From The Center Square

President Donald Trump signed several executive orders on nuclear energy Friday that Trump said would make the U.S. the “real power” in the industry.

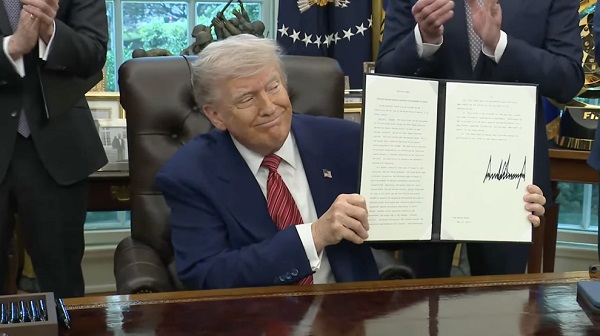

From the White House: President Trump Signs Executive Orders in the Oval Office, May 23, 2025

U.S. Secretary of the Interior Doug Burgum said the orders marked “a huge day for the nuclear industry,” enabling America to pursue nuclear innovation in ways it hasn’t done for decades.

“Mark this day on your calendar. This is going to turn the clock back on over 50 years of overregulation of the industry,” Burgum said.

Each of the executive orders addresses issues that have stifled the industry’s growth in the U.S. and in doing so, promote energy independence, Burgum said. A key priority of the Trump administration has been making America less dependent on foreign countries economically and in terms of energy production, as the administration sees American dependence on other countries as a national security vulnerability.

Assistant to the President and White House Staff Secretary Will Scharf explained each of the orders at the president’s signing session. Several focus mostly on peeling back regulations, while others activate new permissions or programs to spur industry growth.

One order centers on changes to the U.S. Nuclear Regulatory Commission.

“Before 1978, there were 133 reactors built in the United States. Since 1978, only two new commercial reactors have come online. That’s because of overregulation,” Scharf said.

In recalibrating the commission, the administration hopes to clear the way for the industry to expand to quadruple the current amount of nuclear power production within the next 25 years.

Another order, as others of Trump’s executive orders have done, invokes emergency powers through the Defense Production Act, expanding the president’s powers related to domestic industry. Both Trump and former President Joe Biden have invoked the Defense Production Act for national defense and emergency preparedness reasons throughout their terms.

In this case, it’s to “spur a closer collaboration with private industry to ensure that we have the fuel supplies we need for a modernized nuclear energy sector,” Scharf said. The order also aims to boost the development of a nuclear energy sector workforce, as well as some other key industry “building blocks.”

Another aims to speed up the permitting process for new types of nuclear technology like micro-reactors, small modular reactors, and Generation IV and Generation III+ reactors, which have “revolutionary potential,” according to the order. Within that goal, the order directs the establishment of a new pilot program for reactor construction with the target of having three reactors operating by July 4, 2026.

Several industry leaders were also present at the orders’ signing to affirm how they would accelerate growth for their companies.