Alberta

25 facts about the Canadian oil and gas industry in 2023: Facts 16 to 20

From the Canadian Energy Centre

One of the things that really makes us Albertans, and Canadians is what we do and how we do it. It’s taking humanity a while to figure it out, but we seem to be grasping just how important access to energy is to our success. This makes it important that we all know at least a little about the industry that drives Canadians and especially Albertans as we make our way in the world.

The Canadian Energy Centre has compiled a list of 25 (very, extremely) interesting facts about the oil and gas industry in Canada. Over the next 5 days we will post all 25 amazing facts, 5 at a time. Here are facts 16 to 20.

The Canadian Energy Centre’s 2023 reference guide to the latest research on Canada’s oil and gas industry

The following summary facts and data were drawn from 30 Fact Sheets and Research Briefs and various Research Snapshots that the Canadian Energy Centre released in 2023. For sources and methodology and for additional data and information, the original reports are available at the research portal on the Canadian Energy Centre website: canadianenergycentre.ca.

16. Employment and wages in the oil and gas sector remain high

In 2021, the oil and gas sector directly employed 147,371 Canadians. The number of direct jobs in the sector rose from 158,483 in 2009 to 185,393 in 2014, then fell to 134,939 in 2016, the result of the sharp decline in energy prices, before rising to 160,379 in 2019 as energy prices gradually recovered. The onslaught of COVID-19 in 2020 saw oil and gas sector jobs fall back to 135,475, before recovering to 147,371 in 2021. The average salary of a worker in the Canadian oil and gas sector in 2021 was $133,293. The average salary for a worker in the sector had risen from $103,448 in 2009 to $133,776 in 2015, before leveling off to $129,716 in 2019 due to the energy price slump. However, between 2009 and 2021, the average annual wage of a worker in the Canadian oil and gas sector increased by nearly 29 per cent.

Source: Statistics Canada

Social and Governance

17. Women’s employment in Canada’s oil and gas sector is recovering

The number of females employed in the oil and gas sector reached a high of 42,440 in 2013, dipping to 30,285 in 2020 due to COVID-19, and then recovering somewhat to 33,068 in 2021. Between 2009 and 2021, the average wage for a female worker in the Canadian oil and gas industry increased by over 53 per cent.

Source: Statistics Canada

18. Diversity increasing in the oil and gas sector

Between 2009 and 2021, workers in the Canada’s oil and gas sector who identified as Indigenous increased by nearly 17 per cent. Between 2009 and 2021, the average salary of an Indigenous person employed in Canada’s oil and gas sector increased by over 39 per cent.

Source: Statistics Canada

19. More new Canadians working in the oil and gas sector over the long term

In 2021, 24,931 immigrants were directly employed in the Canadian oil and gas sector. The number of immigrants employed in the oil and gas industry reached 28,469 by 2014, declining to 21,622 in 2016 before recovering to 26,569 in 2019. Between 2009 and 2021, immigrant employment in the Canadian oil and gas sector increased by over 9 per cent. Between 2009 and 2021, the average wage and salary of an immigrant employed in the Canadian oil and gas sector increased by nearly 25 per cent.

Source: Statistics Canada

Carbon Capture, Utilization and Storage (CCUS)

20. Carbon Capture, Utilization and Storage (CCUS) growing across the world

At the end of 2022, there were 65 commercial carbon capture, utilization and storage (CCUS) projects in operation globally capable of capturing nearly 41 million tonnes per annum (mtpa) of CO2 across various industries, including the oil and gas sector. There are another 478 projects in various stages of development around the world that will be capable of capturing roughly another 559 mtpa of CO2. These projects are in various stages of development: some are at the feasibility stage while others are in the concept and construction phases. If all projects move ahead as scheduled, by 2030 it is estimated that nearly 500 CCUS projects could be operating worldwide, having the ability to capture 623.0 mtpa of CO2. In fact, between 2023 and 2030, global carbon capture capacity could grow from 43.5 mtpa to 623.0 mtpa, an increase of over 1,332 per cent.

Source: Derived from Rystad Energy

CEC Research Briefs

Canadian Energy Centre (CEC) Research Briefs are contextual explanations of data as they relate to Canadian energy. They are statistical analyses released periodically to provide context on energy issues for investors, policymakers, and the public. The source of profiled data depends on the specific issue. This research brief is a compilation of previous Fact Sheets and Research Briefs released by the centre in 2023. Sources can be accessed in the previously released reports. All percentages in this report are calculated from the original data, which can run to multiple decimal points. They are not calculated using the rounded figures that may appear in charts and in the text, which are more reader friendly. Thus, calculations made from the rounded figures (and not the more precise source data) will differ from the more statistically precise percentages we arrive at using the original data sources.

About the author

This CEC Research Brief was compiled by Ven Venkatachalam, Director of Research at the Canadian Energy Centre.

Acknowledgements

The author and the Canadian Energy Centre would like to thank and acknowledge the assistance of an anonymous reviewer for the review of this paper.

Alberta

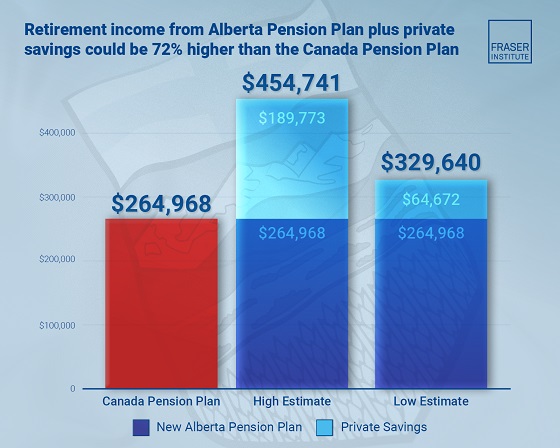

Median workers in Alberta could receive 72% more under Alberta Pension Plan compared to Canada Pension Plan

From the Fraser Institute

By Tegan Hill and Joel Emes

Moving from the CPP to a provincial pension plan would generate savings for Albertans in the form of lower contribution rates (which could be used to increase private retirement savings while receiving the same pension benefits as the CPP under the new provincial pension), finds a new study published today by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“Due to Alberta’s comparatively high rates of employment, higher average incomes, and younger population, Albertans would pay a lower contribution rate through a separate provincial pension plan while receiving the same benefits as under the CPP,” said Tegan Hill, director of Alberta policy at the Fraser Institute and co-author of Illustrating the Potential of an Alberta Pension Plan.

Assuming Albertans invested the savings from moving to a provincial pension plan into a private retirement account, and assuming a contribution rate of 5.85 per cent, workers earning the median income in Alberta ($53,061 in 2025) could accrue a stream of retirement payments totalling $454,741 (pre-tax)—a 71.6 per cent increase from their stream of CPP payments ($264,968).

Put differently, under the CPP, a median worker receives a total of $264,968 in retirement income over their life. If an Alberta worker saved the difference between what they pay now into the CPP and what they would pay into a new provincial plan, the income they would receive in retirement increases. If the contribution rate for the new provincial plan was 5.85 per cent—the lower of the available estimates—the increase in retirement income would total $189,773 (or an increase of 71.6 per cent).

If the contribution rate for a new Alberta pension plan was 8.21 per cent—the higher of the available estimates—a median Alberta worker would still receive an additional $64,672 in retirement income over their life, a marked increase of 24.4 per cent compared to the CPP alone.

Put differently, assuming a contribution rate of 8.21 per cent, Albertan workers earning the median income could accrue a stream of retirement payments totaling $329,640 (pre-tax) under a provincial pension plan—a 24.4 per cent increase from their stream of CPP payments.

“While the full costs and benefits of a provincial pension plan must be considered, its clear that Albertans could benefit from higher retirement payments under a provincial pension plan, compared to the CPP,” Hill said.

Illustrating the Potential of an Alberta Pension Plan

- Due to Alberta’s comparatively high rates of employment, higher average incomes, and younger population, Albertans would pay a lower contribution rate with a separate provincial pension plan, compared with the CPP, while receiving the same benefits as under the CPP.

- Put differently, moving from the CPP to a provincial pension plan would generate savings for Albertans, which could be used to increase private retirement income. This essay assesses the potential savings for Albertans of moving to a provincial pension plan. It also estimates an Albertan’s potential increase in total retirement income, if those savings were invested in a private account.

- Depending on the contribution rate used for an Alberta pension plan (APP), ranging from 5.85 to 8.2 percent, an individual earning the CPP’s yearly maximum pensionable earnings ($71,300 in 2025), would accrue a stream of retirement payments under the total APP (APP plus private retirement savings), yielding a total retirement income of between $429,524 and $584,235. This would be 22.9 to 67.1 percent higher, respectively, than their stream of CPP payments ($349,545).

- An individual earning the median income in Alberta ($53,061 in 2025), would accrue a stream of retirement payments under the total APP (APP plus private retirement savings), yielding a total retirement income of between $329,640 and $454,741, which is between 24.4 percent to 71.6 percent higher, respectively, than their stream of CPP payments ($264,968).

Joel Emes

Alberta

Alberta ban on men in women’s sports doesn’t apply to athletes from other provinces

From LifeSiteNews

Alberta’s Fairness and Safety in Sport Act bans transgender males from women’s sports within the province but cannot regulate out-of-province transgender athletes.

Alberta’s ban on gender-confused males competing in women’s sports will not apply to out-of-province athletes.

In an interview posted July 12 by the Canadian Press, Alberta Tourism and Sport Minister Andrew Boitchenko revealed that Alberta does not have the jurisdiction to regulate out-of-province, gender-confused males from competing against female athletes.

“We don’t have authority to regulate athletes from different jurisdictions,” he said in an interview.

Ministry spokeswoman Vanessa Gomez further explained that while Alberta passed legislation to protect women within their province, outside sporting organizations are bound by federal or international guidelines.

As a result, Albertan female athletes will be spared from competing against men during provincial competition but must face male competitors during inter-provincial events.

In December, Alberta passed the Fairness and Safety in Sport Act to prevent biological men who claim to be women from competing in women’s sports. The legislation will take effect on September 1 and will apply to all school boards, universities, as well as provincial sports organizations.

The move comes after studies have repeatedly revealed what almost everyone already knew was true, namely, that males have a considerable advantage over women in athletics.

Indeed, a recent study published in Sports Medicine found that a year of “transgender” hormone drugs results in “very modest changes” in the inherent strength advantages of men.

Additionally, male athletes competing in women’s sports are known to be violent, especially toward female athletes who oppose their dominance in women’s sports.

Last August, Albertan male powerlifter “Anne” Andres was suspended for six months after a slew of death threats and harassments against his female competitors.

In February, Andres ranted about why men should be able to compete in women’s competitions, calling for “the Ontario lifter” who opposes this, apparently referring to powerlifter April Hutchinson, to “die painfully.”

Interestingly, while Andres was suspended for six months for issuing death threats, Hutchinson was suspended for two years after publicly condemning him for stealing victories from women and then mocking his female competitors on social media. Her suspension was later reduced to a year.

-

Addictions1 day ago

Addictions1 day agoWhy B.C.’s new witnessed dosing guidelines are built to fail

-

Frontier Centre for Public Policy2 days ago

Frontier Centre for Public Policy2 days agoCanada’s New Border Bill Spies On You, Not The Bad Guys

-

Business1 day ago

Business1 day agoCarney Liberals quietly award Pfizer, Moderna nearly $400 million for new COVID shot contracts

-

Business1 day ago

Business1 day agoMark Carney’s Fiscal Fantasy Will Bankrupt Canada

-

Energy2 days ago

Energy2 days agoCNN’s Shock Climate Polling Data Reinforces Trump’s Energy Agenda

-

Opinion1 day ago

Opinion1 day agoCharity Campaigns vs. Charity Donations

-

Red Deer1 day ago

Red Deer1 day agoWesterner Days Attraction pass and New Experiences!

-

COVID-191 day ago

COVID-191 day agoTrump DOJ dismisses charges against doctor who issued fake COVID passports