Economy

Top Scientists Deliberately Misrepresented Sea Level Rise For Years

From Michael Shellenberger

Accelerated sea level is one of the main justifications for predicting very high costs for adapting to climate change. And while good scientists have debunked acceleration claims in the past, they did not clearly show how IPCC scientists engaged in their manipulations.

Scientists for years said they had proof that climate change was accelerating sea level rise. But that's not what the evidence shows. They knew the truth and misled the public. And now I have a long email exchange with a top scientist that shows how they did it. Massive scandal. pic.twitter.com/MNIX1025Fe

— Michael Shellenberger (@shellenberger) October 24, 2025

Business

UNDRIP now guides all B.C. laws. BC Courts set off an avalanche of investment risk

From Resource Works

Gitxaala has changed all the ground rules in British Columbia reshaping the risks around mills, mines and the North Coast transmission push.

The British Columbia Court of Appeal’s decision in Gitxaala v. British Columbia (Chief Gold Commissioner) is poised to reshape how the province approves and defends major resource projects, from mills and mines to new transmission lines.

In a split ruling on 5 December, the court held that British Columbia’s Declaration on the Rights of Indigenous Peoples Act makes consistency with the United Nations Declaration on the Rights of Indigenous Peoples a question courts can answer. The majority went further, saying UNDRIP now operates as a general interpretive aid across provincial law and declaring the Mineral Tenure Act’s automatic online staking regime inconsistent with article 32(2).

University of Saskatchewan law professor Dwight Newman, who has closely followed the case, says the majority has stretched what legislators thought they were doing when they passed the statute. He argues that section 2 of British Columbia’s UNDRIP law, drafted as a purpose clause, has been turned from guidance for reading that Act into a tool for reading all provincial laws, shifting decisions that were meant for cabinet and the legislature toward the courts.

The decision lands in a province already coping with legal volatility on land rights. In August, the Cowichan Tribes title ruling raised questions about the security of fee simple ownership in parts of Richmond, with critics warning that what used to be “indefeasible” private title may now be subject to senior Aboriginal claims. Newman has called the resulting mix of political pressure, investor hesitation and homeowner anxiety a “bubbling crisis” that governments have been slow to confront.

Gitxaala’s implications reach well beyond mining. Forestry communities are absorbing another wave of closures, including the looming shutdown of West Fraser’s 100 Mile House mill amid tight fibre and softwood duties. Industry leaders have urged Ottawa to treat lumber with the same urgency as steel and energy, warning that high duties are squeezing companies and towns, while new Forests Minister Ravi Parmar promises to restore prosperity in mill communities and honour British Columbia’s commitments on UNDRIP and biodiversity, as environmental groups press the government over pellet exports and protection of old growth.

At the same time, Premier David Eby is staking his “Look West” agenda on unlocking about two hundred billion dollars in new investment by 2035, including a shift of trade toward Asia. A centrepiece is the North Coast Transmission Line, a grid expansion from Prince George to Bob Quinn Lake that the government wants to fast track to power new mines, ports, liquefied natural gas facilities and data centres. Even as Eby dismisses a proposed Alberta to tidewater oil pipeline advanced under a new Alberta memorandum as a distraction, Gitxaala means major energy corridors will also be judged against UNDRIP in court.

Supporters of the ruling say that clarity is overdue. Indigenous nations and human rights advocates who backed the appeal have long argued that governments sold UNDRIP legislation as more than symbolism, and that giving it judicial teeth will front load consultation, encourage genuine consent based agreements and reduce the risk of late stage legal battles that can derail projects after years of planning.

Critics are more cautious. They worry that open ended declarations about inconsistency with UNDRIP will invite strategic litigation, create uncertainty around existing approvals and tempt courts into policy making by another name, potentially prompting legislatures to revisit UNDRIP statutes altogether. For now, the judgment leaves British Columbia with fewer excuses: the province has built its growth plans around big, nation building projects and reconciliation framed as partnership with Indigenous nations, and Gitxaala confirms that those partnerships now have a hard legal edge that will shape the next decade of policy and investment.

Resource Works News

Business

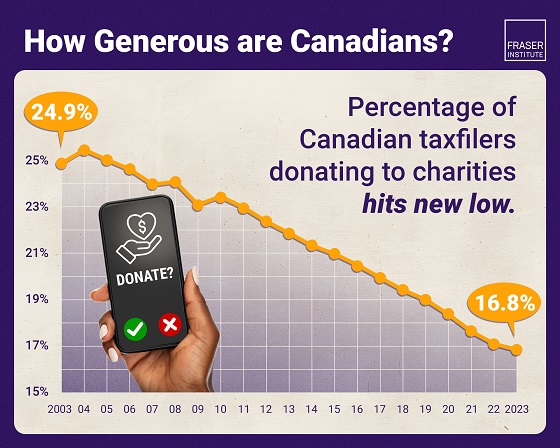

Albertans give most on average but Canadian generosity hits lowest point in 20 years

From the Fraser Institute

By Jake Fuss and Grady Munro

The number of Canadians donating to charity—as a percentage of all tax filers—is at the lowest point in 20 years, finds a new study published by the

Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“The holiday season is a time to reflect on charitable giving, and the data shows Canadians are consistently less charitable every year, which means charities face greater challenges to secure resources to help those in need,” said Jake Fuss, director of Fiscal Studies at the Fraser Institute and co-author of Generosity in Canada: The 2025 Generosity Index.

The study finds that the percentage of Canadian tax filers donating to charity during the 2023 tax year—just 16.8 per cent—is the lowest proportion of Canadians donating since at least 2003. Canadians’ generosity peaked at 25.4 per cent of tax-filers donating in 2004, before declining in subsequent years.

Nationally, the total amount donated to charity by Canadian tax filers has also fallen from 0.55 per cent of income in 2013 to 0.52 per cent of income in 2023.

The study finds that Manitoba had the highest percentage of tax filers that donated to charity among the provinces (18.7 per cent) during the 2023 tax year while New Brunswick had the lowest (14.4 per cent).

Likewise, Manitoba also donated the highest percentage of its aggregate income to charity among the provinces (0.71 per cent) while Quebec and Newfoundland and Labrador donated the lowest (both 0.27 per cent).

“A smaller proportion of Canadians are donating to registered charities than what we saw in previous decades, and those who are donating are donating less,” said Fuss.

“This decline in generosity in Canada undoubtedly limits the ability of Canadian charities to improve the quality of life in their communities and beyond,” said Grady Munro, policy analyst and co-author.

Generosity of Canadian provinces and territories

Ranking (2025) % of tax filers who claiming donations Average of all charitable donations % of aggregate income donated

Manitoba 18.7 $2,855 0.71

Ontario 17.2 $2,816 0.58

Quebec 17.1 $1,194 0.27

Alberta 17.0 $3,622 0.68

Prince Edward Island 16.6 $1,936 0.45

Saskatchewan 16.4 $2,597 0.52

British Columbia 15.9 $3,299 0.61

Nova Scotia 15.3 $1,893 0.40

Newfoundland and Labrador 15.0 $1,333 0.27

New Brunswick 14.4 $2,076 0.44

Yukon 14.1 $2,180 0.27

Northwest Territories 10.2 $2,540 0.20

Nunavut 5.1 $2,884 0.15

NOTE: Table based on 2023 tax year, the most recent year of comparable data in Canada

Generosity in Canada: The 2025 Generosity Index

- Manitoba had the highest percentage of tax filers that donated to charity among the provinces (18.7%) during the 2023 tax year while New Brunswick had the lowest (14.4%).

- Manitoba also donated the highest percentage of its aggregate income to charity among the provinces (0.71%) while Quebec and Newfoundland and Labrador donated the lowest (both 0.27%).

- Nationally, the percentage of Canadian tax filers donating to charity has fallen over the last decade from 21.9% in 2013 to 16.8% in 2023.

- The percentage of aggregate income donated to charity by Canadian tax filers has also decreased from 0.55% in 2013 to 0.52% in 2023.

- This decline in generosity in Canada undoubtedly limits the ability of Canadian charities to improve the quality of life in their communities and beyond.

-

Automotive2 days ago

Automotive2 days agoThe $50 Billion Question: EVs Never Delivered What Ottawa Promised

-

Local Business2 days ago

Local Business2 days agoRed Deer Downtown Business Association to Wind Down Operations

-

International2 days ago

International2 days agoTrump admin wants to help Canadian woman rethink euthanasia, Glenn Beck says

-

Agriculture2 days ago

Agriculture2 days agoGrowing Alberta’s fresh food future

-

C2C Journal2 days ago

C2C Journal2 days agoWisdom of Our Elders: The Contempt for Memory in Canadian Indigenous Policy

-

Alberta2 days ago

Alberta2 days agoAlberta introducing three “all-season resort areas” to provide more summer activities in Alberta’s mountain parks

-

Alberta2 days ago

Alberta2 days agoThe case for expanding Canada’s energy exports

-

Censorship Industrial Complex2 days ago

Censorship Industrial Complex2 days agoConservative MP calls on religious leaders to oppose Liberal plan to criminalize quoting Scripture