note. Sovereignty is not lost in one dramatic act. It erodes incrementally: through treaties we don’t read, agreements we don’t question, and decisions made without our consent.

If democracy and national control still matter to Canadians, they would do well to pay attention.

Isidoros Karderinis was born in Athens, Greece. He is a journalist, foreign press correspondent, economist, novelist and poet. He is accredited by the Greek Ministry of Foreign Affairs as a foreign press correspondent and has built a distinguished career in journalism and literature.

Troy Media empowers Canadian community news outlets by providing independent, insightful analysis and commentary. Our mission is to support local media in helping Canadians stay informed and engaged by delivering reliable content that strengthens community connections and deepens understanding across the country.

Business

EU investigates major pornographic site over failure to protect children

From LifeSiteNews

Pornhub has taken down 91% of its images and videos and a huge portion of the last 9% will be gone by June 30 because it never verified the age or consent of those in the videos.

Despite an aggressive PR operation to persuade lawmakers that they have reformed, Pornhub is having a very bad year.

On May 29, it was reported that the European Commission is investigating the pornography giant and three other sites for failing to verify the ages of users.

The investigation, which comes after a letter sent to the companies last June asking what measures they have taken to protect minors, is being carried out under the Digital Services Act. The DSA came into effect in November 2022 and directs platforms to ensure “appropriate and proportionate measures to ensure a high level of privacy, safety, and security of minors, on their service” and implement “targeted measures to protect the rights of the child, including age verification and parental control tools, tools aimed at helping minors signal abuse or obtain support, as appropriate.”

According to France24: “The commission, the EU’s tech regulator, accused the platforms of not having ‘appropriate; age verification tools to prevent children from being exposed to pornography. An AFP correspondent only had to click a button on Tuesday stating they were older than 18 without any further checks to gain access to each of the four platforms.”

Indeed, Pornhub’s alleged safety mechanisms are a sick joke, and Pornhub executives have often revealed the real reason behind their opposition to safeguards: It limits their traffic.

Meanwhile, Pornhub — and other sites owned by parent company Aylo — are blocking their content in France in response to a new age verification law that came into effect on June 7. Solomon Friedman, Aylo’s point man in the Pornhub propaganda war, stated that the French law was “potentially privacy infringing” and “dangerous,” earning a scathing rebuke from France’s deputy minister for digital technology Clara Chappaz.

“We’re not stigmatizing adults who want to consume this content, but we mustn’t do so at the expense of protecting our children,” she said, adding later, “Lying when one does not want to comply with the law and holding others hostage is unacceptable. If Aylo would rather leave France than apply our law, they are free to do so.” According to the French media regulator Arcom, 2.3 million French minors visit pornographic sites every month.

Incidentally, anti-Pornhub activist Laila Mickelwait reported another major breakthrough on June 7. “P*rnhub is deleting much of what’s left of the of the site by June 30,” she wrote on X. “Together we have collectively forced this sex trafficking and rape crime scene to take down 91% of the entire site, totaling 50+ million videos and images. Now a significant portion of the remaining 9% will be GONE this month in what will be the second biggest takedown of P*rnhub content since December 2020.”

“The reason for the mass deletion is that they never verified the age or consent of the individuals depicted in the images and videos, and therefore the site is still awash with real sexual crime,” she added. “Since the fight began in 2020, 91% of P*rnhub has been taken down — over 50 million images and videos. Now a huge portion of the last 9% will be gone by June 30 because P*rnhub never verified the age or consent of those in the videos and the site is a crime scene.”

Mickelwait has long called for the shutdown of Pornhub and the prosecution of those involved in its operation. This second mass deletion of content, as welcome as it is, reeks of a desperate attempt to eliminate the evidence of Pornhub’s crimes.

-

Censorship Industrial Complex2 days ago

Censorship Industrial Complex2 days agoConservatives slam Liberal bill to allow police to search through Canadians’ mail

-

Business1 day ago

Business1 day agoEU investigates major pornographic site over failure to protect children

-

Courageous Discourse2 days ago

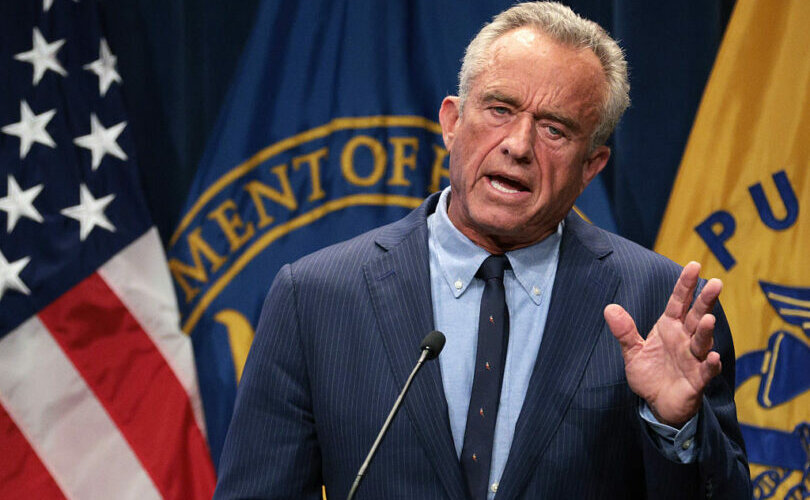

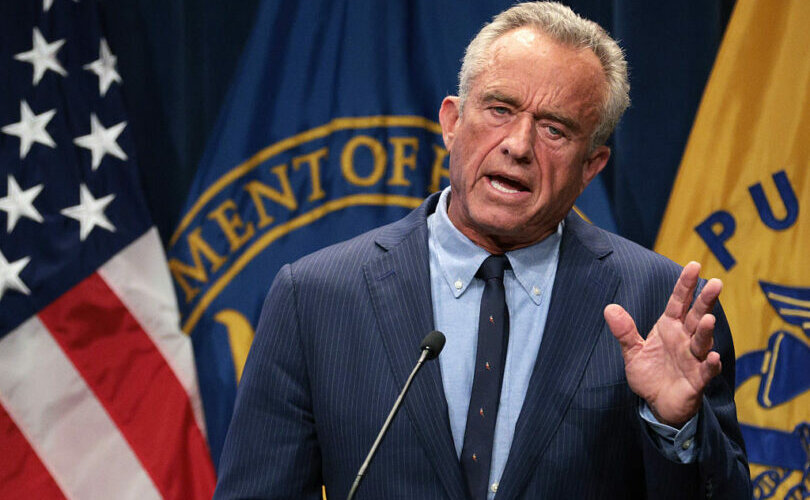

Courageous Discourse2 days agoHealthcare Blockbuster – RFK Jr removes all 17 members of CDC Vaccine Advisory Panel!

-

Health2 days ago

Health2 days agoRFK Jr. purges CDC vaccine panel, citing decades of ‘skewed science’

-

Immigration2 days ago

Immigration2 days agoMass immigration can cause enormous shifts in local culture, national identity, and community cohesion

-

Censorship Industrial Complex2 days ago

Censorship Industrial Complex2 days agoAlberta senator wants to revive lapsed Trudeau internet censorship bill

-

Canadian Energy Centre1 day ago

Canadian Energy Centre1 day agoCross-Canada economic benefits of the proposed Northern Gateway Pipeline project

-

Health2 days ago

Health2 days agoPolice are charging parents with felonies for not placing infants who died in sleep on their backs