Business

Red Deer City Budget 2025: An Opportunity for Council to Step Up for Taxpayers

Opinion on Red Deer City Budget 2025

By Al Poole

I have lived in Red Deer for 45 years and loved every year. So happy to be here.

Having said that, I see things, patterns over time, that worry me. When I worry I dig deeper – I just need to understand.

Budget 2025: Wow – a massive document. I can only imagine what it cost to build this document. Even more concerning – the amount of time and effort for council members to understand. Crazy!

I will say up front – I wonder if anyone on council has a good grasp on operations performance

based on the budget – as presented. If I am correct, what does that say for citizens of Red Deer

understanding? [note: I do not equate understanding with agreement]

This could be so much easier. Council needs to insist this becomes clearer and easier to understand. (I can help).

As in the past, generally, I find this another document reads from a position of fear and defensiveness – simply looks like justifying “what we do is already the best”. Why would you do that to yourselves?

It starts at the top – the City Manager message is not inspiring. It lacks the leadership that says I got this and here is what I am going to do to correct our current course.

Upfront, an area that confuses me is the reserve transfers. I find it hard to get a real good grasp on spending. I will work to close that gap soon.

Back to the document, a couple of things that caught my attention and I find encouraging. In the

Executive Summary, item 4 on page 5: establish expectations of Administration to achieve a positive variance to budget. I presume this means a fair budget that requires Administration to be more effective and efficient in executing its work (i.e. not only from more tax revenue). I applaud you writing it down – achieving it is akin to retained earnings in my work world (for City – healthy reserves). Second, the citizen surveys in the spring and then the fall. They serve as a great guide for Council and Administration.

The City’s current financial situation is not great. If you understand and accept how we got here – the path forward becomes clearer. Based on what I see in the document you have not understood or accepted. It still appears it’s the taxpayer who is carrying most of the load.

It is interesting that the citizen surveys point to reducing the size of City organization. That tells me everyone, without knowing the details, has a good sense that the City Operations are not as effective or efficient as they could be. I know some of you know it to be true, as well.

Ok – let’s delve into the budget. I like the breakout in TTAX sheet, page 65. I commend Administration for projecting a positive variance over 4% Good job. Now, a bold move demonstrating real leadership would be to take the projected 2024-year end outcome and make that the 2025 budget — and still deliver a positive variance in 2025. Instead, all of that seems to have been lost – the 2025 budget is 6.3% higher. Who thought this an acceptable approach.

Secondly, Considerations and Bold Moves on page 71. The title is impressive — the content is anything but bold.

If you were to assume, based on preamble, I started this review with skepticism – you would be correct. The two items above, a 6.3% increase to base budget and lack of bold moves are absolute derailers for me. Given our financial position – regardless of how we got here – I am ok with, as a taxpayer, to help improve the financial position of my city. Note: I said help – not carry it all. You totally missed it. Why would I as a tax paying citizen, or any other citizen believe we are being served by strong informed leadership? In essence you are pushing all of the fix onto us.

In closing – to keep it clear and simple: show me the math to $18,201,505 tax revenue increase. I can not find a pathway to that number. I realize MGA dictates certain rules you must follow – but it does not stop you from presenting a clear picture. Also, why would you list $512,317,612 – like it is the cash you will spend. Roughly, $89M is non-cash – it is an accounting transaction. I would like to see a summary of financials so I can reasonably assess how operations are doing — akin to EBITDA line in the for-profit world. In the absence of that summary, I have little confidence in Councils ability to reasonably assess operating performance.

I know from experience large organizations tend to grow organically and suffer from increasing

inefficiency over time unless specific actions are taken to correct the course.

You have a chance as Council and Administration to demonstrate leadership – the type that earns

trust and respect. Step up!

It is my intent to be helpful. I am happy to chat in more detail.

Al

PS: Please do not come back to me with it is a complicated operation and you do not understand.

I concede City operations have complicated elements but the nice thing about complicated – it

leads to prescriptive processes/procedures (easy to monitor and evaluate). Now on the revenue

side – there are some complexities that require more nuanced solutions.

Al Poole is a business and community leader. Former Site Leader Joffre Complex, Poole served with the United Way Central Alberta and Red Deer College.

Business

Storm clouds of uncertainty as BC courts deal another blow to industry and investment

From the Fraser Institute

By Tegan Hill and Jason Clemens

Recent court decision adds to growing uncertainty in B.C.

A recent decision by the B.C. Court of Appeal further clouds private property rights and undermines investment in the province. Specifically, the court determined British Columbia’s mineral claims system did not follow the province’s Declaration on the Rights of Indigenous Peoples Act (DRIPA), which incorporated the United Nations Declaration on the Rights of Indigenous Peoples (UNDRIP) into law.

DRIPA (2019) requires the B.C. provincial government to “take all measures necessary to ensure the laws of British Columbia are consistent with the Declaration,” meaning that all legislation in B.C. must conform to the principles outlined in the UNDRIP, which states that “Indigenous peoples have the right to the lands, territories and resources which they have traditionally owned, occupied or otherwise used or acquired.” The court’s ruling that the provincial government is not abiding by its own legislation (DRIPA) is the latest hit for the province in terms of ongoing uncertainty regarding property rights across the province, which will impose massive economic costs on all British Columbians until it’s resolved.

Consider the Cowichan First Nations legal case. The B.C. Supreme Court recently granted Aboriginal title to over 800 acres of land in Richmond valued at $2.5 billion, and where such aboriginal title is determined to exist, the court ruled that it is “prior and senior right” to other property interests. Put simply, the case puts private property at risk in BC.

The Eby government is appealing the case, yet it’s simultaneously negotiating bilateral agreements that similarly give First Nations priority rights over land swaths in B.C.

Consider Haida Gwaii, an archipelago on Canada’s west coast where around 5,000 people live—half of which are non-Haida. In April 2024, the Eby government granted Haida Aboriginal title over the land as part of a bilateral agreement. And while the agreement says private property must be honoured, private property rights are incompatible with communal Aboriginal title and it’s unclear how this conflict will be resolved.

Moreover, the Eby government attempted to pass legislation that effectively gives First Nations veto power over public land use in B.C. in 2024. While the legislation was rescinded after significant public backlash, the Eby’s government’s continued bilateral negotiations and proposed changes to other laws indicate it’s supportive of the general move towards Aboriginal title over significant parts of the province.

UNDRIP was adopted by the United Nations in 2007 and the B.C. Legislature adopted DRIPA in 2019. DRIPA requires that the government must secure “free, prior and informed consent” before approving projects on claimed land. Premier Eby is directly tied to DRIPA since he was the attorney general and actually drafted the interpretation memo.

The recent case centres around mineral exploration. Two First Nations groups—the Gitxaala Nation and the Ehattesaht First Nation—claimed the duty to consult was not adequately met and that granting mineral claims in their land “harms their cultural, spiritual, economic, and governance rights over their traditional territories,” which is inconsistent with DRIPA.

According to a 2024 survey of mining executives, more uncertainty is the last thing B.C. needs. Indeed, 76 per cent of respondents for B.C. said uncertainty around protected land and disputed land claims deters investment compared to only 29 per cent and 44 per cent (respectively) for Saskatchewan.

This series of developments have and will continue to fuel uncertainty in B.C. Who would move to or invest in B.C. when their private property, business, and investment is potentially at risk?

It’s no wonder British Columbians are leaving the province in droves. According to the B.C. Business Council, nearly 70,000 residents left B.C. for other parts of Canada last year. Similarly, business investment (inflation-adjusted) fell by nearly 5 per cent last year, exports and housing starts were down, and living standards in the province (as measured by per-person GDP) contracted in both 2023 and 2024.

B.C.’s recent developments will only worsen uncertainty in the province, deterring investment and leading to stagnant or even declining living standards for British Columbians. The Eby government should do its part to reaffirm private property rights, rather than continue fuelling uncertainty.

Business

Inflation Reduction Act, Green New Deal Causing America’s Energy Crisis

From the Daily Caller News Foundation

By Greg Blackie

Our country is facing an energy crisis. No, not because of new demand from data centers or AI. Instead, it’s because utilities in nearly every state, due to government imposed “renewable” mandates, self-imposed mandates, and the supercharging of the Green New Scam under the so-called “Inflation Reduction Act,” have been shutting down vital coal resources and building out almost exclusively intermittent and costly resources like solar, wind, and battery storage.

President Donald Trump understands this, and that is why on day one of his administration he declared an Energy Emergency. Then, a few months later, the President signed a trio of Executive Orders designed to keep our “beautiful, clean coal” burning and providing the reliable, baseload, and affordable electricity Americans have benefitted from for generations.

Those orders have been used to keep coal generation online that was slated to shut down in Michigan and will potentially keep two units operating that were scheduled to shut down in Colorado this December. In Arizona, however, the Cholla Power Plant in Navajo County was shuttered by the utility just weeks after Trump explicitly called out the plant for saving in a press conference.

Dear Readers:

As a nonprofit, we are dependent on the generosity of our readers.

Please consider making a small donation of any amount here.

Thank you!

Unlike states with green mandates, Arizona essentially has none. Instead, our utilities, like many around the country, have self-imposed commitments to go “Net Zero” by 2050. To meet that target, they have planned to shut down all coal generation in the state by 2032 and plan to build out almost exclusively solar, wind, and battery storage to meet an expected explosive growth in demand, at a cost of tens of billions of dollars. So it is no surprise that like much of the rest of the country, Arizona is facing an energy crisis.

Taking a look at our largest regulated utilities (APS, TEP, and UNS) and the largest nonprofit utility, SRP, future plans paint an alarming picture. Combined, over the next 15 years, these utilities expect to see demand increase from 19,200 MW to 28,000 MW. For reference, 1,000 MW of electricity is enough to power roughly 250,000 homes. To meet that growth in demand, however, Arizonans will only get a net increase of 989 MW of reliable generation (coal, natural gas, and nuclear) compared to 22,543 MW (or nearly 23 times as much) of intermittent solar, wind, and battery storage.

But what about all of the new natural gas coming into the state? The vast majority of it will be eaten up just to replace existing coal resources, not to bring additional affordable energy to the grid. For example, the SRP board recently voted to approve the conversion of their Springerville coal plant to natural gas by 2030, which follows an earlier vote to convert another of their coal plants, Coronado, to natural gas by 2029. This coal conversion trap leaves ratepayers with the same amount of energy as before, eating up new natural gas capacity, without the benefit of more electricity.

So, while the Arizona utilities plan to collectively build an additional 4,538 MW of natural gas capacity over the next 15 years, at the same time they will be removing -3,549 MW (all of what is left on the grid today) of coal. And there are no plans for more nuclear capacity anytime soon. Instead, to meet their voluntary climate commitments, utilities plan to saddle ratepayers with the cost and resultant blackouts of the green new scam.

It’s no surprise then that Arizona’s largest regulated utilities, APS and TEP, are seeking double digit rate hikes next year. It’s not just Arizona. Excel customers in Colorado (with a 100% clean energy commitment) and in Minnesota (also with a 100% clean energy commitment) are facing nearly double-digit rate hikes. The day before Thanksgiving, PPL customers in Rhode Island (with a state mandate of 100% renewable by 2033) found out they may see rate hikes next year. Dominion (who has a Net Zero by 2050 commitment) wanted to raise rates for customers in Virginia by 15%. Just last month, regulators approved a 9% increase. Importantly, these rate increases are to recover costs for expenses incurred years ago, meaning they are clearly to cover the costs of the energy “transition” supercharged under the Biden administration, not from increased demand from data centers and AI.

It’s the same story around the country. Electricity rates are rising. Reliability is crumbling. We know the cause. For generations, we’ve been able to provide reliable energy at an affordable cost. The only variable that has changed has been what we are choosing to build. Then, it was reliable, dispatchable power. Now, it is intermittent sources that we know cost more, and that we know cause blackouts, all to meet absurd goals of going 100% renewable – something that no utility, state, or country has been able to achieve. And we know the result when they try.

This crisis can be avoided. Trump has laid out the plan to unleash American Energy. Now, it’s time for utilities to drop their costly green new scam commitments and go back to building reliable and affordable power that generations to come will benefit from.

Greg Blackie, Deputy Director of Policy at the Arizona Free Enterprise Club. Greg graduated summa cum laude from Arizona State University with a B.S. in Political Science in 2019. He served as a policy intern with the Republican caucus at the Arizona House of Representatives and covered Arizona political campaigns for America Rising during the 2020 election cycle.

-

Bruce Dowbiggin2 days ago

Bruce Dowbiggin2 days agoWayne Gretzky’s Terrible, Awful Week.. And Soccer/ Football.

-

espionage1 day ago

espionage1 day agoWestern Campuses Help Build China’s Digital Dragnet With U.S. Tax Funds, Study Warns

-

Focal Points1 day ago

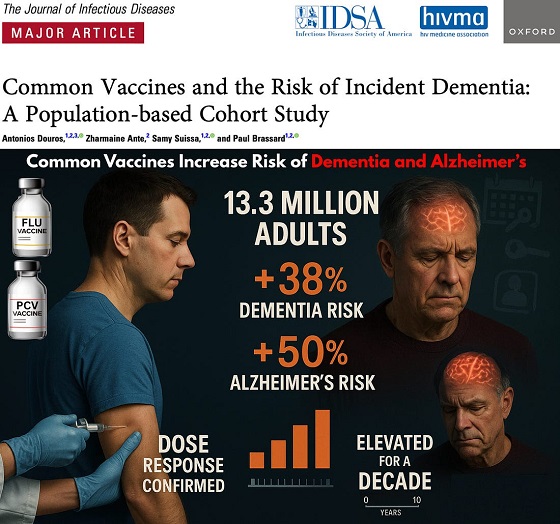

Focal Points1 day agoCommon Vaccines Linked to 38-50% Increased Risk of Dementia and Alzheimer’s

-

Opinion2 days ago

Opinion2 days agoThe day the ‘King of rock ‘n’ roll saved the Arizona memorial

-

Automotive16 hours ago

Automotive16 hours agoThe $50 Billion Question: EVs Never Delivered What Ottawa Promised

-

Agriculture2 days ago

Agriculture2 days agoCanada’s air quality among the best in the world

-

Business1 day ago

Business1 day agoCanada invests $34 million in Chinese drones now considered to be ‘high security risks’

-

Health1 day ago

Health1 day agoThe Data That Doesn’t Exist