Business

Will U.S. streaming companies play ball with the CRTC?: Peter Menzies

From the MacDonald Laurier Institute

By Peter Menzies

Domestic streamers have to live with the rules the CRTC comes up with, not so when it comes to global streamers

The fundamental weakness in Canada’s Online Streaming Act will be exposed for all to see on Nov. 20, when the Canadian Radio-television and Telecommunications Commission (CRTC) comes face-to-face with American streaming companies.

For the first time, the regulator will be dealing with companies that, if they don’t like the rules and the financial burden the CRTC imposes, are free to leave the country.

To be clear, neither Netflix, Disney+ nor any other company has yet suggested they are prepared to quit Canada. There have been no threats to do anything similar to what Meta did and Google might – stop carrying news – in response to the Online News Act. But there is nothing that compels foreign companies from continuing here if CRTC decisions make it no longer sensible for them to do so.

That shapes the conversation in a way that the commission, which commences a three-week-long hearing Nov. 20 involving 127 intervenors, isn’t accustomed to. Throughout its history, the primary players in CRTC procedures have always been captives of “the system” – domestic companies that depend for their existence on a commission license or rely upon the regulator’s decisions for their sustenance. They may not like the rules the CRTC comes up with, but they have to live with them.

Not so when it comes to global streamers that, as it turns out, are global.

Netflix’s base here is robust – 6.7 million subscribers – but that is just 10 per cent of its U.S. audience and only 2.8 per cent of its global subscriber base. According to its submission to the CRTC, it has already invested $3.5-billion in film and TV production since launching here in 2010 – roughly equivalent to the Canada Media Fund’s spend over the same period. And, it claims, people are 1.8 times more likely to view a Canadian production on Netflix than on TV. Let that sink in.

Disney+ makes similar arguments. It has 4.4 million Canadian subscribers out of a global total of about 147 million (down significantly this year). It points out that it has invested $1.5-billion in Canada, which is one of its top four production markets. As it gently states in its submission to the CRTC: “We encourage the commission to adopt a modernized contribution framework and a revised, modern definition of a ‘Canadian program’ that provide sufficient incentives for global producers and foreign online undertakings to continue to bring large-scale productions to, and make capital investments in, Canada.”

Large domestic companies that have been forced by regulation to contribute to the production and airing of certified Canadian content, meanwhile, argue for their “burden” in that regard to be reduced and shifted onto the backs of foreign companies.

In its submission, BCE Inc., which has a current profit margin of 21.2 per cent, describes the broadcasting system as in crisis, accuses streamers of having “contributed precious little to the Canadian system” and calls for its contributions to be reduced from 30 per cent to 20 per cent of the media division’s revenue – a figure it believes should be applied to all offshore streamers with more than $50-million in Canadian revenue.

BCE Inc. goes on to argue that if the commission takes its advice and forces the streamers to pay 20 per cent of their revenue directly into Canadian content funds, an additional $457-million – growing to $678-million by 2026 – will pour into the pockets of ACTRA, the Writers Guild and others involved in the creation of certified Canadian TV and film content.

And that, right there, is where Netflix, with a profit margin of 13 per cent clears its throat. Politely but firmly, it says the CRTC appears to have already made up its mind that streamers should be paying into funds and “submits that this is not an appropriate starting point.”

The decade prior to the introduction of the Online Streaming Act was by far the most prosperous in the history of the Canadian film and television industry, including in terms of Canadian content production.

Most of that growth took place beyond the reach of the CRTC, which was in charge of an increasingly irrelevant system upon which many legacy companies had grown dependent. But instead of fostering what was working, the government chose to sustain what wasn’t.

So now, as with the Online News Act, it’s playing at a table where it no longer holds all the cards.

Peter Menzies is a senior fellow with the Macdonald-Laurier Institute, a former publisher of the Calgary Herald and a previous vice-chair of the Canadian Radio-television and Telecommunications Commission (CRTC).

Business

Democracy Watchdog Says PM Carney’s “Ethics Screen” Actually “Hides His Participation” In Conflicted Investments

Sam Cooper

Sam Cooper

A democracy watchdog is warning that Prime Minister Mark Carney’s sprawling private investments, including substantial holdings in Brookfield as well as shares in more than 550 other companies, cause a disabling conflict of interest that cannot be solved by his so-called “ethics screen,” ultimately undermining Ottawa’s credibility and negating Carney’s capacity to confront hostile regimes, including China.

In a scathing statement this week, Democracy Watch urged Carney to fully divest his shares and stock options, arguing that Ottawa’s purported “screen” — which relies on Carney’s chosen staff to supposedly shield the prime minister from conflicted business decisions — actually “allows him to participate in, and hides his participation in, almost all decisions that affect his investments.”

Democracy Watch cited the landmark 1987 Parker Commission on conflicts of interest, which concluded that top public officials must sell all investments outright and that blind trusts should be banned as ineffective “shams.”

These warnings echo The Bureau’s March 2025 pre-election investigation, which outlined in granular detail Carney’s deep entanglements with Brookfield and China.

The Bureau revealed that Brookfield, the $900 billion investment giant Carney joined in 2020, held over $3 billion in politically sensitive assets connected to Chinese state-linked real estate and energy conglomerates, as well as a significant offshore banking footprint. One of its headline deals — a $750 million stake in a Shanghai commercial property project dating back to 2013 — was tied to a Hong Kong tycoon with official links to the Chinese People’s Political Consultative Conference, a central “united front” body identified by the CIA as a tool of Beijing’s overseas influence operations.

Brookfield’s heavy exposure in Shanghai was compounded last year when, amid China’s collapsing real estate market, Carney’s company secured nearly $300 million in emergency loans from the Bank of China. As The Bureau reported, this arrangement carried echoes of Carney’s tenure as Bank of England governor, when he helped facilitate the global expansion of the Chinese financial system and lauded the internationalisation of the renminbi as “a global good.”

While Carney claims to have stepped away from operational control at Brookfield before entering politics, The Bureau’s reporting suggested that his influence over the firm’s China strategy lingered well into his leadership tenure.

Duff Conacher, co-founder of Democracy Watch, reinforced the watchdog’s position in interviews with The Bureau.

“It was very unethical for Mark Carney to hide his investments in more than 560 companies for the past four months,” Conacher said. “Unfortunately, many media outlets failed to cover the conflicts of interest, especially regarding Brookfield, and failed to point out that his so-called blind trust isn’t blind at all.”

Conacher warned that Carney’s private holdings risk tainting not just domestic policy but also Canada’s international relationships and moral authority.

“Mark Carney’s investments will affect not only his decisions about laws, policies, taxes and subsidies that affect businesses in Canada but also, given Brookfield’s business interests around the world, will also taint the Canadian government’s relationships,” Conacher said. “This will weaken the government’s actions concerning other countries, including countries like China that interfere in Canadian politics and threaten Canada’s interests in many ways.”

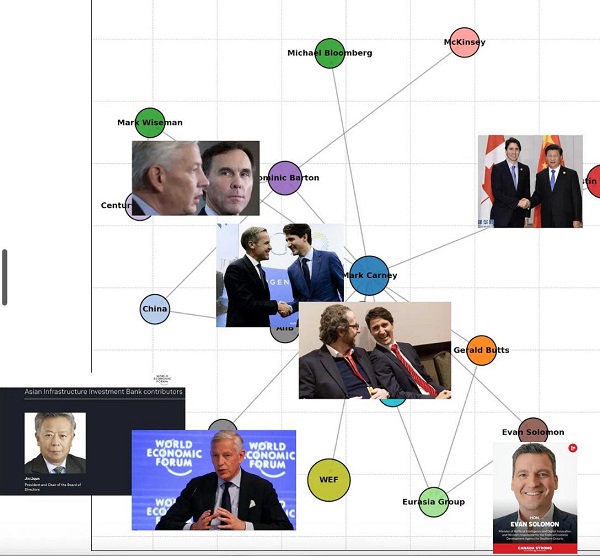

In yet another pre-election investigation published in February 2025, The Bureau delved into Carney’s deep political and business networks that bridge global trade interests converging around China and pro-Beijing Western business elites — networks that illustrate the same theme of ethical conflicts haunting Ottawa today.

As Canada braced for a leadership change — with Prime Minister Justin Trudeau poised to step down in February — the central question of Carney’s campaign, as The Bureau reported, was whether he would govern differently from the deeply unpopular Trudeau. That framework held until Carney’s team succeeded in shifting baby boomer voters onto a new predominant election issue: that he was the best leader to confront President Donald Trump in a trade war — a claim that, in hindsight, appears absurd to critics, given Carney’s massive personal investment interests in American companies.

Regardless, back in February, Carney’s camp insisted he was a fundamentally different figure from Trudeau.

Yet The Bureau’s closer examination of Carney’s elite network — guided by the principle that long-standing relationships of trust and shared financial interests shape governance — revealed a constellation of global influencers deeply tied to the World Economic Forum and China’s trade and finance arms, particularly the Asian Infrastructure Investment Bank (AIIB). At its core, this network of influential figures — whose stated goals center on consolidating financial power across borders to coordinate carbon-reduction policies and progressive social outcomes — included not just Carney and Trudeau but also former Canadian ambassador to China Dominic Barton, Trudeau campaign backers Mark Wiseman and Gerald Butts, and AIIB’s Jin Liqun, a senior Chinese Communist Party operative.

Carney’s influence also appeared to extend into Canada’s state broadcaster. Former Power & Politics host Evan Solomon — who in 2015 was embroiled in an art-dealing scandal involving Carney, whom he referred to as “the Guv” — later joined a consultancy with Carney’s wife and Gerald Butts. In a leaked email, cited in The Toronto Star’s 2015 art-dealing exposé, Solomon reportedly wrote: “Next year in terms of the Guv will be very interesting. He has access to the highest power network in the world.”

As it turned out, the ties between the former CBC art-dealing host and the former Bank of Canada governor stood the test of years. Solomon was ultimately chosen by Carney to run for the Liberal Party in Toronto and now serves as his Minister of Artificial Intelligence — a revealing trajectory that exemplifies the ethical ambiguity behind Carney’s deeply intertwined media, business, and political influence networks.

The Bureau is a reader-supported publication.

To receive new posts and support my work, consider becoming a free or paid subscriber.

Invite your friends and earn rewards

Business

It’s Time To End Canada’s Protectionist Supply Management Regime

From the Frontier Centre for Public Policy

Senior Fellow Brian Giesbrecht says it’s time to stop coddling millionaire dairy barons. Supply management drives up grocery bills, blocks trade and makes Canada a global joke. Australia fixed it—we can too.

Canadians are paying the price for political cowardice

Canada’s outdated supply management system forces the average Canadian family to spend $500 a year to protect a small group of wealthy dairy producers, most of them millionaires. This protectionist regime enriches a few at the expense of many, drives up food prices and undermines Canada’s credibility in trade negotiations. It no longer fits the times, and it has to go.

Let’s be clear: this isn’t about attacking dairy farmers. Most are hardworking, conscientious people who’ve built their lives around a system they didn’t create. They rise early, work long hours, rarely take holidays and deserve fair compensation if the system is dismantled. But good intentions don’t justify bad policy.

Under supply management, the government tightly controls how much dairy, poultry and eggs Canadian farmers can produce and imposes steep tariffs—sometimes more than 400 per cent—on imported products to limit competition. The result is artificially high prices, limited consumer choice and retaliatory tariffs from other countries.

This system, once designed to protect small family farms, is now dominated by fewer than 10,000 large operations, many worth millions. It no longer serves its original purpose, yet it remains in place because of political cowardice. Pierre Poilievre and Mark Carney both know the system is flawed but won’t challenge it. Why? Because it’s popular in Quebec, a province with significant electoral influence. No party wants to risk alienating those voters.

Australia and New Zealand once faced similar challenges. They phased out their systems, fairly compensated farmers through levies and built globally competitive dairy sectors. We can too. Trump’s return to power may force our hand, but it also gives us an opportunity to act on what we should have done long ago.

Even without outside pressure, the inefficiency is clear. Every year, billions of litres of milk are dumped when quotas are exceeded. At the same time, Canadian companies like Saputo are forced to relocate abroad to reach global markets. Our artisan cheese producers are trapped in a small domestic economy while foreign markets block our exports in retaliation for our own protectionism.

The hypocrisy is glaring. We call for free trade but defend a system that imposes up to 400 per cent tariffs on imports. Our global partners are right to scoff.

Trump did. In a social media post, he wrote: “Canada is a very difficult country to TRADE with, including the fact that they have charged our Farmers as much as 400 per cent Tariffs, for years, on Dairy Products.” And in his July 10 letter announcing 35 per cent tariffs on Canadian goods, he added: “Canada charges extraordinary Tariffs to our Dairy Farmers—up to 400 per cent—and that is even assuming our Dairy Farmers even have access to sell their products to the people of Canada.”

This isn’t just an American objection. High-quality dairy from France and Germany can’t be sold in Canada because of our import barriers. Their governments respond by blocking our dairy exports. Canada loses jobs, investment and credibility.

Some defenders claim foreign dairy is unsafe. But countries like France and Germany have food safety standards as strict as ours. And Canada already has legal mechanisms to block substandard imports. We don’t need tariffs for that.

Former Liberal MP Martha Hall Findlay said it plainly: supply management is a dead end. So did Maxime Bernier, who made it a central issue during his bid for the Conservative leadership. The dairy lobby made sure he didn’t win. And we’re still stuck.

Now, all parties have voted to exclude supply management from current trade talks. We are entering negotiations that demand fair treatment while protecting one of the most unfair systems in the developed world. It’s a national embarrassment.

But this can change. A phased buyout funded by a modest, temporary levy—not taxpayer dollars—could end supply management and open our dairy sector to global opportunity. Australia and New Zealand proved it works. Their citizens don’t pay $10 for butter or yogurt. Neither should we.

It’s time to stop protecting the past. Dismantle the system. Free our producers. Lower grocery bills. Restore our credibility.

Maxime Bernier saw it in 2017. Trump is saying it again in 2025.

This time, we’d better listen.

Brian Giesbrecht is a retired judge and senior fellow at the Frontier Centre for Public Policy.

-

National2 days ago

National2 days agoCanada’s immigration office admits it failed to check suspected terrorists’ background

-

Alberta2 days ago

Alberta2 days agoAlberta ban on men in women’s sports doesn’t apply to athletes from other provinces

-

Crime1 day ago

Crime1 day agoDEA Busts Canadian Narco Whose Chinese Supplier Promised to Ship 100 Kilos of Fentanyl Precursors per Month From Vancouver to Los Angeles

-

Business1 day ago

Business1 day agoCanada must address its birth tourism problem

-

Alberta1 day ago

Alberta1 day agoMedian workers in Alberta could receive 72% more under Alberta Pension Plan compared to Canada Pension Plan

-

International1 day ago

International1 day agoBiden autopen scandal: Did unelected aides commit fraud during his final days in office?

-

Fraser Institute1 day ago

Fraser Institute1 day agoDemocracy waning in Canada due to federal policies

-

conflict2 days ago

conflict2 days agoTrump’s done waiting: 50-day ultimatum for Putin to end Ukraine war