Alberta

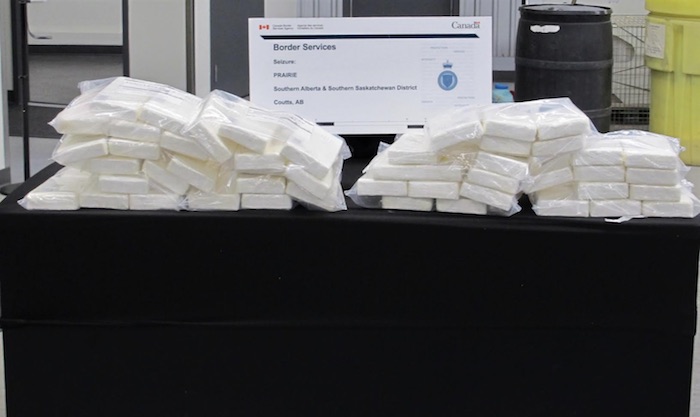

$5.3 million worth of cocaine seized at Coutts. 25 year old Calgary man arrested

News release from the Integrated Border Enforcement Team (IBET)

Integrated Border Enforcement Team lays charges for drug importation

Coutts, Alta. – The Integrated Border Enforcement Team (IBET), a joint force operation between the Royal Canadian Mounted Police, Canada Border Services Agency (CBSA) and Calgary Police Service (CPS), has charged a man for importing cocaine into Canada.

On Nov. 21, 2022, CBSA officers discovered and seized 53 kg of cocaine following a secondary examination of a commercial transport vehicle at the Coutts border crossing. The drugs, which has a street value of approximately $5.3 million, were hidden within a shipment of produce and have been referred over to IBET for further investigation.

On Nov. 22, 2022, Jagroop Singh, 25, a resident of Calgary, was charged with the following offences:

- Importation of a Controlled Substance contrary to section 6(1) of the Controlled Drugs and Substances Act; and,

- Possession of a Controlled Substance for the Purpose of Trafficking contrary to section 5(2) of theControlled Drugs and Substances Act.

Singh is scheduled to appear in Lethbridge Provincial Court on Nov. 29, 2022.

“I cannot overstate the contributions of each law enforcement partner represented in IBET. Together, we successfully prevented harmful drugs from entering Canada and harming our communities.”

– Supt. Sean Boser, OIC of Federal Policing – Calgary

“The safety and security of Canadians is our government’s top priority. By stopping illegal drugs at the border, we’re keeping our communities safe. This seizure is another great example of the ongoing cooperation between the CBSA, the RCMP and the Calgary Police Service in securing our borders.”

– Brad Wozny, Regional Director General, Canada Border Services Agency

“Anytime a significant seizure like this is taken off our streets is a win for the communities we all work in partnership to protect.”

– Acting Supt. Melanie Oncescu, CPS Criminal Operations and Intelligence

IBET’s mandate is to enhance border integrity and security along the shared border, between designated ports of entry, by identifying, investigating and interdicting persons, organizations and goods that are involved in criminal activities.

Alberta

Median workers in Alberta could receive 72% more under Alberta Pension Plan compared to Canada Pension Plan

From the Fraser Institute

By Tegan Hill and Joel Emes

Moving from the CPP to a provincial pension plan would generate savings for Albertans in the form of lower contribution rates (which could be used to increase private retirement savings while receiving the same pension benefits as the CPP under the new provincial pension), finds a new study published today by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“Due to Alberta’s comparatively high rates of employment, higher average incomes, and younger population, Albertans would pay a lower contribution rate through a separate provincial pension plan while receiving the same benefits as under the CPP,” said Tegan Hill, director of Alberta policy at the Fraser Institute and co-author of Illustrating the Potential of an Alberta Pension Plan.

Assuming Albertans invested the savings from moving to a provincial pension plan into a private retirement account, and assuming a contribution rate of 5.85 per cent, workers earning the median income in Alberta ($53,061 in 2025) could accrue a stream of retirement payments totalling $454,741 (pre-tax)—a 71.6 per cent increase from their stream of CPP payments ($264,968).

Put differently, under the CPP, a median worker receives a total of $264,968 in retirement income over their life. If an Alberta worker saved the difference between what they pay now into the CPP and what they would pay into a new provincial plan, the income they would receive in retirement increases. If the contribution rate for the new provincial plan was 5.85 per cent—the lower of the available estimates—the increase in retirement income would total $189,773 (or an increase of 71.6 per cent).

If the contribution rate for a new Alberta pension plan was 8.21 per cent—the higher of the available estimates—a median Alberta worker would still receive an additional $64,672 in retirement income over their life, a marked increase of 24.4 per cent compared to the CPP alone.

Put differently, assuming a contribution rate of 8.21 per cent, Albertan workers earning the median income could accrue a stream of retirement payments totaling $329,640 (pre-tax) under a provincial pension plan—a 24.4 per cent increase from their stream of CPP payments.

“While the full costs and benefits of a provincial pension plan must be considered, its clear that Albertans could benefit from higher retirement payments under a provincial pension plan, compared to the CPP,” Hill said.

Illustrating the Potential of an Alberta Pension Plan

- Due to Alberta’s comparatively high rates of employment, higher average incomes, and younger population, Albertans would pay a lower contribution rate with a separate provincial pension plan, compared with the CPP, while receiving the same benefits as under the CPP.

- Put differently, moving from the CPP to a provincial pension plan would generate savings for Albertans, which could be used to increase private retirement income. This essay assesses the potential savings for Albertans of moving to a provincial pension plan. It also estimates an Albertan’s potential increase in total retirement income, if those savings were invested in a private account.

- Depending on the contribution rate used for an Alberta pension plan (APP), ranging from 5.85 to 8.2 percent, an individual earning the CPP’s yearly maximum pensionable earnings ($71,300 in 2025), would accrue a stream of retirement payments under the total APP (APP plus private retirement savings), yielding a total retirement income of between $429,524 and $584,235. This would be 22.9 to 67.1 percent higher, respectively, than their stream of CPP payments ($349,545).

- An individual earning the median income in Alberta ($53,061 in 2025), would accrue a stream of retirement payments under the total APP (APP plus private retirement savings), yielding a total retirement income of between $329,640 and $454,741, which is between 24.4 percent to 71.6 percent higher, respectively, than their stream of CPP payments ($264,968).

Joel Emes

Alberta

Alberta ban on men in women’s sports doesn’t apply to athletes from other provinces

From LifeSiteNews

Alberta’s Fairness and Safety in Sport Act bans transgender males from women’s sports within the province but cannot regulate out-of-province transgender athletes.

Alberta’s ban on gender-confused males competing in women’s sports will not apply to out-of-province athletes.

In an interview posted July 12 by the Canadian Press, Alberta Tourism and Sport Minister Andrew Boitchenko revealed that Alberta does not have the jurisdiction to regulate out-of-province, gender-confused males from competing against female athletes.

“We don’t have authority to regulate athletes from different jurisdictions,” he said in an interview.

Ministry spokeswoman Vanessa Gomez further explained that while Alberta passed legislation to protect women within their province, outside sporting organizations are bound by federal or international guidelines.

As a result, Albertan female athletes will be spared from competing against men during provincial competition but must face male competitors during inter-provincial events.

In December, Alberta passed the Fairness and Safety in Sport Act to prevent biological men who claim to be women from competing in women’s sports. The legislation will take effect on September 1 and will apply to all school boards, universities, as well as provincial sports organizations.

The move comes after studies have repeatedly revealed what almost everyone already knew was true, namely, that males have a considerable advantage over women in athletics.

Indeed, a recent study published in Sports Medicine found that a year of “transgender” hormone drugs results in “very modest changes” in the inherent strength advantages of men.

Additionally, male athletes competing in women’s sports are known to be violent, especially toward female athletes who oppose their dominance in women’s sports.

Last August, Albertan male powerlifter “Anne” Andres was suspended for six months after a slew of death threats and harassments against his female competitors.

In February, Andres ranted about why men should be able to compete in women’s competitions, calling for “the Ontario lifter” who opposes this, apparently referring to powerlifter April Hutchinson, to “die painfully.”

Interestingly, while Andres was suspended for six months for issuing death threats, Hutchinson was suspended for two years after publicly condemning him for stealing victories from women and then mocking his female competitors on social media. Her suspension was later reduced to a year.

-

Energy2 days ago

Energy2 days agoActivists using the courts in attempt to hijack energy policy

-

National2 days ago

National2 days agoCanada’s immigration office admits it failed to check suspected terrorists’ background

-

Daily Caller2 days ago

Daily Caller2 days agoWhat Happened in Butler, PA?

-

Crime1 day ago

Crime1 day agoDEA Busts Canadian Narco Whose Chinese Supplier Promised to Ship 100 Kilos of Fentanyl Precursors per Month From Vancouver to Los Angeles

-

Alberta2 days ago

Alberta2 days agoAlberta ban on men in women’s sports doesn’t apply to athletes from other provinces

-

Business1 day ago

Business1 day agoCanada must address its birth tourism problem

-

Alberta1 day ago

Alberta1 day agoMedian workers in Alberta could receive 72% more under Alberta Pension Plan compared to Canada Pension Plan

-

International1 day ago

International1 day agoBiden autopen scandal: Did unelected aides commit fraud during his final days in office?