Freedom Convoy

Three years after TD Bank froze his bank accounts, peaceful protestor Evan Blackman faces retrial

The Justice Centre for Constitutional Freedoms announces that the retrial of peaceful protestor Evan Blackman is set to begin on Thursday, August 14, 2025, in the Ontario Court of Justice in Ottawa. When Mr. Blackman was first charged with mischief and obstruction for his participation in the 2022 Freedom Convoy protests, Toronto-Dominion Bank froze several of his bank accounts, sparking a national debate about government overreach.

Mr. Blackman was acquitted of all charges in October 2023, but the Crown appealed that decision.

If Mr. Blackman is convicted at his second trial, his lawyer will ask the court to stay all proceedings against him as a remedy for the freezing of his bank accounts.

The judge hearing Mr. Blackman’s retrial has already compelled TD Bank and the RCMP to hand over records about the bank account freezes. “The freezing of Mr. Blackman’s bank accounts was an extreme overreach on the part of the police and the federal government,” says constitutional lawyer Chris Fleury.

“These records will hopefully reveal exactly how and why Mr. Blackman’s accounts were frozen,” he says.

Further information about these records may be revealed, if necessary, at another hearing scheduled for Thursday, August 21, 2025.

Video evidence from the original trial shows Mr. Blackman acting as a peacemaker during the 2022 Freedom Convoy protests, at one point even holding back other protesters to prevent confrontation with police, kneeling in front of officers for several minutes, removing his hat, placing his hands on his chest, and singing “O Canada” shortly before his arrest.

Constitutional lawyer Chris Fleury said, “After being acquitted on all charges following his first trial, and being called a peacemaker by the judge, Mr. Blackman has endured another two years of legal uncertainty.”

“Mr. Blackman is hopeful that he will once again be acquitted, and this matter will finally end,” he added.

COVID-19

Freedom Convoy protestor Evan Blackman convicted at retrial even after original trial judge deemed him a “peacemaker”

Evan Blackman and his son at a hockey game

The Justice Centre for Constitutional Freedoms announces that peaceful Freedom Convoy protestor Evan Blackman has been convicted of mischief and obstructing a peace officer at the conclusion of his retrial at the Ontario Court of Justice, despite being fully acquitted on these charges at his original trial in October 2023.

The Court imposed a conditional discharge, meaning Mr. Blackman will have no jail time and no criminal record, along with 12 months’ probation, 122 hours of community service, and a $200 victim fine surcharge.

The judge dismissed a Charter application seeking to have the convictions overturned on the basis of the government freezing his bank accounts without explanation amid the Emergencies Act crackdown in 2022.

Lawyers funded by the Justice Centre had argued that Mr. Blackman acted peacefully during the enforcement action that followed the federal government’s February 14, 2022, invocation of the Emergencies Act. Drone footage entered as evidence showed Mr. Blackman deescalating confrontations, raising his hand to keep protestors back, and kneeling in front of officers while singing “O Canada.” The original trial judge described Mr. Blackman as a “peacemaker,” and acquitted him on all charges, but the Crown challenged that ruling, resulting in the retrial that has now led to his conviction.

Mr. Blackman was first arrested on February 18, 2022, during the police action to clear protestors from downtown Ottawa. Upon his release that same day, he discovered that three of his personal bank accounts had been frozen under the Emergency Economic Measures Order. RCMP Assistant Commissioner Michel Arcand later confirmed that 257 bank accounts had been frozen nationwide under the Emergencies Act.

Constitutional lawyer Chris Fleury said, “While we are relieved that Mr. Blackman received a conditional discharge and will not carry a criminal record, we remain concerned that peaceful protestors continue to face disproportionate consequences stemming from the federal government’s response in February 2022.”

“We are disappointed that the Court declined to stay Mr. Blackman’s convictions, which are tainted by the serious infringements of his Charter-protected rights. Mr. Blackman is currently assessing whether he will be appealing this finding,” he added.

COVID-19

Crown still working to put Lich and Barber in jail

From LifeSiteNews

The Crown’s appeal claims the judge made a mistake in her verdict on the intimidation charges, and also in how she treated aggravating and mitigating factors regarding sentencing.

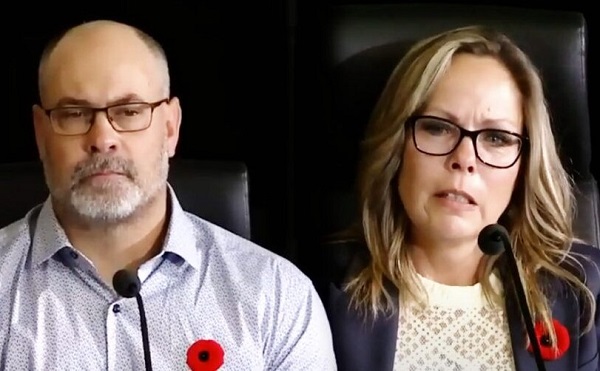

Government lawyers for the Crown have filed an appeal the acquittals of Freedom Convoy leaders Tamara Lich and Chris Barber on intimidation charges.

The Crown also wants their recent 18-month conditional sentence on mischief charges replaced with harsher penalties, which could include possible jail time.

According to the Justice Centre for Constitutional Freedoms (JCCF), it is “asking the Ontario Court of Appeal to enter a conviction on the intimidation charge or order a new trial on that count,” for Barber’s charges.

Specifically, the Crown’s appeal claims that the judge made a mistake in her verdict on the intimidation charges, and also in how she treated aggravating and mitigating factors regarding sentencing.

As reported by LifeSiteNews, both Lich and Barber have filed appeals of their own against their house arrest sentences, arguing that the trial judge did not correctly apply the law on their mischief charges.

Barber’s lawyer, Diane Magas, said that her client “relied in good faith on police and court direction during the protest. The principles of fairness and justice require that citizens not be punished for following the advice of authorities. We look forward to presenting our arguments before the Court.”

On October 7, Ontario Court Justice Heather Perkins-McVey sentenced Lich and Chris Barber to 18 months’ house arrest after being convicted earlier in the year of “mischief.”

Lich was given 18 months less time already spent in custody, amounting to 15 1/2 months.

Lich and Barber were declared guilty of mischief for their roles as leaders of the protest against COVID mandates in April 2022, and as social media influencers. The conviction came after a nearly two-year trial despite the non-violent nature of the popular movement.

The Lich and Barber trial concluded in September 2024, more than a year after it began. It was originally scheduled to last 16 days.

As reported by LifeSiteNews, the Canadian government was hoping to put Lich in jail for no less than seven years and Barber for eight years.

LifeSiteNews recently reported that Lich detailed her restrictive house arrest conditions, revealing she is “not” able to leave her house or even pick up her grandchildren from school without permission from the state.

As reported by LifeSiteNews, Lich, reflecting on her recent house arrest verdict, said she has no “remorse” and will not “apologize” for leading a movement that demanded an end to all COVID mandates.

-

Carbon Tax2 days ago

Carbon Tax2 days agoCarney fails to undo Trudeau’s devastating energy policies

-

Health2 days ago

Health2 days agoNEW STUDY: Infant Vaccine “Intensity” Strongly Predicts Autism Rates Worldwide

-

Business2 days ago

Business2 days agoThe UN Pushing Carbon Taxes, Punishing Prosperity, And Promoting Poverty

-

Business2 days ago

Business2 days agoClimate Climbdown: Sacrificing the Canadian Economy for Net-Zero Goals Others Are Abandoning

-

Alberta2 days ago

Alberta2 days agoAlberta to protect three pro-family laws by invoking notwithstanding clause

-

Artificial Intelligence2 days ago

Artificial Intelligence2 days agoLawsuit Claims Google Secretly Used Gemini AI to Scan Private Gmail and Chat Data

-

Health1 day ago

Health1 day agoCDC’s Autism Reversal: Inside the Collapse of a 25‑Year Public Health Narrative

-

Crime1 day ago

Crime1 day ago‘Modern-Day Escobar’: U.S. Says Former Canadian Olympian Ran Cocaine Pipeline with Cartel Protection and a Corrupt Toronto Lawyer