In an attempt to open an area that producers have essentially been shut out of in northeastern B.C., the B.C. government directly awarded oil and gas tenure to the Halfway River First Nation, giving them greater control over how oil and gas extraction in the area might happen.

That tenure is now getting “farmed out” to companies like ARC Resources.

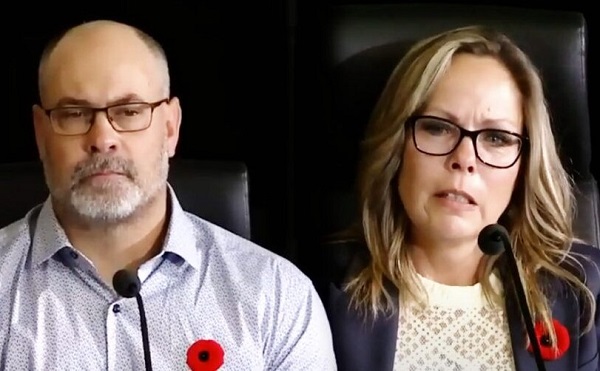

“The granting of the tenure by the B.C. government to the nation is new,” said Greg Kist, executive manager for Tsaa Dunne Za Energy, the Halfway River First Nation’s energy business.

Depending on the outcome of the experiment, it’s the kind of thing that might one day be showcased at a future Indigenous Partnership Success Showcase event.

For more than two decades, a large area in Halfway River First Nation traditional territory in northeastern B.C. has been off limits to industrial activities like logging and oil and gas exploration and extraction, due to treaty rights.

In 1999, the BC Supreme Court quashed a timber harvesting permit approved by the province for Canfor, based on Halfway River First Nation’s Treaty 8 rights.

An extraction moratorium of sorts was placed over core HRFN territory, which happens to be in the “fairway” of the Montney natural gas formation.

“All of the lands were deferred from any further development,” Kist said. “And that meant everything from logging it, to oil and gas activities.”

This “deferral” of industrial activities in the area has been one of the question marks hanging over the oil and gas-rich Montney formation in northeastern B.C.

The 2021 BC Supreme Court Yahey decision had also left Treaty 8 territory dotted with question marks.

In Yahey, the court ruled cumulative impacts of activities like oil and gas development constituted a breach of the treaty rights of the Blueberry River First Nation, one of eight B.C. signatories to Treaty 8.

These various treaty rights rulings in northeastern B.C. create a serious challenge: How can B.C. continue to benefit from an abundance of natural gas to feed a burgeoning LNG industry without infringing the rights of Treaty 8 First Nations?

In the case of Halfway River, the B.C. government, the First Nation and industry are taking an innovative approach, using oil and gas tenure.

Last year, the B.C. government and HRFN signed a treaty settlement agreement that grants the nation more control over land use and development. As part of the agreement, the B.C. government directly awarded HRFN oil and gas tenure over 34,000 hectares of land. It was the first time the province has directly awarded oil and gas tenure to a First Nation.

In turn, the HRFN is now farming out its tenure rights to companies like ARC Resources, whose existing land holdings in the Attachie play are directly adjacent to the HRFN tenure.

“The resource quality is comparable to ARC’s existing Attachie asset, further extending the development runway at one of ARC’s most profitable assets,” ARC said in its second quarter financials at the end of July.

The tenure awarded to HRFN through its energy business, Tsaa Dunne Ta Energy, encompasses prime Montney real estate that had been essentially sterilized from development for decades.

“That 34,000 hectares is right in the middle of the Montney fairway,” Kist said.

Under an “earning and development” agreement with Tsaa Dunne Za Energy, ARC Resources will gain access to 36 parcels of land contiguous with its existing land parcel in the Attachie play. This expands its Attachie holdings by 10%.

Green area denotes Halfway River First Nation tenure; blue represents ARC Resources tenure.

“Think of it as Tsaa Dunne farming that land out to ARC, and we have an agreement that benefits us financially,” Kist said.

“The tenure award and landscape planning pilot will help to ensure that oil and gas development in these areas is sustainable and managed in accordance with the values of the Halfway River First Nation,” Chief Darlene Hunter said last year with the signing of the treaty settlement agreement.

Kist notes that the agreement with ARC represents only 25% of the land tenure granted to HRFN. So 75% of the land tenure could be open to further agreements with other natural gas producers.

“There will likely be more deals over time as we look at the different opportunities that are out there,” Kist said.

Kist is the former president of Rockies LNG and, before that, president of Pacific Northwest LNG. He and Jim Stannard, a former Petronas executive, are now managers for Tsaa Dunne Za Energy.

The tenure award does not represent a transfer of subsurface rights. All subsurface rights to things like minerals, coal, and oil and gas belong to the Crown.

“And at the end of the day, the B.C. government still gets its royalties,” Kist said. “But now the nation is very much in control of that activity.”

The recent agreement with ARC to develop 36 parcels adjacent to its Attachie lands is just the first one to be signed so far. There may be more such agreements in the future, Kist said.

Kist said the First Nation tenure model could end up being used elsewhere.

“I think the B.C. government’s going to look at these sorts of opportunities in areas where maybe there is a lack of development moving things forward,” he said.

“I think this could potentially be the model for development, with First Nations leading the way.”