Banks

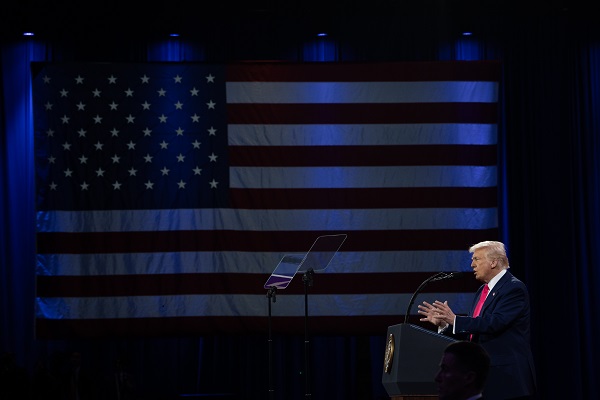

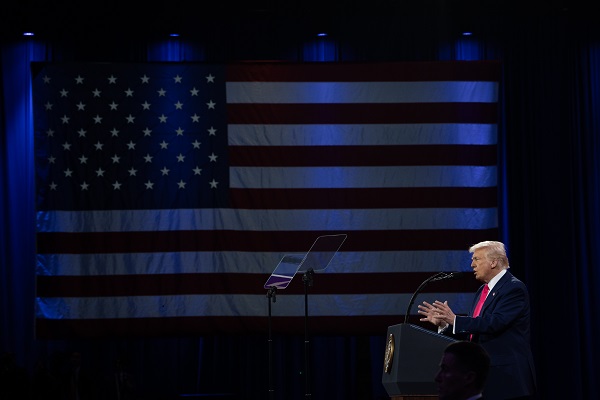

Trump admin preparing executive order to stop debanking of conservatives

From LifeSiteNews

The Trump administration is preparing an executive order to penalize institutions that “debank” Americans over their political views, a practice the president says he was personally subjected to.

The Wall Street Journal reports it has seen a draft of the order, which has not been finalized, that tells federal regulators to review financial institutions for potential violations of federal laws by dropping customers or denying service for “impermissible factors” such as political views and review and rescind any policies that might have played a role in doing so. “Violators could be subject to monetary penalties, consent decrees or other disciplinary measures,” or potentially even referred for prosecution in extreme cases, the Journal reports.

President Donald Trump recounted his own experience with the issue earlier this week during an interview on CNBC, during which he said that Bank of America CEO Brian Moynihan “was kissing my a– when I was president, and when I called him after I was president, to deposit $1 billion plus and a lot of other things… ‘no, we can’t do it.’ That’s because the banks discriminated against me very badly. And I was very good to the banks. I had the greatest economy in the history of our country when I was president. They discriminated against many conservatives.”

“The banking regulators do everything you can to destroy Trump. And that’s what they did. And guess what? I’m president. How did that happen?” he boasted.

When asked about the president’s comments, Moynihan said his company “has been working with the Treasury administration today in this administration trying to figure out how to get these roles balanced so that we’re not subject to this swinging back and forth” and insisted “we bank everybody,” but did not specifically address Trump’s claims about their interaction.

Over the past several years, there have been numerous instances of banks, credit card companies, and crowdfunding platforms cutting off services to conservative individuals and groups, thanks in large part to the influence of left-wing groups like the Southern Poverty Law Center and Anti-Defamation League and corporate trends such as ESG (environmental, societal, governance) scoring.

The Biden administration’s interest in centralized digital currency further intensified fears of a future in which Americans’ basic economic freedoms are tied to conformity with the views of those in power. Thanks in part to such overreaches by the previous Democrat administration, the United States is now widely perceived as being in the midst of a widespread political and cultural backlash against so-called “woke” ideology.

Agriculture

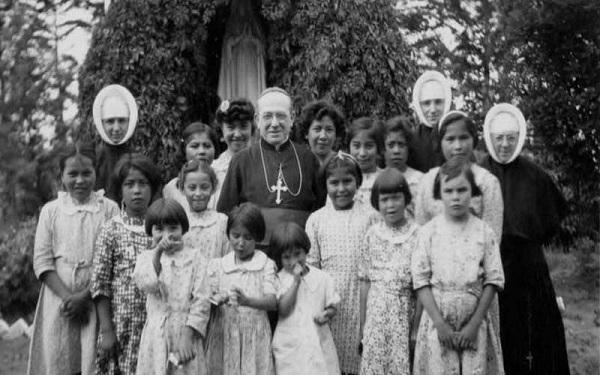

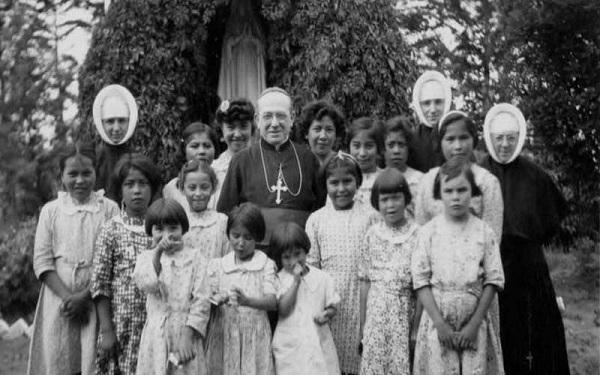

Federal cabinet calls for Canadian bank used primarily by white farmers to be more diverse

From LifeSiteNews

A finance department review suggested women, youth, Indigenous, LGBTQ, Black and racialized entrepreneurs are underserved by Farm Credit Canada.

The Cabinet of Prime Minister Mark Carney said in a note that a Canadian Crown bank mostly used by farmers is too “white” and not diverse enough in its lending to “traditionally underrepresented groups” such as LGBT minorities.

Farm Credit Canada Regina, in Saskatchewan, is used by thousands of farmers, yet federal cabinet overseers claim its loan portfolio needs greater diversity.

The finance department note, which aims to make amendments to the Farm Credit Canada Act, claims that agriculture is “predominantly older white men.”

Proposed changes to the Act mean the government will mandate “regular legislative reviews to ensure alignment with the needs of the agriculture and agri-food sector.”

“Farm operators are predominantly older white men and farm families tend to have higher average incomes compared to all Canadians,” the note reads.

“Traditionally underrepresented groups such as women, youth, Indigenous, LGBTQ, and Black and racialized entrepreneurs may particularly benefit from regular legislative reviews to better enable Farm Credit Canada to align its activities with their specific needs.”

The text includes no legal amendment, and the finance department did not say why it was brought forward or who asked for the changes.

Canadian census data shows that there are only 590,710 farmers and their families, a number that keeps going down. The average farmer is a 55-year-old male and predominantly Christian, either Catholic or from the United Church.

Data shows that 6.9 percent of farmers are immigrants, with about 3.7 percent being “from racialized groups.”

National census data from 2021 indicates that about four percent of Canadians say they are LGBT; however, those who are farmers is not stated.

Historically, most farmers in Canada are multi-generational descendants of Christian/Catholic Europeans who came to Canada in the mid to late 1800s, mainly from the United Kingdom, Ireland, Ukraine, Russia, Italy, Poland, the Netherlands, Germany, and France.

Banks

Bank of Canada Cuts Rates to 2.25%, Warns of Structural Economic Damage

Governor Tiff Macklem concedes the downturn runs deeper than a business cycle, citing trade wars, weak investment, and fading population growth as permanent drags on Canada’s economy.

In an extraordinary press conference on October 29th, 2025, Bank of Canada Governor Tiff Macklem stood before reporters in Ottawa and calmly described what most Canadians have already been feeling for months: the economy is unraveling. But don’t expect him to say it in plain language. The central bank’s message was buried beneath bureaucratic doublespeak, carefully manicured forecasts, and bilingual spin. Strip that all away, and here’s what’s really going on: the Canadian economy has been gutted by a combination of political mismanagement, trade dependence, and a collapsing growth model based on mass immigration. The central bank knows it. The data proves it. And yet no one dares to say the quiet part out loud.

Start with the headline: the Bank of Canada cut interest rates by 25 basis points, bringing the policy rate down to 2.25%, its second consecutive cut and part of a 100 basis point easing campaign this year. That alone should tell you something is wrong. You don’t slash rates in a healthy economy. You do it when there’s pain. And there is. Canada’s GDP contracted by 1.6% in the second quarter of 2025. Exports are collapsing, investment is weak, and the unemployment rate is stuck at 7.1%, the highest non-pandemic level since 2016.

Macklem admitted it: “This is more than a cyclical downturn. It’s a structural adjustment. The U.S. trade conflict has diminished Canada’s economic prospects. The structural damage caused by tariffs is reducing the productive capacity of the economy.” That’s not just spin—that’s an admission of failure. A major trading nation like Canada has built its economic engine around exports, and now, thanks to years of reckless dependence on U.S. markets and zero effort to diversify, it’s all coming apart.

And don’t miss the implications of that phrase “structural adjustment.” It means the damage is permanent. Not temporary. Not fixable with a couple of rate cuts. Permanent. In fact, the Bank’s own Monetary Policy Report says that by the end of 2026, GDP will be 1.5% lower than it was forecast back in January. Half of that hit comes from a loss in potential output. The other half is just plain weak demand. And the reason that demand is weak? Because the federal government is finally dialing back the immigration faucet it’s been using for years to artificially inflate GDP growth.

The Bank doesn’t call it “propping up” GDP. But the facts are unavoidable. In its MPR, the Bank explicitly ties the coming consumption slowdown to a sharp drop in population growth: “Population growth is a key factor behind this expected slowdown, driven by government policies designed to reduce the inflow of newcomers. Population growth is assumed to slow to average 0.5% over 2026 and 2027.” That’s down from 3.3% just a year ago. So what was driving GDP all this time? People. Not productivity. Not innovation. Not exports. People.

And now that the government has finally acknowledged the political backlash of dumping half a million new residents a year into an overstretched housing market, the so-called “growth” is vanishing. It wasn’t real. It was demographic window dressing. Macklem admitted as much during the press conference when he said: “If you’ve got fewer new consumers in the economy, you’re going to get less consumption growth.” That’s about as close as a central banker gets to saying: we were faking it.

And yet despite all of this, the Bank still clings to its bureaucratic playbook. When asked whether Canada is heading into a recession, Macklem hedged: “Our outlook has growth resuming… but we expect that growth to be very modest… We could get two negative quarters. That’s not our forecast, but we can’t rule it out.” Translation: It’s already here, but we’re not going to admit it until StatsCan confirms it six months late.

Worse still, when reporters pressed him on what could lift the economy out of the ditch, he passed the buck. “Monetary policy can’t undo the damage caused by tariffs. It can’t target the hard-hit sectors. It can’t find new markets for companies. It can’t reconfigure supply chains.” So what can it do? “Mitigate spillovers,” Macklem says. That’s central banker code for “stand back and pray.”

So where’s the recovery supposed to come from? The Bank pins its hopes on a moderate rebound in exports, a bit of resilience in household consumption, and “ongoing government spending.” There it is. More public sector lifelines. More debt. More Ottawa Band-Aids.

And looming behind all of this is the elephant in the room: U.S. trade policy. The Bank explicitly warns that the situation could worsen depending on the outcome of next year’s U.S. election. The MPR highlights that tariffs are already cutting into Canadian income, raising business costs, and eliminating entire trade-dependent sectors. Governor Macklem put it plainly: “Unless something else changes, our incomes will be lower than they otherwise would have been.”

Canadians should be furious. For years, we were told everything was fine. That our economy was “resilient.” That inflation was “transitory.” That population growth would solve all our problems. Now we’re being told the economy is structurally impaired, trade-dependent to a fault, and stuck with weak per-capita growth, high unemployment, and sticky core inflation between 2.5–3%. And the people responsible for this mess? They’ve either resigned (Trudeau), failed upward (Carney), or still refuse to admit they spent a decade selling us a fantasy.

This isn’t just bad economics. It’s political malpractice.

Canada isn’t failing because of interest rates or some mysterious global volatility. It’s failing because of deliberate choices—trade dependence, mass immigration without infrastructure, and a refusal to confront reality. The central bank sees the iceberg. They’re easing the throttle. But the ship has already taken on water. And no one at the helm seems willing to turn the wheel.

So here’s the truth: The Bank of Canada just rang the alarm bell. Quietly. Cautiously. But clearly. The illusion is over. The fake growth era is ending. And the reckoning has begun.

-

COVID-1918 hours ago

COVID-1918 hours agoNew report warns Ottawa’s ‘nudge’ unit erodes democracy and public trust

-

Great Reset2 days ago

Great Reset2 days agoEXCLUSIVE: A Provincial RCMP Veterans’ Association IS TARGETING VETERANS with Euthanasia

-

Daily Caller2 days ago

Daily Caller2 days agoSpreading Sedition? Media Defends Democrats Calling On Soldiers And Officers To Defy Chain Of Command

-

Crime1 day ago

Crime1 day agoHow Global Organized Crime Took Root In Canada

-

Digital ID2 days ago

Digital ID2 days agoLeslyn Lewis urges fellow MPs to oppose Liberal push for mandatory digital IDs

-

Business2 days ago

Business2 days agoThe Payout Path For Indigenous Claims Is Now National Policy

-

Energy1 day ago

Energy1 day agoExpanding Canadian energy production could help lower global emissions

-

Business1 day ago

Business1 day agoThe numbers Canada uses to set policy don’t add up