Fraser Institute

Powerful players count on corruption of ideal carbon tax

From the Fraser Institute

Prime Minister Trudeau recently whipped out the big guns of rhetoric and said the premiers of Alberta, Nova Scotia, New Brunswick, Newfoundland and Labrador, Ontario, Prince Edward Island and Saskatchewan are “misleading” Canadians and “not telling the truth” about the carbon tax. Also recently, a group of economists circulated a one-sided open letter extolling the virtues of carbon pricing.

Not to be left out, a few of us at the Fraser Institute recently debated whether the carbon tax should or could be reformed. Ross McKitrick and Elmira Aliakbari argued that while the existing carbon tax regime is badly marred by numerous greenhouse gas (GHG) regulations and mandates, is incompletely revenue-neutral, lacks uniformity across the economy and society, is set at an arbitrary price and so on, it remains repairable. “Of all the options,” they write, “it is widely acknowledged that a carbon tax allows the most flexibility and cost-effectiveness in the pursuit of society’s climate goals. The federal government has an opportunity to fix the shortcomings of its carbon tax plan and mitigate some of its associated economic costs.”

I argued, by contrast, that due to various incentives, Canada’s relevant decision-makers (politicians, regulators and big business) would all resist any reforms to the carbon tax that might bring it into the “ideal form” taught in schools of economics. To these groups, corruption of the “ideal carbon tax” is not a bug, it’s a feature.

Thus, governments face the constant allure of diverting tax revenues to favour one constituency over another. In the case of the carbon tax, Quebec is the big winner here. Atlantic Canada was also recently won by having its home heating oil exempted from carbon pricing (while out in the frosty plains, those using natural gas heating will feel the tax’s pinch).

Regulators, well, they live or die by the maintenance and growth of regulation. And when it comes to climate change, as McKitrick recently observed in a separate commentary, we’re not talking about only a few regulations. Canada has “clean fuel regulations, the oil-and-gas-sector emissions cap, the electricity sector coal phase-out, strict energy efficiency rules for new and existing buildings, new performance mandates for natural gas-fired generation plants, the regulatory blockade against liquified natural gas export facilities” and many more. All of these, he noted, are “boulders” blocking the implementation of an ideal carbon tax.

Finally, big business (such as Stellantis-LG, Volkswagen, Ford, Northvolt and others), which have been the recipients of subsidies for GHG-reducing activities, don’t want to see the driver of those subsidies (GHG regulations) repealed. And that’s only in the electric vehicle space. Governments also heavily subsidize wind and solar power businesses who get a 30 per cent investment tax credit though 2034. They also don’t want to see the underlying regulatory structures that justify the tax credit go away.

Clearly, all governments that tax GHG emissions divert some or all of the revenues raised into their general budgets, and none have removed regulations (or even reduced the rate of regulation) after implementing carbon-pricing. Yet many economists cling to the idea that carbon taxes are either fine as they are or can be reformed with modest tweaks. This is the great carbon-pricing will o’ the wisp, leading Canadian climate policy into a perilous swamp.

Author:

Business

Carney’s ‘major projects’ list no cause for celebration

From the Fraser Institute

By Alex Whalen

Early in his term, Prime Minister Mark Carney placed great emphasis on the need to think big and move quickly, to make Canada the “world’s leading energy superpower.” Recently, the government announced the first group of projects to be championed by its new Major Projects Office (MPO), which was also recently created to circumvent existing rules and regulations to speed up approvals. Unfortunately, the list of projects is decidedly underwhelming, which highlights the need for a true course correction when it comes to fixing Canada’s investment crisis.

According to the government, the purpose of the Major Projects Office is to fast-track “nation building” projects, with a focus on regulatory approvals and financing. Yet, of the first five projects referred to the MPO, regulatory approvals have largely already been secured and the projects were likely to proceed without any intervention or assistance from Ottawa.

For example, many of the regulatory approvals required for the Darlington Small Nuclear Reactor are already in place, and construction has already begun. The McIlvenna Bay copper mine in Saskatchewan is already half-built.

Other projects, such as LNG Phase 2 and the Red Chris Copper Mine, both in British Columbia, are expansions of existing facilities and are backed by industry-leading firms such as Shell and Rio Tinto, respectively. In general, these projects do not need government assistance or financing since they’re already largely approved.

A further six projects being referred to the MPO are at an earlier stage of development, and for the most part do not yet require regulatory approvals. Carney has referred this list—which includes projects ranging from carbon capture to high speed rail to offshore wind—to the MPO to be matched with government “business development teams” to “advance these concepts.”

These initiatives parallel the approach by the Trudeau government to rely on government-directed projects to foster economic growth, which failed miserably. The Trudeau government’s economic policies featured a much larger role for government in the economy, including a general increase in the size and scope of the federal government, as measured by increased spending and regulation. The result? Under Trudeau, annual growth of per-person GDP (an indicator of living standards) was just 0.3 per cent, the worst track record of any recent prime minister. Net business investment (foreign direct investment in Canada minus Canadian direct investment abroad) declined by $388 billion between 2015 and 2023 (the latest year of available data).

To set Canada on a course to reverse the investment crisis, Carney must abandon the notion of government-directed economic growth. Approving projects already largely approved, while sending other less-certain projects to government business development bureaucrats, will not fix Canada’s problem. Simply put, the government should craft policy to create the right conditions for investment and entrepreneurship for all firms in all sectors of the economy, not simply its chosen winners.

To attract the kinds of major projects that will meaningfully improve Canada’s investment crisis, the Carney government should eliminate a host of regulations and reform those that survive. As other analysts have noted, the list of regulatory hurdles in Canada is long. Canada’s total regulatory load has increased substantially over time and across a wide range of industries including energy, autos, child care, supermarkets and more.

Nowhere is this more evident than the energy industry, which is one of the largest drivers of investment in Canada. Federal Bills C-69 and C-48 (which govern the project approval process and ban oil tankers on the west cost, respectively), alongside the federal greenhouse gas emissions cap, net-zero policies, and a host of other regulation such as new fuel standard have significantly constrained this industry, which is vital to Canada’s economic success.

Canada’s regulatory explosion has effectively decimated the country’s investment climate. While Bill C-5 allows cabinet to circumvent these regulations, it places the cabinet, and more specifically the prime minister, in the position of picking winners and losers. Broad-based tax and regulatory reduction and reform would be a much more effective approach.

Canada continues to struggle amid an investment crisis that’s holding back economic growth and living standards. Our country needs bold changes to the policy environment conducive to attracting more investment. The government’s response to date, through Bill C-5 and the MPO, involves making the government more, not less, involved in the economy. The government should reverse course.

Business

Carney government’s housing GST rebate doesn’t go far enough

From the Fraser Institute

While there are many reasons for Canada’s housing affordability crisis, taxes on new homes—including the federal Goods and Services Tax (GST)—remain a major culprit. The Carney government is currently advancing legislation that would rebate GST on some new home purchases, but only for a narrow slice of the market, falling short of what’s needed to improve affordability. A broader GST rebate, extending to more homebuyers and more new homes, would cost Ottawa more, but it would likely deliver better results than the billions the Carney government plans to spend on other housing-related programs.

Today, Ottawa already offers some GST relief for new housing: partial rebates for homes under $450,000, full rebates for small-scale rental units (e.g. condos, townhomes, duplexes) valued under $450,000, and a full rebate for large-scale rental buildings (with no price cap). Rebates can lower costs for homebuyers and encourage more homebuilding. However, at today’s high prices, these rebate programs mean most new homes, and many small-scale rental projects, remain burdened by federal GST.

The Carney government’s new proposal would offer a full GST rebate for new homes—but only for first-time homebuyers purchasing a primary residence at under $1 million (a partial rebate would be available for homes up to $1.5 million). Any tax cut on new housing is welcome, but these criteria are arbitrary and will limit the policy’s impact.

Firstly, by restricting the new GST rebate to first-time buyers, the government ignores how housing markets work. If a retired couple downsizes into a new condo, or a growing family upgrades to a bigger house, they typically free up their previous home for someone else to buy or rent. It doesn’t matter whether the new home is purchased by a first-time buyer—all buyers can benefit when a new home appears on the market.

Secondly, by limiting the GST rebate to primary residences, the government won’t reduce the existing tax burden on rental properties—recall, many small-scale projects still face the full GST burden. Extending the rebate to include rental properties would reduce costs, unlock more construction and expand options for renters.

Thirdly, because the proposed GST rebate only applies in-full to homes under $1 million, it will have little effect in Canada’s most expensive cities. For example, in the first half of 2025, 31.8 per cent of new homes sold in Toronto and 27.4 per cent in Vancouver exceeded $1 million. Taxing these homes discourages homebuilding where it’s most needed.

Altogether, these restrictions mean the Carney proposal would help very few Canadians. According to the Parliamentary Budget Officer, of the 237,324 housing units projected to be completed in 2026—the first full year of the proposed GST rebate program—only 12,903 (5.4 per cent) would qualify for the new rebate. With such limited coverage, the policy is unlikely to spur much new housing or improve affordability.

The proposed GST rebate will cost a projected $390 million per year. However, if the Carney government went further and expanded the rebate to cover all new homes under $1.3 million, it would cost about $2 billion. That’s a big price tag, especially given Ottawa’s strained finances, but it would do much more to improve housing affordability.

Instead, the Carney government plans to spend $3 billion annually on “Build Canada Homes”—a misguided federal entity set to compete with private builders for scarce construction resources. The government has earmarked another $1.5 billion per year to subsidize municipal fees on new housing projects—an approach that merely shift costs from city halls to Ottawa. A broader GST rebate would likely be a more effective, lower-risk alternative to these programs.

Finally, it’s important to note that exempting new homes from GST is not a slam dunk. GST is one of the more efficient ways for the federal government to raise revenue, since it doesn’t discourage work or investment as much as other taxes. GST rebates mean the government may increase more economically harmful taxes to recoup the lost revenue. Still, tax relief is a better way to increase housing affordability than the Carney government’s expensive spending programs. In fact, the government should also reform other federal taxes on housing-related capital gains and rental income to help encourage more homebuilding.

The Carney government’s proposed GST rebate is a step in the right direction, but it’s too narrow to meaningfully boost supply or ease affordability. If Ottawa is prepared to spend billions on questionable programs such as “Build Canada Homes,” it should first consider a more expansive GST rebate on new home purchases, which would likely do more to help Canadian homebuyers.

-

Business2 days ago

Business2 days agoCarney Admits Deficit Will Top $61.9 Billion, Unveils New Housing Bureaucracy

-

Alberta1 day ago

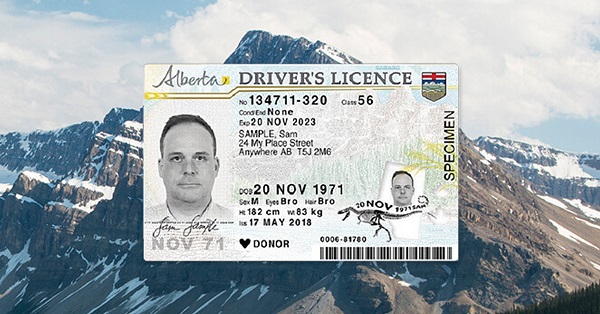

Alberta1 day agoAlberta first to add citizenship to licenses

-

Artificial Intelligence2 days ago

Artificial Intelligence2 days agoWhat are data centers and why do they matter?

-

Business1 day ago

Business1 day agoCarney government’s housing GST rebate doesn’t go far enough

-

Business1 day ago

Business1 day agoCarney’s Ethics Test: Opposition MP’s To Challenge Prime Minister’s Financial Ties to China

-

Alberta1 day ago

Alberta1 day agoBreak the Fences, Keep the Frontier

-

Daily Caller2 days ago

Daily Caller2 days agoTrump Admin To Push UN Overhaul Of ‘Haphazard And Chaotic’ Refugee Policy

-

Business1 day ago

Business1 day agoAttrition doesn’t go far enough, taxpayers need real cuts