Energy

Sending natural gas pipeline project back for environmental review could put $20 billion investment at risk

From Resource Works

Ksi Lisims LNG too important to fail

The BC Environmental Assessment Office (EAO) is expected to soon determine whether the Prince Rupert Gas Transmission (PRGT) pipeline project has been “substantially started” as per the conditions of its provincial environmental certificate. Later this summer, the EAO is also expected to issue a recommendation on the Ksi Lisims LNG project, which would be supplied by the PRGT pipeline.

If these regulatory hurdles are cleared, the project is still likely to face court challenges, including judicial review applications from environmental groups and potentially the Gitanyow First Nation. The stakes are high: Ksi Lisims LNG represents a $20 billion investment and is a clean energy mega-project that the government of Premier David Eby cannot afford to lose, both in terms of economic development and reconciliation with Indigenous communities.

Should the EAO conclude that PRGT has not made a substantial start, the project’s environmental certificate would expire. The proponents—the Nisga’a Nation and Western LNG—would then be required to restart the environmental review process from scratch. This would result in years of delay and potentially hundreds of millions of dollars in additional costs. Timing is especially critical for LNG projects targeting Asian markets, where long-term supply contracts, often lasting 15 to 20 years, must align with project timelines. Ksi Lisims aims to be operational by 2029.

Petronas Energy Canada CEO Mark Fitzgerald recently told the Greater Vancouver Board of Trade that Canada has an 18-month window to move key projects forward or risk losing investment opportunities. This warning echoes past experience: in 2017, Petronas canceled the Pacific Northwest LNG project just one week after the NDP government took office, despite having invested nearly $1 billion. That decision resulted in the mothballing of the PRGT pipeline and signaled the collapse of other major LNG projects, including Kitimat LNG (Chevron), Aurora LNG (Nexen), WCC LNG (ExxonMobil), and Prince Rupert LNG (Shell). Many investors instead shifted their focus to the United States.

While previous cancellations were partially attributed to macroeconomic factors, these did not deter LNG investment in other jurisdictions. In contrast, Ksi Lisims LNG has recently gained momentum, with significant financial backing from Blackstone Energy Transition Partners, Shell, and TotalEnergies through private placements, off-take agreements, and planned equity stakes. However, investor confidence is fragile and can evaporate if the project becomes mired in regulatory or legal delays.

The PRGT pipeline received its original environmental certificate in 2014 with a five-year term, later renewed once. The Nisga’a Nation and Western LNG must now demonstrate that substantial construction has commenced to maintain that certification. According to Western LNG, work completed includes clearing 47 kilometers of right-of-way on Nisga’a treaty lands, constructing 42 kilometers of road, and building nine bridges. Whether this constitutes a “substantial start” is under review. Groups such as Ecojustice and the Gitanyow First Nation have submitted objections, arguing that it does not meet the threshold.

It is notable that the Gitanyow originally supported PRGT through impact benefits agreements with the province and project agreements with the previous proponent, TC Energy. However, their position shifted after ownership transferred to the Nisga’a Nation and Western LNG. The Gitanyow now argue the project has changed substantially, including a re-routing near the western terminus to accommodate the new Ksi Lisims LNG terminal, which is located further north than the originally planned Pacific Northwest LNG terminal.

Such disputes highlight why both federal and provincial governments have recently begun developing fast-tracking legislation for major infrastructure projects deemed to be in the national interest. These new legislative tools are intended to reduce bureaucratic delays and provide greater regulatory certainty. Ksi Lisims and PRGT meet many of the criteria such legislation is designed to support and would be strong candidates for such treatment should the EAO’s decision result in further delays.

Importantly, Ksi Lisims LNG is not simply a project supported by the Nisga’a Nation—it is being led by them. In addition, all other First Nations along the proposed pipeline route, except the Gitanyow, appear to support the project and are being offered equity participation. This makes Ksi Lisims a powerful example of reconciliation in action.

Furthermore, the project’s floating LNG design significantly reduces its terrestrial footprint and associated environmental impact, particularly on fish habitats. The proponents have also committed to using electricity to power the liquefaction process—when it becomes available—to align with British Columbia’s net-zero emissions targets. These factors support the classification of Ksi Lisims LNG as a clean energy project.

If this project does not meet B.C.’s environmental and social standards, it is difficult to imagine what project could. As Ellis Ross, the newly elected Conservative MP for Skeena–Bulkley Valley, recently stated, “It hits so many of the bullets that politicians have been talking about for so many years.”

If federal and provincial leaders are serious about supporting “nation-building” infrastructure, then Ksi Lisims LNG should be at the top of the list—particularly if the EAO process creates further complications. That said, proponents remain cautiously optimistic. “I don’t think the Nisga’a will give up,” Ross added. “I don’t think it will fail. But if it doesn’t get approved, it will have to incur more cost and more time.”

Energy

A picture is worth a thousand spreadsheets

From Resource Works

What if the secret to understanding Canada’s energy future lies not in spreadsheets but in storytelling?

When I think about who has done the most to make sense of Canada’s energy story — not just in charts and forecasts but in human terms — Peter Tertzakian sits near the top of that list. He’s an energy economist, author, and communicator who has spent decades helping Canadians understand the world beneath their light switches and fuel gauges — and why prosperity, energy, and responsible development are inseparable.

Peter is the founder and CEO of Studio.Energy. He is also widely known as the founder of the ARC Energy Research Institute and co-host of the ARC Energy Ideas podcast, alongside Jackie Forrest. Week after week, they unpack what’s happening in the markets, in technology, and in policy, always with the rare gift of clarity. He’s also the author of two influential books, A Thousand Barrels a Second and The End of Energy Obesity, both written long before “energy transition” became a household term.

When we sat down for our Power Struggle conversation, I mentioned how remarkable it is that someone with Peter’s credentials — an economist, investor, and advisor to industry — is also an exhibiting artist whose photography can regularly be found in a gallery in the Canadian Rockies. That’s when he smiled and said what has become one of his signature lines: “I’ve always said a picture is worth a thousand spreadsheets.”

What followed was a fascinating discussion about how visual storytelling can bridge the gap between data and understanding. Peter explained that what began as a hobby has evolved into a personal quest to communicate complex energy subjects more effectively. His photographs, which range from industrial scenes to landscapes shaped by human activity, help connect the emotional and analytical sides of the energy story. The pictures, he said, reveal the same truths that his spreadsheets do — only in a way that more people can feel.

That resonates deeply with what we do at Resource Works — translating complexity into clarity so that Canadians can see how responsible resource development strengthens communities, funds public services, and opens doors for Indigenous partnerships. Like Peter, we believe that understanding energy isn’t about choosing sides; it’s about understanding systems, trade-offs, and the people behind the numbers.

Peter’s concern — and one I share — is how difficult it has become to find truth amid the noise. “People are bombarded by noise, especially today. And not all of that noise is true,” he said. “The challenge now is extracting the signal.” Whether you’re a policymaker, a corporate leader, or just someone trying to make sense of global change, Peter’s approach is to step away from confrontation and toward comprehension. His ability to blend visuals, narrative, and numbers makes complicated issues accessible without oversimplifying them.

Prosperity, Not Population, Drives Energy Demand

Our conversation also turned to the forces shaping global energy demand. Peter reminded me that the biggest driver isn’t population growth — it’s prosperity. “When a person moves from a rural setting to a city, their energy consumption goes up twentyfold, sometimes more,” he said. The story of urbanization, particularly in China, explains much of the past few decades of energy growth. Renewables have slowed that curve, but as Peter points out, “our use of fossil fuels is still growing.”

What I most admire about Peter is that he doesn’t preach. “I don’t have all the answers,” he told me. “My role is to discuss treatment options — not to perform the surgery.” It’s a refreshingly honest stance in a world where too many experts claim certainty.

On Power Struggle, Peter Tertzakian reminded me why he’s so respected across the energy world: he brings intelligence without ego, curiosity without ideology, and a deep respect for the audience’s ability to think. His work reminds us that Canada’s resource story — when told with honesty and creativity — is one of innovation, community, and shared prosperity. And that storytelling — visual, verbal, and numerical — remains our most powerful tool for navigating change.

- Power Struggle audio and transcript

- Peter Tertzakian in Arc Energy Research Institute podcasts

- Peter Tertzakian on X

- Peter Tertzakian on LinkedIn

- Stewart Muir on X

- Stewart Muir on LinkedIn

Power Struggle on social media

Alberta

Federal budget: It’s not easy being green

From Resource Works

Canada’s climate rethink signals shift from green idealism to pragmatic prosperity.

Bill Gates raised some eyebrows last week – and probably the blood pressure of climate activists – when he published a memo calling for a “strategic pivot” on climate change.

In his memo, the Microsoft founder, whose philanthropy and impact investments have focused heavily on fighting climate change, argues that, while global warming is still a long-term threat to humanity, it’s not the only one.

There are other, more urgent challenges, like poverty and disease, that also need attention, he argues, and that the solution to climate change is technology and innovation, not unaffordable and unachievable near-term net zero policies.

“Unfortunately, the doomsday outlook is causing much of the climate community to focus too much on near-term emissions goals, and it’s diverting resources from the most effective things we should be doing to improve life in a warming world,” he writes.

Gates’ memo is timely, given that world leaders are currently gathered in Brazil for the COP30 climate summit. Canada may not be the only country reconsidering things like energy policy and near-term net zero targets, if only because they are unrealistic and unaffordable.

It could give some cover for Canadian COP30 delegates, who will be at Brazil summit at a time when Prime Minister Mark Carney is renegotiating his predecessor’s platinum climate action plan for a silver one – a plan that contains fewer carbon taxes and more fossil fuels.

It is telling that Carney is not at COP30 this week, but rather holding a summit with Alberta Premier Danielle Smith.

The federal budget handed down last week contains kernels of the Carney government’s new Climate Competitiveness Strategy. It places greater emphasis on industrial strategy, investment, energy and resource development, including critical minerals mining and LNG.

Despite his Davos credentials, Carney is clearly alive to the fact it’s a different ballgame now. Canada cannot afford a hyper-focus on net zero and the green economy. It’s going to need some high octane fuel – oil, natural gas and mining – to prime Canada’s stuttering economic engine.

The prosperity promised from the green economy has not quite lived up to its billing, as a recent Fraser Institute study reveals.

Spending and tax incentives totaling $150 billion over a decade by Ottawa, B.C, Ontario, Alberta and Quebec created a meagre 68,000 jobs, the report found.

“It’s simply not big enough to make a huge difference to the overall performance of the economy,” said Jock Finlayson, chief economist for the Independent Contractors and Business Association and co-author of the report.

“If they want to turn around what I would describe as a moribund Canadian economy…they’re not going to be successful if they focus on these clean, green industries because they’re just not big enough.”

There are tentative moves in the federal budget and Climate Competitiveness Strategy to recalibrate Canada’s climate action policies, though the strategy is still very much in draft form.

Carney’s budget acknowledges that the world has changed, thanks to deglobalization and trade strife with the U.S.

“Industrial policy, once seen as secondary to market forces, is returning to the forefront,” the budget states.

Last week’s budget signals a shift from regulations towards more investment-based measures.

These measures aim to “catalyse” $500 billion in investment over five years through “strengthened industrial carbon pricing, a streamlined regulatory environment and aggressive tax incentives.”

There is, as-yet, no commitment to improve the investment landscape for Alberta’s oil industry with the three reforms that Alberta has called for: scrapping Bill C-69, a looming oil and gas emissions cap and a West Coast oil tanker moratorium, which is needed if Alberta is to get a new oil pipeline to the West Coast.

“I do think, if the Carney government is serious about Canada’s role, potentially, as an global energy superpower, and trying to increase our exports of all types of energy to offshore markets, they’re going to have to revisit those three policy files,” Finlayson said.

Heather Exner-Pirot, director of energy, natural resources and environment at the Macdonald-Laurier Institute, said she thinks the emissions cap at least will be scrapped.

“The markets don’t lie,” she said, pointing to a post-budget boost to major Canadian energy stocks. “The energy index got a boost. The markets liked it. I don’t think the markets think there is going to be an emissions cap.”

Some key measures in the budget for unlocking investments in energy, mining and decarbonization include:

- incentives to leverage $1 trillion in investment over the next five years in nuclear and wind power, energy storage and grid infrastructure;

- an expansion of critical minerals eligible for a 30% clean technology manufacturing investment tax credit;

- $2 billion over five years to accelerate critical mineral production;

- tax credits for turquoise hydrogen (i.e. hydrogen made from natural gas through methane pyrolysis); and

- an extension of an investment tax credit for carbon capture utilization and storage through to 2035.

As for carbon taxes, the budget promises “strengthened industrial carbon pricing.”

This might suggest the government’s plan is to simply simply shift the burden for carbon pricing from the consumer entirely onto industry. If that’s the case, it could put Canadian resource industries at a disadvantage.

“How do we keep pushing up the carbon price — which means the price of energy — for these industries at a time when the United States has no carbon pricing at all?” Finlayson wonders.

Overall, Carney does seem to be moving in the right direction in terms of realigning Canada’s energy and climate policies.

“I think this version of a Liberal government is going to be more focused on investment and competitiveness and less focused around the virtue-signaling on climate change, even though Carney personally has a reputation as somebody who cares a lot about climate change,” Finlayson said.

“It’s an awkward dance for them. I think they are trying to set out a different direction relative to the Trudeau years, but they’re still trying to hold on to the Trudeau climate narrative.”

Pictured is Mark Carney at COP26 as UN Special Envoy on Climate Action and Finance. He is not at COP30 this week. UNRIC/Miranda Alexander-Webber

Resource Works News

-

Frontier Centre for Public Policy2 days ago

Frontier Centre for Public Policy2 days agoRichmond Mayor Warns Property Owners That The Cowichan Case Puts Their Titles At Risk

-

Business2 days ago

Business2 days agoSluggish homebuilding will have far-reaching effects on Canada’s economy

-

Business2 days ago

Business2 days agoMark Carney Seeks to Replace Fiscal Watchdog with Loyal Lapdog

-

COVID-192 days ago

COVID-192 days agoMajor new studies link COVID shots to kidney disease, respiratory problems

-

Business2 days ago

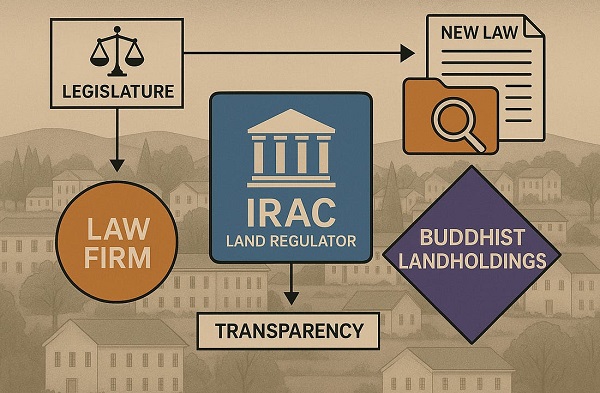

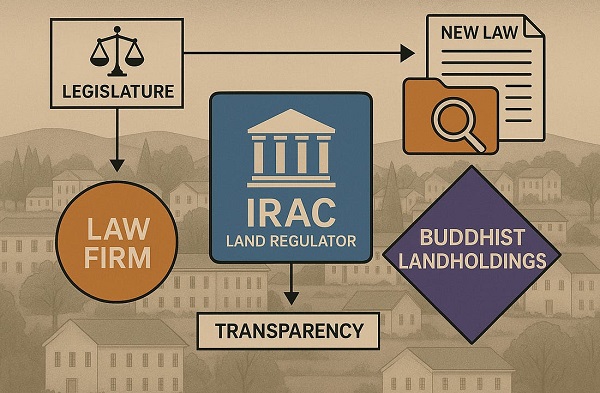

Business2 days agoP.E.I. Moves to Open IRAC Files, Forcing Land Regulator to Publish Reports After The Bureau’s Investigation

-

Energy2 days ago

Energy2 days agoCanada’s oilpatch shows strength amid global oil shakeup

-

International1 day ago

International1 day agoBondi and Patel deliver explosive “Clinton Corruption Files” to Congress

-

International1 day ago

International1 day agoState Department designates European Antifa groups foreign terror organizations