Business

Don’t be fooled by high-speed rail

From the Frontier Centre for Public Policy

Rail advocates admit that trains can’t compete with airliners over long distances or with cars over short distances but claim there is a middle distance – supposedly around 150 to 800 kilometers – in which rail has an advantage over its competitors. That would be true only if the trains were almost 100 percent subsidized.

The Canadian government is considering spending $6 billion to $12 billion to introduce what it calls “high-frequency trains” between Toronto and Quebec City. Though some media reports have described these as high-speed trains (which generally means trains capable of going 250 kilometers per hour), they won’t be. Building such a rail line would easily cost $60 billion and probably much more.

Passenger-train advocates argue that Canada needs to join the international race to have the fastest trains in the world. But this is a race Canada can afford to lose because the country has something that is faster and far less costly: jet airliners.

High-speed trains were already obsolete in 1964, when Japan started operating its first bullet trains. Six years before that, Boeing had introduced the 707 and Douglas the DC-8, both of which cruised four times faster than the early bullet trains and twice as fast as the fastest trains in the world today.

Aside from speed, airliners also have a huge cost advantage because they don’t require a lot of expensive infrastructure between cities. While airports are infrastructure, the only infrastructure airliners really need are paved runways and perhaps a Quonset hut for ticket agents, baggage handling, and a waiting room—which is all that some of Canada’s more remote airports have.

Today’s big-city airports with huge concourses, shops, and jetways were built up over time and mostly paid for out of ticket fees. In contrast, rail advocates want taxpayers to put up tens of billions of dollars before a single wheel turns in the hope that trains that are slower than flying, less convenient than driving, and more expensive than both will somehow attract a significant number of travelers.

Rail advocates admit that trains can’t compete with airliners over long distances or with cars over short distances but claim there is a middle distance – supposedly around 150 to 800 kilometers – in which rail has an advantage over its competitors. That would be true only if the trains were almost 100 percent subsidized.

Air Canada and its competitors currently offer more than three dozen flights a day between Toronto and Montreal with fares starting at $118, less than 25 cents per passenger-kilometer. Fares on VIA Rail Canada averaged 68 cents per passenger-kilometer in 2022, and more than half of its costs are subsidized. People are simply not going to ride high-speed trains in large numbers if those trains cost far more than airlines, buses, or driving.

Amtrak’s only high-speed train, the Acela, collected fares of CN$1.80 per passenger-kilometer in 2022, and while Amtrak claims it covers its operating costs, all of its infrastructure costs are paid for by taxpayers. Amtrak brags that it carries more passengers in the Washington-New York corridor than the airlines, but cars and buses in this corridor carry well over 10 times as many intercity passengers as Amtrak.

The other argument rail advocates make is that high-speed trains will offer shorter downtown-to-downtown times than airlines in some markets. But most people neither work nor live downtown. Toronto and Montreal each have three commercial airports and residents are more likely to be near one of those airports than downtown.

Finally, rail proponents claim that high-speed trains will emit fewer greenhouse gases than cars or planes. But as usual they ignore the construction costs—that is, the billions of kilograms of greenhouse gases that would be emitted to build a high-speed rail line. It is likely that operational savings would never recover this cost, especially since it would be far less expensive to power jets and automobiles with biofuels.

One thing is certain: building high-speed or even high-frequency rail will require lots of workers. Far from being a benefit, Canada is currently suffering a labour shortage that is not expected to end soon. If the government decides to spend billions on a rail line, it will only make the costs of housing, cars, and just about everything else rise even faster.

China, Japan, and Spain have practically wrecked their economies by spending too much on high-speed trains. Just because other countries are foolishly building high-speed rail lines doesn’t mean Canada should do so any more than the country should spend billions on other obsolete technologies such as telegraphs, electric typewriters, or slide rules. Taxpayers should tell the government not to waste money on such boondoggles.

Randal O’Toole is a transportation policy analyst and author of Building 21st Century Transit Systems for Canadian Cities. (20 pages) March 12,2024.

Business

Resurfaced Video Shows How Somali Scammers Used Day Care Centers To Scam State

From the Daily Caller News Foundation

A resurfaced 2018 video from a Minneapolis-area TV station shows how Somali scammers allegedly bilked Minnesota out of millions of dollars for services that they never provided.

Independent journalist Nick Shirley touched off a storm on social media Friday after he posted a photo of one day-care center, which displayed a banner calling it “The Greater Learing Center” on X, along with a 42-minute video that went viral showing him visiting that and other day-care centers. The surveillance video, which aired on Fox 9 in 2018 after being taken in 2015, showed parents taking kids into the center, then leaving with them minutes later, according to Fox News.

“They were billing too much, they went up to high,” Hennepin County attorney Mike Freeman told Fox 9 in 2018. “It’s hard to imagine they were serving that many people. Frankly if you’re going to cheat, cheat little, because if you cheat big, you’re going to get caught.”

Dear Readers:

As a nonprofit, we are dependent on the generosity of our readers.

Please consider making a small donation of any amount here.

Thank you!

Democratic Gov. Tim Walz of Minnesota was accused of engaging in “systemic” retaliation against whistleblowers in a Nov. 30 statement by state employees. Assistant United States Attorney Joe Thompson announced on Dec. 18 that the amount of suspected fraud in Minnesota’s Medicaid program had reached over $9 billion.

After Shirley’s video went viral, FBI Director Kash Patel announced the agency was already sending additional resources in a Sunday post on X, citing the case surrounding Feeding Our Future, which at one point accused the Minnesota government of racism during litigation over the suspension of funds after earlier allegations of fraud.

KSTP reported that the Quality Learning Center, one of the centers visited by Shirley, had 95 citations for violations from one Minnesota agency between 2019 to 2023.

President Donald Trump announced in a Nov. 21 post on Truth Social that he would end “Temporary Protected Status” for Somalis in the state in response to allegations of welfare fraud and said that the influx of refugees had “destroyed our country.”

Business

Disclosures reveal Minnesota politician’s husband’s companies surged thousands-fold amid Somali fraud crisis

Rep. Ilhan Omar’s latest financial disclosures reveal seemingly sudden wealth accumulation inside her household, even as Minnesota grapples with revelations of massive fraud that may have siphoned more than $9 billion from government programs. The numbers, drawn from publicly filed congressional reports, show two companies tied to Omar’s husband, Tim Mynett, surging in value at a pace that raises more questions than answers.

According to the filings, Rose Lake Capital LLC — a business advisory firm Mynett co-founded in 2022 — jumped from an assessed range of $1 to $1,000 in 2023 to between $5 million and $25 million in 2024. Even using the most conservative assumptions allowed under Congress’ broad valuation ranges, the company’s value would have increased thousands of times in a single year. The firm advertises itself as a facilitator of “deal-making, mergers and acquisitions, banking, politics and diplomacy.”

Archived versions of Rose Lake’s website once showcased an eye-catching lineup of political heavyweights: former Ambassador to Bahrain Adam Ereli, former Sen. Max Baucus, and prominent Democratic National Committee alumni William Derrough and Alex Hoffman. But as scrutiny surrounding Omar intensifies — particularly over whether her political network intersected with sprawling fraud schemes exposed in Minnesota — the company has quietly scrubbed its online footprint. Names and biographies of team members have vanished, and the firm has not clarified whether these figures remain involved. Omar’s office offered no comment when asked to explain the company’s sudden growth or the removal of its personnel listings.

Mynett, Omar’s third husband, has long been a controversial presence in her political orbit, but the dramatic swell in his business holdings comes at a moment when trust in Minnesota’s oversight systems is already badly shaken. Federal and state investigators now estimate that fraud involving pandemic-era and nonprofit programs may exceed $9 billion, a staggering figure for a state often held up as a model of progressive governance. For many residents, the revelation that Omar’s household wealth soared during the same period only deepens skepticism about who benefited from Minnesota’s expansive social-spending apparatus.

The financial story doesn’t stop with Rose Lake. A second Mynett-linked entity, ESTCRU LLC — a boutique winery registered in Santa Rosa, California — reported an assessed value of $1 million to $5 million in 2024. Just a year earlier, Omar disclosed its worth at $15,000 to $50,000. Despite the dramatic valuation spike, ESTCRU’s online storefront does not appear to function, its last social media activity dates back to early 2023, and the phone number listed on its website is no longer in service. As with Rose Lake, Omar’s office declined to comment on the winery’s sudden rise in reported value.

The House clerk has yet to release 2025 disclosures, leaving unanswered how these companies are performing today — and how such explosive growth materialized in the first place.

-

Business7 hours ago

Business7 hours agoICYMI: Largest fraud in US history? Independent Journalist visits numerous daycare centres with no children, revealing massive scam

-

Daily Caller1 day ago

Daily Caller1 day agoWhile Western Nations Cling to Energy Transition, Pragmatic Nations Produce Energy and Wealth

-

Daily Caller1 day ago

Daily Caller1 day agoUS Halts Construction of Five Offshore Wind Projects Due To National Security

-

Alberta2 days ago

Alberta2 days agoAlberta Next Panel calls for less Ottawa—and it could pay off

-

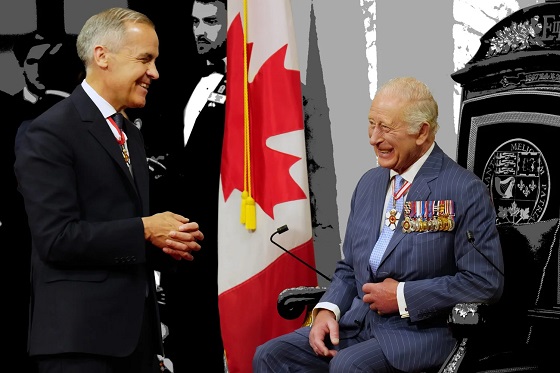

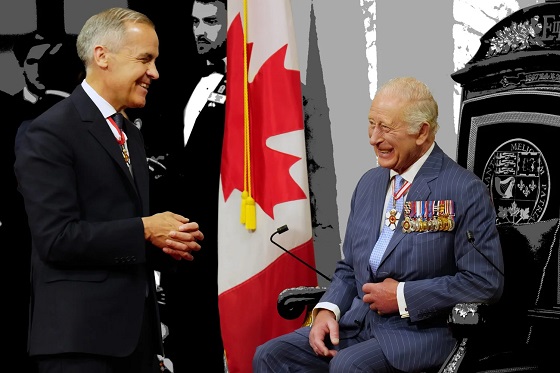

Bruce Dowbiggin1 day ago

Bruce Dowbiggin1 day agoBe Careful What You Wish For In 2026: Mark Carney With A Majority

-

Energy2 days ago

Energy2 days agoWhy Japan wants Western Canadian LNG

-

Business2 days ago

Business2 days agoLand use will be British Columbia’s biggest issue in 2026

-

Business2 days ago

Business2 days agoMainstream media missing in action as YouTuber blows lid off massive taxpayer fraud