Business

Within a month, 6 largest U.S. banks leave UN Net-Zero Banking Alliance

From The Center Square

Texas Comptroller Glenn Hegar has expressed skepticism about companies claiming to withdraw from ESG commitments, noting there is often doublespeak in their announcements

Within one month of each other, six of the largest U.S. banks left the United Nations Net-Zero Banking Alliance (NZBA) not soon after Donald Trump was elected president.

Last month, Goldman Sachs was the first to withdraw from the alliance, followed by Wells Fargo, The Center Square reported.

By Dec. 31, Citigroup and Bank of America left, followed by Morgan Stanley on Jan. 6 and JPMorgan on Jan. 7.

They did so after joining the alliance several years ago pledging to require environmental social governance standards (ESG) across their platforms, products and systems.

According to the “bank-led and UN-convened” alliance, global banks joined, pledging to align their lending, investment and capital markets activities with a net-zero greenhouse gas emissions by 2050, NZBA explains.

Since April 2021, 141 banks in 44 countries with more than $61 trillion in assets had joined NZBA, the alliance says. That’s down from 145 banks with more than $73 trillion in assets it reported last month after Wells Fargo and Goldman Sachs withdrew.

“In April 2021 when NZBA launched, no bank had set a science-based sectoral 2030 target for its financed emissions using 1.5°C scenarios,” it says. “Today, over half of NZBA banks have set such targets.”

They started to drop off after President-elect Donald Trump vowed to increase domestic oil and natural gas production and pledged to go after “woke” companies.

They also announced their departure two years after 19 state attorneys general launched an investigation into them for alleged deceptive trade practices connected to ESG.

Four states led the investigation: Arizona, Kentucky, Missouri and Texas. Others involved include Arkansas, Indiana, Kansas, Louisiana, Mississippi, Montana, Nebraska, Oklahoma, Tennessee and Virginia. Five state investigations aren’t public for confidentiality reasons.

In Texas, the state legislature passed a bill, which Gov. Greg Abbott signed into law, that prohibits governmental entities from entering into contracts with companies that boycott the oil and natural gas industry. The law also requires state entities to divest from financial companies that boycott the industry through ESG policies.

To date, 17 companies and 353 publicly traded investment funds are on Texas’ ESG divestment list.

After financial institutions withdraw from the NZBA, they are permitted to do business with Texas, the office of Texas Attorney General says.

However, Texas Comptroller Glenn Hegar has expressed skepticism about companies claiming to withdraw from ESG commitments, noting there is often doublespeak in their announcements, The Center Square reported.

Notably, when leaving the alliance, a Goldman Sachs spokesperson said the company was still committed to the NZBA goals and has “the capabilities to achieve our goals and to support the sustainability objectives of our clients,” EST Today reported. The company also said it was “very focused on the increasingly elevated sustainability standards and reporting requirements imposed by regulators around the world.”

“Goldman Sachs also confirmed that its goal to align its financing activities with net zero by 2050, and its interim sector-specific targets remained in place,” EST Today reported.

Five Goldman Sachs funds are listed in Texas’ ESG divestment list.

While announcing it was leaving the alliance, a JPMorgan spokesperson also affirmed the company’s commitment to reaching net-zero emissions. “We aim to contribute to real-economy decarbonization by providing our clients with the advice and capital needed to transform business models and lower carbon intensity,” the spokesperson said, Reuters reported.

Yahoo!Finance also notes that JPMorgan will continue to work with Glasgow Financial Alliance for Net Zero. “We will also continue to support the banking and investment needs of our clients who are engaged in energy transition and in decarbonizing different sectors of the economy,” the spokesperson said.

Citigroup and Bank of America also remain committed to net-zero objectives, including continuing to report on efforts to achieve 2030 net-zero targets and reducing CO2 emissions associated with corporate lending, FiNews reported.

The Comptroller’s office remains committed to “enforcing the laws of our state as passed by the Texas Legislature,” Hegar said. “Texas tax dollars should not be invested in a manner that undermines our state’s economy or threatens key Texas industries and jobs.”

Business

Looks like the Liberals don’t support their own Pipeline MOU

From Pierre Poilievre

Business

Canada Can Finally Profit From LNG If Ottawa Stops Dragging Its Feet

From the Frontier Centre for Public Policy

By Ian Madsen

Canada’s growing LNG exports are opening global markets and reducing dependence on U.S. prices, if Ottawa allows the pipelines and export facilities needed to reach those markets

Canada’s LNG advantage is clear, but federal bottlenecks still risk turning a rare opening into another missed opportunity

Canada is finally in a position to profit from global LNG demand. But that opportunity will slip away unless Ottawa supports the pipelines and export capacity needed to reach those markets.

Most major LNG and pipeline projects still need federal impact assessments and approvals, which means Ottawa can delay or block them even when provincial and Indigenous governments are onside. Several major projects are already moving ahead, which makes Ottawa’s role even more important.

The Ksi Lisims floating liquefaction and export facility near Prince Rupert, British Columbia, along with the LNG Canada terminal at Kitimat, B.C., Cedar LNG and a likely expansion of LNG Canada, are all increasing Canada’s export capacity. For the first time, Canada will be able to sell natural gas to overseas buyers instead of relying solely on the U.S. market and its lower prices.

These projects give the northeast B.C. and northwest Alberta Montney region a long-needed outlet for its natural gas. Horizontal drilling and hydraulic fracturing made it possible to tap these reserves at scale. Until 2025, producers had no choice but to sell into the saturated U.S. market at whatever price American buyers offered. Gaining access to world markets marks one of the most significant changes for an industry long tied to U.S. pricing.

According to an International Gas Union report, “Global liquefied natural gas (LNG) trade grew by 2.4 per cent in 2024 to 411.24 million tonnes, connecting 22 exporting markets with 48 importing markets.” LNG still represents a small share of global natural gas production, but it opens the door to buyers willing to pay more than U.S. markets.

LNG Canada is expected to export a meaningful share of Canada’s natural gas when fully operational. Statistics Canada reports that Canada already contributes to global LNG exports, and that contribution is poised to rise as new facilities come online.

Higher returns have encouraged more development in the Montney region, which produces more than half of Canada’s natural gas. A growing share now goes directly to LNG Canada.

Canadian LNG projects have lower estimated break-even costs than several U.S. or Mexican facilities. That gives Canada a cost advantage in Asia, where LNG demand continues to grow.

Asian LNG prices are higher because major buyers such as Japan and South Korea lack domestic natural gas and rely heavily on imports tied to global price benchmarks. In June 2025, LNG in East Asia sold well above Canadian break-even levels. This price difference, combined with Canada’s competitive costs, gives exporters strong margins compared with sales into North American markets.

The International Energy Agency expects global LNG exports to rise significantly by 2030 as Europe replaces Russian pipeline gas and Asian economies increase their LNG use. Canada is entering the global market at the right time, which strengthens the case for expanding LNG capacity.

As Canadian and U.S. LNG exports grow, North American supply will tighten and local prices will rise. Higher domestic prices will raise revenues and shrink the discount that drains billions from Canada’s economy.

Canada loses more than $20 billion a year because of an estimated $20-per-barrel discount on oil and about $2 per gigajoule on natural gas, according to the Frontier Centre for Public Policy’s energy discount tracker. Those losses appear directly in public budgets. Higher natural gas revenues help fund provincial services, health care, infrastructure and Indigenous revenue-sharing agreements that rely on resource income.

Canada is already seeing early gains from selling more natural gas into global markets. Government support for more pipelines and LNG export capacity would build on those gains and lift GDP and incomes. Ottawa’s job is straightforward. Let the industry reach the markets willing to pay.

Ian Madsen is a senior policy analyst at the Frontier Centre for Public Policy.

-

COVID-192 days ago

COVID-192 days agoUniversity of Colorado will pay $10 million to staff, students for trying to force them to take COVID shots

-

Bruce Dowbiggin2 days ago

Bruce Dowbiggin2 days agoIntegration Or Indignation: Whose Strategy Worked Best Against Trump?

-

Focal Points2 days ago

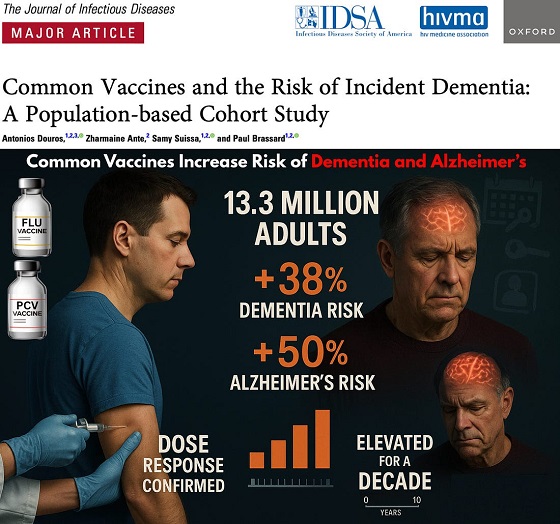

Focal Points2 days agoCommon Vaccines Linked to 38-50% Increased Risk of Dementia and Alzheimer’s

-

espionage2 days ago

espionage2 days agoWestern Campuses Help Build China’s Digital Dragnet With U.S. Tax Funds, Study Warns

-

Opinion2 days ago

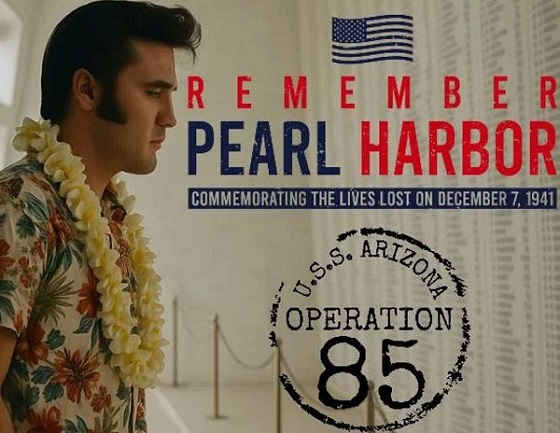

Opinion2 days agoThe day the ‘King of rock ‘n’ roll saved the Arizona memorial

-

Bruce Dowbiggin1 day ago

Bruce Dowbiggin1 day agoWayne Gretzky’s Terrible, Awful Week.. And Soccer/ Football.

-

Agriculture1 day ago

Agriculture1 day agoCanada’s air quality among the best in the world

-

Health1 day ago

Health1 day agoCDC Vaccine Panel Votes to End Universal Hep B Vaccine for Newborns