Inflation

Trudeau’s carbon tax rebrand lipstick on a pig

From the Canadian Taxpayers Federation

Author: Franco Terrazzano

the Liberals are now calling it the ‘Canada Carbon Rebate.’

The Canadian Taxpayers Federation is criticizing the federal government for rebranding its carbon tax rebate instead of providing relief by scrapping the tax altogether.

“Prime Minister Justin Trudeau’s carbon tax rebrand is just lipstick on a pig,” said Franco Terrazzano, CTF Federal Director. “Canadians need tax relief, not a snappy new slogan that won’t do anything to make life more affordable.”

“The federal government is rebranding the carbon tax rebate,” reported CTV News today. “Previously known as the Climate Action Incentive Payment, the Liberals are now calling it the ‘Canada Carbon Rebate.’

“The change does not come with any adjustments to how the federal fuel charge system and corresponding refund actually works.”

The carbon tax will cost the average family up to $710 this year even after the rebates, according to the Parliamentary Budget Officer.

The federal government is increasing the carbon tax again on April 1. After the hike, the carbon tax will cost 17 cents per litre of gasoline, 21 cents per litre of diesel and 15 cents per cubic metre of natural gas.

“Trudeau’s real problem isn’t that Canadians don’t know what his government is doing, Trudeau’s real problem is that Canadians know his carbon tax is making life more expensive,” Terrazzano said. “Instead of a rebrand, Trudeau should scrap the carbon tax to provide real relief.”

Business

White House declares inflation era OVER after shock report

The White House on Thursday declared a decisive turn in the inflation fight, pointing to new data showing core inflation has fallen to its lowest level in nearly five years — a milestone the administration says validates President Donald Trump’s economic reset after inheriting what it calls a historic cost-of-living crisis from the Biden era. In a statement accompanying the report, White House Press Secretary Karoline Leavitt said inflation “came in far lower than market expectations,” drawing a sharp contrast with the 9 percent peak under President Joe Biden and arguing the numbers reflect sustained relief for American households. “Core inflation is at a new multi-year low, as prices for groceries, medicine, gas, airfare, car rentals, and hotels keep falling,” Leavitt said, adding that lower prices and rising paychecks are expected to continue into the new year.

According to the White House, core inflation — widely viewed by economists as the most reliable gauge because it strips out volatile food and energy costs — is now down roughly 70 percent from its Biden-era high. Officials noted that if inflation continues at the pace of the last two months, it would be running at an annualized rate of about 1.2 percent, well below the Federal Reserve’s 2 percent target. The report also highlighted broad-based price moderation across consumer staples and services, with declines in groceries, dairy, fruits and vegetables, prescription drugs, clothing, airfares, natural gas, car and truck rentals, and hotel prices. Average gas prices have fallen to multi-year lows, while rent inflation has dropped to its lowest level since October 2021, a shift the administration attributes in part to tougher enforcement against illegal immigration and reduced pressure on housing demand.

Wages, the White House says, are rising alongside easing prices. Private-sector workers are on track to see real wages increase by about $1,300 in President Trump’s first full year back in office, clawing back purchasing power lost during the inflation surge of the previous administration. Gains are strongest among blue-collar workers, with annualized real earnings up roughly $1,800 for construction workers and $1,600 for manufacturing employees. Administration officials also took aim at critics who warned Trump’s tariff policies would reignite inflation, arguing the data shows no demonstrable inflationary impact despite repeated predictions from Wall Street and academic economists.

NEC Director Kevin Hassett on the latest inflation report: "It was just an absolute blockbuster report… We looked at 61 forecasts, and this number came in better than every single one of them." 🔥 pic.twitter.com/rBJpkmjuNa

— Rapid Response 47 (@RapidResponse47) December 18, 2025

Even commentators across the media spectrum acknowledged the strength of the report. CNBC’s Steve Liesman called it “a very good number,” while CNN’s Matt Egan said it was “another step in the right direction.” Harvard economist Ken Rogoff described the reading as “a better number than anyone was expecting,” adding, “There’s no other way to spin it.” Bloomberg’s Chris Anstey noted the figure came in two-tenths below the lowest estimate in a survey of 62 economists, calling it “remarkable,” while The Washington Post’s Andrew Ackerman wrote that inflation “cooled unexpectedly,” easing pressure on household budgets.

For the White House, the message was blunt: the inflation era is over. Officials framed Thursday’s report as proof that Trump has followed through on his promise to defeat the cost-of-living crisis he inherited, laying what they called the groundwork for a strong year ahead. As the president told the nation this week, the administration insists the progress is real — and that, in his words, the best is yet to come.

Business

Taxpayers paying wages and benefits for 30% of all jobs created over the last 10 years

From the Fraser Institute

By Jason Childs

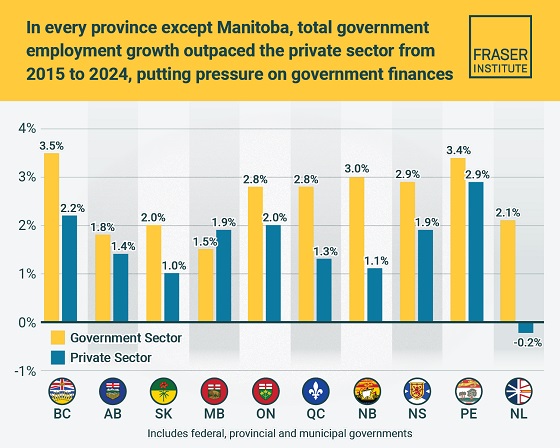

From 2015 to 2024, the government sector in Canada—including federal, provincial and municipal—added 950,000 jobs, which accounted for roughly 30 per cent of total employment growth in the country, finds a new study published today by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“In Canada, employment in the government sector has skyrocketed over the last 10 years,” said Jason Childs, a professor of economics at the University of Regina, senior fellow at the Fraser Institute and author of Examining the Growth of Public-Sector Employment Since 2015.

Over the same 10-year period (2015-2024), government-sector employment grew at an annual average rate of 2.7 per cent compared to only 1.7 per cent for the private sector. The study also examines employment growth by province. Government employment (federal, provincial, municipal) grew at a higher annual rate than the private sector in every province except Manitoba over the 10-year period.

The largest gaps between government-sector employment growth compared to the private sector were in Newfoundland and Labrador, New Brunswick, Quebec and British Columbia. The smallest gaps were in Alberta and Prince Edward Island.

“The larger government’s share of employment, the greater the ultimate burden on taxpayers to support government workers—government does not pay for itself,” Childs said.

A related study (Measuring the Cost to Canadians from the Growth in Public Administration, also authored by Childs) finds that, from 2015 to 2024, across all levels of government in Canada, the number of public administrators (many of who

work in government ministries, agencies and other offices that do not directly provide services to the public) grew by more than 328,000—or 3.5 per cent annually (on average).

“If governments want to reduce costs, they should look closely at the size of their public administration,” Childs said.

Examining the Growth of Public Sector Employment Since 2015

-

Business4 hours ago

Business4 hours agoICYMI: Largest fraud in US history? Independent Journalist visits numerous daycare centres with no children, revealing massive scam

-

Daily Caller1 day ago

Daily Caller1 day agoUS Halts Construction of Five Offshore Wind Projects Due To National Security

-

Daily Caller1 day ago

Daily Caller1 day agoWhile Western Nations Cling to Energy Transition, Pragmatic Nations Produce Energy and Wealth

-

Alberta1 day ago

Alberta1 day agoAlberta Next Panel calls for less Ottawa—and it could pay off

-

Fraser Institute2 days ago

Fraser Institute2 days agoCarney government sowing seeds for corruption in Ottawa

-

Bruce Dowbiggin1 day ago

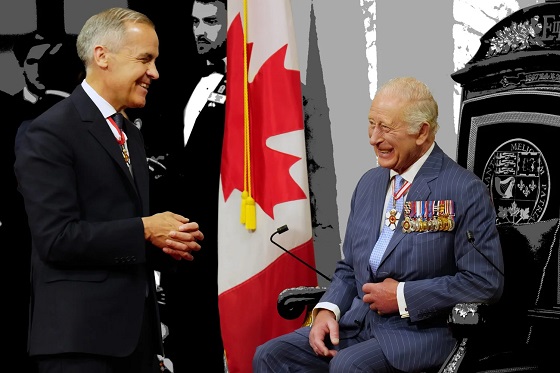

Bruce Dowbiggin1 day agoBe Careful What You Wish For In 2026: Mark Carney With A Majority

-

Energy2 days ago

Energy2 days agoWhy Japan wants Western Canadian LNG

-

Frontier Centre for Public Policy2 days ago

Frontier Centre for Public Policy2 days agoTent Cities Were Rare Five Years Ago. Now They’re Everywhere