Business

The UN Pushing Carbon Taxes, Punishing Prosperity, And Promoting Poverty

From the Daily Caller News Foundation

Unelected regulators and bureaucrats from the United Nations have pushed for crushing the global economy in the name of saving the planet.

In October, the International Maritime Organization (IMO), a specialized agency within the U.N., proposed a carbon tax in order to slash the emissions of shipping vessels. This comes after the IMO’s April 2025 decision to adopt net-zero standards for global shipping.

Had the IMO agreed to the regulation, it would have been the first global tax on greenhouse gas emissions. Thankfully, the United States was able to effectively shut down those proposals; however, while these regulations have been temporarily halted, the erroneous ideas behind them continue to grow in support.

Proponents of carbon taxes generally argue that since climate change is an existential threat to human existence, drastic measures must be taken in all aspects of our lives to address the projected costs. People should eat less meat and use public transportation more often. In the political arena, they should vote out so-called “climate deniers.” In the economic sphere, carbon taxes are offered as a technocratic quick fix to carbon emissions. Is any of this worth it? Or are the benefits greater than the costs? In the case of climate change, the answer is no.

Carbon taxes are not a matter of scientific fact. As with all models, the assumptions drive the analysis. In the case of carbon taxes, the time horizon selected plays a major role in the outcome. So, too, does the discount rate and the specific integrated assessment models.

In other words, “Two economists can give vastly different estimates of the social cost of carbon, even if they agree on the objective facts underlying the analysis.” If the assumptions are subjective, as they are in carbon taxes, then they are not scientific facts. As I’ve pointed out, “carbon pricing models are as much political constructs as they are economic tools.” One must also ask whether carbon taxes will remain unchanged or gradually increase over time to advance other political agendas. In this proposal, the answer is that it increases over time.

Additionally, since these models are driven by assumptions, one would be right in asking who gets to impose these taxes? Of course, those would be the unelected bureaucrats at the IMO. No American who would be subject to these taxes ever voted for the people attempting to create the “world’s first global carbon tax.” It brings to mind the phrase “no taxation without representation.”

In an ironic twist, imposing carbon taxes on global shipping might actually be one of the worst ways to slash emissions, given the enormous gains from trade. Simply put, trade makes the world grow rich. Not just wealthy nations like those in the West, but every nation, even the most poor, grows richer. In wealthy countries, trade can help address climate change by enabling adaptation and innovation. For poorer countries, material gains from trade can help prevent their populations from starving and also help them advance along the environmental Kuznets curve.

In other words, the advantages of trade can, over time, make a country go from being so poor that a high level of air pollution is necessary for its survival to being rich enough to afford reducing or eliminating pollution. Carbon taxes, if sufficiently high, can prevent or significantly delay these processes, thereby undermining their supposed purpose. Not to mention, as of today, maritime shipping accounts for only about 3% of total global emissions.

The same ingenuity that brought us modern shipping will continue to power the global economy and fund growth and innovation, if we let it. The world does not need a layer of global bureaucracy for the sake of virtue signaling. What it needs is an understanding of both economics and human progress.

History shows that prosperity, innovation, and free trade are what make societies cleaner, healthier, and richer. Our choice is not between saving the planet and saving the economy; it is between free societies and free markets or surrendering responsibility to unelected international regulators and busybodies. The former has lifted billions out of poverty, and the latter threatens to drag us all backwards.

Samuel Peterson is a Research Fellow at the Institute for Energy Research.

Agriculture

Federal cabinet calls for Canadian bank used primarily by white farmers to be more diverse

From LifeSiteNews

A finance department review suggested women, youth, Indigenous, LGBTQ, Black and racialized entrepreneurs are underserved by Farm Credit Canada.

The Cabinet of Prime Minister Mark Carney said in a note that a Canadian Crown bank mostly used by farmers is too “white” and not diverse enough in its lending to “traditionally underrepresented groups” such as LGBT minorities.

Farm Credit Canada Regina, in Saskatchewan, is used by thousands of farmers, yet federal cabinet overseers claim its loan portfolio needs greater diversity.

The finance department note, which aims to make amendments to the Farm Credit Canada Act, claims that agriculture is “predominantly older white men.”

Proposed changes to the Act mean the government will mandate “regular legislative reviews to ensure alignment with the needs of the agriculture and agri-food sector.”

“Farm operators are predominantly older white men and farm families tend to have higher average incomes compared to all Canadians,” the note reads.

“Traditionally underrepresented groups such as women, youth, Indigenous, LGBTQ, and Black and racialized entrepreneurs may particularly benefit from regular legislative reviews to better enable Farm Credit Canada to align its activities with their specific needs.”

The text includes no legal amendment, and the finance department did not say why it was brought forward or who asked for the changes.

Canadian census data shows that there are only 590,710 farmers and their families, a number that keeps going down. The average farmer is a 55-year-old male and predominantly Christian, either Catholic or from the United Church.

Data shows that 6.9 percent of farmers are immigrants, with about 3.7 percent being “from racialized groups.”

National census data from 2021 indicates that about four percent of Canadians say they are LGBT; however, those who are farmers is not stated.

Historically, most farmers in Canada are multi-generational descendants of Christian/Catholic Europeans who came to Canada in the mid to late 1800s, mainly from the United Kingdom, Ireland, Ukraine, Russia, Italy, Poland, the Netherlands, Germany, and France.

Alberta

National Crisis Approaching Due To The Carney Government’s Centrally Planned Green Economy

From Energy Now

By Ron Wallace

Welcome to the Age of Ottawa’s centrally planned green economy.

On November 13, 2025, the Carney government announced yet another round of projects to be referred to the newly created Major Projects Office (MPO) established under the authority of the Building Canada Act (2025). That Office, designed to coordinate and streamline federal approvals for infrastructure projects deemed by Cabinet to be in the “national interest”. The announcement made scant reference to the fact that most of the referred projects had already received the regulatory permits required for construction or are, in several cases, already well under way.

Meanwhile, the aspirations of Alberta’s Premier Danielle Smith were not realized with a “Memorandum of Understanding” (MoU) signed with the Carney government before the 112th Grey Cup in Winnipeg. It remains to be seen if Canada and Alberta can in fact “create the circumstances whereby the oil and gas emissions cap would no longer be required” and if these negotiations will result in a “grand bargain” with the federal government. For its part, Alberta has signaled a willingness to change its industrial carbon tax program to encourage corporations to invest in emissions reduction projects while Alberta’s major energy producers have signalled that they are willing to consider carbon capture and methane reduction within an agreed industrial carbon pricing scheme. Notwithstanding concerns about its financial and technical viability, the Pathways Alliance Project appears to have become a cornerstone of Alberta’s negotiations with the federal government.

In early 2025 Premier Smith issued a list of nine demands accompanied by a six month ultimatum demanding the federal government roll back key elements of its climate policy. Designed to re-assert Alberta’s autonomy over natural resources, Smith’s core issues centered on the repeal of Bill C-69 (the “no new pipelines act) and Bill C-48 (the Oil Tanker Moratorium Act) scrapping the proposed Clean Electricity Regulations and abandonment of the net-zero automobile mandate. In face of a possible refusal by Ottawa to deal with these outstanding issues, Premier Smith launched a “Next Steps” panel as a province-wide consultation to “strengthen provincial sovereignty within Canada” – a process that could possibly lead to a referendum on Alberta’s future within Confederation.

Subsequently, in early October, Premier Smith also announced that her government, in collaboration with three pipeline industry partners, would advance an application to the Major Projects Office for a new oil pipeline from Alberta to a marine terminal on the northwest coast of British Columbia. The intent of the application is to have this new pipeline designated as a ‘project in the national interest’ to receive an accelerated review and approval timeline. Alberta is planning to submit that application in May 2026 to address the five criteria set by Ottawa for national interest determinations. Notably, the removal of what Premier Smith has termed ‘bad laws’ would be a prerequisite to construction of this proposed project.

As the Carney government continues its complex dance around these issues it remains to be seen how, or if, Smith’s demands for Canada to roll back federal legislation will be met. While Premier Smith staunchly advocated for the removal of what she termed to be the ‘bad laws’ standing in the way of the “ultimate approval” of a pipeline to the B.C. coast it remains to be seen if the Carney government will to accede to most, or even any, of these demands in ways that could clear the way for a new oil export pipeline from Alberta. At a time when the Carney government appears to be doubling down on its priority to reduce Canadian emissions it remains to be seen if Alberta can in fact increase oil production without increasing emissions.

Liberal MP Corey Hogan, who serves as parliamentary secretary to the Minister of Energy and Natural Resources the Honourable Tim Hodgson, noted that: “So as long as we can get to common understandings of what all of those mean, there’s not really a need for an emissions cap.” This ‘common understanding’ may signal a willingness by Ottawa to set aside the Trudeau government’s signature proposed oil and gas emissions cap in exchange for major carbon capture and storage projects in Alberta that would be combined with strong carbon pricing and methane regulations.

While this ‘common understanding’ may yet lead to a ‘grand bargain’ it would nevertheless effectively create two different classes of oil in Canada, each operating under different sets of regulations and different cost structures. Western Canada’s crude oil producers would be forced to shoulder costly and technically challenging decarbonization requirements in face of a federal veto over any new oil projects that weren’t ‘decarbonized.’ Canadian-produced oil would be faced with entering international export markets at a significant, if not ruinous, competitive disadvantage risking not only profitability but market share. Meanwhile, this hypocritical policy would allow eastern Canadian oil refiners to import ‘carbonized’ oil from countries with significantly looser environmental standards.

Carney’s November 2025 “Canada Strong” federal budget sets out $141.4 billion in new spending over five years with a projected $78.3 billion deficit for 2025–26. As Jack Mintz points out, while that budget claims to be “spending less to invest more”, annual capital spending will double from $30 billion a year to $60 billion a year over five years:

“… as federal program spending, which excludes interest on debt, is forecast to rise by 16 per cent from $490 billion this fiscal year to $568 billion in 2029-30. During the current year alone, the spending increase is a remarkable seven per cent. Public debt charges will soar by 43 per cent from $53 billion to $76 billion due to growing indebtedness and higher interest rates. No surprise there. Deficits — $78 billion this year alone — accumulate by a whopping $320 billion over five years.”

Since 2015 Canada has experienced a flight of investment capital approaching CAD$650 billion due to lost, or deferred, resource projects – particularly in the energy sector. While many economists recognize that Canada’s fiscal status may be worse than it appears, the Carney government is asking Canadians to ignore these figures while they implement industrial policies that, for all intents and purposes, represent a significant regression into central planning. The ‘modernization’ of the National Energy Board that began early in the Trudeau government’s mandate appears now to have been but a first step in the progressive centralization of control by the federal government. Gone are the days when an independent expert energy regulator made national interest determinations based upon cross-examined evidence presented in a public forum. Instead, a cabinet cloaked in confidentiality that is clearly inclined toward emissions reduction as its paramount consideration, will now determine and select projects.

This process of centralized decision-making represents a dilemma that confronts not just Premier Smith but the entire Canadian energy sector. The emerging financial debacle in the Canadian EV battery and vehicular manufacturing market is but one example of how centrally planned criteria designed to achieve a Net Zero economy will almost invariably lead to unanticipated, if not economically disastrous, results.

In short, the “green economy” is not working. The Fraser Institute noted that while Federal spending on the green economy surged from $600 million in 2014/15 to $23 billion in 2024/25, a nearly 40-fold increase, the green economy’s share of GDP rose only marginally from 3.1% in 2014 to 3.6% in 2023. Moreover, promised “green jobs” have not materialized at scale while traditional energy sectors vital to Alberta’s and the Canadian GDP have been actively constrained.

This economic reality has apparently not yet dawned in Ottawa. As Gwyn Morgan points out, Prime Minister Carney who, in 2021 with Michael Bloomberg, launched the Glasgow Financial Alliance for Net Zero (GFANZ), has not changed his determination to hike Canadian carbon taxes, proposing to increase the industrial levy from $80 to $170/ton by 2030. GFANZ was created to align global financial institutions with net-zero emissions targets bringing together sector-specific alliances like the Net Zero Banking Alliance (NZBA) and the Net Zero Asset Managers (NZAM). However, early in 2025 GFANZ faced significant challenges as major U.S. banks exited the NZBA followed by the Net-Zero Insurance Alliance (NZIA) that disbanded entirely in 2024 after a wave of member withdrawals. GFANZ was forced to undergo a strategic restructuring in January 2025 to shift from a coalition-of-alliances to a more open, standalone platform focused on mobilizing capital for the low-carbon transition through pragmatic climate financing. ‘Pragmatic’ indeed.

While Carney’s GFANZ has effectively imploded, his government ignores developing new realities in climate policy by continuing to implement the Trudeau government’s green agenda with programs like the Pan-Canadian Framework on Clean Growth and Climate Change. That program contains a plethora of ‘green economy’ measures designed to reduce carbon emissions in parallel with the 2030 Emissions Reduction Plan that commits Canada to reducing greenhouse gases (GHG) to achieve net-zero by 2050.

These policies ignore the recent change of mind by thought-leaders like Bill Gates who acknowledges that “climate change, disease, and poverty are all major problems we should deal with them in proportion to the suffering they cause.” This aligns his thinking with that of Bjorn Lomborg who states:

“Climate change demands action, but not at the expense of poverty reduction. Rich governments should invest in long-overdue R&D for breakthrough green technologies — affordable, reliable alternatives that everyone, rich and poor alike, will adopt. That is how we can solve climate without sacrificing the vulnerable. More countries, including Canada, need to get on board with the mission of returning the World Bank to focusing on poverty. Raiding development funds for climate initiatives isn’t just misguided. It’s an affront to human suffering.”

Philip Cross also expressed hope that 2025 may yet represent a “turning point in a return to sanity in public policy:”

“Nowhere is the change more evident than in attitudes to green energy policies, once the rallying cry for left-wing parties in North America. Support has collapsed for three pillars of green energy advocacy: building electric vehicles to eliminate our need for oil pipelines and refineries; using the financial clout of the Net-Zero Banking Alliance to force firms to eliminate carbon emissions; and legally mandating the shift from fossil fuels to green energy.”

Nonetheless, Prime Minister Carney appears resolute in the belief that Canadian policies for Net Zero are not hobbling investment in the energy sector while choosing to ignore alternative regulatory and investment tools that could make a material difference for the economy. Carney also appears to ignore major Canadian firms like TC Energy that have re-directed investments of $8.5 billion into the U.S. as they cite significant concerns about the Canadian regulatory structure. Similarly, Enbridge has advocated for “significant energy policy changes” in Canada while focussing attention not on new export pipelines but instead to incrementally upgrade capacity within its existing Mainline system network.

Canada’s destiny as a ‘decarbonized energy superpower’ will be largely determined by the serious economic consequences that will result from a sustained ideological push into ‘clean energy’. That said, will this be accomplished by a chaotic, ever-more centralized process of decision making, masquerading as a coherent national energy policy?

Conclusion

As Gwyn Morgan has succinctly written, it remains to be seen if the Carney government will be willing to make a “climate climbdown” in face of the reality that net zero goals are being broadly abandoned globally or will they continue to sacrifice the Canadian economy to single-minded, unrealistic or unattainable, goals for emissions reduction?

To date none of the projects referred by the Carney government to the Major Projects Office has been designated as ‘being in the national interest’. Moreover, the Alberta bitumen pipeline advocated by Premier Smith has not yet appeared on any list. Nonetheless, she apparently remains resolute in maintaining negotiations with Ottawa stating: “Currently, we are working on an agreement with the federal government that includes the removal, carve out or overhaul of several damaging laws chasing away private investment in our energy sector, and an agreement to work towards ultimate approval of a bitumen pipeline to Asian markets.”

As Alberta’s ultimatums and deadlines to Ottawa pass, it would be reasonable to question whether Premier Smith is, in fact, being confronted with the illusory freedom of a Hobson’s choice: Either Alberta must accept, at unprecedented cost, Ottawa’s determination to realize Net Zero or it will get nothing at all. While she may be seeking federal support to enable, or accelerate, construction of new pipelines, all Ottawa may be willing to concede is a promise to do better with an MoU that would ultimately impose massive costs for ‘decarbonization’ on Alberta while eastern Canada imports oil from other, less constrained, jurisdictions. Is this a “Grand Bargain?”

Budget 2025 has introduced a Climate Competitiveness Strategy for nuclear, hydro, wind and grid modernization that projects over CAD$1 trillion in spending over five years. It also reaffirms a commitment to increase carbon taxes by $80-$170/tonne for CO2-equivalent emissions by 2030. Since it appears committed to maintaining, or even expanding, Trudeau-era green legislation, some might question any commitments from the Carney government to enter into an even-handed debate on Canadian energy policies that are so critical to Alberta’s energy sector? As the Fraser Institute points out:

“The Canadian case shows an even greater mismatch between Ottawa’s COP commitments and its actual results. Despite billions spent by the federal government on the low-carbon economy (electric vehicle subsidies, tax credits to corporations, etc.), fossil fuel consumption increased 23 per cent between 1995 and 2024. Over the same period, the share of fossil fuels in Canada’s total energy consumption rose from 62.0 to 66.3 per cent.”

While the creation of the MPO may give the appearance of accelerating projects deemed to be in the national interest it nonetheless requires a circumvention of an existing legislative base. This approach further enhances a centrally-planned economy and presupposes that more, not less, bureaucracy will somehow make Canada an “energy superpower”.

Canada continues to overlook rising economic challenges while pursuing climate goals with inconsistent policies. As such, it risks becoming an outlier in energy policy at a time when the world is beginning to recognize the immense costs and implausibility of implementing policies for Net Zero.

Premier Danielle Smith may yet face a pivotal moment in Alberta’s, and possibly Canadian, history. If Ottawa’s past performance is but a prologue, predictions of a happy outcome may require a significant dose of optimism.

Ron Wallace is a former Member of the National Energy Board.

-

Alberta2 days ago

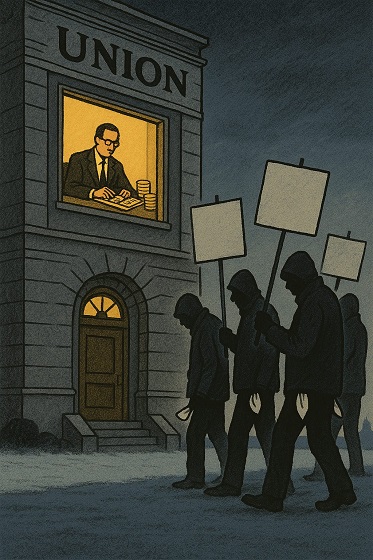

Alberta2 days agoATA Collect $72 Million in Dues But Couldn’t Pay Striking Teachers a Dime

-

Media2 days ago

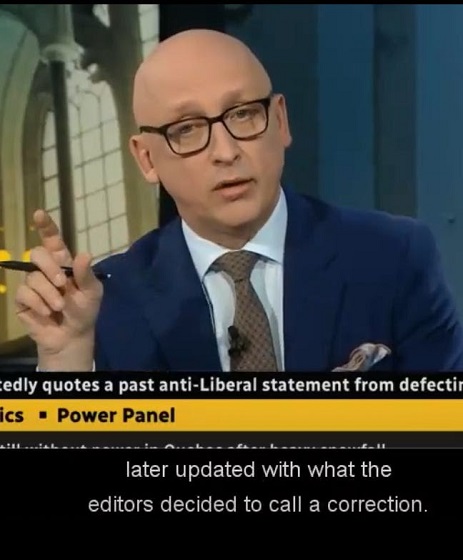

Media2 days agoBreaking News: the public actually expects journalists to determine the truth of statements they report

-

Artificial Intelligence2 days ago

Artificial Intelligence2 days agoAI seems fairly impressed by Pierre Poilievre’s ability to communicate

-

National2 days ago

National2 days agoWatchdog Demands Answers as MP Chris d’Entremont Crosses Floor

-

Business1 day ago

Business1 day agoCarney doubles down on NET ZERO

-

Alberta14 hours ago

Alberta14 hours agoCalgary mayor should retain ‘blanket rezoning’ for sake of Calgarian families

-

Business1 day ago

Business1 day agoLiberal’s green spending putting Canada on a road to ruin

-

Alberta12 hours ago

Alberta12 hours agoAlberta Offers Enormous Advantages for AI Data Centres