Business

Rise of Canadian Fentanyl ‘Superlabs’ Marks Shift in Chinese-Driven Global Drug Trade

Sam Cooper

Sam Cooper

Elevated production levels in Canada—particularly from highly sophisticated fentanyl “super laboratories,” such as the type dismantled by the Royal Canadian Mounted Police in October 2024—pose a mounting concern.

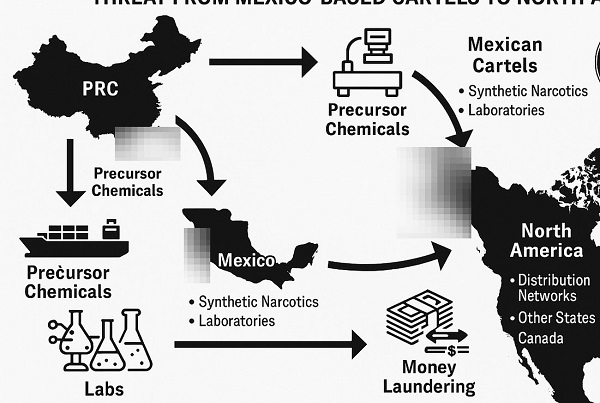

A rising convergence of Chinese state-linked chemical suppliers, Mexican drug cartels, Chinese narcotics cash brokers operating across North America, and the emergence of Canadian fentanyl “super laboratories” has triggered new concerns for United States national security agencies, according to the latest threat assessment from the Drug Enforcement Administration.

The 2025 National Drug Threat Assessment, released Thursday, describes the crisis as a transnational system driven by industrial-scale synthetic drug production and laundering networks stretching from Guangdong to Sinaloa to Vancouver. While Mexican cartels remain the dominant traffickers of fentanyl and methamphetamine into the United States, the DEA names Canada for the first time as a growing supply-side threat.

Elevated production levels in Canada—particularly from highly sophisticated fentanyl “super laboratories,” such as the type dismantled by the Royal Canadian Mounted Police in October 2024—pose a mounting concern.

The laboratory was uncovered in Falkland, British Columbia—a remote, mountainous region roughly midway between Vancouver and Calgary. While Royal Canadian Mounted Police officials released few details, law enforcement sources in both Canada and the United States confirmed to The Bureau that the raid was triggered by intelligence from the DEA.

According to these sources, the site forms part of a broader criminal convergence involving Chinese, Mexican, and Iranian networks operating across British Columbia, Alberta, Saskatchewan, Manitoba, Ontario, and Quebec. The Bureau’s sources indicate that the Falkland facility was connected to Chinese chemical exporters sanctioned by the United States Treasury, Iranian threat actors, and operatives from Mexican drug cartels.

The 80-page DEA assessment emphasizes that while fentanyl flows from Canada remain smaller in volume compared to Mexico, the potential for Canadian production to scale quickly is a major concern. United States officials warn that law enforcement crackdowns in Mexico could prompt traffickers to shift operations northward, where precursor chemical controls and policing pressures are widely seen as more permissive.

The fallout from the Falkland raid continues to expand. Investigations in British Columbia’s Lower Mainland are probing chemical importers tied to methamphetamine and fentanyl precursor shipments from China. Authorities are examining companies suspected of misrepresenting the commercial purpose and origin of these dual-use chemicals.

One case highlighted by the DEA underscores the scale and sophistication of cartel-linked financial operations. A multi-billion-dollar smuggling and laundering scheme—spanning petroleum, methamphetamine, and heroin—was discovered involving Mexico’s state-owned oil company, Petróleos Mexicanos. The criminal network, according to the report, funneled stolen crude oil into the United States and sold it to American energy firms using trade-based money laundering mechanisms. It was linked to senior figures in multiple cartels, including Sinaloa, the Jalisco New Generation Cartel, La Familia Michoacana, and the Gulf Cartel.

“The investigation has determined that this black-market petroleum smuggling operation is the primary means by which the transnational criminal organization funds its networks,” the DEA report states. “It is estimated that Mexico is losing tens of billions in tax revenue annually, while simultaneously costing the United States oil and gas companies billions of dollars annually due to a decline in petroleum imports and exports during this same period.”

Officials describe the petroleum scheme as a major financial lifeline for cartel power, and say investigations are now expanding to examine American facilitators and corporate enablers.

The DEA further outlines how Chinese and Mexican actors evade international chemical controls through mislabeling, transshipment via third countries, and freight forwarding chains—some knowingly complicit, others unwittingly exploited. Precursor shipments often arrive in the United States or Canada under false declarations, before being diverted to clandestine laboratories in Mexico.

Distribution methods include air cargo, maritime freight, land couriers, and even border tunnels. Once drugs enter the United States, they are routed through interstate highways and distributed to urban markets by street-level dealers, many of whom are recruited through encrypted channels such as Snapchat and Telegram.

Another network detailed in the report illustrates a continent-wide money laundering system anchored by the Chinese underground banking model, with a central hub operating out of New York City. Drug proceeds from across the United States are funneled through marijuana cultivation fronts using nominee owners, casino laundering, and mortgage fraud. Sources familiar with Canadian enforcement files told The Bureau this laundering model mirrors, and is connected to, operations in Vancouver and Toronto, where Triad-linked criminal networks manage shell companies and real estate portfolios.

The report also outlines the extensive involvement of Chinese organized crime groups in illicit cannabis production—particularly in regions where recreational marijuana is legalized or poorly regulated. These groups now dominate marijuana cultivation and distribution in both Canada and the United States. They are producing what the DEA calls the most potent marijuana in the history of trafficking, with tetrahydrocannabinol content averaging between 25 and 30 percent.

These networks rely on a logistics model that spans the continent. Domestically grown cannabis is transported across the United States in personal vehicles, tractor-trailers, and rental trucks. Criminal groups move product from jurisdictions such as British Columbia, California, Ontario, Maine, Oklahoma and Oregon into other states and provinces. High-THC cannabis is also in high demand in international markets such as the United Kingdom, France, and Spain, with overseas shipments typically dispatched via air cargo or container shipping from Canadian ports.

The Bureau has reported extensively on how Triads and individuals linked to Chinese foreign influence efforts have acquired numerous residential and industrial and agricultural properties in British Columbia and Ontario—many of which were converted into covert cannabis grow operations. These properties are routinely purchased in cash, registered under nominee names, and later tied to underground banking flows. According to sources with access to United States enforcement files, the laundering architecture is identical to systems used to recycle fentanyl and methamphetamine profits through bulk cash pickups, informal transfer networks, and false invoicing in international trade.

Seizure statistics underscore the increasing scale and complexity of the fentanyl crisis. In 2024, United States authorities intercepted more than 61 million fentanyl pills, many disguised as prescription pharmaceuticals. Xylazine, a veterinary sedative, remains the most common fentanyl adulterant. But a new, far more powerful veterinary anesthetic—medetomidine—is now being detected in seized drug supplies. The Drug Enforcement Administration flags this trend as extremely dangerous, noting that medetomidine may be 200 to 300 times more potent than xylazine, posing life-threatening risks to drug users and first responders alike.

New data obtained by The Bureau illustrates the geography of fentanyl’s impact across the United States. A study analyzing overdose fatalities from 2018 to 2022, using data from the Centers for Disease Control and Prevention, identifies Ohio as one of the states hardest hit by the synthetic opioid epidemic. The research, conducted by Georgia-based Bader Scott Injury Lawyers, found that Ohio averaged 40.8 overdose deaths per 100,000 residents—nearly 50 percent above the national average of 27.5. The state recorded an average of 4,795 overdose deaths per year during the five-year study period, peaking at 5,397 in 2021.

West Virginia had the highest overdose fatality rate, with an average of 65.9 deaths per 100,000 people, followed by Delaware, Tennessee, Kentucky, and Maryland. Other states in the top ten included Louisiana, Pennsylvania, New Mexico, and Connecticut—all experiencing relentless waves of synthetic opioid deaths.

“These states have been particularly hard-hit by the opioid epidemic, facing challenges with prescription painkillers, heroin, and increasingly, synthetic opioids like fentanyl,” the study concludes. “A combination of socioeconomic factors, healthcare access limitations, and geographic challenges has created perfect conditions for this crisis across these regions.”

The Bureau is a reader-supported publication.

To receive new posts and support my work, consider becoming a free or paid subscriber.

Invite your friends and earn rewards

Business

Loblaws Owes Canadians Up to $500 Million in “Secret” Bread Cash

Yakk Stack

(Only 5 Days Left!) Claim Yours Before It’s GONE FOREVER

Hey, all.

Imagine this…you’re slicing into that fresh loaf from Loblaws or just making a Wonder-ful sammich, the one you’ve bought hundreds of times over the years, and suddenly… ka-ching!

A fat check lands in your mailbox.

Not from a lottery ticket, not from a side hustle – from the very store that’s been quietly owing you money for two decades of illegal price fixing.

Sound too good to be true?

It’s real.

It’s court-approved.

And right now, on December 7, 2025, you’ve got exactly 5 days to grab your share before the door slams shut. Don’t let this slip away – keep reading, feel that spark of possibility ignite, and let’s get you paid.

Back in 2001, you were probably juggling work, kids, or just surviving on that weekly grocery run. Little did you know, while you were reaching for the President’s Choice white bread or those golden rolls, Loblaws and their cronies were playing a sneaky game of price-fixing. They jacked up the cost of packaged bread across Canada – every loaf, every bun, every sneaky sandwich slice. For 20 years. From coast to coast to coast.

And now…the courts have spoken. $500 million in settlements to make it right. That’s not pocket change – that’s your money, recycled back into your life.

Given the number of people who will be throwing in a claim…this ain’t gunna be life-changing cash…but also, given the cost of food in Canada, it’s better than sweet fuck all, which you will receive by NOT doing this.

If you’re a Canadian resident (yep, that’s you, unless you’re in Quebec with your own sweet deal), and you’ve ever bought bread for your family – not for resale, just real life – between January 1, 2001, and December 31, 2021… you’re in.

No receipts needed.

No fancy proofs.

Just you, confirming your story, and boom – eligible.

Quick check: Were you under 18 back then?

Or an exec at Loblaw?

Nah, skip it.

But for the rest of us everyday schleps…Jackpot.

Again…the clock’s ticking on this.

Claims opened on September 11, 2025, and slam shut on December 12, 2025.

That’s this Friday.

Payments roll out in 2026, 6-12 months later, straight to your bank or mailbox.

Here’s what you need to do…

- Breathe deep, click → HEREQuebec frens →HERE

- 10 second form that’s completed by your autofill…30 seconds off of a mobile device.

- Hit submit and wait for that sweet cash to hit your account.

Again…this won’t be life saving money and most certainly ain’t gunna hit your account before Christmas.

And before you go out an Griswald yourself into a depost on pool in the backyard…you may only end up with enough cash for the Jam-of-the-Month…the gift that truly does give, all year round…just be a little patient.

If you end up with a couple of backyard steaks in time for summer…

Some treats for the children or grandchildren…

Maybe just a donation to the foodbank…

This is what’s owed to you. Your neighbors. Friends. Family.

Take advantage!

Banks

To increase competition in Canadian banking, mandate and mindset of bank regulators must change

From the Fraser Institute

By Lawrence L. Schembri and Andrew Spence

Canada’s weak productivity performance is directly related to the lack of competition across many concentrated industries. The high cost of financial services is a key contributor to our lagging living standards because services, such as payments, are essential input to the rest of our economy.

It’s well known that Canada’s banks are expensive and the services that they provide are outdated, especially compared to the banking systems of the United Kingdom and Australia that have better balanced the objectives of stability, competition and efficiency.

Canada’s banks are increasingly being called out by senior federal officials for not embracing new technology that would lower costs and improve productivity and living standards. Peter Rutledge, the Superintendent of Financial Institutions and senior officials at the Bank of Canada, notably Senior Deputy Governor Carolyn Rogers and Deputy Governor Nicolas Vincent, have called for measures to increase competition in the banking system to promote innovation, efficiency and lower prices for financial services.

The recent federal budget proposed several new measures to increase competition in the Canadian banking sector, which are long overdue. As a marker of how uncompetitive the market for financial services has become, the budget proposed direct interventions to reduce and even eliminate some bank service fees. In addition, the budget outlined a requirement to improve price and fee transparency for many transactions so consumers can make informed choices.

In an effort to reduce barriers to new entrants and to growth by smaller banks, the budget also proposed to ease the requirement that small banks include more public ownership in their capital structure.

At long last, the federal government signalled a commitment to (finally) introduce open banking by enacting the long-delayed Consumer Driven Banking Act. Open banking gives consumers full control over who they want to provide them with their financial services needs efficiently and safely. Consumers can then move beyond banks, utilizing technology to access cheaper and more efficient alternative financial service providers.

Open banking has been up and running in many countries around the world to great success. Canada lags far behind the U.K., Australia and Brazil where the presence of open banking has introduced lower prices, better service quality and faster transactions. It has also brought financing to small and medium-sized business who are often shut out of bank lending.

Realizing open banking and its gains requires a new payment mechanism called real time rail. This payment system delivers low-cost and immediate access to nonbank as well as bank financial service providers. Real time rail has been in the works in Canada for over a decade, but progress has been glacial and lags far behind the world’s leaders.

Despite the budget’s welcome backing for open banking, Canada should address the legislative mandates of its most important regulators, requiring them to weigh equally the twin objectives of financial system stability as well as competition and efficiency.

To better balance these objectives, Canada needs to reform its institutional framework to enhance the resilience of the overall banking system so it can absorb an individual bank failure at acceptable cost. This would encourage bank regulators to move away from a rigid “fear of failure” cultural mindset that suppresses competition and efficiency and has held back innovation and progress.

Canada should also reduce the compliance burden imposed on banks by the many and varied regulators to reduce barriers to entry and expansion by domestic and foreign banks. These agencies, including the Office of the Superintendent of Financial Institutions, Financial Consumer Agency of Canada, Financial Transactions and Reports Analysis Centre of Canada, the Canada Deposit Insurance Corporation plus several others, act in largely uncoordinated manner and their duplicative effort greatly increases compliance and reporting costs. While Canada’s large banks are able, because of their market power, to pass those costs through to their customers via higher prices and fees, they also benefit because the heavy compliance burden represents a significant barrier to entry that shelters them from competition.

More fundamental reforms are needed, beyond the measures included in the federal budget, to strengthen the institutional framework and change the regulatory mindset. Such reforms would meaningfully increase competition, efficiency and innovation in the Canadian banking system, simultaneously improving the quality and lowering the cost of financial services, and thus raising productivity and the living standards of Canadians.

-

Business2 days ago

Business2 days agoRecent price declines don’t solve Toronto’s housing affordability crisis

-

MAiD20 hours ago

MAiD20 hours agoFrom Exception to Routine. Why Canada’s State-Assisted Suicide Regime Demands a Human-Rights Review

-

MAiD2 days ago

MAiD2 days agoHealth Canada report finds euthanasia now accounts for over 5% of deaths nationwide

-

Daily Caller2 days ago

Daily Caller2 days agoTech Mogul Gives $6 Billion To 25 Million Kids To Boost Trump Investment Accounts

-

Automotive2 days ago

Automotive2 days agoPower Struggle: Governments start quietly backing away from EV mandates

-

Energy2 days ago

Energy2 days agoUnceded is uncertain

-

Business18 hours ago

Business18 hours agoCarney government should privatize airports—then open airline industry to competition

-

Business2 days ago

Business2 days agoNew Chevy ad celebrates marriage, raising children