Business

Tariffs by Tuesday: Trump Says There Is ‘No Room Left’ For Any Negotiations On Postponing Tariffs On Mexico, Canada

From the Daily Caller News Foundation

By Nicole Silverio

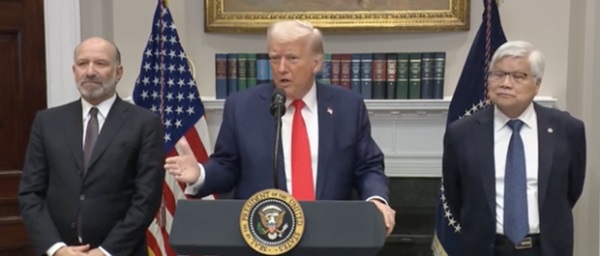

President Donald Trump said Monday that there is “no room left” for any negotiations on postponing tariffs on Mexico, Canada or China in response to their handling of the immigration and fentanyl crisis.

Trump initially planned to impose 25% tariffs on Mexico and Canada and a 10% tariff on China over its role in allowing illegal immigration and fentanyl to pour into the U.S. in record numbers. After postponing these tariffs for a month after Mexico and Canada caved to his requests, the president said he has fully made up his mind to officially impose these tariffs this upcoming Tuesday.

“No room left for Mexico or for Canada. No, the tariffs [are] all set, they go into effect tomorrow,” Trump said. “And just so you understand, vast amounts of fentanyl have poured into our country from Mexico and as you know, also from China where it goes to Mexico and goes to Canada and China also had an additional 10 [percent], so it’s 10 + 10, and it comes in from Canada and it comes in from Mexico and that’s a very important thing to say.”

Dear Readers:

As a nonprofit, we are dependent on the generosity of our readers.

Please consider making a small donation of any amount here. Thank you!

WATCH:

Trump postponed the tariffs on Feb. 3 after Mexican President Claudia Sheinbaum and Canadian Prime Minister Justin Trudeau caved to his requests by increasing their efforts to tackle illegal immigration and fentanyl. Sheinbaum deployed 10,000 National Guard soldiers to the U.S.-Mexico border while Trudeau invested $1.3 billion to crackdown on illegal migration and appointed a “Fentanyl Czar” to oversee a $200 million effort against the drug.

The president announced in a Feb. 27 Truth Social post that he planned to double the tariffs on China to 20% and move forward with the tariffs on Mexico and Canada over the “very high and unacceptable levels” of drugs pouring into the U.S.

“We cannot allow this scourge to continue to harm the USA, and therefore, until it stops, or is seriously limited, the proposed TARIFFS scheduled to go into effect on MARCH FOURTH will, indeed, go into effect, as scheduled,” Trump said. “China will likewise be charged an additional 10% Tariff on that date. The April Second Reciprocal Tariff date will remain in full force and effect. Thank you for your attention to this matter. GOD BLESS AMERICA!”

These three countries are being slapped with tariffs as the U.S. suffers a fentanyl epidemic, with over 21,000 pounds of the deadly drug being seized at the southern border in the fiscal year 2024, according to Customs and Border Protection (CBP). Border agents have seized over 5,400 pounds in the 2025 fiscal year thus far.

At the U.S.-Canadian border, officials encountered over 11,000 pounds of drugs in the 2024 fiscal year and over 3,200 pounds have so far been seized in the 2025 fiscal year, according to CBP data. Over 60,000 pounds and 55,000 pounds of drugs were seized in the 2022 and 2023 fiscal years.

U.S. border officials also encountered over 8.5 million migrants at the southern border during the four fiscal years of former President Joe Biden’s administration. Border crossings at the northern border skyrocketed with over 198,000 encounters and nearly 19,000 arrests occurring in the 2024 fiscal year.

Business

Mystery cloaks Doug Ford’s funding of media through Ontario advertising subsidy

Plus! Some tough lessons learned by journalists at all levels – not everyone is telling the truth and there are many people with the same name. Verify.

By now it’s established that Ontario Premier Doug Ford is either an ever so dreamy “elbows up” super hero kinda guy who’s shown US President Donald Trump who his daddy is or …. a ham fisted, narcissistic blowhard with all the finesse of a drunken linebacker crashing through the Royal Doulton.

If you follow social media, those appear to be the options. You choose.

The Rewrite needs your support to hold journalism accountable.

Please become a free or paid subscriber.

His $75 million ad buy attempting to show Americans how Trump is offside on tariffs with the late Republican icon President Ronald Reagan (1981-89) was either, as Ford insists, a triumph, or a disaster of epic proportions. Either way, the result is the Americans broke off trade talks until, well, whenever a very aggrieved Trump next wakes up on the right side of the bed. And the progressive bromance between Ford and Prime Minister Mark Carney looks to be on the rocks, with the latter admitting he apologized to Trump and had advised against the ads. Me? I thought Matt Gurney summarized the situation very well in the Toronto Star.

“The Americans are more than savvy enough to have figured out what we’re up to. They’ve responded to our good cop/bad cop strategy by shooting both cops and then torching the police station.”

The Rewrite, though, is about media, not tugging forelocks and authoring political thumb suckers. So what really made me curious about Ford’s ad spend was whether the premier’s media friends in Ontario were going to get their – what’s that phrase again? – oh, right: fair share.

People may have forgotten but it was only last year when Ford, succumbing to News Media Canada’s lobbying, decided that too much government advertising money was going to American tech companies like Meta and Google and not enough to people who report about him and his opponents. Consistent with the progressive belief that government subsidies can cure any problem, Ford ordered that 25 per cent of the $100 million spent on advertising annually by the Liquor Control Board of Ontario (LCBO), the Ontario Cannabis Store, Metrolinx and the Ontario Lottery and Gaming Corporation (OLG) be directed to Ontario newspapers. And he didn’t stop there. The directive news release made it clear that “the government is also making similar commitments with its own advertising spending, helping to provide even more support for Ontario jobs and promote Ontario culture.”

Word on the street is that this cashapalooza – announced mere months before an election- has been warmly received by Ontario media, so I was already trying to find out who was getting how much when the US ads launched.

Turns out what should have been a simple task is not so easy. The specifics are not to be found within Ontario’s public accounts. So I wrote to Grace Lee, the director of communications in the Premier’s office and then Hannah Jensen, who also works there. No response. Then I tried again. Still nothing. When I asked if the directive “also applies to the Government of Ontario’s recent advertising buy in the United States so that additional government advertising – as is indicated in the directive – worth 25 per cent of the US spend will benefit qualified Ontario media” I got the same cold shoulder.

So, while there was a bit of publicity regarding Ford’s initial decision to subsidize Ontario publishers to the tune of $25 million-plus, no one is providing the details. The publishers must know and the government must know, but they seem to be keeping it a secret. It doesn’t seem likely, but if Ford is faithful to the words and spirit of his 2024 directive, there should be some additional cash flowing to approved Ontario publishers as a result of his Trump tantrum-inducing investment.

Alas, it appears unlikely the public will ever know if that’s the case or which media outlets are benefiting from the premier’s benefaction. That makes these arrangements look all too grubby. Keeping them in the dark, where they’ll stay because that’s the way the politicians and the publishers like it, is only going to further diminish public trust in media. But it’s unclear most of them care anymore.

A phrase in a Juno News report caught my eye last week and it should serve as a cautionary tale. In its report on a large Alberta Independence rally in Edmonton, separatism-friendly lawyer Jeffrey Rath was, understandably, a key source. But he was loosely quoted when referring to a competing Pro-Canada petition on the question of separation. Juno reported that “Rath said Saturday that he heard (organizer Thomas) Lukaszuk was 50,000 signatures short, with a Tuesday deadline.”

The issue isn’t whether Rath said that or not – it’s whether what “he heard” was based on anything other than wishful thinking and rumour-planting. Reporters should not pass along that form of information without verifying because, as it turned out, Rath wasn’t even close. Needing 294,000 signatures, the Pro-Canada petition collected 456,000 or at least 200,000 more than what Juno’s source, Rath, “heard.”

Fine if Rath wants to make a fool of himself. Reporters should be careful not to share the distinction.

A more established title than Juno was in a shambles last week when the venerable Times of London had to quickly pull a story in which former New York Mayor Bill de Blasio was quoted criticizing Democrat mayoralty candidate Zohran Mamdani.

What went wrong? The Times reporter believed he had reached out to de Blasio via email and got a response that questioned Mamdani’s economic plan. The New York Post, also owned by Rupert Murdoch, jumped all over it but when the real former mayor de Blasio responded on X that the report was bogus, The Times stepped back quickly, issuing a statement that it had “apologised to Bill de Blasio and removed the article immediately after discovering that our reporter had been misled by an individual falsely claiming to be the former New York mayor.”

In an interesting twist, the international publication Semafor reported that it had “reached out to a Gmail address our sources believed to be the one used by The Times.”

And:

“You are correct. It was me. The real Bill DeBlasio,” the person who controls the email address responded.

As it turns out, just as there’s more than one Peter Menzies in this world, there’s not just one Bill de Blasio and The Times’ assertion that someone was impersonating the former mayor quickly proved contentious.

The guy who responded to the email turned out to be a 59-year-old Long Island wine importer named Bill DeBlasio.

“I’m Bill DeBlasio. I’ve always been Bill DeBlasio,” DeBlasio (not de Blasio) told Semafor after it knocked on his door. “I never once said I was the mayor. He never addressed me as the mayor.

“So I just gave him my opinion.”

The moral of this story for journos? As the old Chicago City desk saying goes, always “check it out – if your mother says she loves you, check it out.”

In the meantime, we await The Times’ apology to DeBlasio – the one with the wine.

(Peter Menzies is a commentator and consultant on media, Macdonald-Laurier Institute Senior Fellow, a past publisher of the Calgary Herald, a former vice chair of the CRTC and a National Newspaper Award winner.)

Business

You Won’t Believe What Canada’s Embassy in Brazil Has Been Up To

Canada’s embassy in Brazil has been having a terrific year. Well, at least that’s how it might look from the perspective of the 15 or so Canadians who live and work there.

Oh sure, they just faced a conviction in a local court over labour law infractions. And, OK, there are also multiple related cases pending. But the vibe down there must be great.

The Audit is a reader-supported publication.

To receive new posts and support my work, consider becoming a free or paid subscriber.

After all, it never snows in Brasilia and, not counting a half million Canadian dollars for security and “common services”, they spent $1.1 million keeping their various properties running according to a 2024-2025 budget document I’ve seen. Here, courtesy of Google Satellite, is what the embassy itself looks like:

And here’s how that $1.1 million in spending broke down:

To be sure, this isn’t a story about vast crooked fortunes being gained through devious financial scams. I’m aware of no 300ft luxury yachts being quietly moved between Dows Lake and the Bahamas each fall and spring. And it’s certainly reasonable for Canadians on foreign missions to expect to enjoy an above-average lifestyle while serving their country abroad.

But perhaps some of the spending here is getting a bit too close to the line. Take the ten pool covers purchased last year for nearly $25,000 (Canadian) in total. The budget document actually notes how such covers can help with the high cost of replacing water lost through evaporation.

In fact, water costs (totaling $103,000 that year) have been rising: they’re 20 percent higher than fiscal year 2022-2023. So it does seem that someone on staff is aware of the problem and is trying to address it. But a simpler solution might involve just shutting down at least some of the pools (there’s no way they need 10 covers for just one pool) or switching to using trucked-in water for the pools (which is supposed to be cheaper).

And how about the $16,900 spent on a Rational iCombi Pro Xs 6 2/3 220V Mono Elétrico oven for the official residence? Nice. But that’s around ten times the cost of a standard high-end home oven. Add to that the $2,140 spent on a KitchenAid 6.6L, Espresso Machine, Pasta Maker, Blender, and Electrical Slicer.

Don’t you just hate it when everything breaks down at the same time?

I realize that, in the grand scheme of things, nothing here feels all that evil. And I know it’s not fair to peer over people’s shoulders and judge their actions from such a distance. But it certainly does look like here’s yet one more Global Affairs Canada operation that’s missed the memo on the need to tone down public spending.

The Audit is a reader-supported publication.

To receive new posts and support my work, consider becoming a free or paid subscriber.

-

Alberta2 days ago

Alberta2 days agoFrom Underdog to Top Broodmare

-

Business24 hours ago

Business24 hours agoTrans Mountain executive says it’s time to fix the system, expand access, and think like a nation builder

-

Economy2 days ago

Economy2 days agoIn his own words: Stunning Climate Change pivot from Bill Gates. Poverty and disease should be top concern.

-

Business2 days ago

Business2 days agoPaying for Trudeau’s EV Gamble: Ottawa Bought Jobs That Disappeared

-

Business2 days ago

Business2 days agoCBC uses tax dollars to hire more bureaucrats, fewer journalists

-

International22 hours ago

International22 hours agoBiden’s Autopen Orders declared “null and void”

-

National2 days ago

National2 days agoElection Officials Warn MPs: Canada’s Ballot System Is Being Exploited

-

Addictions2 days ago

Addictions2 days agoThe Shaky Science Behind Harm Reduction and Pediatric Gender Medicine