Fraser Institute

Trudeau and Ford should attach personal fortunes to EV corporate welfare

From the Fraser Institute

By Jason Clemens and Tegan Hill

Last week, with their latest tranche of corporate welfare for the electric vehicle (EV) sector, the Trudeau and Ford governments announced a $5.0 billion subsidy for Honda to help build an EV battery plant and ultimately manufacture EVs in Ontario. Here’s a challenge: if politicians in both governments truly believe these measures are in the public interest, they should tie their personal fortunes with the outcomes of these subsidies (a.k.a. corporate welfare).

One of the major challenges with corporate welfare is the horrendous economic incentives. The politicians and bureaucrats who distribute corporate welfare have no vested financial interest in the outcome of the program. Whether these programs are spectacularly successful (or more likely spectacular failures), the politicians and bureaucrats experience no direct financial gain or loss. Simply put, they’re investing taxpayer money, not their own.

Put differently, the discipline imposed on investors in private markets, such as the risk of losing money or even going out of business, is wholly absent in the government sector. Indeed, the history of corporate welfare in Canada, at both the federal and provincial levels, is rife with abject failures due in large measure to the absence of this investing discipline.

In the last 12 months in Ontario, automakers have been major beneficiaries of corporate welfare. The $5.0 billion for Honda is on top of $13.2 billion to Volkswagen and $15.0 billion to Stellantis. That equates to roughly $979 per taxpayer nationally for federal subsidies and an additional $1,372 for Ontario taxpayers. And these figures do not include the debt interest costs that will be incurred as both governments are borrowing money to finance the subsidies.

And there’s legitimate reason to be skeptical already of the potential success of these largescale industrial interventions by the federal (Liberal) and Ontario (Conservative) governments. EV sales in both Canada and the United States have not grown as expected by governments despite purchase subsidies. Disappointing EV sales have led several auto manufacturers including Toyota and Ford to scale-back their EV production plans.

There are also real concerns about the practical ability of EV manufacturers to secure required materials. Consider the minerals needed for EV batteries. According to a recent study, 388 new mines—including 50 lithium mines, 60 nickel mines and 17 cobalt mines—would be required by 2030 to meet EV adoption commitments by various governments. For perspective, there were a total of 340 metal mines operating across Canada and the U.S. in 2021. The massive task of finding, constructing and developing this level of new mines seems impractical and unattainable, meaning that EV plants being built now will struggle to secure needed inputs. Indeed, depending on the type of mine, it takes anywhere from six to 18 years to develop.

Which brings us back to the Trudeau and Ford governments. Given the economic incentive problems and practical challenges to a large-scale transition to EVs, would members of the Trudeau and Ford governments—including the prime minister and premier—want to attach a portion of their personal pensions to the success of these corporate welfare programs?

More specifically, assume an arrangement whereby those politicians would share the benefits of the program’s success but also share any losses through the value of their pensions. If the programs work as marketed, the politicians would enjoy higher valued pensions. But if the programs disappoint or even fail, their pensions would be reduced or even cancelled. Would these politicians still support billions in corporate handouts if their personal financial wellbeing was tied to the outcomes?

As the funding of private companies to develop the EV sector in Ontario continues with the support of taxpayer subsidies, Ontarians and all Canadians should consider the misalignment of economic incentives underpinning these subsidies and the practical challenges to the success of this industrial intervention.

Authors:

Business

Prairie provinces and Newfoundland and Labrador see largest increases in size of government

From the Fraser Institute

By Jake Fuss and Grady Munro

A recent study found that Canada has experienced one of the largest increases in the size of government of any advanced country over the last decade. But within Canada, which provinces have led the way?

The size of government refers to the extent to which resources within the economy are controlled and directed by the government, and has important implications for economic growth, living standards, and economic freedom—the degree to which people are allowed to make their own economic choices.

Too much of anything can be harmful, and this is certainly true regarding the size of government. When government grows too large it begins to take on roles and resources that are better left to the private sector. For example, rather than focusing on core functions like maintaining the rule of law or national defence, a government that has grown too large might begin subsidizing certain businesses and industries over others (i.e. corporate welfare) in order to pick winners and losers in the market. As a result, economic growth slows and living standards are lower than they otherwise would be.

One way to measure the size of government is by calculating total general government spending as a share of the economy (GDP). General government spending refers to spending by governments at all levels (federal, provincial, and municipal), and by measuring this as a share of gross domestic product (GDP) we can compare across jurisdictions of different sizes.

A recent study compared the size of government in Canada as a whole with that of 39 other advanced economies worldwide, and found that Canada experienced the second-largest increase in the size of government (as a share of the economy) from 2014 to 2024. In other words, since 2014, governments in Canada have expanded their role within the economy faster than governments in virtually every other advanced country worldwide—including all other countries within the Group of Seven (France, Germany, Italy, Japan, the United Kingdom, and the United States). Moreover, the study showed that Canada as a whole has exceeded the optimal size of government (estimated to fall between 24 and 32 per cent of GDP) at which a country can maximize their economic growth. Beyond that point, growth slows and is lower than it otherwise would be.

However, Canada is a decentralized country and provinces vary as to the extent to which governments direct overall economic activity. Using data from Statistics Canada, the following charts illustrate which provinces in Canada have the largest size of government and which have seen the largest increases since 2014.

The chart above shows total general government spending as a share of GDP for all ten provinces in 2023 (the latest year of available provincial data). The size of government in the provinces varies considerably, ranging from a high of 61.4 per cent in Nova Scotia to a low of 30.0 per cent in Alberta. There are geographical differences, as three Atlantic provinces (Nova Scotia, Prince Edward Island, and New Brunswick) have the largest governments while the three western-most provinces (Alberta, Saskatchewan, and British Columbia) have the smallest governments. However, as of 2023, all provinces except Alberta exceeded the optimal size of government—which again, is between 24 and 32 per cent of the economy.

To show which provinces have experienced the greatest increase in the size of government in recent years, the second chart shows the percentage point increase in total general government spending as a share of GDP from 2014 to 2023. It should be noted that this is measuring the expansion of the federal government’s role in the economy—which has been substantial nationwide—as well as growth in the respective provincial and municipal governments.

The increases in the size of government since 2014 are largest in four provinces: Newfoundland and Labrador (10.82 percentage points), Alberta (7.94 percentage points), Saskatchewan (7.31 percentage points), and Manitoba (7.17 percentage points). These are all dramatic increases—for perspective, in the study referenced above, Estonia’s 6.66 percentage point increase in its size of government was the largest out of 40 advanced countries.

The remaining six provinces experienced far lower increases in the size of government, ranging from a 2.74 percentage point increase in B.C. to a 0.44 percentage point increase in Quebec. However, since 2014, every province in Canada has seen government expand its role within the economy.

Over the last decade, Canada has experienced a substantial increase in the size of total government. Within the country, Newfoundland and Labrador and the three Prairie provinces have led the way in growing their respective governments.

Alberta

Alberta government records $8.3 billion surplus—but the good times may soon end

From the Fraser Institute

By Tegan Hill

According to last week’s fiscal update, the Smith government recorded a $8.3 billion surplus in 2024/25—$8 billion more than what the government projected in its original 2024 budget. But the good times won’t last forever.

Due largely to population growth, personal income tax revenue exceeded budget projections by $500 million. Business tax revenue exceeded budget expectations by $1.1 billion. And critically, thanks to relatively strong oil prices, resource revenue (e.g. oil and gas royalties) saw a $4.7 billion jump.

The large budget surplus is good news, particularly as it will be used to pay down government debt (which taxpayers must ultimately finance) and to invest for the future. But again, the good times could soon be over.

Recall, the Alberta government incurred a $17.0 billion budget deficit just a few years ago in 2020/21. And it wasn’t only due to COVID—until the recent string of surpluses, the government ran deficits almost every year since 2008/09, racking up significant amounts of debt, which still largely persists today. As a result, provincial government debt interest payments cost each Albertan $658 in 2024/25. Moreover, in February’s budget, the Smith government projected more deficits over the next three years.

Generally, Alberta’s fiscal fortunes follow the price of oil. Over the past decade, for example, resource revenue has been as low as $2.8 billion in 2015/16, while oil prices slumped to $US45.00 per barrel, and as high as $25.2 billion in 2022/23, when oil prices jumped to $US89.69 per barrel.

Put simply, resource revenue volatility fuels Alberta’s boom-and-bust cycle. In 2025/26, the West Texas Intermediate oil price will be a projected $US68.00 per barrel with projected resource revenue falling by $4.9 billion year-over-year.

But oil prices don’t need to dictate Alberta’s fiscal fortune. Indeed, if the Smith government restrains its spending, it can avoid deficits even when resource revenues fall.

There are plenty of ways to rein in spending. For instance, the government spends billions of dollars in subsidies (a.k.a. corporate welfare) to select industries and businesses in Alberta every year despite a significant body of research that shows these subsidies fail to generate widespread economic benefit. Eliminating these subsidies is a clear first step to deliver significant savings.

The budget surplus is undoubtedly positive for Albertans, but the good times could soon come to an end. To avoid deficits and debt accumulation moving forward, the Smith government should rein in spending.

-

COVID-192 days ago

COVID-192 days agoTop COVID doctor given one of Canada’s highest honors

-

Alberta1 day ago

Alberta1 day agoAlberta government records $8.3 billion surplus—but the good times may soon end

-

International2 days ago

International2 days agoWoman wins settlement after YMCA banned her for complaining about man in girls’ locker room

-

Opinion2 days ago

Opinion2 days agoBlind to the Left: Canada’s Counter-Extremism Failure Leaves Neo-Marxist and Islamist Threats Unchecked

-

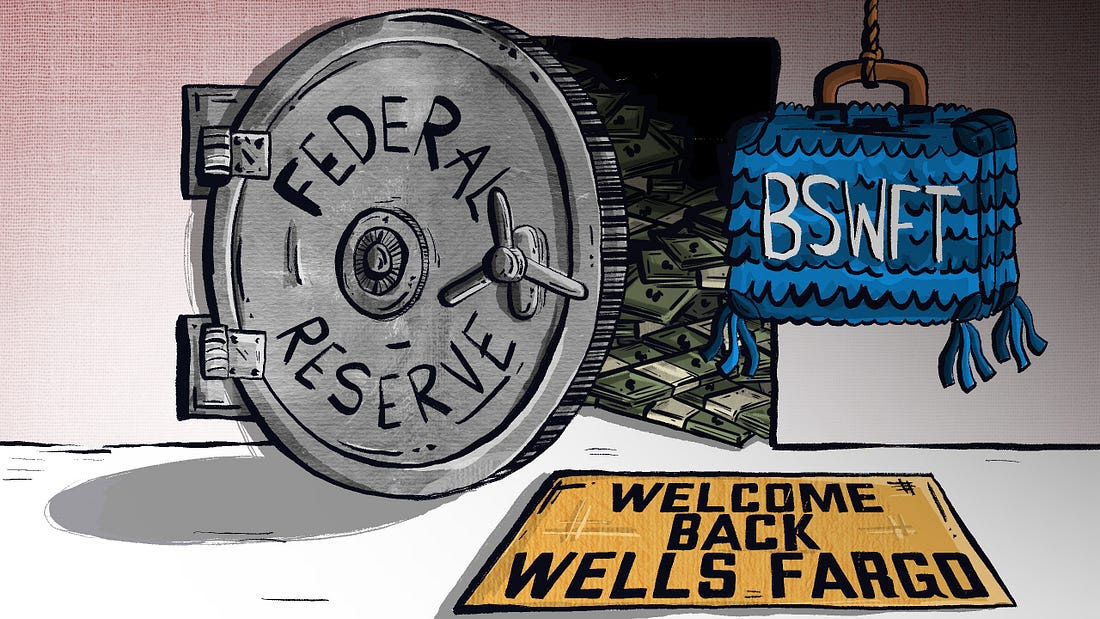

Banks2 days ago

Banks2 days agoWelcome Back, Wells Fargo!

-

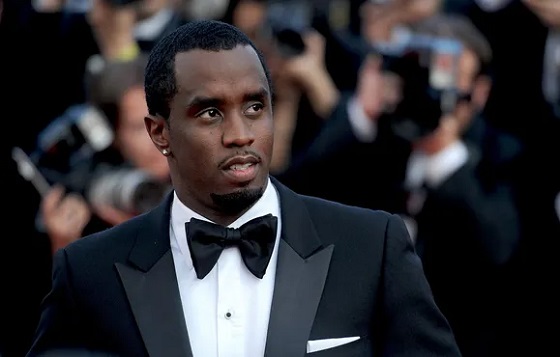

MxM News1 day ago

MxM News1 day agoDiddy found not guilty of trafficking, faces prison on lesser charge

-

Bruce Dowbiggin1 day ago

Bruce Dowbiggin1 day agoCanada Day 2025: It’s Time For Boomers To Let The Kids Lead

-

Also Interesting1 day ago

Also Interesting1 day agoEndorphina Slots: High-Quality Games Now at Zoome Casino Canada