Business

US government buys stakes in two Canadian mining companies

From the Fraser Institute

Prime Minister Mark Carney recently visited the White House for meetings with President Donald Trump. In front of the cameras, the mood was congenial, with both men complimenting each other and promising future cooperation in several areas despite the looming threat of Trump tariffs.

But in the last two weeks, in an effort to secure U.S. access to key critical minerals, the Trump administration has purchased sizable stakes in in two Canadian mining companies—Trilogy Metals and Lithium Americas Corp (LAC). And these aggressive moves by Washington have created a dilemma for Ottawa.

Since news broke of the investments, the Carney government has been quiet, stating only it “welcomes foreign direct investment that benefits Canada’s economy. As part of this process, reviews of foreign investments in critical minerals will be conducted in the best interests of Canadians.”

In the case of LAC, lithium is included in Ottawa’s list of critical minerals that are “essential to Canada’s economic or national security.” And the Investment Canada Act (ICA) requires the government to scrutinize all foreign investments by state-owned investors on national security grounds. Indeed, the ICA specifically notes the potential impact of an investment on critical minerals and critical mineral supply chains.

But since the lithium will be mined and processed in Nevada and presumably utilized in the United States, the Trump administration’s investment will likely have little impact on Canada’s critical mineral supply chain. But here’s the problem. If the Carney government initiates a review, it may enrage Trump at a critical moment in the bilateral relationship, particularly as both governments prepare to renegotiate the Canada-U.S.-Mexico Agreement (CUSMA).

A second dilemma is whether the Carney government should apply the ICA’s “net benefits” test, which measures the investment’s impact on employment, innovation, productivity and economic activity in Canada. The investment must also comport with Canada’s industrial, economic and cultural policies.

Here, the Trump administration’s investment in LAC will likely fail the ICA test, since the main benefit to Canada is that Canadian investors in LAC have been substantially enriched by the U.S. government’s initiative (a week before the Trump administration announced the investment, LAC’s shares were trading at around US$3; two days after the announcement, the shares were trading at US$8.50). And despite any arguments to the contrary, the ICA has never viewed capital gains by Canadian investors as a benefit to Canada.

Similarly, the shares of Trilogy Minerals surged some 200 per cent after the Trump administration announced its investment to support Trilogy’s mineral exploration in Alaska. Again, Canadian shareholders benefited, yet according to the ICA’s current net benefits test, that’s irrelevant.

But in reality, inflows of foreign capital augment domestic savings, which, in turn, provide financing for domestic business investment in Canada. And the prospect of realizing capital gains from acquisitions made by foreign investors encourages startup Canadian companies.

So, what should the Carney government do?

In short, it should revise the ICA so that national security grounds are the sole basis for approving or rejecting investments by foreign governments in Canadian companies. This may still not sit well in Washington, but the prospect of retaliation by the Trump administration should not prevent Canada from applying its sovereign laws. However, the Carney government should eliminate the net benefits test, or at least recognize that foreign investments that enrich Canadian shareholders convey benefits to Canada.

These recent investments by the Trump administration may not be unique. There are hundreds of Canadian-owned mining companies operating in the U.S. and in other jurisdictions, and future investments in some of those companies by the U.S. or other foreign governments are quite possible. Going forward, Canada’s review process should be robust while recognizing all the benefits of foreign investment.

Business

Over two thirds of Canadians say Ottawa should reduce size of federal bureaucracy

From the Fraser Institute

By Matthew Lau

From 2015 to 2024, headcount at Natural Resources Canada increased 39 per cent even though employment in Canada’s natural resources sector actually fell one per cent. Similarly, there was 382 per cent headcount growth at the federal department for Women and Gender Equality—obviously far higher than the actual growth in Canada’s female population.

According to a recent poll, there’s widespread support among Canadians for reducing the size of the federal bureaucracy. The support extends across the political spectrum. Among the political right, 82.8 per cent agree to reduce the federal bureaucracy compared to only 5.8 per cent who disagree (with the balance neither agreeing nor disagreeing); among political moderates 68.4 per cent agree and only 10.0 per cent disagree; and among the political left 44.8 per cent agree and 26.3 per cent disagree.

Taken together, “67 per cent agreed the federal bureaucracy should be significantly reduced. Only 12 per cent disagreed.” These results shouldn’t be surprising. The federal bureaucracy is ripe for cuts. From 2015 to 2024, the federal government added more than 110,000 new bureaucrats, a 43 per cent increase, which was nearly triple the rate of population growth.

This bureaucratic expansion was totally unjustified. From 2015 to 2024, headcount at Natural Resources Canada increased 39 per cent even though employment in Canada’s natural resources sector actually fell one per cent. Similarly, there was 382 per cent headcount growth at the federal department for Women and Gender Equality—obviously far higher than the actual growth in Canada’s female population. And there are many similar examples.

While in 2025 the number of federal public service jobs fell by three per cent, the cost of the federal bureaucracy actually increased as the number of fulltime equivalents, which accounts for whether those jobs were fulltime or part-time, went up. With the tax burden created by the federal bureaucracy rising so significantly in the past decade, it’s no wonder Canadians overwhelmingly support its reduction.

Another interesting poll result: “While 42 per cent of those surveyed supported the government using artificial intelligence tools to resolve bottlenecks in service delivery, 32 per cent opposed it, with 25 per cent on the fence.” The authors of the poll say the “plurality in favour is surprising, given the novelty of the technology.”

Yet if 67 per cent of Canadians agree with significantly shrinking the federal bureaucracy, then solid support for using AI to increasing efficiency should not be too surprising, even if the technology is relatively new. Separate research finds 58 per cent of Canadian workers say they use AI tools provided by their workplace, and although many of them do not necessarily use AI regularly, of those who report using AI the majority say it improves their productivity.

In fact, there’s massive potential for the government to leverage AI to increase efficiency and control labour expenses. According to a recent study by a think-tank at Toronto Metropolitan University (formerly known as Ryerson), while the federal public service and the overall Canadian workforce are similar in terms of the percentage of roles that could be made more productive by AI, federal employees were twice as likely (58 per cent versus 29 per cent) to have jobs “comprised of tasks that are more likely to be substituted or replaced” by AI.

The opportunity to improve public service efficiency and deliver massive savings to taxpayers is clearly there. However, whether the Carney government will take advantage of this opportunity is questionable. Unlike private businesses, which must continuously innovate and improve operational efficiency to compete in a free market, federal bureaucracies face no competition. As a result, there’s little pressure or incentive to reduce costs and increase efficiency, whether through AI or other process or organizational improvements.

In its upcoming budget and beyond, it would be a shame if the federal government does not, through AI or other changes, restrain the cost of its workforce. Taxpayers deserve, and clearly demand, a break from this ever-increasing burden.

Business

Judges are Remaking Constitutional Law, Not Applying it – and Canadians’ Property Rights are Part of the Collateral Damage

By Peter Best

The worst thing that can happen to a property owner isn’t a flood or a leaky foundation. It’s learning that you don’t own your property – that an Aboriginal band does. This summer’s Cowichan Tribes v. Canada decision presented property owners in Richmond B.C. with exactly that horrible reality, awarding Aboriginal

title to numerous properties, private and governmental, situated within a large portion of Richmond’s Fraser River riverfront area, to Vancouver Island’s

Cowichan Tribes. For more than 150 years, these properties had been owned privately or by the government. The Cowichan Tribes had never permanently lived

there.

But B.C. Supreme Court Justice Barbara Young ruled that because the lands had never been formally surrendered by the Cowichans to the Crown by treaty, (there

were no land-surrender treaties for most of B.C.), the first Crown grants to the first settlers were in effect null and void and thus all subsequent transfers down

the chain of title to the present owners were defective and invalid.

The court ordered negotiations to “reconcile” Cowichan Aboriginal title with the interests of the current owners and governments. The estimated value of the

property and government infrastructure at stake is $100 billion.

This ruling, together with previous Supreme Court of Canada rulings in favour of the concept of Aboriginal title, vapourizes more than 150 years of legitimate

ownership and more broadly, threatens every land title in most of the rest of B.C. and in any other area in Canada not subject to a clear Aboriginal land surrender

treaty.

Behind this decision lies a revolution – one being waged not in the streets but in the courts.

In recent years Canadian judges, inspired and led by the Supreme Court of Canada, have become increasingly activist in favour of Aboriginal rights, in effect

unilaterally amending our constitutional order, without public or legislative input, to invent the “consult and accommodate” obligation, decree Aboriginal title and grant Canadian Aboriginal rights to American Indians. No consideration of the separation of powers doctrine or the national interest has ever been evidenced by

the Court in this regard.

Following the Supreme Court’s lead, Canadian judges have increasingly embraced the rhetoric of Aboriginal activism over restrained, neutral language, thus

sacrificing their need to appear to be impartial at all times.

In the Cowichan case the judge refused to use the constitutional and statutory term “Indian,” calling it harmful, thereby substituting her discretion for that of our

legislatures. She thanked Aboriginal witnesses with the word “Huychq’u”, which she omitted to translate for the benefit of others reading her decision. She didn’t

thank any Crown witnesses.

What seems like courtesy in in fact part of a larger pattern: judges in Aboriginal rights cases appearing to adopt the idiom, symbolism and worldview of the

Aboriginal litigant. From eagle staffs in the courtroom, to required participation in sweat lodge ceremonies, as in the Supreme Court-approved Restoule decision,

Canada’s justice system has drifted from impartial adjudication toward the appearance of ritualized, Aboriginal-cause solidarity.

The pivot began with the Supreme Court’s 1997 Delgamuukw v. British Columbia decision, which first accepted Aboriginal “oral tradition” hearsay evidence. Chief

Justice Lamer candidly asked in effect, “How can Aboriginals otherwise prove their case?” And with that question centuries of evidentiary safeguards intended

to ensure reliability vanished.

In Cowichan Justice Young acknowledged that oral tradition hearsay can be “subjective” and is often “not focused on establishing objective truth”, yet she

based much of her ruling on precisely such “evidence”.

The result: inherently unreliable hearsay elevated to gospel, speculation hardened into Aboriginal title, catastrophe caused to Richmond private and government property owners, the entire land titles systems of Canadian non-treaty areas undermined, and Crown sovereignty, the fount and source of all real property rights generally, further undermined.

Peter Best is a retired lawyer living in Sudbury, Ontario.

The original, full-length version of this article was recently published in C2C Journal.

-

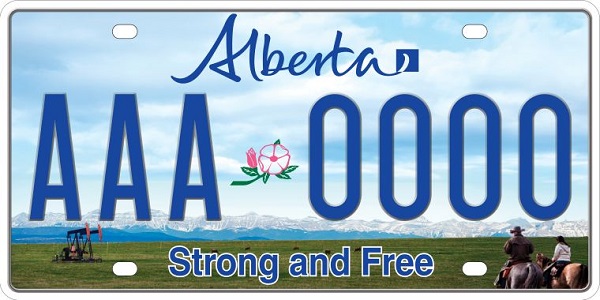

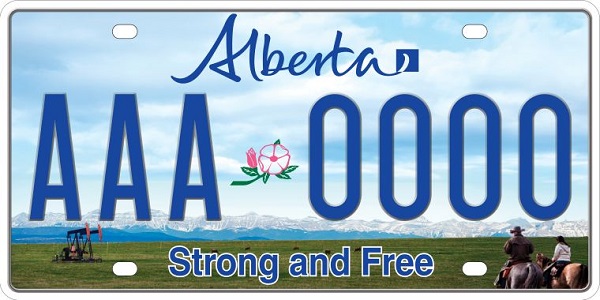

Alberta16 hours ago

Alberta16 hours agoClick here to help choose Alberta’s new licence plate design

-

National17 hours ago

National17 hours agoDemocracy Watch Renews Push for Independent Prosecutor in SNC-Lavalin Case

-

International2 days ago

International2 days agoPoland’s president signs new zero income tax law for parents with two children

-

Business18 hours ago

Business18 hours agoOver two thirds of Canadians say Ottawa should reduce size of federal bureaucracy

-

Automotive2 days ago

Automotive2 days ago$15 Billion, Zero Assurances: Stellantis Abandons Brampton as Trudeau-Era Green Deal Collapses

-

Business1 day ago

Business1 day agoTrump Admin Blows Up UN ‘Global Green New Scam’ Tax Push, Forcing Pullback

-

Business1 day ago

Business1 day agoTrump Blocks UN’s Back Door Carbon Tax

-

Business2 days ago

Business2 days agoFord’s Whisky War