Business

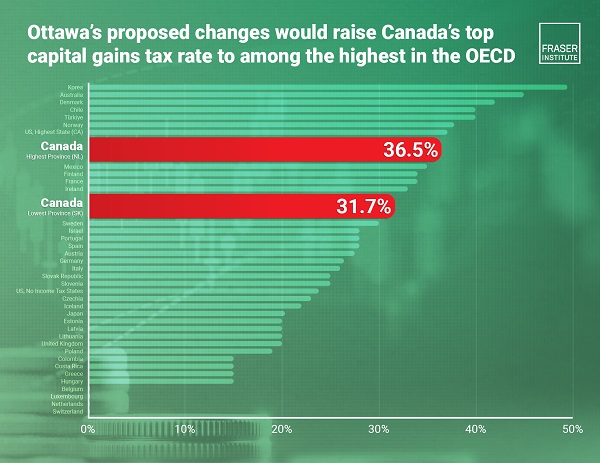

Proposed federal tax hike would make Canada’s top capital gains tax rate among the highest of 37 advanced countries

From the Fraser Institute

By Jake Fuss and Grady Munro

Ottawa’s proposed increase to the effective capital gains tax rate will result in Canada having among the highest—and least competitive—top capital gains tax rates in the industrialized world, finds a new study released today by the Fraser Institute, an independent, non-partisan, Canadian public policy think-tank.

“The evidence is clear—taxing capital gains deters investment, particularly smaller and start-up firms, which in turn slows productivity gains and innovation, all things Canada needs right now to raise living standards for workers,” said Jake Fuss, director of fiscal studies at the Fraser Institute and co-author of Canada’s Waning Competitiveness on Capital Gains Taxes.

The study finds that by increasing the inclusion rate, the federal government has made Canada less competitive compared to other advanced countries. At a 50 per cent inclusion rate, Canada’s top capital gains tax rate ranked between 17th and 23rd (depending on the province) out of 37 high-income developed countries in the Organization for Economic Co-operation and Development (OECD).

Raising the inclusion rate to 66.7 per cent means Canada’s top capital gains tax rate would be among the highest and least competitive (between 8th and 13th highest, depending on the province).

The study notes that if Canada’s capital gains inclusion rate were lowered to 33.3 per cent, Canada would be among the most competitive in the OECD, ranking 30th and 31st, again, depending on the province.

“Instead of raising taxes on capital gains, policymakers should consider reducing taxes as a way of attracting much-needed investment, and reversing Canada’s current economic slump,” Fuss said.

Business

The UN Pushing Carbon Taxes, Punishing Prosperity, And Promoting Poverty

From the Daily Caller News Foundation

Unelected regulators and bureaucrats from the United Nations have pushed for crushing the global economy in the name of saving the planet.

In October, the International Maritime Organization (IMO), a specialized agency within the U.N., proposed a carbon tax in order to slash the emissions of shipping vessels. This comes after the IMO’s April 2025 decision to adopt net-zero standards for global shipping.

Had the IMO agreed to the regulation, it would have been the first global tax on greenhouse gas emissions. Thankfully, the United States was able to effectively shut down those proposals; however, while these regulations have been temporarily halted, the erroneous ideas behind them continue to grow in support.

Proponents of carbon taxes generally argue that since climate change is an existential threat to human existence, drastic measures must be taken in all aspects of our lives to address the projected costs. People should eat less meat and use public transportation more often. In the political arena, they should vote out so-called “climate deniers.” In the economic sphere, carbon taxes are offered as a technocratic quick fix to carbon emissions. Is any of this worth it? Or are the benefits greater than the costs? In the case of climate change, the answer is no.

Carbon taxes are not a matter of scientific fact. As with all models, the assumptions drive the analysis. In the case of carbon taxes, the time horizon selected plays a major role in the outcome. So, too, does the discount rate and the specific integrated assessment models.

In other words, “Two economists can give vastly different estimates of the social cost of carbon, even if they agree on the objective facts underlying the analysis.” If the assumptions are subjective, as they are in carbon taxes, then they are not scientific facts. As I’ve pointed out, “carbon pricing models are as much political constructs as they are economic tools.” One must also ask whether carbon taxes will remain unchanged or gradually increase over time to advance other political agendas. In this proposal, the answer is that it increases over time.

Additionally, since these models are driven by assumptions, one would be right in asking who gets to impose these taxes? Of course, those would be the unelected bureaucrats at the IMO. No American who would be subject to these taxes ever voted for the people attempting to create the “world’s first global carbon tax.” It brings to mind the phrase “no taxation without representation.”

In an ironic twist, imposing carbon taxes on global shipping might actually be one of the worst ways to slash emissions, given the enormous gains from trade. Simply put, trade makes the world grow rich. Not just wealthy nations like those in the West, but every nation, even the most poor, grows richer. In wealthy countries, trade can help address climate change by enabling adaptation and innovation. For poorer countries, material gains from trade can help prevent their populations from starving and also help them advance along the environmental Kuznets curve.

In other words, the advantages of trade can, over time, make a country go from being so poor that a high level of air pollution is necessary for its survival to being rich enough to afford reducing or eliminating pollution. Carbon taxes, if sufficiently high, can prevent or significantly delay these processes, thereby undermining their supposed purpose. Not to mention, as of today, maritime shipping accounts for only about 3% of total global emissions.

The same ingenuity that brought us modern shipping will continue to power the global economy and fund growth and innovation, if we let it. The world does not need a layer of global bureaucracy for the sake of virtue signaling. What it needs is an understanding of both economics and human progress.

History shows that prosperity, innovation, and free trade are what make societies cleaner, healthier, and richer. Our choice is not between saving the planet and saving the economy; it is between free societies and free markets or surrendering responsibility to unelected international regulators and busybodies. The former has lifted billions out of poverty, and the latter threatens to drag us all backwards.

Samuel Peterson is a Research Fellow at the Institute for Energy Research.

Agriculture

Federal cabinet calls for Canadian bank used primarily by white farmers to be more diverse

From LifeSiteNews

A finance department review suggested women, youth, Indigenous, LGBTQ, Black and racialized entrepreneurs are underserved by Farm Credit Canada.

The Cabinet of Prime Minister Mark Carney said in a note that a Canadian Crown bank mostly used by farmers is too “white” and not diverse enough in its lending to “traditionally underrepresented groups” such as LGBT minorities.

Farm Credit Canada Regina, in Saskatchewan, is used by thousands of farmers, yet federal cabinet overseers claim its loan portfolio needs greater diversity.

The finance department note, which aims to make amendments to the Farm Credit Canada Act, claims that agriculture is “predominantly older white men.”

Proposed changes to the Act mean the government will mandate “regular legislative reviews to ensure alignment with the needs of the agriculture and agri-food sector.”

“Farm operators are predominantly older white men and farm families tend to have higher average incomes compared to all Canadians,” the note reads.

“Traditionally underrepresented groups such as women, youth, Indigenous, LGBTQ, and Black and racialized entrepreneurs may particularly benefit from regular legislative reviews to better enable Farm Credit Canada to align its activities with their specific needs.”

The text includes no legal amendment, and the finance department did not say why it was brought forward or who asked for the changes.

Canadian census data shows that there are only 590,710 farmers and their families, a number that keeps going down. The average farmer is a 55-year-old male and predominantly Christian, either Catholic or from the United Church.

Data shows that 6.9 percent of farmers are immigrants, with about 3.7 percent being “from racialized groups.”

National census data from 2021 indicates that about four percent of Canadians say they are LGBT; however, those who are farmers is not stated.

Historically, most farmers in Canada are multi-generational descendants of Christian/Catholic Europeans who came to Canada in the mid to late 1800s, mainly from the United Kingdom, Ireland, Ukraine, Russia, Italy, Poland, the Netherlands, Germany, and France.

-

Alberta2 days ago

Alberta2 days agoATA Collect $72 Million in Dues But Couldn’t Pay Striking Teachers a Dime

-

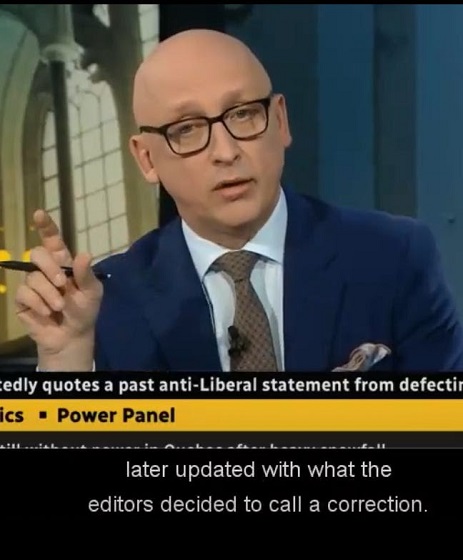

Media2 days ago

Media2 days agoBreaking News: the public actually expects journalists to determine the truth of statements they report

-

Artificial Intelligence2 days ago

Artificial Intelligence2 days agoAI seems fairly impressed by Pierre Poilievre’s ability to communicate

-

Business2 days ago

Business2 days agoCarney doubles down on NET ZERO

-

National2 days ago

National2 days agoWatchdog Demands Answers as MP Chris d’Entremont Crosses Floor

-

Business2 days ago

Business2 days agoLiberal’s green spending putting Canada on a road to ruin

-

Alberta16 hours ago

Alberta16 hours agoCalgary mayor should retain ‘blanket rezoning’ for sake of Calgarian families

-

Alberta14 hours ago

Alberta14 hours agoNational Crisis Approaching Due To The Carney Government’s Centrally Planned Green Economy