Business

Toronto taxpayers should demand better of city’s homelessness services

From the Fraser Institute

By Matthew Lau

The city’s homelessness operating budget alone works out to about $51,000 per homeless person per year. For reference, the median after-tax income among Canadians in 2023 was $39,900. In other words, if you took the City of Toronto’s homelessness services operating budget in 2024 and divided the cash among the city’s homeless population, each homeless person would have 28 per cent higher income than the typical Canadian.

According to a recent City of Toronto report, in October 2024 there were an estimated 15,400 people experiencing homelessness in the city—more than double the approximately 7,300 homeless in April 2021. Of the homeless population, about 80 per cent stay in city-administered sites, 10 per cent in provincially-administered sites, and 10 per cent outdoors.

Clearly, homelessness and poverty are significant problems in Toronto, and governments should undertake some efforts to tackle these problems and mitigate their effects. However, whether politicians are using taxpayer money effectively in trying to do so is another matter, and in the case of Toronto’s spending on homelessness services, the numbers suggest there’s significant room for improvement.

In 2024, the gross expenditures operating budget for Toronto Shelter and Support Services, which is responsible for managing homelessness services, was $787.5 million. The capital budget was another $78.2 million. With a homeless population of 15,400, the city’s homelessness operating budget alone works out to about $51,000 per homeless person per year. For reference, the median after-tax income among Canadians in 2023 was $39,900.

In other words, if you took the City of Toronto’s homelessness services operating budget in 2024 and divided the cash among the city’s homeless population, each homeless person would have 28 per cent higher income than the typical Canadian.

Another data point in the report: the average market rent for a bachelor unit in Toronto in 2024 was $1,456 per month, which works out to $17,472 per year. This is one-third of that $51,000 per-homeless person to put a roof over the head of each of the 15,400 homeless people, even at a level of quality such that the amenities and comfort is comparable to that of an average resident of a bachelor unit in the city. Homelessness services include more than just providing shelter, but again, the wide gap between $17,472 and $51,000 suggests taxpayer money is not efficiently spent.

I am reminded of a 1978 speech by famed American economist Milton Friedman on the welfare state. If you took the total annual welfare expenditures made by federal, state and local governments in the name of helping the poor, according to Friedman, and divided it among the entire population that the government defined as being in poverty, it would work out to $9,000 per person. For comparison, the average after-tax income per person in the United States in those days was $6,500 per year.

“If that $9,000 per person were really going to the poor,” Friedman exclaimed, “they’d be among the rich! That income given to them would put them in the top 20 per cent of the income distribution.” The obvious explanation for what was going on: money the government spent, supposedly on helping the poor, wasn’t actually going to the poor.

The same appears to be true with Toronto’s homelessness services spending. Divide the city’s homelessness services spending among the homeless, and the homeless could well be considered richer than the average Canadian.

Toronto residents aren’t alone in having their money spent ineffectively. There’s plenty of evidence that governments elsewhere are ineffective in anti-poverty spending. See for example a California state auditor report last year detailing the state’s significant rise in homelessness even as nine state agencies spent US$24 billion on at least 30 programs over five years to prevent homelessness. Taxpayers—in Toronto, California and everywhere else—should demand better.

Business

Dominic Barton’s Shadow Over $1-Billion PRC Ferry Deal: An Investigative Op-Ed

Ottawa’s story never added up. When the Canada Infrastructure Bank pushed through a $1-billion loan to BC Ferries for vessels built at a Chinese state-owned shipyard, federal ministers claimed they were “dismayed” and blindsided. Chrystia Freeland even wrote a letter to the BC government citing national security concerns. In hindsight, she and her staff were engaged in political theatre, performing shock to deflect responsibility onto Premier David Eby.

Documents later showed Freeland’s own ministry of transport had been briefed six weeks before the public rollout. In one internal exchange, her staff admitted officials had received “a confidential heads-up” well in advance. Then came testimony from Housing and Infrastructure Minister Gregor Robertson — also responsible for the Infrastructure Bank — acknowledging the loan was already “inked” in March, before he supposedly raised concerns, a claim as hollow as Freeland’s staged outrage.

The $1-billion Canadian Infrastructure Bank loan to BC Ferries flows directly to China Merchants Industry Weihai — a dual-use shipyard central to Beijing’s military-civil fusion strategy. Critics have long warned that such contracts risk entangling Canadian taxpayers with Chinese state enterprises linked to the People’s Liberation Army.

Those concerns take on new urgency with fresh revelations from Australia. ABC News reported yesterday on a classified U.S. Defense Intelligence Agency assessment showing that China’s commercial ferry fleet is being militarized for amphibious operations against Taiwan. These are not neutral passenger vessels but dual-use platforms modified to carry tanks and PLA troops. The timing of the four-ship build for BC Ferries, the nature of the shipyard, and the class of vessel all suggest that Canada could be indirectly bolstering Beijing’s invasion platform — and, at the very least, injecting Canadian funds into the industrial ecosystem driving the PLA’s buildup.

The nature of CIB’s involvement, and Ottawa’s actions that fit the pattern of an emerging cover-up, point to a deeper story that has been bubbling in the capital for nearly a decade: former McKinsey global director and Canadian ambassador to China Dominic Barton, his deep ties to Chinese state-owned and dual-use enterprises, and his founding role in the CIB.

Defensive “talking points” prepared for Gregor Robertson’s August 1, 2025 testimony provide a revealing glimpse. The records, obtained through freedom of information by The Bureau, are mostly boilerplate answers. But two pages on the CIB’s structure show clearly what outside reporting has long established: the Bank carries Barton’s DNA, and the imprint of his McKinsey network continues to this day. That raises a plausible theory — that Canada’s pro-Beijing trade lobby, a circle of business leaders revolving around Barton, Sabia, McKinsey, and now Prime Minister Mark Carney, looks like the hidden hand guiding this supposedly arm’s-length deal.

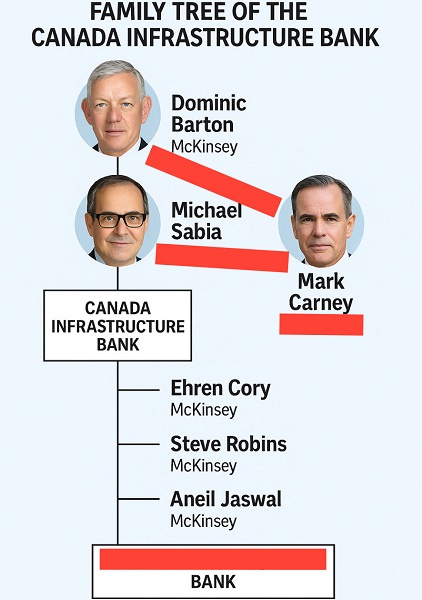

The records that anchor this OpEd show the Infrastructure Bank’s story can be traced like a family tree. At the top is Dominic Barton. In 2016, while serving as McKinsey’s global managing director, he chaired the federal Advisory Council on Economic Growth. That council produced the blueprint for the Canada Infrastructure Bank — and McKinsey itself was paid as a consultant during its creation. Sitting beside Barton on the council was Michael Sabia, who would later become chair of the Bank in 2020 and today serves as chief of staff to Prime Minister Mark Carney.

As the Bank moved from paper to practice, Sabia’s role became pivotal. When he took over as chair, he pulled Barton back into the fold. In June 2020, Barton joined a “strategic refresh” meeting of the CIB. Emails later revealed that McKinsey staff had arranged the session so that “Dom” could “speak freely,” even though he was then serving as Canada’s ambassador to China.

The pattern deepened as new leadership arrived. In November 2020, Ehren Cory was appointed CEO. Cory, too, had worked at McKinsey. Around him, other alumni filled senior posts: Steve Robins, now head of strategy; Aneil Jaswal, director of strategic sectors; even Cory’s executive assistant came directly from McKinsey, according to notes prepared for Gregor Robertson’s August testimony and obtained by The Bureau.

Running alongside this McKinsey chain is a side branch that loops back into the heart of Ottawa. Sabia, Barton’s colleague from the Advisory Council, now serves as Mark Carney’s right hand in the Prime Minister’s Office.

Seen this way, the CIB is not just a Crown corporation with a neutral mandate. It is an institution shaped from the start by Barton’s hand, nurtured by Sabia, and still run day to day by McKinsey-trained managers. The government’s defensive claim — that McKinsey’s influence ended in 2017, as set out in notes for Robertson’s testimony — is impossible to believe. It is as false as Chrystia Freeland’s June 2025 letter to David Eby’s government.

The continuity of influence is not just structural — it’s personal. On June 23, 2020, while serving as ambassador to China, Barton joined a CIB “strategic refresh” meeting. He says it was at Sabia’s invitation. But emails tabled in committee show McKinsey staff helped arrange the call and even discussed limiting participants so “Dom” could “speak freely.” Pressed in Parliament during May 2023 testimony, Barton initially failed to disclose the meeting. Only after documents surfaced did he confirm it.

That evasiveness set off a bruising clash. Conservative MP Leslyn Lewis told him flatly: “We have testimony that you gave before, and that was false indeed.” She added: “Mr. Sabia, the former chair of the CIB, testified here on Tuesday that you participated in a McKinsey seminar, led by McKinsey, while you were ambassador — and you have now confirmed this information today.”

Garnett Genuis drove the point home: “Mr. Barton is clearly lying to this committee. We have the emails in black and white. It seems McKinsey was able to infiltrate the government and shape decision making. Your presence and close relationship with the government allowed that to happen.”

Three years earlier, Barton had faced an even higher-profile grilling before the Canada–China Committee — testimony with direct geographical and geopolitical relevance to the CIB’s mysterious $1-billion loan to CMC Weihai.

Back in 2020, Genuis pressed him on McKinsey’s advisory work for Chinese state-owned enterprises, including the China Communications Construction Company — sanctioned by the World Bank for corruption and implicated in Beijing’s militarized islands in the South China Sea. Barton ducked, dissembled, and insisted he was unaware.

“At the time you were in charge of McKinsey, from 2009, it’s my understanding that you advised almost two dozen Chinese state-owned companies. According to The New York Times, one of those companies was the China Communications Construction Company,” Genuis prodded. “When you signed the China Communications Construction Company as a client in 2015, they were still under World Bank sanctions because of the corruption and bid-rigging they engaged in in the Philippines.”

Next, the Conservative MP asked directly: “McKinsey was advising a company that was carrying out the Chinese government’s policy of building militarized islands in the South China Sea. Was it your position that those islands are a violation of international law?”

“What I would say is that I am not familiar at all with our being involved in designing the islands in the South China Sea,” Barton answered. “If you want to talk to someone at McKinsey to find out more information, I’m sure we’d be happy to get someone to talk to you about it.”

McKinsey did not return with information on China’s military action in the South China Sea — the very same theater where Beijing now threatens Taiwan with its civilian ferry buildup plan.

Genuis also asked: “Would you be prepared to submit to this committee a list of all of the Chinese state-owned companies that you did work for at McKinsey?”

“McKinsey’s pretty careful about client confidentialities,” Barton answered. “I’d be happy if there were some mechanism so that it isn’t in the public domain but that some people could look at it. I’m open to that.”

That list was never provided, based on The Bureau’s follow-up in Ottawa. Given the questions surrounding the CIB’s loan to fund CMC Weihai ferries, this lack of transparency takes on a more ominous colour.

The historical record of testimony, going back to the Genuis–Barton stand-off, now casts a long shadow. There is a clear through line to the questioning still to come for Carney’s responsible ministers in the BC Ferries deal — Chrystia Freeland and Gregor Robertson. After revelations that Freeland and her staff staged their supposed shock at the deal with a Chinese military-linked shipbuilder, Freeland has been recalled.

Savvy questioners will likely look beyond her — and above her — in their probing. The CIB, seeded by Barton, staffed by McKinsey alumni, and previously steered by Mark Carney’s chief of staff Michael Sabia, has financed a project that objectively strengthens Beijing’s naval-industrial complex. Who really profits, in conjunction with Beijing? Certainly not Canadian workers, shipbuilders, or citizens, who are left carrying the burden of their government’s deals with China.

This is not just about procurement missteps or potential conflicts of interest. It is the culmination of a decade of weak, negligent thinking on China’s military aggression — stretching from the South China Sea to Canada’s Pacific, Atlantic, and Arctic coasts. Until Canadians confront Barton’s enduring imprint on the CIB, they will continue to discover — too late — that their money is underwriting Beijing’s rise.

The Bureau is a reader-supported publication.

To receive new posts and support my work, consider becoming a free or paid subscriber.

Business

Natural gas bans are fuelling higher energy costs

This article supplied by Troy Media.

By Roslyn Kunin

By Roslyn Kunin

Governments are pulling the plug on natural gas with no real backup plan in place and Canadians are paying the price

Banning natural gas and pushing electricity without enough supply is a recipe for soaring energy costs and blackouts. Politicians may forget the basics of economics, but supply and demand won’t go away.

When the supply of anything goes up, its price falls. Limit or decrease supply and the price rises. Demand works in the opposite direction—high demand drives up prices, and lower demand brings them down.

Like gravity, the law of supply and demand is always there, but many politicians behave as though it doesn’t exist. Nowhere is that clearer than in energy policy, where environmental goals are prioritized while economic realities are sidelined. The drive to eliminate energy-related emissions

in just a few years may sound noble, but it ignores practical limits, and Canadians are paying the price.

Take natural gas. It emits far less carbon than coal or oil. In Canada, most natural gas comes from Alberta and British Columbia, and it’s one of the country’s most affordable and secure energy sources. Despite this, several jurisdictions in B.C. are banning its use in new and renovated buildings—moves encouraged by federal emissions targets and climate incentives.

These policies may be well-intentioned, but they ignore a basic fact: people still need to heat their homes and cook their meals. Without gas, they’ll be forced to use electricity. But unlike gas, electricity is already in short supply and getting more expensive. Our current generating capacity can’t keep up with rising demand, and that’s before we even consider the added strain from electric vehicles, data centres and energy-hungry artificial intelligence.

British Columbia’s Site C dam, a multibillion-dollar hydroelectric project under construction on the Peace River, is expected to generate enough electricity for 450,000 homes when complete. But all of that power is already spoken for. There are no Site C-scale replacements on the horizon. Meanwhile, our distribution infrastructure can’t meet today’s needs, let alone tomorrow’s.

In one recent case, buildings planning to install EV chargers were told by B.C. Hydro, the Crown corporation responsible for electricity in B.C., that there wasn’t enough power available. Major housing developments have even been blocked due to limited electricity supply.

These constraints aren’t just technical—they’re already making it harder to build new housing. Canadians may accept higher costs for environmental gains, but pushing up both housing and energy bills risks crossing a line. Banning natural gas makes it harder to build and maintain affordable homes, directly undermining what governments claim to support. In homes forced to switch from gas to electricity, heating and hot water bills could quadruple. Reliability also drops. Builders are now being advised to install backup generators to handle expected power outages—ironically, those generators will often run on the very natural gas being banned.

We can no longer assume the government will keep the lights on. That’s a serious blow to Canadians’ standard of living.

Some argue these trade-offs are justified if they cut emissions. But even that goal is questionable. The gas we don’t burn here will simply be sold elsewhere—likely to countries still relying on coal, oil or even dung. Because emissions don’t respect borders, the global climate impact remains the same, or worse.

Of course, Canada could go further and stop producing natural gas altogether. Leave it all in the ground. But doing so would deliver a major blow to our economy and standard of living: something no elected government is likely to survive. Alternatively, Canada could export more of its low-cost, lower-emission natural gas to displace dirtier fuels abroad. That would reduce global emissions more effectively than restricting gas at home.

Canadians care about the environment. But we need smart, balanced policies—ones that use our resources wisely, not wastefully. We can pursue conservation and cleaner technologies while still recognizing that economic laws apply, even when they’re inconvenient.

It’s not about choosing between prosperity and the planet. It’s about realizing that ignoring the fundamentals—like supply and demand—comes at a cost most Canadians can’t afford.

Dr. Roslyn Kunin is a respected Canadian economist known for her extensive work in economic forecasting, public policy, and labour market analysis. She has held various prominent roles, including serving as the regional director for the federal government’s Department of Employment and Immigration in British Columbia and Yukon and as an adjunct professor at the University of British Columbia. Dr. Kunin is also recognized for her contributions to economic development, particularly in Western Canada.

Troy Media empowers Canadian community news outlets by providing independent, insightful analysis and commentary. Our mission is to support local media in helping Canadians stay informed and engaged by delivering reliable content that strengthens community connections and deepens understanding across the country.

-

Business19 hours ago

Business19 hours agoOver $2B California Solar Plant Built To Last, Now Closing Over Inefficiency

-

espionage2 days ago

espionage2 days agoCanada Under Siege: Sparking a National Dialogue on Security and Corruption

-

Business18 hours ago

Business18 hours agoWEF has a plan to overhaul the global financial system by monetizing nature

-

Business20 hours ago

Business20 hours agoThe Leaked Conversation at the heart of the federal Gun Buyback Boondoggle

-

Business2 days ago

Business2 days agoGoogle Admits Biden White House Pressured Content Removal, Promises to Restore Banned YouTube Accounts

-

Opinion19 hours ago

Opinion19 hours agoThe City of Red Deer’s financial mess – KPMG report outlines failure of council to control spending

-

Business2 days ago

Business2 days agoBC Ferries Deal With China Risks Canada’s Security

-

armed forces2 days ago

armed forces2 days agoUnderfunded and undermanned, Canada’s Reserves are facing a crisis