Business

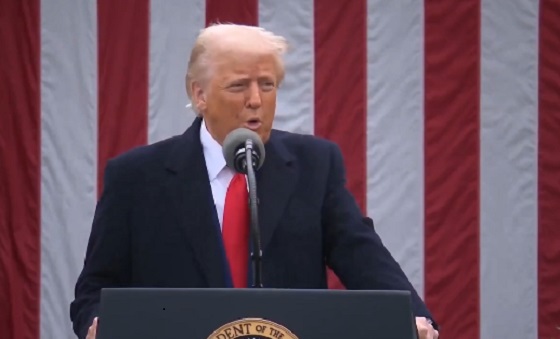

Trump raises China tariffs to 125%, announces 90-day pause for countries who’ve reached out to negotiate

MxM News

MxM News

Quick Hit:

On Wednesday, President Donald Trump announced an immediate increase in tariffs on China to 125%, citing “a lack of respect” toward global markets. At the same time, he approved a 90-day pause and tariff reduction for over 75 countries that have engaged with the U.S. on trade reforms.

Key Details:

-

Trump said the dramatic tariff hike on China is meant to send a clear message: “the days of ripping off the U.S.A., and other Countries, is no longer sustainable or acceptable.”

-

The president added that over 75 countries have reached out to the U.S. Departments of Commerce, Treasury, and the U.S. Trade Representative (USTR) to negotiate on issues including trade barriers, tariffs, and currency manipulation.

-

As a goodwill measure, Trump authorized “a 90 day PAUSE, and a substantially lowered Reciprocal Tariff during this period, of 10%, also effective immediately,” noting that these countries had not retaliated against the U.S. despite strong prior warnings.

Diving Deeper:

President Donald Trump on Wednesday took a major step in reshaping the global trade landscape, announcing via Truth Social that he is raising tariffs on China to 125% effective immediately. Trump attributed the decision to “the lack of respect that China has shown to the World’s Markets,” and said it is time for Beijing to face consequences for its trade practices.

“At some point, hopefully in the near future, China will realize that the days of ripping off the U.S.A., and other Countries, is no longer sustainable or acceptable,” Trump stated.

The president emphasized that this was not a blanket policy toward all trading partners. In contrast to China, Trump said more than 75 countries have reached out to American trade officials to address ongoing issues related to tariffs and trade barriers.

“More than 75 Countries have called Representatives of the United States, including the Departments of Commerce, Treasury, and the USTR, to negotiate a solution to the subjects being discussed relative to Trade, Trade Barriers, Tariffs, Currency Manipulation, and Non Monetary Tariffs,” he wrote.

Citing those discussions and the absence of retaliation against the U.S., Trump approved a temporary reduction in reciprocal tariffs for those countries. “I have authorized a 90 day PAUSE, and a substantially lowered Reciprocal Tariff during this period, of 10%, also effective immediately.”

The move reflects a two-pronged strategy—punishing China for what Trump sees as longstanding economic abuses while rewarding countries that have shown a willingness to work with the U.S. to level the playing field.

The 125% tariff marks one of the most aggressive steps in Trump’s America First trade doctrine, likely signaling to both allies and adversaries that a second Trump administration would continue its hardline economic policies.

Business

Bill Gates Gets Mugged By Reality

From the Daily Caller News Foundation

You’ve probably heard by now the blockbuster news that Microsoft founder Bill Gates, one of the richest people to ever walk the planet, has had a change of heart on climate change.

For several decades Gates poured billions of dollars into the climate industrial complex.

Some conservatives have sniffed that Bill Gates has shifted his position on climate change because he and Microsoft have invested heavily in energy intensive data centers.

AI and robotics will triple our electric power needs over the next 15 years. And you can’t get that from windmills.

What Bill Gates has done is courageous and praiseworthy. It’s not many people of his stature that will admit that they were wrong. Al Gore certainly hasn’t. My wife says I never do.

Although I’ve only once met Bill Gates, I’ve read his latest statements on global warming. He still endorses the need for communal action (which won’t work), but he has sensibly disassociated himself from the increasingly radical and economically destructive dictates from the green movement. For that, the left has tossed him out of their tent as a “traitor.”

I wish to highlight several critical insights that should be the starting point for constructive debate that every clear-minded thinker on either side of the issue should embrace.

(1) It’s time to put human welfare at the center of our climate policies. This includes improving agriculture and health in poor countries.

(2) Countries should be encouraged to grow their economies even if that means a reliance on fossil fuels like natural gas. Economic growth is essential to human progress.

(3) Although climate change will hurt poor people, for the vast majority of them it will not be the only or even the biggest threat to their lives and welfare. The biggest problems are poverty and disease.

I would add to these wise declarations two inconvenient truths: First: the solution to changing temperatures and weather patterns is technological progress. A far fewer percentage of people die of severe weather events today than 50 or 100 or 1,000 years ago.

Second, energy is the master resource and to deny people reliable and affordable energy is to keep them poor and vulnerable – and this is inhumane.

If Bill Gates were to start directing even a small fraction of his foundation funds to ensuring everyone on the planet has access to electric power and safe drinking water, it would do more for humanity than all of the hundreds of billions that governments and foundations have devoted to climate programs that have failed to change the globe’s temperature.

Stephen Moore is a co-founder of Unleash Prosperity and a former Trump senior economic advisor.

Automotive

Elon Musk Poised To Become World’s First Trillionaire After Shareholder Vote

From the Daily Caller News Foundation

At Tesla’s Austin headquarters, investors backed Musk’s 12-step plan that ties his potential trillion-dollar payout to a series of aggressive financial and operational milestones, including raising the company’s valuation from roughly $1.4 trillion to $8.5 trillion and selling one million humanoid robots within a decade. Musk hailed the outcome as a turning point for Tesla’s future.

“What we’re about to embark upon is not merely a new chapter of the future of Tesla but a whole new book,” Musk said, as The New York Times reported.

Dear Readers:

As a nonprofit, we are dependent on the generosity of our readers.

Please consider making a small donation of any amount here.

Thank you!

The decision cements investor confidence in Musk’s “moonshot” management style and reinforces the belief that Tesla’s success depends heavily on its founder and his leadership.

Tesla Annual meeting starting now

https://t.co/j1KHf3k6ch— Elon Musk (@elonmusk) November 6, 2025

“Those who claim the plan is ‘too large’ ignore the scale of ambition that has historically defined Tesla’s trajectory,” the Florida State Board of Administration said in a securities filing describing why it voted for Mr. Musk’s pay plan. “A company that went from near bankruptcy to global leadership in E.V.s and clean energy under similar frameworks has earned the right to use incentive models that reward moonshot performance.”

Investors like Ark Invest CEO Cathie Wood defended Tesla’s decision, saying the plan aligns shareholder rewards with company performance.

“I do not understand why investors are voting against Elon’s pay package when they and their clients would benefit enormously if he and his incredible team meet such high goals,” Wood wrote on X.

Norway’s sovereign wealth fund, Norges Bank Investment Management — one of Tesla’s largest shareholders — broke ranks, however, and voted against the pay plan, saying that the package was excessive.

“While we appreciate the significant value created under Mr. Musk’s visionary role, we are concerned about the total size of the award, dilution, and lack of mitigation of key person risk,” the firm said.

The vote comes months after Musk wrapped up his short-lived government role under President Donald Trump. In February, Musk and his Department of Government Efficiency (DOGE) team sparked a firestorm when they announced plans to eliminate the U.S. Agency for International Development, drawing backlash from Democrats and prompting protests targeting Musk and his companies, including Tesla.

Back in May, Musk announced that his “scheduled time” leading DOGE had ended.

-

Business1 day ago

Business1 day agoCarney budget doubles down on Trudeau-era policies

-

espionage2 days ago

espionage2 days agoU.S. Charges Three More Chinese Scholars in Wuhan Bio-Smuggling Case, Citing Pattern of Foreign Exploitation in American Research Labs

-

COVID-191 day ago

COVID-191 day agoCrown still working to put Lich and Barber in jail

-

Business1 day ago

Business1 day agoCarney’s Deficit Numbers Deserve Scrutiny After Trudeau’s Forecasting Failures

-

Business1 day ago

Business1 day agoCarney budget continues misguided ‘Build Canada Homes’ approach

-

International1 day ago

International1 day agoKazakhstan joins Abraham Accords, Trump says more nations lining up for peace

-

armed forces16 hours ago

armed forces16 hours agoIt’s time for Canada to remember, the heroes of Kapyong

-

Business1 day ago

Business1 day agoHere’s what pundits and analysts get wrong about the Carney government’s first budget