Alberta

Your money isn’t as safe as you think

This article supplied by Troy Media.

The Emergencies Act proved how quickly bank accounts can be weaponized. Alberta must act now to protect its citizens.

When Eva Chipiuk (the Alberta lawyer who famously confronted former Prime Minister Justin Trudeau’s assertions at the Emergencies Act inquiry) found out her Royal Bank account was being shut down, it confirmed a chilling truth: those who challenge Ottawa are not safe from retribution.

Chipiuk committed no crime and was not charged with any offence. However, the Montreal-based Royal Bank refused to provide her services, citing an unspecified risk. The message is clear: if you challenge Ottawa, you may risk being treated as an economic non-person. This comes just months before Tamara Lich, an Alberta resident, is expected to be sentenced for standing up against COVID overreach.

The Alberta government cannot ignore these threats against its citizens. There is plenty Ottawa doesn’t like about Alberta and Albertans today. Given that, in a February 2022 Globe and Mail oped—written before he became prime minister—Mark Carney described civil protesters as “seditionists,” one doesn’t need much imagination to see how his government could treat Albertans who push for greater control over their future. The province must prepare now to shield its citizens from financial retaliation.

Albertans who think their money is safe if it’s parked at a credit union or ATB, instead of a chartered bank, are mistaken. It isn’t. Under the Criminal Code, the Proceeds of Crime (Money Laundering) and Terrorist Financing Act, and the Emergencies Act, Ottawa can force any “financial service provider”—including provincially regulated credit unions—to freeze accounts. For example, when Tamara Lich tried to open an account with ATB—Alberta’s Crown-owned financial institution—she was denied even an appointment.

Events such as these show that it doesn’t take a judge to determine you have run afoul of those laws—only a government that disagrees with you.

Alberta has the tools to defend its citizens, and it should use them. It should start by making ATB and its provincially regulated credit unions fortresses against politically motivated financial punishment. ATB, created in 1938 to shield farmers from the aggressive lending practices of Laurentian bankers, has a distinct status as an arm of the Alberta government.

That status can be leveraged today to keep Ottawa at bay by:

- Refocusing ATB on serving Albertans, not advancing trendy corporate agendas.

- Amending the ATB Financial Act to require judicial orders for any account freezes or closures, mandate public reporting of such actions, and enshrine political neutrality to ensure no Albertan is denied service for lawful political activity.

- Preparing to invoke the Sovereignty Act if Ottawa attempts another Emergencies Act-style move, instructing ATB and its credit unions to disregard unconstitutional federal orders unless validated by Alberta courts.

- Creating a Québec-style integrated financial regulator to oversee ATB and Alberta’s provincially regulated credit unions, insulating them from Ottawa’s reach.

- Exploring alternative payment systems to reduce reliance on Ottawa-controlled clearing mechanisms. Payments Canada—which Ottawa controls—could be used as a choke point against Alberta institutions. A provincial or private settlement system would blunt that weapon before it can be deployed.

Finally, Alberta should enact an Alberta Financial Rights Act guaranteeing that no one will be denied financial services and that no account can be frozen or closed without due process in open court.

Ottawa will not take this lying down. It can seek court injunctions, threaten ATB’s and our credit unions’ access to national payment systems, or pass legislation directly targeting provincial Crown corporations. Alberta must anticipate these moves now by drafting constitutional challenges, forging alliances with like-minded provinces, and building backup clearing systems.

When the federal government can freeze your account for giving $50 to the “wrong” cause, you are not a free citizen. You are a subject. The treatment of Tamara Lich and Eva Chipiuk’s debanking is a warning.

Alberta can either wait for the next wave of financial punishments to hit its citizens, or it can act decisively to make ATB and its provincially regulated credit unions fortresses that protect them. Premier Danielle Smith has a unique opportunity to put Alberta first again—and she should take it.

Marco Navarro-Genie is vice-president of research at the Frontier Centre for Public Policy and co-author, with Barry Cooper, of Canada’s COVID: The Story of a Pandemic Moral Panic (2023).

Troy Media empowers Canadian community news outlets by providing independent, insightful analysis and commentary. Our mission is to support local media in helping Canadians stay informed and engaged by delivering reliable content that strengthens community connections and deepens understanding across the country.

Alberta

Alberta bill would protect freedom of expression for doctors, nurses, other professionals

From LifeSiteNews

‘Peterson’s law,’ named for Canadian psychologist Jordan Peterson, was introduced by Alberta Premier Danielle Smith.

Alberta’s Conservative government introduced a new law that will set “clear expectations” for professional regulatory bodies to respect freedom of speech on social media and online for doctors, nurses, engineers, and other professionals.

The new law, named “Peterson’s law” after Canadian psychologist Jordan Peterson, who was canceled by his regulatory body, was introduced Thursday by Alberta Premier Danielle Smith.

“Professionals should never fear losing their license or career because of a social media post, an interview, or a personal opinion expressed on their own time,” Smith said in a press release sent to media and LifeSiteNews.

“Alberta’s government is restoring fairness and neutrality so regulators focus on competence and ethics, not policing beliefs. Every Albertan has the right to speak freely without ideological enforcement or intimidation, and this legislation makes that protection real.”

The law, known as Bill 13, the Regulated Professions Neutrality Act, will “set clear expectations for professional regulatory bodies to ensure professionals’ right to free expression is protected.”

According to the government, the new law will “Limit professional regulatory bodies from disciplining professionals for expressive off-duty conduct, except in specific circumstances such as threats of physical violence or a criminal conviction.”

It will also restrict mandatory training “unrelated to competence or ethics, such as diversity, equity, and inclusion training.”

Bill 13, once it becomes law, which is all but guaranteed as Smith’s United Conservative Party (UCP) holds a majority, will also “create principles of neutrality that prohibit professional regulatory bodies from assigning value, blame or different treatment to individuals based on personally held views or political beliefs.”

As reported by LifeSiteNews, Peterson has been embattled with the College of Psychologists of Ontario (CPO) after it mandated he undergo social media “training” to keep his license following posts he made on X, formerly Twitter, criticizing Trudeau and LGBT activists.

He recently noted how the CPO offered him a deal to “be bought,” in which the legal fees owed to them after losing his court challenge could be waived but only if he agreed to quit his job as a psychologist.

Early this year, LifeSiteNews reported that the CPO had selected Peterson’s “re-education coach” for having publicly opposed the LGBT agenda.

The Alberta government directly referenced Peterson’s (who is from Alberta originally) plight with the CPO, noting “the disciplinary proceedings against Dr. Jordan Peterson by the College of Psychologists of Ontario, demonstrate how regulatory bodies can extend their reach into personal expression rather than professional competence.”

“Similar cases involving nurses, engineers and other professionals revealed a growing pattern: individuals facing investigations, penalties or compulsory ideological training for off-duty expressive conduct. These incidents became a catalyst, confirming the need for clear legislative boundaries that protect free expression while preserving professional standards.”

Alberta Minister of Justice and Attorney General Mickey Amery said regarding Bill 13 that the new law makes that protection of professionals “real and holds professional regulatory bodies to a clear standard.”

Last year, Peterson formally announced his departure from Canada in favor of moving to the United States, saying his birth nation has become a “totalitarian hell hole.”

Alberta

‘Weird and wonderful’ wells are boosting oil production in Alberta and Saskatchewan

From the Canadian Energy Centre

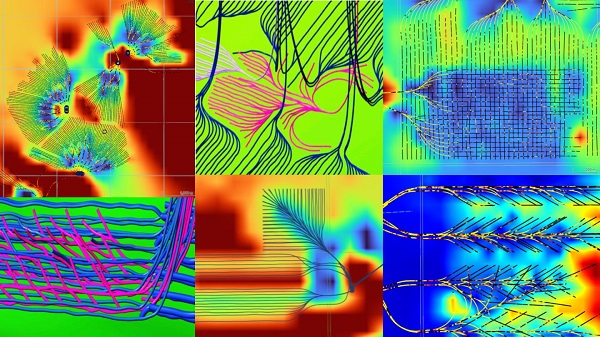

Multilateral designs lift more energy with a smaller environmental footprint

A “weird and wonderful” drilling innovation in Alberta is helping producers tap more oil and gas at lower cost and with less environmental impact.

With names like fishbone, fan, comb-over and stingray, “multilateral” wells turn a single wellbore from the surface into multiple horizontal legs underground.

“They do look spectacular, and they are making quite a bit of money for small companies, so there’s a lot of interest from investors,” said Calin Dragoie, vice-president of geoscience with Calgary-based Chinook Consulting Services.

Dragoie, who has extensively studied the use of multilateral wells, said the technology takes horizontal drilling — which itself revolutionized oil and gas production — to the next level.

“It’s something that was not invented in Canada, but was perfected here. And it’s something that I think in the next few years will be exported as a technology to other parts of the world,” he said.

Dragoie’s research found that in 2015 less than 10 per cent of metres drilled in Western Canada came from multilateral wells. By last year, that share had climbed to nearly 60 per cent.

Royalty incentives in Alberta have accelerated the trend, and Saskatchewan has introduced similar policy.

Multilaterals first emerged alongside horizontal drilling in the late 1990s and early 2000s, Dragoie said. But today’s multilaterals are longer, more complex and more productive.

The main play is in Alberta’s Marten Hills region, where producers are using multilaterals to produce shallow heavy oil.

Today’s average multilateral has about 7.5 horizontal legs from a single surface location, up from four or six just a few years ago, Dragoie said.

One record-setting well in Alberta drilled by Tamarack Valley Energy in 2023 features 11 legs stretching two miles each, for a total subsurface reach of 33 kilometres — the longest well in Canada.

By accessing large volumes of oil and gas from a single surface pad, multilaterals reduce land impact by a factor of five to ten compared to conventional wells, he said.

The designs save money by skipping casing strings and cement in each leg, and production is amplified as a result of increased reservoir contact.

Here are examples of multilateral well design. Images courtesy Chinook Consulting Services.

Parallel

Fishbone

Fan

Waffle

Stingray

Frankenwells

-

COVID-1911 hours ago

COVID-1911 hours agoNew report warns Ottawa’s ‘nudge’ unit erodes democracy and public trust

-

Great Reset2 days ago

Great Reset2 days agoEXCLUSIVE: A Provincial RCMP Veterans’ Association IS TARGETING VETERANS with Euthanasia

-

Health2 days ago

Health2 days agoDisabled Canadians petition Parliament to reverse MAiD for non-terminal conditions

-

Daily Caller2 days ago

Daily Caller2 days agoSpreading Sedition? Media Defends Democrats Calling On Soldiers And Officers To Defy Chain Of Command

-

Crime1 day ago

Crime1 day agoHow Global Organized Crime Took Root In Canada

-

Digital ID2 days ago

Digital ID2 days agoLeslyn Lewis urges fellow MPs to oppose Liberal push for mandatory digital IDs

-

Business2 days ago

Business2 days agoThe Payout Path For Indigenous Claims Is Now National Policy

-

Energy1 day ago

Energy1 day agoExpanding Canadian energy production could help lower global emissions