Business

Will Paramount turn the tide of legacy media and entertainment?

From the Daily Caller News Foundation

The recent leadership changes at Paramount Skydance suggest that the company may finally be ready to correct course after years of ideological drift, cultural activism posing as programming, and a pattern of self-inflicted financial and reputational damage.

Nowhere was this problem more visible than at CBS News, which for years operated as one of the most partisan and combative news organizations. Let’s be honest, CBS was the worst of an already left biased industry that stopped at nothing to censor conservatives. The network seemed committed to the idea that its viewers needed to be guided, corrected, or morally shaped by its editorial decisions.

This culminated in the CBS and 60 Minutes segment with Kamala Harris that was so heavily manipulated and so structurally misleading that it triggered widespread backlash and ultimately forced Paramount to settle a $16 million dispute with Donald Trump. That was not merely a legal or contractual problem. It was an institutional failure that demonstrated the degree to which political advocacy had overtaken journalistic integrity.

Dear Readers:

As a nonprofit, we are dependent on the generosity of our readers.

Please consider making a small donation of any amount here.

Thank you!

For many longtime viewers across the political spectrum, that episode represented a clear breaking point. It became impossible to argue that CBS News was simply leaning left. It was operating with a mission orientation that prioritized shaping narratives rather than reporting truth. As a result, trust collapsed. Many of us who once had long-term professional, commercial, or intellectual ties to Paramount and CBS walked away.

David Ellison’s acquisition of Paramount marks the most consequential change to the studio’s identity in a generation. Ellison is not anchored to the old Hollywood ecosystem where cultural signaling and activist messaging were considered more important than story, audience appeal, or shareholder value.

His professional history in film and strategic business management suggests an approach grounded in commercial performance, audience trust, and brand rebuilding rather than ideological identity. That shift matters because Paramount has spent years creating content and news coverage that seemed designed to provoke or instruct viewers rather than entertain or inform them. It was an approach that drained goodwill, eroded market share, and drove entire segments of the viewing public elsewhere.

The appointment of Bari Weiss as the new chief editor of CBS News is so significant. Weiss has built her reputation on rejecting ideological conformity imposed from either side. She has consistently spoken out against antisemitism and the moral disorientation that emerges when institutions prioritize political messaging over honesty.

Her brand centers on the belief that journalism should clarify rather than obscure. During President Trump’s recent 60 Minutes interview, he praised Weiss as a “great person” and credited her with helping restore integrity and editorial seriousness inside CBS. That moment signaled something important. Paramount is no longer simply rearranging executives. It is rethinking identity.

The appointment of Makan Delrahim as Chief Legal Officer was an early indicator. Delrahim’s background at the Department of Justice, where he led antitrust enforcement, signals seriousness about governance, compliance, and restoring institutional discipline.

But the deeper and more meaningful shift is occurring at the ownership and editorial levels, where the most politically charged parts of Paramount’s portfolio may finally be shedding the habits that alienated millions of viewers.The transformation will not be immediate. Institutions develop habits, internal cultures, and incentive structures that resist correction. There will be internal opposition, particularly from staff and producers who benefited from the ideological culture that defined CBS News in recent years.

There will be critics in Hollywood who see any shift toward balance as a threat to their influence. And there will be outside voices who will insist that any move away from their preferred political posture is regression.

But genuine reform never begins with instant consensus. It begins with leadership willing to be clear about the mission.

Paramount has the opportunity to reclaim what once made it extraordinary. Not as a symbol. Not as a message distribution vehicle. But as a studio that understands that good storytelling and credible reporting are not partisan aims. They are universal aims. Entertainment succeeds when it connects with audiences rather than instructing them. Journalism succeeds when it pursues truth rather than victory.

In an era when audiences have more viewing choices than at any time in history, trust is an economic asset. Viewers are sophisticated. They recognize when they are being lectured rather than engaged. They know when editorial goals are political rather than informational. And they are willing to reward any institution that treats them with respect.

There is now reason to believe Paramount understands this. The leadership is changing. The tone is changing. The incentives are being reassessed.

It is not the final outcome. But it is a real beginning. As the great Winston Churchill once said; “Now this is not the end. It is not even the beginning of the end. But it is, perhaps, the end of the beginning”.

For the first time in a long time, the door to cultural realignment in legacy media is open. And Paramount is standing at the threshold and has the capability to become a market leader once again. If Paramount acts, the industry will follow.

Bill Flaig and Tom Carter are the Co-Founders of The American Conservatives Values ETF, Ticker Symbol ACVF traded on the New York Stock Exchange. Ticker Symbol ACVF

Learn more at www.InvestConservative.com

Business

Parliamentary Budget Officer begs Carney to cut back on spending

PBO slices through Carney’s creative accounting

The Canadian Taxpayers Federation is calling on Prime Minister Mark Carney to cut spending following today’s bombshell Parliamentary Budget Officer report that criticizes the government’s definition of capital spending and promise to balance the operating budget.

“The reality is that Carney is continuing on a course of unaffordable borrowing and the PBO report shows government messaging about ‘balancing the operating budget’ is not credible,” said Franco Terrazzano, CTF Federal Director. “Carney is using creative accounting to hide the spiralling debt.”

Carney’s Budget 2025 splits the budget into operating and capital spending and promises to balance the operating budget by 2028-29.

However, today’s PBO budget report states that Carney’s definition of capital spending is “overly expansive.” Without using that “overly expansive” definition of capital spending, the government would run an $18 billion operating deficit in 2028-29, according to the PBO.

“Based on our definition, capital investments would total $217.3 billion over 2024-25 to 2029-30, which is approximately 30 per cent ($94 billion) lower compared to Budget 2025,” according to the PBO. “Moreover, based on our definition, the operating balance in Budget 2025 would remain in a deficit position over 2024-25 to 2029-30.”

The PBO states that the Carney government is using “a definition of capital investment that expands beyond the current treatment in the Public Accounts and international practice.” The report specifically points out that “by including corporate income tax expenditures, investment tax credits and operating (production) subsidies, the framework blends policy measures with capital formation.”

The federal government plans to borrow about $80 billion this year, according to Budget 2025. Carney has no plan stop borrowing money and balance the budget. Debt interest charges will cost taxpayers $55.6 billion this year, which is more than the federal government will send to the provinces in health transfers ($54.7 billion) or collect through the GST ($54.4 billion).

“Carney isn’t balancing anything when he borrows tens of billions of dollars every year,” Terrazzano said. “Instead of applying creative accounting to the budget numbers, Carney needs to cut spending and debt.”

Business

Carney government needs stronger ‘fiscal anchors’ and greater accountability

From the Fraser Institute

By Tegan Hill and Grady Munro

Following the recent release of the Carney government’s first budget, Fitch Ratings (one of the big three global credit rating agencies) issued a warning that the “persistent fiscal expansion” outlined in the budget—characterized by high levels of spending, borrowing and debt accumulation—will erode the health of Canada’s finances and could lead to a downgrade in Canada’s credit rating.

Here’s why this matters. Canada’s credit rating impacts the federal government’s cost of borrowing money. If the government’s rating gets downgraded—meaning Canadian federal debt is viewed as an increasingly risky investment due to fiscal mismanagement—it will likely become more expensive for the government to borrow money, which ultimately costs taxpayers.

The cost of borrowing (i.e. the interest paid on government debt) is a significant part of the overall budget. This year, the federal government will spend a projected $55.6 billion on debt interest, which is more than one in every 10 dollars of federal revenue, and more than the government will spend on health-care transfers to the provinces. By 2029/30, interest costs will rise to a projected $76.1 billion or more than one in every eight dollars of revenue. That’s taxpayer money unavailable for programs and services.

Again, if Canada’s credit rating gets downgraded, these costs will grow even larger.

To maintain a good credit rating, the government must prevent the deterioration of its finances. To do this, governments establish and follow “fiscal anchors,” which are fiscal guardrails meant to guide decisions regarding spending, taxes and borrowing.

Effective fiscal anchors ensure governments manage their finances so the debt burden remains sustainable for future generations. Anchors should be easily understood and broadly applied so that government cannot get creative with its accounting to only technically abide by the rule, but still give the government the flexibility to respond to changing circumstances. For example, a commonly-used rule by many countries (including Canada in the past) is a ceiling/target for debt as a share of the economy.

The Carney government’s budget establishes two new fiscal anchors: balancing the federal operating budget (which includes spending on day-to-day operations such as government employee compensation) by 2028/29, and maintaining a declining deficit-to-GDP ratio over the years to come, which means gradually reducing the size of the deficit relative to the economy. Unfortunately, these anchors will fail to keep federal finances from deteriorating.

For instance, the government’s plan to balance the “operating budget” is an example of creative accounting that won’t stop the government from borrowing money each year. Simply put, the government plans to split spending into two categories: “operating spending” and “capital investment” —which includes any spending or tax expenditures (e.g. credits and deductions) that relates to the production of an asset (e.g. machinery and equipment)—and will only balance operating spending against revenues. As a result, when the government balances its operating budget in 2028/29, it will still incur a projected deficit of $57.9 billion when spending on capital is included.

Similarly, the government’s plan to reduce the size of the annual deficit relative to the economy each year does little to prevent debt accumulation. This year’s deficit is expected to equal 2.5 per cent of the overall economy—which, since 2000, is the largest deficit (as a share of the economy) outside of those run during the 2008/09 financial crisis and the pandemic. By measuring its progress off of this inflated baseline, the government will technically abide by its anchor even as it runs relatively large deficits each and every year.

Moreover, according to the budget, total federal debt will grow faster than the economy, rising from a projected 73.9 per cent of GDP in 2025/26 to 79.0 per cent by 2029/30, reaching a staggering $2.9 trillion that year. Simply put, even the government’s own fiscal plan shows that its fiscal anchors are unable to prevent an unsustainable rise in government debt. And that’s assuming the government can even stick to these anchors—which, according to a new report by the Parliamentary Budget Officer, is highly unlikely.

Unfortunately, a federal government that can’t stick to its own fiscal anchors is nothing new. The Trudeau government made a habit of abandoning its fiscal anchors whenever the going got tough. Indeed, Fitch Ratings highlighted this poor track record as yet another reason to expect federal finances to continue deteriorating, and why a credit downgrade may be on the horizon. Again, should that happen, Canadian taxpayers will pay the price.

Much is riding on the Carney government’s ability to restore Canada’s credibility as a responsible fiscal manager. To do this, it must implement stronger fiscal rules than those presented in the budget, and remain accountable to those rules even when it’s challenging.

-

Frontier Centre for Public Policy2 days ago

Frontier Centre for Public Policy2 days agoRichmond Mayor Warns Property Owners That The Cowichan Case Puts Their Titles At Risk

-

Business2 days ago

Business2 days agoMark Carney Seeks to Replace Fiscal Watchdog with Loyal Lapdog

-

COVID-191 day ago

COVID-191 day agoMajor new studies link COVID shots to kidney disease, respiratory problems

-

Business2 days ago

Business2 days agoSluggish homebuilding will have far-reaching effects on Canada’s economy

-

Business2 days ago

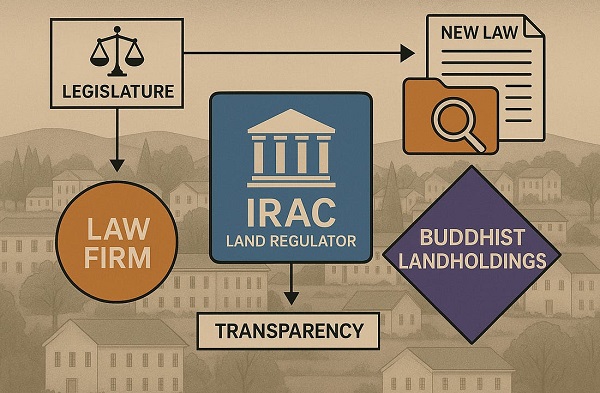

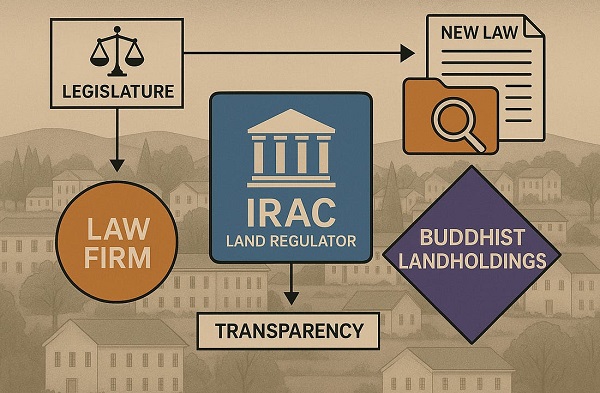

Business2 days agoP.E.I. Moves to Open IRAC Files, Forcing Land Regulator to Publish Reports After The Bureau’s Investigation

-

Energy2 days ago

Energy2 days agoCanada’s oilpatch shows strength amid global oil shakeup

-

International1 day ago

International1 day agoBondi and Patel deliver explosive “Clinton Corruption Files” to Congress

-

International1 day ago

International1 day agoState Department designates European Antifa groups foreign terror organizations