Business

Trudeau’s labor minister pushes ‘equity’ mandate to favor LGBT job applicants

From LifeSiteNews

The report presented by Liberal Labour Minister Seamus O’Regan suggests giving special privileges to ‘LGBT-identifying and Black Canadians’ in the hiring process in the name of ‘equity,’ and dismisses concerns that such a move is tantamount to discrimination.

The Trudeau government is celebrating a newly proposed equity mandate which would reward LGBT-identifying job applicants over those with natural sexual proclivities.

On December 11, Liberal Labour Minister Seamus O’Regan announced the Employment Equity Act Review Task Force report, which seeks to add “LGBT-identifying and Black Canadians” to the list of those with special hiring privileges.

“It’s pretty historical,” O’Regan said outside the House of Commons foyer on Monday. “We are naming Black people and 2SLGBTQI+ individuals as designated groups under the Employment Equity Act.”

According to information obtained by the Canadian Broadcasting Corporation (CBC), the Liberal government, under the leadership of Prime Minister Justin Trudeau, “broadly supports” the recommendation.

The report, led by McGill University law professor Adelle Blackett, assured Canadians that it would not lead to “reverse discrimination” or abolish a merit-based hiring system, despite seemingly being formulated to do exactly that.

“Let us be clear: the Employment Equity Act framework does not impose quotas, and the notion of ‘reverse discrimination’ is not part of Canadian equality law and is likewise not part of the Canadian Employment Equity Act framework,” reads the introduction.

While the job candidates would still have to meet certain requirements to be considered for the position, they would not be competing against all candidates for the position but just those within their so-called minority group. As a result, they would have a higher chance of being hired for the position compared to someone who did not fit into the group.

The report dismissed this concern, however, labeling it as an American, not Canadian, argument. “The U.S. idea of ‘reverse discrimination’ has in particular gained a lot of attention. It is used so often in common parlance that many people do not recognize that it is not a part of Canadian substantive equality law,” reads the report.

The report also attempted to address the problem that because being an LGBT-identifying person is not an objective category, it is conceivable that people could just say they are members of the LGBT so-called community as a way to gain an advantage in the hiring process.

“Declarations of this nature… would constitute dishonesty in the employment relationship and although the threshold for dismissal on that basis is high, contextual factors to assessing the appropriate sanction would rationally include any preferential treatment received on the basis of the false statement,” the report said.

In recent years, there has been a push for in Canada, the United States and much of the West to go along with so-called “diversity, equity, & inclusion” (DEI) hiring and promotion practices.

The controversy surrounding DEI is that it usually goes hand-in-hand with a slew of identity-based social causes and grievances that undermine merit-based hiring, meaning that the most qualified person for a job may be overlooked in favor of someone of a particular skin color, ethnicity or sexual proclivity.

In 2019, the Canadian military was exposed for periodically closing all applications to the armed forces except to women if their so-called employment equity targets had not been met.

Similarly, in June 2023, Ontario announced free training for truck drivers; however, the offer was only extended to “women, newcomers and others from underrepresented groups,” effectively barring anyone except white, heterosexual men.

Additionally, this October, British Columbia construction companies were offered an extra cash incentive if they hire first-year apprentices who “self-identify” as LGBT, disabled, or anything other than a white heterosexual male.

Business

Trump family announces Trump Mobile: Made in America, for America

MxM News

MxM News

Quick Hit:

On the 10-year anniversary of Donald Trump’s iconic campaign launch, the Trump family announced the debut of Trump Mobile, a new wireless company offering American-built smartphones, 5G coverage, and a values-driven alternative to Big Tech carriers.

Key Details:

-

Donald Trump Jr. and Eric Trump introduced Trump Mobile’s flagship service Monday, calling it a “transformational” alternative aimed at “our nation’s hardest-working people.”

-

The “47 Plan,” priced at $47.45/month, offers unlimited talk, text, and data, free international calls to U.S. military families, telehealth, roadside assistance, and no credit checks.

-

Trump Mobile’s customer support is fully U.S.-based and live 24/7—“not automated,” the company says—while a new American-made “T1 Phone” is slated for release in August.

Diving Deeper:

Marking ten years since President Donald Trump descended the golden escalator to launch his first campaign, the Trump Organization on Monday announced its boldest private sector move yet: Trump Mobile.

Flanked by company executives, Donald Trump Jr. and Eric Trump unveiled the new cellular service, touting it as a patriotic, people-first alternative to legacy providers. “We’re building on the movement to put America first,” Trump Jr. said in a statement. “We will deliver the highest levels of quality and service.”

The cornerstone of Trump Mobile is the 47 Plan. Offered for $47.45/month, the plan includes unlimited data, full 5G coverage across all three major carriers, and a suite of benefits tailored to middle-class families, truckers, veterans, and anyone tired of paying premiums to companies that don’t share their values.

Among the key perks: 24/7 American-based customer service (with “real people,” not bots), comprehensive device protection, roadside assistance through Drive America, and telehealth services including mental health support and prescription delivery. Most notably, the plan includes free international calling to over 100 countries—an effort the Trump family says honors U.S. military families stationed abroad.

“We’re especially proud to offer free long-distance calling to our military members and their families,” said Eric Trump. “Those serving overseas should always be able to stay connected to the people they love back home.”

Unlike traditional providers, Trump Mobile advertises no contracts and no credit checks, appealing to a demographic long underserved by mainstream telecom giants. “Hard-working Americans deserve a wireless service that’s affordable, reflects their values, and delivers reliable quality they can count on,” Eric Trump added.

The company is also preparing to launch the T1 Phone in August—a sleek, gold smartphone “engineered for performance” and “proudly designed and built in the United States.” With that, the Trump Organization is not just entering the mobile market—it’s staking a claim as a direct competitor to Apple and Samsung.

Business

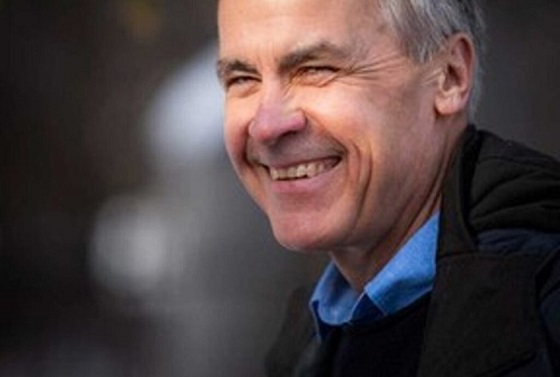

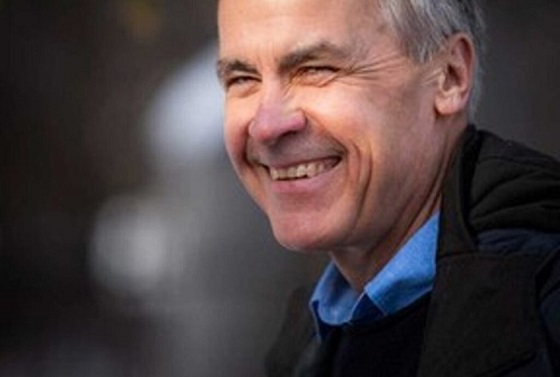

Carney praises Trump’s world ‘leadership’ at G7 meeting in Canada

From LifeSiteNews

Canada’s prime minister said it was a ‘great honor’ to host the U.S. president and praised him for saying Canada wants to work with the U.S. ‘hand-in-hand.’

During the second day of the G7 leaders meeting in the Kananaskis area in Alberta, Canadian Prime Minister Mark Carney praised U.S. President Donald Trump’s world “leadership” despite saying many negative things about him during his election campaign.

While speaking to reporters Monday, Trump hinted that a new trade deal between Canada and the United States was potentially only “weeks” away. This came after a private meeting with Carney before the official G7 talks commenced.

“We’ve developed a very good relationship. And we’re going to be talking about trade and many other things,” Trump told reporters.

Carney was less vocal, however. He used the opportunity to tell reporters he was happy Trump came to his country for the G7 meeting, saying it was a “great honor” to host him.

“This marks the 50th birthday of the G7, and the G7 is nothing without U.S. leadership,” Carney told reporters.

He then spoke about Trump’s “personal leadership” on world issues and praised him for saying Canada wants to work with the U.S. “hand-in-hand.”

Carney ran his election campaign by claiming the Conservative Party would bow to Trump’s demands despite the fact that the party never said such things.

During his federal election campaign, Carney repeatedly took issue with Trump and the U.S. that turned into an anti-American Canadian legacy media frenzy.

However, the reality is, after Carney won the April 28 federal election, Trump praised him, saying, “Canada chose a very talented person.”

Many political pundits have said that Carney owes his win to Trump, as the U.S. president suggested on multiple occasions that he would rather work with Carney than conservative leader Pierre Poilievre.

Trump has routinely suggested that Canada become an American state in recent months, often making such statements while talking about or implementing trade tariffs on Canadian goods.

As for Carney, he has said his government plans to launch a “new economy” in Canada that will involve “deepening” ties to the world.

-

Business2 days ago

Business2 days agoEU investigates major pornographic site over failure to protect children

-

Canadian Energy Centre2 days ago

Canadian Energy Centre2 days agoCross-Canada economic benefits of the proposed Northern Gateway Pipeline project

-

Alberta2 days ago

Alberta2 days agoAlbertans need clarity on prime minister’s incoherent energy policy

-

Economy2 days ago

Economy2 days agoCarney’s Promise of Expediting Resource Projects Feels Like a Modern Version of the Wicked Stepmother from Disney’s Cinderella

-

conflict18 hours ago

conflict18 hours ago“Evacuate”: Netanyahu Warns Tehran as Israel Expands Strikes on Iran’s Military Command

-

Health22 hours ago

Health22 hours agoLast day and last chance to win this dream home! Support the 2025 Red Deer Hospital Lottery before midnight!

-

Energy18 hours ago

Energy18 hours agoCould the G7 Summit in Alberta be a historic moment for Canadian energy?

-

Alberta1 day ago

Alberta1 day agoAlberta’s grand bargain with Canada includes a new pipeline to Prince Rupert