Business

2025 Energy Outlook: Steering Through Recovery and Policy Shifts

From EnergyNow.ca

By Leonard Herchen & Yuchen Wang of GLJ

Their long-term real price forecast projects WTI at USD $74.00 per barrel and Henry Hub natural gas at USD $4.00 per MMBtu in 2025 dollars, signaling expectations of market stabilization and sustained global demand.

The energy markets in 2025 are undergoing transformative structural changes, highlighted by the operational launch of key infrastructure projects such as LNG Canada. This development significantly enhances Canada’s ability to meet rising global LNG demand while alleviating long-standing supply bottlenecks. At the same time, economic recovery across major markets remains uneven, shaping varied trends in energy demand and production activity.

Geopolitical dynamics are poised to redefine the competitive landscape, with the return of a Trump-led U.S. administration introducing potential shifts in trade policies, regulatory frameworks, and relationships with leading energy-producing nations. These changes, coupled with climate policy advancements and an accelerated global transition toward renewable energy, present additional complexities for the oil and gas sector.

Amid these uncertainties, GLJ’s analysts express confidence in the resilience of market fundamentals. Their long-term real price forecast projects WTI at USD $74.00 per barrel and Henry Hub natural gas at USD $4.00 per MMBtu in 2025 dollars, signaling expectations of market stabilization and sustained global demand.

Oil Prices

The oil market in 2025 reflects a delicate balance between supply and demand. During Q4 2024, WTI prices remained stable, fluctuating between $69 and $73 per barrel. This stability highlights the market’s resilience, even in the face of a slower global economic recovery and geopolitical challenges, including weaker demand in regions like China and increased production in North America.

Geopolitical risks remain pivotal, with ongoing tensions in the Middle East and sanctions on oil-exporting nations such as Iran and Venezuela threatening supply disruptions. While OPEC+ production cuts continue to provide vital support to prices by tightening global supply, these efforts are partially offset by the rising output of non-OPEC producers, notably in the U.S. and Canada.

The Trans Mountain Expansion (TMX) project is reshaping the pricing dynamics of WCS crude relative to WTI. By increasing export capacity to the West Coast, TMX has created conditions for a sustained narrowing of the WCS-WTI differential, moving away from seasonal fluctuations.

The return of a Trump-led U.S. administration introduces additional challenges. Deregulation policies aimed at boosting domestic oil production may exert downward pressure on prices, while potential trade tariffs and revised international agreements could further complicate global oil flows.

In this dynamic environment, GLJ forecasts WTI to average $71.25 per barrel and Brent $75.25 per barrel in 2025. These projections reflect robust long-term fundamentals, including sustained global demand and ongoing efforts to manage supply dynamics, emphasizing the market’s resilience despite near-term uncertainties.

Natural Gas Prices

In 2025, GLJ’s forecast suggests Henry Hub prices will average $3.20 per MMBtu, supported by steady domestic demand, seasonal winter peaks, and robust LNG exports. U.S. natural gas continues to play a critical role globally, ensuring supply security for key markets in Europe and Asia. The combination of growing industrial use, power generation demand, and stable production levels provides a solid foundation for price stability.

For the Canadian market, GLJ projects AECO natural gas prices to average $2.05 per MMBtu in 2025, representing a recovery from the lows of 2024. This improvement is attributed to easing regional oversupply and stabilizing demand. However, challenges persist, as production continues to outpace infrastructure expansion, prompting a downward adjustment of GLJ’s long-term AECO price forecast by $0.40 per MMBtu. The ramp-up of LNG Canada’s operations is expected to progressively enhance market dynamics and address these challenges.

On a global scale, LNG benchmarks such as NBP, TTF, and JKM have remained relatively stable, supported by high storage levels in Europe and balanced supply-demand conditions. European suppliers have effectively managed storage drawdowns, ensuring sufficient reserves for winter. Nevertheless, these benchmarks remain susceptible to market volatility driven by geopolitical uncertainties.

The CAD/USD Exchange Rate

The Canadian dollar experienced sharp depreciation during the last quarter of 2024, with the CAD/USD exchange rate falling below 0.70 USD. Economists have attributed this decline to the strength of the U.S. economy and its currency, the widening gap between the Bank of Canada and the U.S. Federal Reserve’s lending rates, as well as tariff threats and a political crisis in Ottawa. These factors have created a favorable environment for the U.S. dollar, putting downward pressure on the Canadian dollar.

Looking ahead to 2025, GLJ forecasts a CAD/USD exchange rate averaging 0.705 USD, underpinned by steady oil and gas revenues and enhanced export capacity from major projects such as LNG Canada and the TMX and eventual resolution of internal political issues and return to normalcy in US tariff policy.

Nevertheless, the outlook for the Canadian dollar remains uncertain, shaped by global economic recovery—particularly in China—and U.S. policy decisions under the Trump administration. While near-term challenges persist, Canada’s resource-driven economy and strategic energy export position provide a degree of resilience. In the absence of significant economic or geopolitical disruptions, GLJ projects the CAD/USD exchange rate to stabilize around 0.75 USD over the long term.

In 2025, GLJ expanded its database to include forecasts for Colombia Vasconia and Castilla Crude, as well as lithium prices, reflecting the increasing focus on diverse energy and resource markets. The addition of lithium forecasts aligns with the growing global emphasis on energy transition minerals critical for electric vehicles and battery storage solutions. A separate blog, set to be published next week on the GLJ website, will explore the lithium price forecast in greater depth, offering a detailed analysis and strategic implications for the energy sector.

GLJ’s forecast values for key benchmarks is as follows:

Business

‘TERMINATED’: Trump Ends Trade Talks With Canada Over Premier Ford’s Ronald Reagan Ad Against Tariffs

From the Daily Caller News Foundation

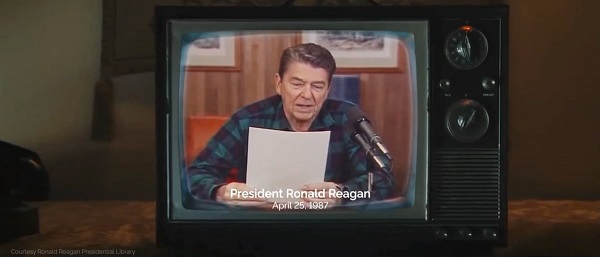

President Donald Trump announced late Thursday that trade negotiations with Canada “ARE HEREBY TERMINATED” after what he called “egregious behavior” tied to an Ontario TV ad that used former President Ronald Reagan’s voice to criticize tariffs.

The ad at the center of the feud was funded by Ontario Premier Doug Ford’s government as part of a multimillion-dollar campaign running on major U.S. networks. The spot features Reagan warning that tariffs may appear patriotic but ultimately “hurt every American worker and consumer.”

Dear Readers:

As a nonprofit, we are dependent on the generosity of our readers.

Please consider making a small donation of any amount here.

Thank you!

“They only did this to interfere with the decision of the U.S. Supreme Court, and other courts. TARIFFS ARE VERY IMPORTANT TO THE NATIONAL SECURITY, AND ECONOMY, OF THE U.S.A,” Trump wrote on his Truth Social platform late Thursday. “Based on their egregious behavior, ALL TRADE NEGOTIATIONS WITH CANADA ARE HEREBY TERMINATED.”

Ford first posted the ad online on Oct. 16, writing in a caption, “Using every tool we have, we’ll never stop making the case against American tariffs on Canada. The way to prosperity is by working together.”

The Ronald Reagan Presidential Foundation and Institute criticized the ad Thursday evening, saying it “misrepresents” Reagan’s 1987 radio address on free and fair trade. The foundation said Ontario did not request permission to use or alter the recording and that it is reviewing its legal options.

The president posted early Friday that Canada “cheated and got caught,” adding that Reagan actually “loved tariffs for our country.”

The ad splices audio from Reagan’s original remarks but includes his authentic statement: “When someone says, ‘let’s impose tariffs on foreign imports’, it looks like they’re doing the patriotic thing by protecting American products and jobs. And sometimes, for a short while it works, but only for a short time.”

Reagan also noted at the end of his remarks that, in “certain select cases,” he had taken steps to stop unfair trade practices against American products and added that the president’s “options” in trade matters should not be restricted, which the ad did not include.

Since returning to the White House, Trump has imposed tariffs on Canadian aluminum, steel, automobiles and lumber, arguing they are vital to protecting U.S. manufacturing and national security.

The Supreme Court is set to hear arguments in November over whether the administration overstepped its authority by invoking the International Emergency Economic Powers Act to impose reciprocal tariffs on dozens of nations, including Canada. Tariffs on commodities such as steel, aluminum and copper were implemented under Section 232 of the Trade Expansion Act and are not currently being challenged, as they align with longstanding precedent established by prior administrations.

Thursday’s move marks the second time this year Trump has canceled trade talks with Ottawa. In June, he briefly halted discussions after Canada imposed a digital services tax on American tech firms, though the Canadian government repealed the measure two days later.

Business

A Middle Finger to Carney’s Elbows Up

Elbows Up Stengthens U.S. Tariff Resolve at Canada’s Expense

The disastrously misguided “Elbows Up” campaign championed by the Carney government rooted in the fantasy that a smug, arrogant Liberal elite wields leverage over the largest economy in human history, has suffered yet another devastating blow. The latest fallout: U.S.-based truck manufacturer Paccar Inc., maker of iconic heavyweights such as Kenworth and Peterbilt, is slashing Canadian production and laying off hundreds of workers in anticipation of a 25-per-cent U.S. import tariff set to take effect next month.

Employees at Paccar’s Sainte-Thérèse, Quebec plant were informed Wednesday that the company will move production of trucks destined for the U.S. market back to its American facilities. According to Daniel Cloutier, Quebec director for Unifor, approximately 300 jobs will be eliminated, leaving roughly 500 workers at the plant.

Honking for Freedom Substack is a reader-supported publication.

To receive new posts and support my work, consider becoming a free or paid subscriber.

“They will continue building trucks for the Canadian market,” Cloutier said, noting that domestic demand represents a much smaller portion of output. At its peak, the plant produced 96 trucks per day; production will now drop to just 18 units daily. That is an 81% drop.

Paccar declined to confirm the restructuring or provide additional details. However, in a financial earnings call a day earlier, CEO Preston Feight described the U.S. tariff policy as advantageous for the company. “I think it helps Paccar significantly,” Feight said. “It gives us a competitive leg up from where we’ve been.”

U.S. Tariffs Driving Industry Shift

U.S. President Donald Trump has confirmed that all medium and heavy-duty trucks imported into the United States will face a 25-per-cent tariff beginning Nov. 1, along with an additional 10-per-cent duty on buses. The tariffs are being imposed under Section 232 of the Trade Expansion Act, which targets imports deemed to pose a national security risk.

These measures follow earlier tariffs that have already struck Canadian steel, aluminum, automobiles, copper, and lumber, forcing companies to shelve investments and reconsider their North American strategies.

Broader Auto Sector Retrenchment

Other automakers are also pulling back production in Canada. General Motors announced Tuesday it is ending production of the Chevrolet BrightDrop electric delivery van in Ingersoll, Ontario, costing over 1,100 workers their jobs. Stellantis recently confirmed plans to shift production of the Jeep Compass from Brampton, Ontario, to Belvidere, Illinois, as part of a strategy to increase U.S. output by 50 per cent by 2029.

Quebec Plant at Risk

The Sainte-Thérèse plant, which manufactures Class 5, 6 and 7 Kenworth and Peterbilt trucks, has already endured two rounds of layoffs over the past year as uncertainty around tariffs weakened demand. At peak production, the facility employed over 1,400 people.

Cloutier said the union is pressing both the Quebec and federal governments to prioritize the purchase of domestically made vehicles to sustain production levels. Without such measures, he warned, the plant could be forced to close due to high fixed costs and insufficient volume. “Let’s not pretend global trade hasn’t changed with this President,” Cloutier said. “We need to stop twiddling our thumbs.”

Bus Manufacturers Also Exposed

Quebec is also home to two major bus manufacturers, Prevost and Nova Bus, both owned by Volvo Group that could face similar challenges due to new tariffs on buses entering the U.S. Executives at both companies say they are still assessing the impact of the policy shift.

What can we learn from all this?

Perhaps our deep reliance on American innovation has consequences we have been unwilling to confront. The warning signs were evident well before Donald Trump’s election. He was explicit that tariffs would be used as a strategic tool to financially incentivize American companies to return to the United States. This was not hidden, it was a core pillar of his economic agenda.

I have said repeatedly on the Marc Patrone Show on Sauga 960 that my frustration is not with America’s strategy, but with Canada’s political class. Their smug arrogance lies in the belief that, as great as Canada can be, we could somehow dominate the greatest economy in the history of civilization rather than work with it. The Trump administration never wanted Canada to become the 51st state; they want our valuable resources and are willing to pay fair value for them, and they expect Canada to finally take our internal security threats seriously; something I have personally presented on in the United States. Yet instead of leveraging our strategic position, Canada’s leadership chose performative resistance over pragmatic partnership.

The most telling moment came when President Trump reportedly asked Justin Trudeau what would happen if the United States imposed a 25-per-cent tariff on all Canadian goods. Trudeau’s response, “It would destroy Canada” was an example of catastrophic stupidity. It handed Trump the gun he could use to execute Canada economically and perhaps cost Canada its sovereignty over the long term.

Reminiscent of the scene from The Hunt for Red October, when Captain Tupolev, in an act of smug Laurentian style arrogance, fires a torpedo at Ramius only for it to circle back and destroy his own submarine, a catastrophic miscalculation born of arrogance and a complete misunderstanding of the enemy’s capabilities. A catastrophic miscalculation that mirrors Elbows Up stupidity.

Order Now!

Honking For Freedom – The Trucker Convoy That Gave Us Hope HonkingForFreedom.com

Twitter | Locals | Rumble | Instagram

www.BenjaminjDichter.com

Audio

Freedom Coffee Podcast

Honking for Freedom Substack is a reader-supported publication.

To receive new posts and support my work, consider becoming a free or paid subscriber.

-

Agriculture1 day ago

Agriculture1 day agoFrom Underdog to Top Broodmare

-

Carbon Tax2 days ago

Carbon Tax2 days agoBack Door Carbon Tax: Goal Of Climate Lawfare Movement To Drive Up Price Of Energy

-

City of Red Deer1 day ago

City of Red Deer1 day agoCindy Jefferies is Mayor. Tristin Brisbois, Cassandra Curtis, Jaelene Tweedle, and Adam Goodwin new Councillors – 2025 Red Deer General Election Results

-

Alberta2 days ago

Alberta2 days agoCalgary’s High Property Taxes Run Counter to the ‘Alberta Advantage’

-

Bruce Dowbiggin1 day ago

Bruce Dowbiggin1 day agoIs The Latest Tiger Woods’ Injury Also A Death Knell For PGA Champions Golf?

-

Alberta1 day ago

Alberta1 day agoAlberta’s licence plate vote is down to four

-

Digital ID2 days ago

Digital ID2 days agoThousands protest UK government’s plans to introduce mandatory digital IDs

-

Health1 day ago

Health1 day agoSovereignty at Stake: Why Parliament Must Review Treaties Before They’re Signed