Daily Caller

Utah Republican Senator Planning To Attend Big Globalist Climate Shindig Despite Trump’s Energy Policies

From the Daily Caller News Foundation

By Audrey Streb

Republican Utah Sen. John Curtis is reportedly planning to co-lead a delegation to the annual U.N. climate change conference, which some critics told the Daily Caller News Foundation clashes with President Donald Trump’s energy agenda.

Curtis told E&E News Friday that he and Democratic Delaware Sen. Chris Coons will lead a delegation to Brazil together for this year’s COP30 and that three other unnamed Republicans are also interested in joining the troop. The U.N. climate change conference is set to host several youth-led climate forums and discuss the Paris Agreement that Trump directed the U.S. to abandon through a day-one executive order.

“RINOs like Sen. Curtis are trying to snatch defeat from the jaws of MAGA victory by going to the annual UN climate confab in Brazil,” Steve Milloy, Senior Fellow at the Energy & Environment Legal Institute told the DCNF. “There, they will conspire with China and Europe in trying to subvert President Trump’s agenda of defeating the climate hoax, terminating the Green New Scam and making America energy dominant.”

Dear Readers:

As a nonprofit, we are dependent on the generosity of our readers.

Please consider making a small donation of any amount here.

Thank you!

The Trump administration has not announced that it will send a delegation to the November conference and Trump recently called climate change policy the “greatest con job ever perpetrated on the world” in front of the United Nations General Assembly in September. Trump has moved to ax federal support for green energy sources like wind and solar that the Biden administration favored while bolstering conventional resources like coal.

“Leave it to ‘Mitt Romney’ style Republicans like Sen. Curtis to try to snatch defeat from the jaws of victory. … The UN climate agenda and the UN’s COP30 meetings should be disbanded, not given credibility by GOP senators,” Marc Morano, author and Climate Depot executive editor, told the DCNF. “This is a pathetic throwback to the pre-Trump Republicanism of George H. Bush, George W. Bush, John McCain, and Mitt Romney. … The UN climate agenda has quite literally overseen the outsourcing of the West’s once dominant industries to China, India, and the developing world. The U.S., Canada, and Europe have boasted about emission accounting tricks, while China builds two new coal plants a week and benefits from the West’s attempts at a ‘green transition.’ The U.S. does not need ‘a seat at the table’ at the UN climate summit, we need to knock the table over.”

Curtis has historically split with many Republicans over climate change policy and has notably advocated against a wholesale repeal of Biden-era green energy tax credits that Trump railed against. Earlier this year, Curtis told Secretary of State Marco Rubio that it is “really important” to have a “Republican voice at that table,” in reference to COP30.

The Senator pointed to nuclear specifically as an energy resource Republicans could elevate at COP30.

Critics like Milloy, Morano and President of the Heartland Institute James Taylor told the DCNF that COP30 should not be endorsed by Republican participation as it runs counter to Trump’s energy policies and suggests that the left-leaning climate talking points the president has fought hold legitimacy.

“Republicans who attend COP30 for any reason other than to mock it are hypocrites and grandstanders,” Taylor told the DCNF. “How much carbon dioxide are they going to spew into the atmosphere merely so they can have a ‘photo op’ at a portion of the Amazon rainforest that was destroyed in order to create a venue for this vacation conference of UN bureaucrats?”

Notably, developers razed portions of the Amazon rainforest to construct a road for COP30, and a 2024 study released right before COP29 showed that emissions rise sharply during major conferences due to private jet travel.

Business

Finance Titans May Have Found Trojan Horse For ‘Climate Mandates’

From the Daily Caller News Foundation

By Audrey Streb

Major global asset managers including BlackRock and Blackstone have been looking to buy power utilities across America in a move that some industry insiders warn could harm consumers, raise electricity costs and advance a climate-driven energy agenda.

In recent months, Blackstone reportedly sought regulatory approval to buy utilities in New Mexico and Texas all while a BlackRock-led group won approval Friday to purchase a major utility in Minnesota. While BlackRock and other huge asset managers have distanced themselves from environmental, social and governance (ESG) investment practices in recent years, some energy experts and consumer advocates that spoke to the Daily Caller News Foundation are concerned that buying up utilities may represent a new frontier of financial giants orchestrating “climate mandates.”

“BlackRock isn’t just influencing utilities anymore, they’re buying them. After years of ESG-driven coercion that pushed utilities to abandon reliable energy in favor of China-dependent renewables, BlackRock is now taking direct control. The result will be more of the same: higher costs, weaker grids, and millions in unpaid bills, all driven by the very climate mandates they lobbied for,” Jason Isaac, CEO of the American Energy Institute, told the DCNF. “Minnesotans should brace for more unreliable power, rising rates, and a media narrative that blames Trump for ending taxpayer-funded handouts instead of holding the woke politicians and Wall Street elites responsible for the crisis.”

Electricity demand is on the rise after years of stagnancy as the artificial intelligence (AI) race ushers in the build out of power-hungry data centers. Utility costs are also spiking as demand takes off in a trend that dates back to the Biden administration.

Against this backdrop, private investment titans like BlackRock and Blackstone are reportedly moving to buy power utility companies and invest in data center expansions and startups.

Minnesota recently granted the BlackRock-led group known as Global Infrastructure Partners (GIP) approval to buy one of the state’s major power utilities, Allete. GIP is also reportedly on the cusp of acquiring the major energy company, AES, according to sources familiar with the matter that spoke with Reuters. The Financial Times reported that the deal may be for $38 billion.

BlackRock referred the DCNF to Allete’s statement on regulators approving its partnership with GIP and declined to comment further for this story.

Allete’s statement notes that the impending partnership with the BlackRock-led group includes “guaranteed access to capital to fund ALLETE’s five-year plan for advancing transmission and renewable energy goals [and a] $50 million Clean Firm Technology Fund to support regional clean-energy projects and partnerships.”

The Federal Energy Regulatory Commission (FERC) renewed BlackRock’s ability to own up to 20% of utility voting shares in April, with former FERC Commissioner Mark Christie stating that BlackRock “pledged not to use its holdings to influence utility management” and that utilities need the access to capital.

Christie also warned in September 2024 that “this is an issue that deserves much greater scrutiny” and that “the influence that large shareholders, BlackRock or otherwise, can potentially exert across the consumer-serving utility industry should not be underestimated.”

Blackstone has reportedly sought regulatory approval to buy out the Public Service Company of New Mexico and Texas New Mexico Power Co. recently, according to The Associated Press. The asset management giant also secured a 19.9% stake in a Northern Indiana public utility for over $2 billion in January 2024.

“Blackstone’s sustainability strategy prioritizes accelerating decarbonization by investing in the energy transition and driving value accretive emissions reduction in our portfolio,” Blackstone’s 2024 sustainability report states. “We believe the transition to cleaner energy creates meaningful investment opportunities for private capital. For over a decade, we have pursued attractive investments in companies and assets that are part of the global energy transition as part of our broader energy investing strategy.”

Blackstone also announced on Sept. 15 that private equity funds affiliated with Blackstone Energy Transition Partners will acquire the Pennsylvania-based Hill Top Energy Center natural gas plant for almost $1 billion. The company also announced in July that funds managed by Blackstone Infrastructure and Blackstone Real Estate would invest over $25 billion to help build out Pennsylvania’s energy infrastructure to support the AI “revolution.”

“Renewable” energy goals and ESG investment tend to align with emissions-reduction targets, with some power companies, utilities and states that set goals to cut emissions striving to retire conventional energy sources like coal plants. Isaac added that companies like American Electric Power, in which BlackRock owns a significant stake, have been decommissioning coal plants and replacing them with intermittent sources like solar.

“What happens is when the wind stops blowing and the sun stops shining, then you have to ramp those generational assets back up, and that’s when price spikes happen,” Isaac said.

University of North Carolina at Chapel Hill professor of finance Greg Brown told the AP that the reason behind these buyouts are “very simple. Because there’s a lot of money to be made.”

Other experts devoted to consumer protection like Executive Director of Consumers’ Research Will Hild told the DCNF that investment companies like BlackRock stand to gain more than just a profit from these purchases.

“There is no world in which BlackRock’s ownership of American energy benefits ordinary American consumers,” Hild told the DCNF. “This is the same firm that proudly brought us the radical ESG rules and Net-Zero nonsense that forced all our energy bills to skyrocket. We wouldn’t have the scourge of woke capitalism without Larry Fink, who already controls nearly $13 trillion in assets and has been sued for violating anti-trust laws.”

ESG investors weigh a company by its social and environmental choices as well as its finances in a move that critics say bogs down businesses with new costs while doing little to combat climate change. One August 2023 InfluenceMap report showed that as Republicans at the state level and in Congress ramped up their opposition to ESG-focused practices, BlackRock and other major U.S. asset managers decreased their support for climate-related resolutions.

BlackRock CEO Larry Fink also said in June 2023 that he no will no longer use the term ESG because it has been “politicized,” less than a year after he noted that climbing energy prices are “accelerating” the green energy transition.

“BlackRock has backpedaled on its ESG messaging and its aggressive, unapologetic imposition of ESG on everything they touch. But the leopard hasn’t changed its spots,” President of the Heartland Institute James Taylor told the DCNF. “It still has the same management group with the same values, and it’s still doing whatever it can to impose ESG on everything it touches, in actuality, if not in name.”

Taylor argued that whether BlackRock buys or acquires a large stake of a utility, it “can now assert itself over legislatures in dictating energy policy.”

Notably, the Federal Trade Commission (FTC) and the Department of Justice (DOJ) threw their weight behind an antitrust lawsuit against major asset managers that alleges the firms colluded to tank coal production with their embrace of zero-emissions goals in May.

The lawsuit, backed by 11 state attorneys general, alleges that BlackRock and multiple other asset managers used their market power to suppress coal production, thereby hurting consumers by causing the price of coal to climb.

The DOJ and FTC’s “support for this baseless case undermines the Trump Administration’s goal of American energy independence,” a BlackRock spokesperson previously told the DCNF. “As we made clear in our earlier motion to dismiss, this case is trying to re-write antitrust law and is based on an absurd theory that coal companies conspired with their shareholders to reduce coal production.”

Daily Caller

Now Is A Great Time To Be Out Of America’s Offshore Wind Business

From the Daily Caller News Foundation

Is the push and pull in the energy and climate regulatory environment hurting the ability for companies to finance and complete energy projects in the United States? The head of Shell in the United States, Colette Hirstius, said she believes it is in a recent interview.

“I think uncertainty in the regulatory environment is very damaging,” Hirstius said, adding, “However far the pendulum swings one way, it’s likely that it’s going to swing just as far the other way.”

Hirstius was addressing the moves made by the Trump administration to slow the progress of the offshore wind industry, which was the crown jewel of the Biden administration’s headlong rush into a government-subsidized energy transition. Trump’s regulators, led by Secretary of Interior Doug Burgum and Energy Secretary Chris Wright, have taken a series of actions in compliance with executive orders signed by Trump since January to halt several projects that were under construction, roll back federal subsidies, and review permits they believe were hastily issued in non-compliance with legally required processes.

Dear Readers:

As a nonprofit, we are dependent on the generosity of our readers.

Please consider making a small donation of any amount here.

Thank you!

That hope seems discordant, coming as it does amid Shell’s ongoing effort to step back from offshore wind and refocus more of its capital budget back to its core oil and gas business following years of unprofitable ventures into renewables. It also seems fair to point out that the political pendulum about which Hirstius warns already swung wildly in favor of offshore wind and other wind and solar projects in the Biden administration. It is odd that Shell only now decides to roll out that particular warning.

Shell was pulling back from its major offshore wind investments while Trump was still fighting off efforts by an array of Democratic prosecutors to put him in prison. In June 2023, for example, the company announced its intent to offload its 50% share in the Southcoast project offshore Connecticut amid Biden era high inflation and supply chain challenges that were already rocking the industry at the time. Nine months later, Shell sold the interest to another party.

The company announced last December that it was “stepping back from new offshore wind investments” as part of a company-wide review implemented by then-new CEO Wael Sawan in mid-2023. A month later, it cancelled its interest in the Atlantic Shores project, writing off $1 billion in investments in the process. Shell’s ventures into the U.S. offshore wind arena had run head-long into economic reality long before the second Trump presidency came along.

That Atlantic Shores project has become an item of special interest inside the Interior Department’s Bureau of Ocean Energy Management (BOEM) in recent days. In a court filing last Friday, BOEM Deputy Director Matthew Giacona said the Bureau plans to conduct a full review of the process that went into approving Atlantic Shores during the Biden presidency. He also said the review would likely expand to other offshore wind projects given the administration’s concerns that Biden’s regulators failed to properly assess the true environmental impacts these major industrial installations create.

In addition to that, the Daily Caller’s Audrey Streb reported on Monday that Biden regulators gave the go-ahead to some of these offshore projects despite internal concerns expressed as early as 2021 that granting long delays in their decommissioning processes “increases risk to the federal taxpayer.” Offshore developers are normally required to provide financial assurance to pre-fund such costs, but big Danish developer Orsted and others were requesting delays as long as 15 years in that requirement to make their project economics work.

Hirstius’s concerns about regulation are absolutely valid: Having such certainty is a crucial element for any company to be able to plan its future business endeavors. But every presidency has a duty to ensure that actions by prior administrations meet the mandates of prevailing laws. It has long been feared that the Biden regulators cut important corners related to environmental and marine mammal protections to speed some offshore wind projects through the process.

As this current review process plays itself out, Shell might well find itself glad it cut its losses in this failing offshore wind sector when it did.

David Blackmon is an energy writer and consultant based in Texas. He spent 40 years in the oil and gas business, where he specialized in public policy and communications.

-

COVID-192 days ago

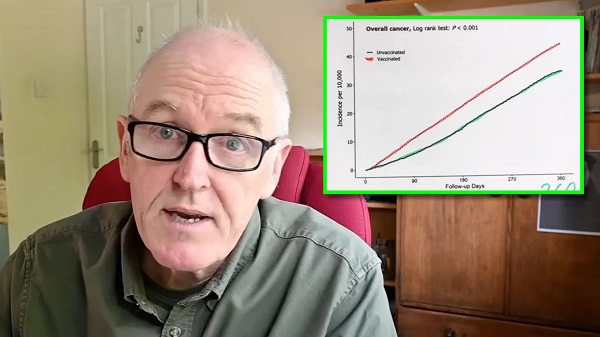

COVID-192 days agoDevastating COVID-19 Vaccine Side Effect Confirmed by New Data: Study

-

Red Deer2 days ago

Red Deer2 days agoThe City of Red Deer’s Financial Troubles: Here Are The Candidates I Am Voting For And Why.

-

Crime2 days ago

Crime2 days agoThe Bureau Exclusive: Chinese–Mexican Syndicate Shipping Methods Exposed — Vancouver as a Global Meth Hub

-

Crime2 days ago

Crime2 days agoCanadian Sovereignty at Stake: Stunning Testimony at Security Hearing in Ottawa from Sam Cooper

-

Business2 days ago

Business2 days agoCanada Post is failing Canadians—time to privatize it

-

Daily Caller2 days ago

Daily Caller2 days agoNow Is A Great Time To Be Out Of America’s Offshore Wind Business

-

Haultain Research2 days ago

Haultain Research2 days agoInclusion and Disorder: Unlearned Lessons from Palestinian Protests

-

Business2 days ago

Business2 days agoYour $350 Grocery Question: Gouging or Economics?