Economy

Young Canadians are putting off having a family due to rising cost of living, survey finds

From LifeSiteNews

An April study has found that 42% of Gen Z and 39% of Millennials are putting off starting families due to a lack of work-life balance spurred by an increase in the cost of living.

A survey has found that more Canadians are delaying starting a family due to a lack of work-life balance spurred by the rising cost of living.

According to an April 24 Express Employment Professionals-Harris Poll survey, one-third of employed job seekers stated that they are putting off starting a family due to a lack of work-life balance, including 42% of Gen Z and 39% of Millennials.

“The most common thing I hear from candidates who are putting off starting a family is that the cost of living is too high,” Jessica Culo, an Express franchise owner in Edmonton, Alberta stated.

“We definitely hear more and more that candidates are looking for flexibility, and I think employers understand family/work balance is important to employees,” she added.

Two-thirds of respondents further stated that they believe it’s essential that the company they work for prioritizes giving its employees a good work-life balance as they look to start a family. This included 77% of Gen Z and 72% of Millennials.

The survey comes as Canada’s fertility rate hit a record-low of 1.33 children per woman in 2022. According to the data collected by Statistics Canada, the number marks the lowest fertility rate in the past century of record keeping.

Sadly, while 2022 experienced a record-breaking low fertility rate, the same year, 97,211 Canadian babies were killed by abortion.

Canadians’ reluctance or delay to have children comes as young Canadians seem to be beginning to reap the effects of the policies of Prime Minister Justin Trudeau’s government, which has been criticized for its overspending, onerous climate regulations, lax immigration policies, and “woke” politics.

In fact, many have pointed out that considering the rising housing prices, most Canadians under 30 will not be able to purchase a home.

Similarly, while Trudeau sends Canadians’ tax dollars oversees and further taxes their fuel and heating, Canadians are struggling to pay for basic necessities including food, rent, and heating.

A September report by Statistics Canada revealed that food prices are rising faster than the headline inflation rate – the overall inflation rate in the country – as staple food items are increasing at a rate of 10 to 18 percent year-over-year.

While the cost of living has increased the financial burden of Canadians looking to rear children, the nation’s child benefit program does provide some relief for those who have kids.

Under the Canadian Revenue Agency’s benefit, Canadians families are given a monthly stipend depending on their family income and situation. Each province also has a program to help families support their children.

Young Canadians looking to start a family can use the child and family benefits calculator to estimate the benefits which they would receive.

Regardless of the cost of raising children, the Catholic Church unchangeably teaches that it is a grave sin for married couples to frustrate the natural ends of the procreative act through contraceptives, abortion or other means.

Such wisdom has even bled into the mainstream in recent years, with non-Catholic pundits like America’s Tucker Carlson advocating that young people “Get married when you’re too young, have more kids than you can afford, take a job you’re not qualified for, live boldly.”

Business

Higher carbon taxes in pipeline MOU are a bad deal for taxpayers

The Canadian Taxpayers Federation is criticizing the Memorandum of Understanding between the federal and Alberta governments for including higher carbon taxes.

“Hidden carbon taxes will make it harder for Canadian businesses to compete and will push Canadian entrepreneurs to shift production south of the border,” said Franco Terrazzano, CTF Federal Director. “Politicians should not be forcing carbon taxes on Canadians with the hope that maybe one day we will get a major project built.

“Politicians should be scrapping all carbon taxes.”

The federal and Alberta governments released a memorandum of understanding. It includes an agreement that the industrial carbon tax “will ramp up to a minimum effective credit price of $130/tonne.”

“It means more than a six times increase in the industrial price on carbon,” Prime Minister Mark Carney said while speaking to the press today.

Carney previously said that by “changing the carbon tax … We are making the large companies pay for everybody.”

A Leger poll shows 70 per cent of Canadians believe businesses pass most or some of the cost of the industrial carbon tax on to consumers. Meanwhile, just nine per cent believe businesses pay most of the cost.

“It doesn’t matter what politicians label their carbon taxes, all carbon taxes make life more expensive and don’t work,” Terrazzano said. “Carbon taxes on refineries make gas more expensive, carbon taxes on utilities make home heating more expensive and carbon taxes on fertilizer plants increase costs for farmers and that makes groceries more expensive.

“The hidden carbon tax on business is the worst of all worlds: Higher prices and fewer Canadian jobs.”

Business

Man overboard as HMCS Carney lists to the right

Steven Guilbeault, Heritage Minister and Quebec lieutenant, leaves cabinet this week with his chief of staff, Ann-Clara Vaillancourt. He resigned on Thursday.

Steven Guilbeault’s resignation will help end a decade of stagnation and lost investment.

Steven Guilbeault’s resignation will come as no surprise to Mark Carney – save, perhaps, for the fact that it took so long.

The former environment minister quit on Thursday evening, after the prime minister unveiled his memorandum of understanding with Alberta premier, Danielle Smith. That deal is aimed at creating the conditions to build an oil pipeline to the West Coast and encouraging new investment in the province’s natural gas electricity generation sector. In doing so, Carney cancelled the oil and gas emissions cap and the clean electricity regulations that Guilbeault had been instrumental in constructing and imposing.

Fly Straight is a reader-supported publication.

To receive new posts and support my work, consider becoming a free or paid subscriber.

The former environmental activist couldn’t accept the continued expansion of fossil fuel production and so walked away after six years in cabinet.

In his resignation statement, he said he strongly opposes the MOU with Alberta because it was signed without consultation with the province of British Columbia and First Nations.

He said removing the moratorium on oil tankers off the West Coast would increase the risk of accidents and suspending clean electricity regulations, which blocked new gas generation, will result in an “upwards emissions trajectory”.

In particular, he was upset about the expansion of federal tax credits to encourage enhanced oil recovery, a carbon storage technology that captures carbon dioxide from industrial emitters and injects it back underground. Guilbeault considered this a direct subsidy for oil production – a business he said he hoped the government was exiting.

In a Twitter post, I called Guilbeault “anti-Pathways” – that is, opposed to the giant carbon capture and storage development that Carney views as crucial to offsetting the building of a new pipeline.

One of Guilbeault’s defenders said he is not anti-Pathways, and that, in fact, he was part of the trifecta, along with Chrystia Freeland and Jonathan Wilkinson, who negotiated the details on the investment tax credit “that will pay 50 percent of the cost of construction to a bunch of rich oil companies”. To me, that showed Guilbeault’s (and his supporters) true colours. If he wasn’t anti-Pathways, he certainly wasn’t pro.

When he said he would back Carney’s leadership bid in January, I wrote that it was an endorsement the aspiring Liberal leader could do without.

The now-prime minister always had in his mind a plan to build, including fossil fuel production, offset by technology adoption and a stronger industrial carbon price in Alberta. Even then, he made clear he was prepared to be pragmatic in a time of crisis.

Guilbeault’s plan was to regulate the industry to death.

It was always going to end badly but, as Carney told me last winter, Guilbeault provided crucial support on the ground in Quebec and any politician’s first responsibility is to win.

Guilbeault should be respected for his deep convictions on climate change and his commitment to leaving a better world to our children.

But he should never have been allowed to dictate environmental policy in this country. He refused to view natural gas as a bridging fuel in the energy transition in a country that has reserves of a resource that will, at current production levels, last 300 years.

He made clear his lack of enthusiasm for small modular nuclear reactors and new road-building.

And he pushed an oil and gas emissions cap that he knew would hit production levels and further (if that were possible) alienate Western Canadians.

His departure – and that of Freeland – give Carney scope to pursue what he hopes is a transformative response to not only Donald Trump, but to federal policies that amounted to driving with the handbrake on. Carney has made his intent clear – to optimize Canada’s resource wealth, while attempting to minimize emissions.

Five years ago, Trudeau was nearly tarred and feathered during a visit to Calgary; Carney received two standing ovations in the same town yesterday.

For too many years under the Trudeau/Freeland duopoly the plan was to redistribute the pie. Now it is clearly about wealth creation.

In my National Post columns, I have been scathing about some of the things the Carney government has done, as is appropriate for someone whose prime directive is the public interest. The decisions to recognize a Palestinian state; apologize to Trump for the Ontario “Ronald Reagan” ad; announce a bunch of major projects that were so advanced they didn’t need to be fast-tracked; split spending into the confusing binary of “operating” or “capital”; and visit the United Arab Emirates on a trade mission in the midst of a genocide in Sudan that the Emiratis had helped to fund were all, to me, missteps.

But, so far, Carney has got the big things right. The budget and this MOU are auspicious moves aimed at ending a decade of stagnation and lost investment.

There is a new mood of anticipation in the country, summed up in the S&P/TSX index, which hit record highs this week on the back of energy and mining stocks. Canadian pension funds are taking another look at the domestic market, intrigued by the prospect of investing in the potential privatization of airports, for example.

Canada is feeling better. There has been a shift in the mindset from saying no to everything to being open to removing barriers that stop the private sector from investing.

Success and prosperity are not guaranteed. But stagnation need not be either.

Fly Straight is a reader-supported publication.

To receive new posts and support my work, consider becoming a free or paid subscriber.

-

Alberta9 hours ago

Alberta9 hours agoFrom Underdog to Top Broodmare

-

armed forces2 days ago

armed forces2 days ago2025 Federal Budget: Veterans Are Bleeding for This Budget

-

Alberta1 day ago

Alberta1 day agoAlberta and Ottawa ink landmark energy agreement

-

Artificial Intelligence2 days ago

Artificial Intelligence2 days agoTrump’s New AI Focused ‘Manhattan Project’ Adds Pressure To Grid

-

International1 day ago

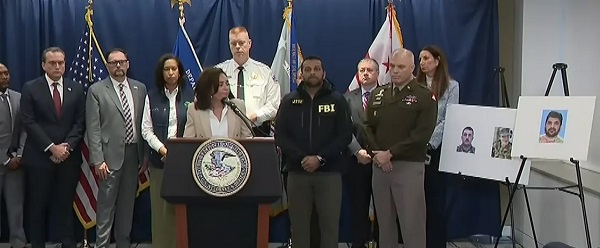

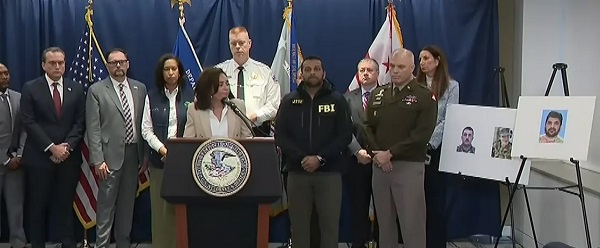

International1 day agoAfghan Ex–CIA Partner Accused in D.C. National Guard Ambush

-

Carbon Tax1 day ago

Carbon Tax1 day agoCanadian energy policies undermine a century of North American integration

-

International1 day ago

International1 day agoIdentities of wounded Guardsmen, each newly sworn in

-

International2 days ago

International2 days agoTrump Admin Pulls Plug On Afghan Immigration Following National Guard Shooting