Opinion

The Great Reset doesn’t care if you believe it exists and Canada is on the front line

If you’re among the many people (can is possibly be the majority?) who still believe The Great Reset is an unfounded conspiracy theory, this article is for you.

The Great Reset ‘conspiracy theory’ has been around for years. If you don’t know what it is, here’s a brief explanation. It basically submits that some of the world’s wealthiest and most powerful people are using some of the world’s largest companies (which they own) as well as many of the world’s richest nations (which they run) to execute a plan to completely change the way our society works (which they don’t like very much). The theory is, these people who refer to themselves as “the elite” are planning to cripple the power of nation states and concentrate that power in a world governing body (like the World Economic Forum). This new powerful “elite” would exercise control over everyone, everywhere. They will completely change our supply chains, our economic systems and our energy systems in an effort to unite the world to protect the environment. There’s more to it, but that gets in most of the main points.

So this is the “theory”. But is there a “conspiracy” around this?

According the the Merriam-Webster Dictionary ‘conspiracy’ means simply “The act of conspiring together”. The Oxford dictionary spices that up a little. According to Oxford, ‘conspiracy’ means “A secret plan by a group of people to do something harmful or illegal”. Seems like it’s going to be easier to prove the Merriam-Webster version, but by the end of this article you’ll see how the Oxford definition might just work as well.

When it comes to all of the people who are not actively conspiring to change the world, there are roughly four categories of understanding The Great Reset. Either you:

- Have no idea there is a Great Reset

- Accept there is a Great Reset, but doubt the ability and the organization of the people conspiring.

- Accept there is a Great Reset, accept the ability of the conspirators, but either agree with their intentions, or at least not oppose their intentions due to your concern for a more fair economic system and an impending world devastating environmental disaster.

- Accept there is a Great Reset, and oppose the intentions of the conspirators because you personally value individual freedoms above everything else.

Group 1 is huge. Recent US polling shows half of Americans aren’t even aware of the Great Reset. It’s not like the people behind the reset aren’t writing and talking about it. It’s just that at least half of Americans haven’t seen them do it. That means we need to establish how it is possible in this age of information, that information of this magnitude is not being distributed to everyone. This part of my explanation is critical to understanding how very intelligent people can be completely unaware of information other people take for-granted.

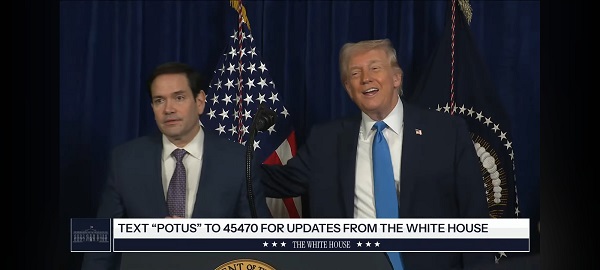

It all comes down to this. We’ve all experienced the vast chasm of division and hatred in society of late. In this atmosphere of doubt and suspicion, there is really only one one thing in the entire world that absolutely everyone can believe in. President Donald Trump is a capital A a-hole. Even the “Don” would likely agree with that, right? But here’s the thing. When the rude TV star began his stunning run through the primaries, the world quickly divided between those who backed Trump and those who absolutely despised the orange tsunami.

How did this happen? Well a very large number of people, many of them living in ‘middle’ America had had it with the quality of the people running, to run America. When a second Clinton announced a Presidential bid they collectively shouted NOOOO. Then they set out in search of the exact opposite of the establishment. They found it in an orange sun rise of vitriol, emerging over the high rises of Manhattan. When Donald Trump threw his hair, ehem.. his hat into the ring, they had their guy. It wasn’t because of his experience, or that they believed he was ultimately qualified for the job. Trump’s crowning quality was the exact thing most people hate about him. You see it was that massive, bulbous, all encompassing ego that was the key. Only someone with an ego this out of control would be capable of resisting and even going on the attack against the oncoming onslaught of opposition from the embedded establishment and the mainstream media who despise him with a passion.

Trump will likely claim differently, but he didn’t invent divisiveness. The world was already moving in this direction. But like every huge event in history, it all starts with one bullet, one border crossing, and sometimes one very unusual Orange head of hair. Camps divided around Trump’s blinding ego. Guess which side the establishment was on? Guess which side the media was on? Guess what this would mean to the distribution of information?

Personally, when the orange glow emerged from Manhattan I tuned out. Not understanding what was happening, I dismissed the orange storm as a weather system that would fizzle out when people got sick of it. I tuned out of mainstream media because I only had so much time for the gong show that was (and remains) the media coverage of the orange blowhard. This is what saved me. I had to go looking elsewhere for information. I would soon find there was more information here, and different takes on the information everyone ‘knows’.

If you still depend on mainstream media you may not know or have time for an entire new world of information that has developed on the internet over the last few years. Comedians who used to turn to late night TV to analyze the daily news through humour (I understand they are still there), have turned to long form and as it turns out, extremely informing conversations in a series of compelling podcasts. They are joined by former media types and some pretty sharp up and coming minds. While their late night and daytime TV competition unite in their humorous hatred of all things Donald, these longer form conversations have tended to go deeper, due simply to the length of the presentation. Conversations often run past two and three hours, and “sound bites” are more like 5 to 15 or even 30 minute explanations of single issues. Yes it is wise to avoid a number of them, just like you would avoid a number of TV programs, but you dismiss many others at your own expense.

You don’t need to agree with them to find them compelling. They are talking about events, people, and issues (including The Great Reset) you will not even find on regular mainstream media. It is not uncommon for these podcaster / interviewers to be covering topics that my friends who rely on mainstream media won’t hear about for months, or even years. A great example of this is the Hunter Biden laptop. If you’ve been paying attention to this new online media, you’d have known about this since the fall of 2020. For those who rely on regular media, they only discovered the exact same information when it was finally confirmed by the New York Times in March of 2022. The fact they call this breaking news is hilarious (and disturbing) for those who read the original articles from the New York Post, about 20 months ago! Here’s a link to a retrospective look at Biden laptop news from The NY Post from December 2020!

Now on to The Great Reset. If you haven’t already clicked on the link in the fist sentence of this article here’s another opportunity.

OK now at least you know The Great Reset is a real thing. So we move on to people who find themselves in group 2 which doubts that the Reset will ever amount to any actual resetting. This group would say these ‘elites’ live really far away, and they’re probably harmless to us because it’s not like they have any control over us. Not in our country. Well. That all depends on how far away you live from people like Canada’s Deputy Prime Minister Chrystia Freeland. Canada’s Deputy PM is also on the Board of Trustees of the WEF. If that’s not a conflict of interest, they probably need to redefine conflict of interest. Don’t take it from me. Take it from the founder of the World Economic Forum Klaus Schwab. (You mean the Klaus Schwab who researched, wrote, and published the book COVID-19: The Great Reset, less than 6 months after Covid-19 was a thing?.. Yes. that’s the guy.) In this short video from way back in 2017 Schwab brags about the success of a WEF program called Young Global Leaders. In Schwab’s own words, the WEF has “penetrated” Canada’s federal cabinet. Sounds kind of conspiratorial.. and a little bit less like a theory when he says it.

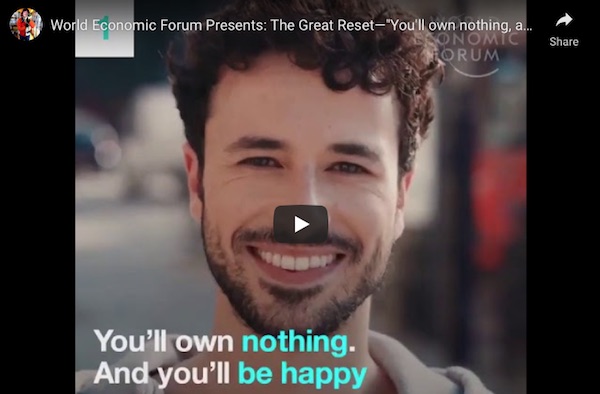

If we want to know if this should be disturbing to us we need to know what Earth’s elites are planning for us. Well the WEF was kind enough to tell us exactly what The Great Reset will mean to.. well.. the rest of us. This (in)famous video reveals just how different life will be for the average person by 2030. It doesn’t say how “the elite” will live, though we can expect they’ll have slightly different rules. Alas, I’m getting ahead of myself. Here’s a list of the 8 things the WEF has been kind enough to let us know we need to prepare for by 2030. I understand this video originally came out in 2016. I first saw it in 2020. In five years it’s been circulated widely. Though it’s no longer featured on the WEF website, there are copies all over the internet.

Recap:

1) We’ll own nothing. Ouch. (Obviously the elite will own everything and since they’re smarter than us we’ll be very happy to know they’re taking care of us so well). It’s being said by opponents of this idea that people who own a bit of land are perhaps the greatest risk to this environmental movement. It’s bad for the environment for us to own property or even your own home. Especially because we decide what happens there. Do we keep animals? Do we cut down trees or burn around on recreation vehicles or inefficient farm machinery? All bad for the environment. All that will change.

2) The US will no longer be the world’s superpower. (Hmmm… Don’t these things often change after brutal wars?) Regardless instead of one superpower, there will be a few important nations. Wonder if that will make the world more secure, or less secure?

3) They plan to use 3D printers to make human organs (lucky for us).

4) We will not be allowed to eat meat very much anymore (cows and pigs and sheep are bad for the environment). Hey, speaking of conspiracies, I mean series of seemingly related facts that are probably just random.. Did you know Bill Gates is the largest private owner of ‘farmland’ in the United States? Not sure when the software magnate and WEF “Agenda Contributor” took up farming. I’m sure none of this is related to what Mr. Gates is going to allow us to eat in the future (nervous smile). Although Gates also happens to be a big investor in synthetic meat. Did I mention he’s an ‘agenda contributor’ with the WEF?

5) One billion people in the world will have to move due to climate change (Not sure if that applies to the beach homes of the elite). (Also not sure why scientists and engineers will stop doing what they’ve always done and help us cope and adapt if conditions are changing quickly and significantly.)

6) Polluters will have to pay to emit carbon dioxide. We already know how this feels in Canada.

7) We will be prepared to travel in space (I’m ready to go now). The logic here is that the earth will be so ruined by us, that we better be prepared to go destroy an entirely different planet. What could go wrong?

Finally and maybe most disturbing of all..

8) Western Values will have been tested to the breaking point. Some probably like the sound of that. But in the history books I’ve read, when a society’s values are tested “to the breaking point” that tends to look incredibly violent and warlike. (In my opinion number 8 is going to be really challenging to accomplish at the same time as the everybody will be happy part in number 1. Maybe that’s why they put them so far apart in their list.). By the way, you have to wonder what they mean by “western values”? Is this finally being enlightened enough to turf Christianity and those silly laws that western societies adopted from those traditional religious beliefs. Can’t wait to find out what the new traditions will be! This outta go over well (Imagine Jerry Seinfeld saying that.)

OK. If you don’t find this a tad disturbing that might mean you are personally in favour of The Great Reset. It’s still a free country so that’s just fine with the rest of us. However the introduction video above is very much prior to the official launch of The Great Reset. That took place in the opening months of the Covid-19 pandemic. It would be better to judge how this is actually going to work by looking at how this New World Order (that’s what they’re calling it now) is unfolding. Now that the resetters have been resetting for about two years, how’s it going so far? Here’s a report from Glenn Beck. Glenn is a conservative pundit and broadcaster. If you follow the mainstream media you will know him as a radical far right conservative (and maybe a lunatic). If you don’t see Beck through that filter you will acknowledge that he sometimes says very interesting things. Things like this. By the way, pay attention to the background behind the speakers at this “world government” conference. Then ask yourself if this group might be planning a new world order.

It’s puzzling that the Canadian media doesn’t give this any coverage. I guess there are simply more important things to talk about than whether our own federal cabinet is working in our interest or in the interests of really rich people who plan to OWN EVERYTHING in just a few short years. Oh this is probably nothing but you may have heard about the federal NDP party making a deal to secure the federal government right up to 2025. That party is lead by the guy who now is Co-Prime Minister Jagmeet Singh. Guess what?

Speaking of Canada. You may find this conversation between the British podcast sensation Russel Brand and Nick Corbishley interesting. Nick is the author of Scanned: Why Vaccine Passports and Digital IDs Will Mean the End of Privacy and Personal Freedom. As Canadians it is interesting to hear how people in other countries are seeing The Great Reset, and how Canadians are “world leaders”. Yippee?

If you’ve managed to find your way through the longest article ever, you will certainly now be able to acknowledge The Great Reset or New World Order exists. The question now is, do you believe this is a good thing or do you think we should resist it as things were working pretty well before they launched this? We can get into that later. At the very least the massive number of people who dismissed the “conspiracy theorists” as slightly insane will see there is a reason many people are concerned. In the end, as all philosophers know we need to establish the facts, before we can decide whether we agree with them or not.

Finally my wise friend Garett reminded about the joke that’s been circulating for many months now on social media. Every time it turns out another conspiracy theory was actually a conspiratorial fact, someone passes it around again. If you haven’t seen it yet it might help with your outlook in the future. Goes like this. “What is the difference between a conspiracy theory and the truth? — About 6 months!”

International

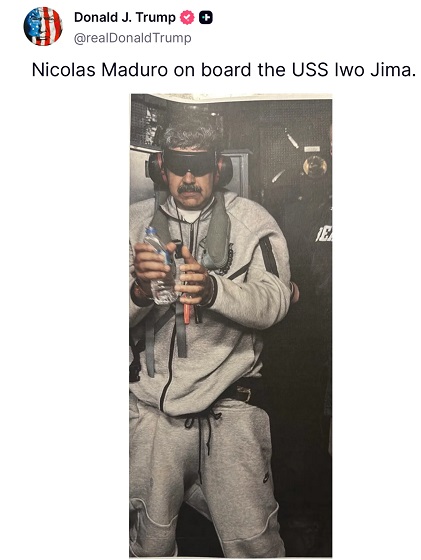

“History in the making”: Venezuelans in Florida flood streets after Maduro’s capture

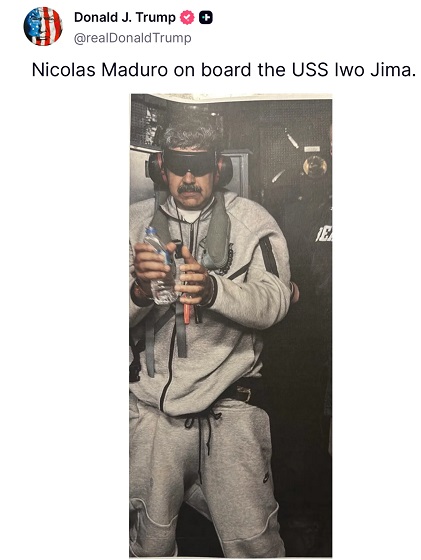

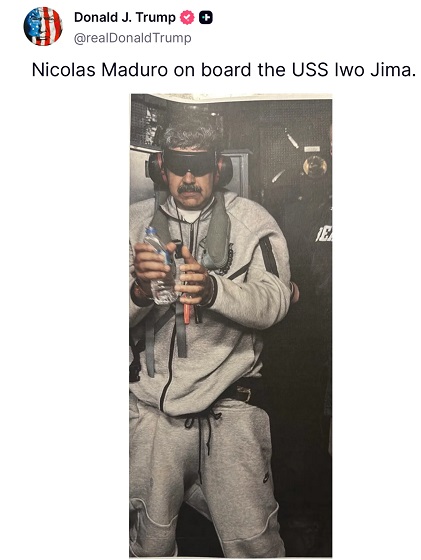

Celebrations broke out across South Florida Saturday as news spread that Venezuela’s longtime socialist strongman Nicolás Maduro had been captured and removed from power, a moment many Venezuelan exiles said they had waited their entire lives to see. In Doral, hundreds gathered outside the El Arepazo restaurant before sunrise, waving flags, embracing strangers, and reacting emotionally to what they described as a turning point for their homeland. Local television footage captured chants, tears, and spontaneous celebrations as word filtered through the community that Maduro and his wife had been “captured and flown out of the country” following U.S. military action announced by Donald Trump earlier that morning.

Venezuelans gathered early this morning in Doral to celebrate after news broke that the U.S. had captured Nicolás Maduro🇻🇪| #ONLYinDADE pic.twitter.com/mSNaF3IhR3

— ONLY in DADE (@ONLYinDADE) January 3, 2026

One young man, Edgar, spoke directly to reporters as the crowd surged behind him, calling the moment “history in the making.” He said his family had spent decades telling him stories about a Venezuela that once had real elections and basic freedoms. “My chest feels like it’s going to explode with joy,” he said, explaining that the struggle against the regime began long before he was born. Edgar thanked President Trump for allowing Venezuelans to work and rebuild their lives in the United States, adding that now, for the first time, he believed they could take those skills back home.

Similar scenes played out beyond Florida. Video circulating online showed Venezuelans celebrating in Chile and other parts of Latin America, reflecting the regional impact of Maduro’s fall. The dictator had clung to power through what U.S. officials and international observers have long described as sham elections, while presiding over economic collapse, mass emigration, and deepening ties to transnational criminal networks. U.S. authorities have pursued him for years, placing a $50 million bounty on information leading to his arrest or conviction. Federal prosecutors accused Maduro in 2020 of being a central figure in the so-called Cartel of the Suns, an international cocaine trafficking operation allegedly run by senior members of the Venezuelan regime and aimed, in prosecutors’ words, at flooding the United States with drugs.

After the overnight strikes, Venezuela’s remaining regime figures declared a state of emergency, even as images of celebration dominated social media abroad. In Washington, reaction from Florida lawmakers was swift. Rep. Carlos Gimenez, who represents a district with large Venezuelan, Cuban, and Nicaraguan exile communities, compared Maduro’s capture to one of the defining moments of the 20th century. “President Trump has changed the course of history in our hemisphere,” Gimenez wrote, calling the operation “this hemisphere’s equivalent to the Fall of the Berlin Wall.” He added that South Florida’s exile communities were “overwhelmed with emotion and hope,” and thanked U.S. service members for what he described as a decisive and successful mission.

For many gathered in Doral, the reaction was deeply personal. A CBS Miami reporter relayed comments from attendees who said they now felt safer about the possibility of returning to Venezuela to see family members they had not hugged in years. One man described it as the end of “26 years of waiting” for a free country, saying the moment felt less like politics and more like the closing of a long, painful chapter.

U.S. Attorney General Pam Bondi confirmed Saturday that Maduro and his wife have been formally indicted in the Southern District of New York. Bondi said the charges include narco-terrorism conspiracy, cocaine importation conspiracy, and weapons offenses involving machine guns and destructive devices. For Venezuelan Americans packed into South Florida streets, those legal details mattered less than the symbolism. After years of watching their country unravel from afar, many said they finally felt something unfamiliar when they looked south — relief, and the cautious hope that Venezuela’s future might no longer be written by a dictator.

Opinion

Hell freezes over, CTV’s fabrication of fake news and our 2026 forecast is still searching for sunshine

Plus! Politico warns that the far right’s stealing Christmas, a CBC content analysis ruffles feathers and more! Happy New Year

Last week, according to the people who produce the nation’s most popular newscast, the hell that is Gaza froze over.

That’s right. According to CTV News, “freezing” rain flooded Gaza camps, leaving “displaced Palestinians in dire conditions.” This, as was pointed out by social media critics (including the National Post’s Chris Selley) was an absolutely false statement. It was, to be clear, a lie.

The Rewrite is a dedicated to saving journalism from its worst instincts.

Please support us with a free or paid subscription

Winter rains had indeed fallen and made life unpleasant for people in Gaza. But the Associated Press (AP) report for which some eager beaver wrote the headline (one is tempted to suspect either a social justice warrior posing as a journalist or a bumbling incompetent produced by J-school) made no mention of anything “freezing.” Of course it didn’t, because on the day the story was published the high temperature in Gaza was 17C with a low of 13C.

Now, as one who has visited Disneyland in January, I am aware that temperatures can be relative. When it’s 14C in southern California, people from Saskatoon and Winnipeg are jumping into the local hotel pools while “cast members” at Disneyland are wearing toques and mittens. So AP was entirely within its rights to refer to conditions as chilly.

CTV Evening News, historically, has been one of Canada’s most watched regularly scheduled programs. It has boasted in the past about being the nation’s “most trusted” newscast.

So it was bad enough that CTV posted a barefaced falsehood. What was worse, although it did soften its internal headline to refer to “winter” rains, was that it did not take down its “freezing” posts or offer any hint of regret – at least none I could find – that it had ever posted information that amounted to the antithesis of journalism’s first obligation – The Truth.

While CTV’s owner, Bell, continues to lobby for its newsrooms to qualify for government subsidies such as the Journalism Labour Tax Credit and campaign in Canadian Radio-television and Telecommunications Commission (CRTC) hearings for newsroom funding, it does not appear super interested in investing in good journalism or even maintaining public trust in it.

Which is a shame, because last week its presentation of fake news did significant harm to trust in the craft and was inconsistent with its published standards.

Peter Stockland did a fine job the other day in addressing the fuss raised in media concerning CBS editor-in-chief Bari Weiss’s decision to pull back a story regarding US deportees because, she said, it wasn’t complete enough for airing on 60 Minutes. Others viewed it more suspiciously.

If you haven’t read it yet, please do. We’ll see how it all turns out but what caught my eye was the manner in which the Globe and Mail’s U.S. correspondent, Adrian Morrow, chose to describe Weiss. He portrayed her only as “an anti-woke media personality” – a term of which his editors apparently approved. Given that Weiss was the Opinion Editor of the Wall Street Journal and then the New York Times, this seems a little, shall we say, catty? A childishly nasty manner in which to refer to Weiss, I thought, considering she also launched an online publication – The Free Press – that, because she was good at being an editor, used talented journalists and paid them well, recently sold to Paramount Skydance for more than $200 million.

Most of all, though, I found the reference entirely unnecessary and self-indulgent, as if the piece was written for the approval of peers and not for the benefit of readers.

Unsubstantiated references to the “far right” continue to be in prolific use as we begin a New Year, still searching for reasons to be optimistic about the state of journalism. References to the “far left,” meanwhile, continue to defy Newton’s Third Law of Motion concerning equal and opposite actions.

The European edition of Politico used no less an occasion that the birth of the previous millenium’s most influential figure to weigh in with its report on “How the far right stole Christmas.”

“U.S. President Donald Trump claims to have “brought back” the phrase “Merry Christmas” in the United States,” Politico declared, “framing it as defiance against political correctness. Now, European far-right parties more usually focused on immigration or law-and-order concerns have adopted similar language, recasting Christmas as the latest battleground in a broader struggle over culture.”

Whew. Politico, focusing on Italian leader Giorgia Meloni, went so far as to quote attendees at a Christmas celebration who wished to remain anonymous for fear of being associated with a “far right” event.

Me? I thought it was Karl Marx, father of the far left, who labeled religion the “opium of the masses” and a human creation designed to keep the working classes oppressed. And weren’t the Soviet Union, China, North Korea and other Communist states the ones that did and do their level best to “steal” Christmas and other festivities founded in faith? Times have clearly changed, even if some newsroom instincts have not.

Speaking of disconnected media, prolific numbers man David Clinton has ruffled a few feathers with an extensive analysis in his Substack platform, The Audit, of CBC content. Here’s his summary of what he found:

“Of the 300 stories covered by my data, around 30 per cent – month after month – focused on Donald Trump and U.S.- Canada relations. Another 12-15 percent related to Gaza and the Israel-Palestine conflict. Domestic politics – including election coverage – took up another 12 percent, Indigenous issues attracted 9 percent, climate and the environment grabbed 8 percent, and gender identity, health-care worker assaults, immigrant suffering, and crime attracted around 4 percent each.”

Clinton provides a list of topics that were not “meaningfully represented in my sample of CBC’s Top Stories.” It includes housing affordability, immigration levels, crime rate, private sector investment success stories, the oil and gas sector, Chinese interference, etc. You can read his full analysis here.

You can also look for my New Year’s predictions on media that (spoiler alert) states that seeing as there has been no evidence of reform in CBC President Marie-Philippe Bouchard’s first year at the helm of the Mother Corp, you can expect more of the same nothing in 2026. That piece is expected to appear in The Hub this week.

Western Standard announced before Christmas that it’s heading East and hiring a reporter to cover news emanating from Queen’s Park, Ontario’s provincial legislature.

The most notable media-on-media smackdown that came to my attention over the festive season goes to the reliably rambunctious Ezra Levant of Rebel News.

Seizing on a year-end column by the Globe and Mail’s Lawrence Martin that hailed 2025 “as one of Canada’s great nation-building years” under Prime Minister Mark Carney, Levant had this to say:

|

And that, for this week, is that. Welcome to 2026.

(Peter Menzies is a commentator and consultant on media, Macdonald-Laurier Institute Senior Fellow, a past publisher of the Calgary Herald, a former vice chair of the CRTC and a National Newspaper Award winner.)

Invite your friends and earn rewards

-

International2 days ago

International2 days ago“Captured and flown out”: Trump announces dramatic capture of Maduro

-

International2 days ago

International2 days agoTrump Says U.S. Strike Captured Nicolás Maduro and Wife Cilia Flores; Bondi Says Couple Possessed Machine Guns

-

Energy1 day ago

Energy1 day agoThe U.S. Just Removed a Dictator and Canada is Collateral Damage

-

International1 day ago

International1 day agoUS Justice Department Accusing Maduro’s Inner Circle of a Narco-State Conspiracy

-

Haultain Research1 day ago

Haultain Research1 day agoTrying to Defend Maduro’s Legitimacy

-

Business2 days ago

Business2 days agoVacant Somali Daycares In Viral Videos Are Also Linked To $300 Million ‘Feeding Our Future’ Fraud

-

Daily Caller19 hours ago

Daily Caller19 hours agoTrump Says US Going To Run Venezuela After Nabbing Maduro

-

International1 day ago

International1 day agoU.S. Claims Western Hemispheric Domination, Denies Russia Security Interests On Its Own Border