Fraser Institute

Trudeau and Ford should attach personal fortunes to EV corporate welfare

From the Fraser Institute

By Jason Clemens and Tegan Hill

Last week, with their latest tranche of corporate welfare for the electric vehicle (EV) sector, the Trudeau and Ford governments announced a $5.0 billion subsidy for Honda to help build an EV battery plant and ultimately manufacture EVs in Ontario. Here’s a challenge: if politicians in both governments truly believe these measures are in the public interest, they should tie their personal fortunes with the outcomes of these subsidies (a.k.a. corporate welfare).

One of the major challenges with corporate welfare is the horrendous economic incentives. The politicians and bureaucrats who distribute corporate welfare have no vested financial interest in the outcome of the program. Whether these programs are spectacularly successful (or more likely spectacular failures), the politicians and bureaucrats experience no direct financial gain or loss. Simply put, they’re investing taxpayer money, not their own.

Put differently, the discipline imposed on investors in private markets, such as the risk of losing money or even going out of business, is wholly absent in the government sector. Indeed, the history of corporate welfare in Canada, at both the federal and provincial levels, is rife with abject failures due in large measure to the absence of this investing discipline.

In the last 12 months in Ontario, automakers have been major beneficiaries of corporate welfare. The $5.0 billion for Honda is on top of $13.2 billion to Volkswagen and $15.0 billion to Stellantis. That equates to roughly $979 per taxpayer nationally for federal subsidies and an additional $1,372 for Ontario taxpayers. And these figures do not include the debt interest costs that will be incurred as both governments are borrowing money to finance the subsidies.

And there’s legitimate reason to be skeptical already of the potential success of these largescale industrial interventions by the federal (Liberal) and Ontario (Conservative) governments. EV sales in both Canada and the United States have not grown as expected by governments despite purchase subsidies. Disappointing EV sales have led several auto manufacturers including Toyota and Ford to scale-back their EV production plans.

There are also real concerns about the practical ability of EV manufacturers to secure required materials. Consider the minerals needed for EV batteries. According to a recent study, 388 new mines—including 50 lithium mines, 60 nickel mines and 17 cobalt mines—would be required by 2030 to meet EV adoption commitments by various governments. For perspective, there were a total of 340 metal mines operating across Canada and the U.S. in 2021. The massive task of finding, constructing and developing this level of new mines seems impractical and unattainable, meaning that EV plants being built now will struggle to secure needed inputs. Indeed, depending on the type of mine, it takes anywhere from six to 18 years to develop.

Which brings us back to the Trudeau and Ford governments. Given the economic incentive problems and practical challenges to a large-scale transition to EVs, would members of the Trudeau and Ford governments—including the prime minister and premier—want to attach a portion of their personal pensions to the success of these corporate welfare programs?

More specifically, assume an arrangement whereby those politicians would share the benefits of the program’s success but also share any losses through the value of their pensions. If the programs work as marketed, the politicians would enjoy higher valued pensions. But if the programs disappoint or even fail, their pensions would be reduced or even cancelled. Would these politicians still support billions in corporate handouts if their personal financial wellbeing was tied to the outcomes?

As the funding of private companies to develop the EV sector in Ontario continues with the support of taxpayer subsidies, Ontarians and all Canadians should consider the misalignment of economic incentives underpinning these subsidies and the practical challenges to the success of this industrial intervention.

Authors:

Alberta

Alberta Next Panel calls for less Ottawa—and it could pay off

From the Fraser Institute

By Tegan Hill

Last Friday, less than a week before Christmas, the Smith government quietly released the final report from its Alberta Next Panel, which assessed Alberta’s role in Canada. Among other things, the panel recommends that the federal government transfer some of its tax revenue to provincial governments so they can assume more control over the delivery of provincial services. Based on Canada’s experience in the 1990s, this plan could deliver real benefits for Albertans and all Canadians.

Federations such as Canada typically work best when governments stick to their constitutional lanes. Indeed, one of the benefits of being a federalist country is that different levels of government assume responsibility for programs they’re best suited to deliver. For example, it’s logical that the federal government handle national defence, while provincial governments are typically best positioned to understand and address the unique health-care and education needs of their citizens.

But there’s currently a mismatch between the share of taxes the provinces collect and the cost of delivering provincial responsibilities (e.g. health care, education, childcare, and social services). As such, Ottawa uses transfers—including the Canada Health Transfer (CHT)—to financially support the provinces in their areas of responsibility. But these funds come with conditions.

Consider health care. To receive CHT payments from Ottawa, provinces must abide by the Canada Health Act, which effectively prevents the provinces from experimenting with new ways of delivering and financing health care—including policies that are successful in other universal health-care countries. Given Canada’s health-care system is one of the developed world’s most expensive universal systems, yet Canadians face some of the longest wait times for physicians and worst access to medical technology (e.g. MRIs) and hospital beds, these restrictions limit badly needed innovation and hurt patients.

To give the provinces more flexibility, the Alberta Next Panel suggests the federal government shift tax points (and transfer GST) to the provinces to better align provincial revenues with provincial responsibilities while eliminating “strings” attached to such federal transfers. In other words, Ottawa would transfer a portion of its tax revenues from the federal income tax and federal sales tax to the provincial government so they have funds to experiment with what works best for their citizens, without conditions on how that money can be used.

According to the Alberta Next Panel poll, at least in Alberta, a majority of citizens support this type of provincial autonomy in delivering provincial programs—and again, it’s paid off before.

In the 1990s, amid a fiscal crisis (greater in scale, but not dissimilar to the one Ottawa faces today), the federal government reduced welfare and social assistance transfers to the provinces while simultaneously removing most of the “strings” attached to these dollars. These reforms allowed the provinces to introduce work incentives, for example, which would have previously triggered a reduction in federal transfers. The change to federal transfers sparked a wave of reforms as the provinces experimented with new ways to improve their welfare programs, and ultimately led to significant innovation that reduced welfare dependency from a high of 3.1 million in 1994 to a low of 1.6 million in 2008, while also reducing government spending on social assistance.

The Smith government’s Alberta Next Panel wants the federal government to transfer some of its tax revenues to the provinces and reduce restrictions on provincial program delivery. As Canada’s experience in the 1990s shows, this could spur real innovation that ultimately improves services for Albertans and all Canadians.

Fraser Institute

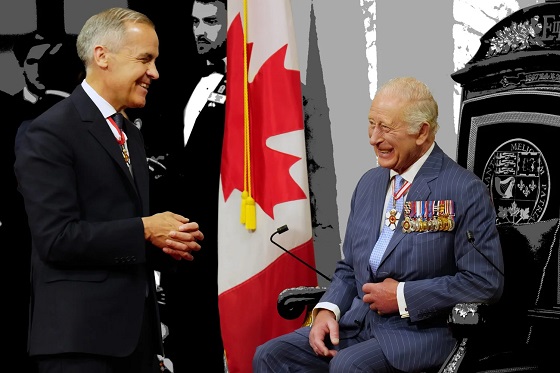

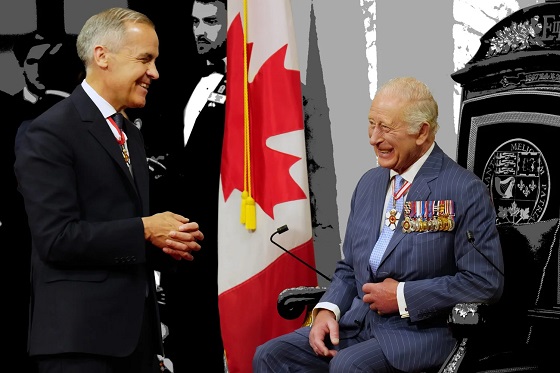

Carney government sowing seeds for corruption in Ottawa

From the Fraser Institute

By Jason Clemens and Niels Veldhuis

A number of pundits and commentators have observed the self-confidence and near-unilateralist approach of our prime minister, Mark Carney. The seemingly boundless self-assurance of the prime minister in his own abilities to do the right thing has produced legislation that sets the foundation for corruption.

Consider the Carney government’s signature legislation, known as the Building Canada Act (Bill C-5), which among other things established the Major Projects Office (MPO). The stated purpose of the MPO and the act is to create a process whereby the government—in practical terms, the prime minister and his cabinet—identify projects in the “national interest” and fast-track their approval by overriding existing laws and regulations.

Put differently, a small group of politicians are now able to circumvent the laws and regulations that apply to every other entrepreneur, businessowner and investor to expedite projects they deem will benefit the country. According to several reports, senators openly referred to the bill as the “trust me” act because it lacked details and guardrails, which meant “trusting” that the prime minister and cabinet would use these new powers reasonably and responsibly.

Rather than fix the actual policies causing problems, which include a litany of laws and regulations from the Trudeau era such as Bill C-69 (which added vague criteria to the approval process for large infrastructure projects including pipelines) and Bill C-48 (which bans oil tankers from docking in British Columbia ports), the Carney government chose to create a new bureaucracy and political process to get around these rules.

And that’s the problem. By granting itself power to get around rules that everyone else has to play by, the government created the opportunity for corruption. Entrepreneurs, businessowners and investors interested in infrastructure projects, particularly energy projects, now need to consider how to convince a handful of politicians of the merits of their project. This lays the groundwork for potentially corrosive and damaging corruption now and into the future. While this prime minister may have an infinite amount of confidence in his abilities to do the right thing, what about the next prime minister, or the next one? These rules will outlive Prime Minister Carney and his government.

And it’s not just the Carney government’s signature Build Canada Act. The more recent Bill C-15, which implements certain aspects of the federal budget, contains provisions similar to the Build Canada Act that would also allow cabinet ministers to circumvent existing laws and regulations. A number of commentators have raised red flags about how the legislation would empower any minister to exempt any entity (i.e. person or firm) from any law or regulation—except the Criminal Code—under the minister’s responsibility for up to six years in order to foster innovation. The underlying rationale is that we have laws and regulations on the books that impede experimentation and innovation.

Again, rather than undertake the difficult work of updating and modernizing existing laws and regulations to empower entrepreneurs, businessowners, workers, and investors, and ensure they all play by the same rules, the Carney government instead wants to create a new mechanism for a select few to be able to sidestep existing laws and regulations.

A different way to think about both legislative initiatives is that the prime minister and his ministers are now able to provide specific companies with enormous advantages over their competitors through the political system. Those advantages have enormous value, and that value creates the opportunity for corruption now and in the future.

The Carney government recognizes that our regulatory system is badly broken, otherwise it wouldn’t create these work-around laws. It should do the hard work, which it was elected to do, and actually fix the laws and regulations that impede economic development and progress for all entrepreneurs, businessowners and investors. Otherwise, we risk a future littered with stories of advantage and corruption for political insiders.

-

Business8 hours ago

Business8 hours agoICYMI: Largest fraud in US history? Independent Journalist visits numerous daycare centres with no children, revealing massive scam

-

Daily Caller2 days ago

Daily Caller2 days agoWhile Western Nations Cling to Energy Transition, Pragmatic Nations Produce Energy and Wealth

-

Daily Caller1 day ago

Daily Caller1 day agoUS Halts Construction of Five Offshore Wind Projects Due To National Security

-

Alberta2 days ago

Alberta2 days agoAlberta Next Panel calls for less Ottawa—and it could pay off

-

Bruce Dowbiggin1 day ago

Bruce Dowbiggin1 day agoBe Careful What You Wish For In 2026: Mark Carney With A Majority

-

Energy2 days ago

Energy2 days agoWhy Japan wants Western Canadian LNG

-

Business2 days ago

Business2 days agoLand use will be British Columbia’s biggest issue in 2026

-

Business2 days ago

Business2 days agoMainstream media missing in action as YouTuber blows lid off massive taxpayer fraud