Business

The world needs energy. Canada has the supply. Other nations eagerly fill the demand.

From the Fraser Institute

Spend time on the websites of Canada’s leading environmental non-governmental organizations (ENGOs) and you will see repeated references to the “energy transition”—the shift away from fossil-fuel energy sources to no- and low-carbon alternatives, to help lower the greenhouse gas (GHG) emissions that lie behind concerns over climate change.

While most countries—albeit not Donald Trump’s America—notionally support the 2015 Paris Agreement goal to limit global temperature increases to between 1.5 and 2.0 degrees centigrade, few are on track to slash their emissions sufficiently to reach that target. Indeed, emissions are still climbing, mainly due to the ravenous appetite for energy in many emerging economies.

Notwithstanding decades of climate change conferences, humanity remains firmly wedded to fossil fuels, which currently supply about four-fifths of global primary energy demand—a share that has fallen only slightly since the late-1990s. Moreover, as Canadian energy scholar Vaclav Smil recently noted, the absolute quantity of fossil fuels consumed by the world has risen by more than half since 1997.

Stupendous amounts of energy are needed to provide electrical power, for heating and cooling, transportation and agriculture, and to support many industrial processes. Today, fossil fuels are ubiquitous in all these areas. Only in the case of electricity have we observed a quantitatively significant move away from fossil fuel energy.

A glance at recent energy supply/demand projections highlights the dominant role of fossil fuels in the world’s energy system. The latest global outlook from multinational giant Shell is a good example.

According to Shell’s 2025 baseline forecast, worldwide demand for energy “will continue to increase as the global population grows and living standards rise.” By 2050, energy demand “could be nearly a quarter higher than in 2024 depending on economic growth rates, energy efficiency gains and the pace of electrification.”

Global oil demand is expected by grow by another 3-5 million barrels per day into the mid-2030s, confounding earlier forecasts of imminent “peak oil” consumption. Shell notes that “petroleum fuels remain affordable and convenient in transport, particularly in long-distance haulage, aviation and marine.” Oil also remains crucial to the petrochemicals sector.

Meanwhile, natural gas use is set to increase into the 2040s at least, with liquefied natural gas (LNG) representing a steadily rising share of the total natural gas market. Natural gas is a principal source of “industrial heat, fuel for power generation and heat for buildings.” It’s also critical to “helping the world move away from coal.”

Significant investments in oil and gas exploration, production, infrastructure and downstream processing “will be required for decades to come.” So much for the argument of Canadian environmental activists that it’s time to starve the oil and gas business of capital.

What are the implications of all of this for Canada?

We are endowed with an almost unmatched abundance of energy riches, notably the world’s third-largest oil reserves and vast amounts of natural gas. Canada is also a global leader in producing electricity from carbon-free sources. And energy plays an outsized role in our economy, directly accounting for one-tenth of GDP and supplying roughly a quarter of the country’s merchandise exports.

As a major energy producer, Canada has well-respected environmental standards and rigorous project approval and permitting processes. These are a long-term competitive advantage.

Even as efforts continue to reduce the carbon intensity of energy use and expand renewable power capacity, a growing world will need prodigious quantities of energy including oil and gas. Canada is well-placed to help meet it.

Business

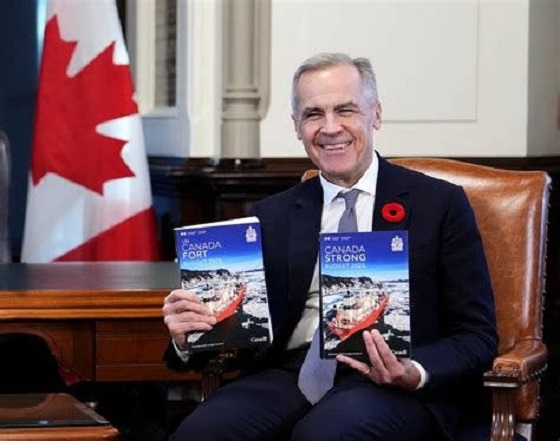

Budget 2025: Ottawa Fakes a Pivot and Still Spends Like Trudeau

It finally happened. Canada received a federal budget earlier this month, after more than a year without one. It’s far from a budget that’s great. It’s far from what many expected and distant from what the country needs. But it still passed.

With the budget vote drama now behind us, there may be space for some general observations beyond the details of the concerning deficits and debt. What kind of budget did Canada get?

Haultain’s Substack is a reader-supported publication.

To receive new posts and support our work, please consider becoming a free or paid subscriber.

Try it out.

For a government that built its political identity on social-program expansion and moralized spending, Budget 2025 arrives wearing borrowed clothing. It speaks in the language of productivity, infrastructure, and capital formation, the diction of grown-up economics, yet keeps the full spending reflex of the Trudeau era. The result feels like a cabinet trying to change its fiscal costume without changing the character inside it. Time will tell, to be fair, but it feels like more rhetoric, and we have seen this same rhetoric before lead to nothing. So, I remain skeptical of what they say and how they say it.

The government insists it has found a new path, one where public investment leads private growth. That sounds bold. However, it is more a rebranding than a reform. It is a shift in vocabulary, not in discipline.

A comparison with past eras makes this clear.

Jean Chrétien and Paul Martin did not flirt with restraint; they executed it. Their budgets were cut deeply, restored credibility, and revived Canada’s fiscal health when it was most needed. The Chrétien years were unsentimental. Political capital was spent so financial capital could return. Ottawa shrank so the country could grow. Budget 2025 tries to invoke their spirit but not their actions. Nothing in this plan resembles the structural surgery of the mid 1990s.

Stephen Harper, by contrast, treated balanced budgets as policy and principle. Even during the global financial crisis, his government used stimulus as a bridge, not a way of life. It cut taxes widely and consistently, limited public service growth, and placed the long-term burden on restraint rather than rhetoric. Budget 2025 nods toward Harper’s focus on productivity and capital assets, yet it rejects the tax relief and spending controls that made his budgets coherent.

Then there is Justin Trudeau, the high tide of redistribution, vacuous identity politics, and deficit-as-virtue posturing. Ottawa expanded into an ideological planner for everything, including housing, climate, childcare, inclusion portfolios, and every new identity category. Much of that ideological scaffolding consisted of mere words, weakening the principle of equality under the law and encouraging the government to referee culture rather than administer policy.

Budget 2025 is the first hint of retreat from that style. The identity program fireworks are dimmer, though they have not disappeared. The social policy boosterism is quieter. Perhaps fiscal gravity has begun to whisper in the prime minister’s ear.

However, one cannot confuse tone for transformation.

Spending is still vast. Deficits grew. The new fiscal anchor, balancing only the operating budget, is weaker than the one it replaced. The budget relies on the hopeful assumption that Ottawa’s capital spending will attract private investment on a scale that economists politely describe as ambitious.

The housing file illustrates the contradiction. The budget announces new funding for the construction of purpose-built rentals and a larger federal role in modular and subsidized housing builds. These are presented as productivity measures, yet they continue the Trudeau-era instinct to centralize housing policy rather than fix the levers that matter. Permitting delays, zoning rigidity, municipal approvals, and labour shortages continue to slow actual construction. Ottawa spends, but the foundations still cure at the same pace.

Defence spending tells the same story. Budget 2025 offers incremental funding and some procurement gestures, but it avoids the core problem: Canada’s procurement system is broken. Delays stretch across decades. Projects become obsolete before contracts are signed. The system cannot buy a ship, an aircraft, or an armoured vehicle without cost overruns and missed timelines. Spending more through this machinery will waste time and money. It adds motion, not capability.

Most importantly, the structural problems remain untouched: no regulatory reform for major projects, no tax competitiveness agenda, no strategy for shrinking a federal bureaucracy that has grown faster than the economy it governs. Ottawa presides over a low-productivity country but insists that a new accounting framework will solve what decades of overregulation and policy clutter have created. More bluster.

To receive new posts and support our work, please consider becoming a free or paid subscriber.

From an Alberta vantage, the pivot is welcome but inadequate. The economy that pays for Confederation, energy, mining, agriculture, and transportation receives more rhetorical respect in Budget 2025, yet the same regulatory thicket that blocks pipelines and mines remains intact. The government praises capital formation but still undermines the key sectors that generate it.

Budget 2025 tries to walk like Chrétien and talk like Harper while spending like Trudeau. That is not a transformation; it is a costume change. The country needed a budget that prioritized growth rooted in tangible assets and real productivity. What it got instead is a rhetorical turn without the courage to cut, streamline, or reform.

Canada does not require a new budgeting vocabulary. It requires a government willing to govern in the best interest of the country.

Haultain’s Substack is a reader-supported publication.

Help us bring you more quality research and commentary.

Business

Climate Climbdown: Sacrificing the Canadian Economy for Net-Zero Goals Others Are Abandoning

By Gwyn Morgan

Canada has spent the past decade pursuing climate policies that promised environmental transformation but delivered economic decline. Ottawa’s fixation on net-zero targets – first under Justin Trudeau and now under Prime Minister Mark Carney – has meant staggering public expenditures, resource project cancellations and rising energy costs, all while failing to

reduce the country’s dependence on fossil fuels. Now, as key international actors reassess the net-zero doctrine, Canada stands increasingly alone in imposing heavy burdens for negligible gains.

The Trudeau government launched its agenda in 2015 by signing the Paris Climate Agreement aimed at limiting the forecast increase in global average temperature to 1.5°C by the end of the century. It followed the next year with the Pan-Canadian Framework on Clean Growth and Climate Change that imposed more than 50 measures on the economy, key among them a

carbon “pricing” regime – Liberal-speak for taxes on every Canadian citizen and industry. Then came the 2030 Emissions Reduction Plan, committing Canada to cut greenhouse gas emissions to 40 percent below 2005 levels by 2030, and to achieve net-zero by 2050. And then the “On-Farm Climate Action Fund,” the “Green and Inclusive Community Buildings Program” and the “Green Municipal Fund.”

It’s a staggering list of nation-impoverishing subsidies, taxes and restrictions, made worse by regulatory measures that hammered the energy industry. The Trudeau government cancelled the fully-permitted Northern Gateway pipeline, killing more than $1 billion in private investment and stranding hundreds of billions of dollars’ worth of crude oil in the ground. The

Energy East project collapsed after Ottawa declined to challenge Quebec’s political obstruction, cutting off a route that could have supplied Atlantic refineries and European markets. Natural gas developers fared no better: 11 of 12 proposed liquefied natural gas export terminals were abandoned amid federal regulatory delays and policy uncertainty. Only a single LNG project in Kitimat, B.C., survived.

None of this has had the desired effect. Between Trudeau’s election in 2015 and 2023, fossil fuels’ share of Canada’s energy supply actually increased from 75 to 77 percent. As for saving the world, or even making some contribution towards doing so, Canada contributes just 1.5 percent of global GHG emissions. If our emissions went to zero tomorrow, the emissions

growth from China and India would make that up in just a few weeks.

And this green fixation has been massively expensive. Two newly released studies by the Fraser Institute found that Ottawa and the four biggest provinces have either spent or foregone a mind-numbing $158 billion to create just 68,000 “clean” jobs – an eye-watering cost of over $2.3 million per job “created”. At that, the green economy’s share of GDP crept up only 0.3

percentage points.

The rest of the world is waking up to this folly. A decade after the Paris Agreement, over 81 percent of the world’s energy still comes from fossil fuels. Environmental statistician and author Bjorn Lomborg points out that achieving global net-zero by 2050 would require removing the equivalent of the combined emissions of China and the United States in each of the next five

years. “This puts us in the realm of science fiction,” he wrote recently.

In July, the U.S. Department of Energy released a major assessment assembled by a team of highly credible climate scientists which asserted that “CO 2 -induced warming appears to be less damaging economically than commonly believed,” and that aggressive mitigation policies might be “more detrimental than beneficial.” The report found no evidence of rising frequency or severity of hurricanes, floods, droughts or tornadoes in U.S. historical data, while noting that U.S. emissions reductions would have “undetectably small impacts” on global temperatures in any case.

U.S. Energy Secretary Chris Wright welcomed the findings, noting that improving living standards depends on reliable, affordable energy. The same day, the Environmental Protection Agency proposed rescinding the 2009 “endangerment finding” that had designated CO₂ and other GHGs as “pollutants.” It had led to sweeping restrictions on oil and gas development and fuelled policies that the current administration estimates cost the U.S. economy at least US$1 trillion in lost growth.

Even long-time climate alarmists are backtracking. Ted Nordhaus, a prominent American critic, recently acknowledged that the dire global warming scenarios used by the Intergovernmental Panel on Climate Change rely on implausible combinations of rapid population growth, strong economic expansion and stagnant technology. Economic growth typically reduces population increases and accelerates technological improvement, he pointed out, meaning emissions trends will likely be lower than predicted. Even Bill Gates has tempered his outlook, writing that climate change will not be “cataclysmic,” and that although it will hurt the poor, “it will not be the only or even the biggest threat to their lives and welfare.” Poverty and disease pose far greater threats and resources, he wrote, should be focused where they can do the most good now.

Yet Ottawa remains unmoved. Prime Minister Carney’s latest budget raises industrial carbon taxes to as much as $170 per tonne by 2030, increasing the competitive disadvantage of Canadian industries in a time of weak productivity and declining investment. These taxes will not measurably alter global emissions, but they will deepen Canada’s economic malaise and

push production – and emissions – toward jurisdictions with more lax standards. As others retreat from net-zero delusions, Canada moves further offside global energy policy trends – extending our country’s sad decline.

The original, full-length version of this article was recently published in C2C Journal.

Gwyn Morgan is a retired business leader who has been a director of five global corporations.

-

Alberta18 hours ago

Alberta18 hours agoNational Crisis Approaching Due To The Carney Government’s Centrally Planned Green Economy

-

Carbon Tax6 hours ago

Carbon Tax6 hours agoCarney fails to undo Trudeau’s devastating energy policies

-

Business7 hours ago

Business7 hours agoThe UN Pushing Carbon Taxes, Punishing Prosperity, And Promoting Poverty

-

COVID-191 day ago

COVID-191 day agoNew report warns Ottawa’s ‘nudge’ unit erodes democracy and public trust

-

Agriculture19 hours ago

Agriculture19 hours agoFederal cabinet calls for Canadian bank used primarily by white farmers to be more diverse

-

Health5 hours ago

Health5 hours agoNEW STUDY: Infant Vaccine “Intensity” Strongly Predicts Autism Rates Worldwide

-

Great Reset17 hours ago

Great Reset17 hours agoCanadian government forcing doctors to promote euthanasia to patients: report

-

Business4 hours ago

Business4 hours agoClimate Climbdown: Sacrificing the Canadian Economy for Net-Zero Goals Others Are Abandoning