Business

Plan to delay federal budget makes it harder for Canadians to track spending and debt

From the Fraser Institute

By Jake Fuss and Grady Munro

Although Parliament is set to return next week for the first time in more than five months, Canadians are being asked for even more patience when it comes to a federal budget.

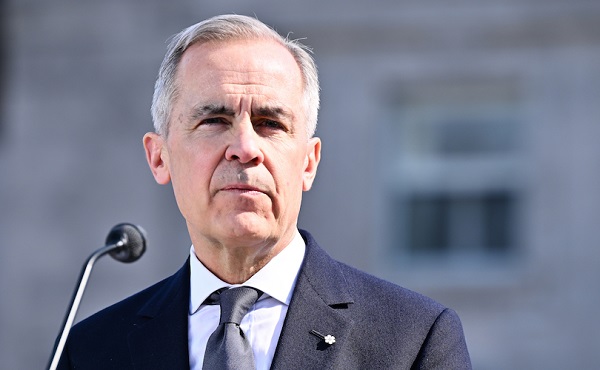

Last week, after conflicting messages from his finance minister, Prime Minister Mark Carney said his government will table a budget in the fall. While this is better than the government’s original plan to punt the budget into 2026, it’s still a long time to wait. Past federal governments have been able to quickly turn around a budget following an election. There’s no simply no reason why the government can’t deliver a budget within the next few months. Clearly, fiscal transparency and accountability are not high priorities for the Carney government.

While the federal government is not legislatively required to release a budget in the spring—spending is functionally approved in Parliament through periodic votes (the next vote is scheduled for June)—the budget provides a comprehensive and accessible outline of federal spending, taxing and borrowing plans now and for the coming years. In other words, an annual budget is a critically important financial and democratic document that informs Canadians on their government’s fiscal plan.

Budgets also help the public hold the government accountable to its campaign commitments. Without a budget, it’s virtually impossible for Canadians to know whether or not the government is actually staying true to its promises. For instance, the Carney government could run bigger deficits and accumulate more debt than promised, but Canadians would have little way of knowing. This only adds to the uncertainty around the government’s plan for certain key areas of policy—contradicting Prime Minister Carney’s promise of an “action-oriented” government that moves quickly.

The budget also allows parliamentarians to understand how the estimates and policies they vote on will impact the state of federal finances. For instance, the Carney government plans to cut income taxes, which will have a big impact on government finances. But without a timely budget, parliamentarians may not have the necessary information to make informed decisions on behalf of their constituents. Incidentally, the Trudeau government delayed the release of important fiscal documents to push off bad news until it garners less attention from the media and the public, and there’s reason to believe the Carney government is doing the same thing now.

The Liberal election platform—which currently provides the only indication of the new government’s fiscal plan—promises higher spending, larger deficits and more debt than the Trudeau government had planned in its last fiscal update. This flies in the face of Prime Minister Carney’s promise of a “very different approach” to fiscal policy. The Carney government also plans to split federal spending into two separate budgets: an operating budget and capital budget. This will further reduce government transparency by making it more difficult to identify the actual size of the deficit, while also giving the government leeway to get creative with its accounting.

Prime Minister Carney promised a new responsible approach to government finances. However, he’s off to a poor start on delivering this promise.

Business

Prime minister can make good on campaign promise by reforming Canada Health Act

From the Fraser Institute

While running for the job of leading the country, Prime Minister Carney promised to defend the Canada Health Act (CHA) and build a health-care system Canadians can be proud of. Unfortunately, to have any hope of accomplishing the latter promise, he must break the former and reform the CHA.

As long as Ottawa upholds and maintains the CHA in its current form, Canadians will not have a timely, accessible and high-quality universal health-care system they can be proud of.

Consider for a moment the remarkably poor state of health care in Canada today. According to international comparisons of universal health-care systems, Canadians endure some of the lowest access to physicians, medical technologies and hospital beds in the developed world, and wait in queues for health care that routinely rank among the longest in the developed world. This is all happening despite Canadians paying for one of the developed world’s most expensive universal-access health-care systems.

None of this is new. Canada’s poor ranking in the availability of services—despite high spending—reaches back at least two decades. And wait times for health care have nearly tripled since the early 1990s. Back then, in 1993, Canadians could expect to wait 9.3 weeks for medical treatment after GP referral compared to 30 weeks in 2024.

But fortunately, we can find the solutions to our health-care woes in other countries such as Germany, Switzerland, the Netherlands and Australia, which all provide more timely access to quality universal care. Every one of these countries requires patient cost-sharing for physician and hospital services, and allows private competition in the delivery of universally accessible services with money following patients to hospitals and surgical clinics. And all these countries allow private purchases of health care, as this reduces the burden on the publicly-funded system and creates a valuable pressure valve for it.

And this brings us back to the CHA, which contains the federal government’s requirements for provincial policymaking. To receive their full federal cash transfers for health care from Ottawa (totalling nearly $55 billion in 2025/26) provinces must abide by CHA rules and regulations.

And therein lies the rub—the CHA expressly disallows requiring patients to share the cost of treatment while the CHA’s often vaguely defined terms and conditions have been used by federal governments to discourage a larger role for the private sector in the delivery of health-care services.

Clearly, it’s time for Ottawa’s approach to reflect a more contemporary understanding of how to structure a truly world-class universal health-care system.

Prime Minister Carney can begin by learning from the federal government’s own welfare reforms in the 1990s, which reduced federal transfers and allowed provinces more flexibility with policymaking. The resulting period of provincial policy innovation reduced welfare dependency and government spending on social assistance (i.e. savings for taxpayers). When Ottawa stepped back and allowed the provinces to vary policy to their unique circumstances, Canadians got improved outcomes for fewer dollars.

We need that same approach for health care today, and it begins with the federal government reforming the CHA to expressly allow provinces the ability to explore alternate policy approaches, while maintaining the foundational principles of universality.

Next, the Carney government should either hold cash transfers for health care constant (in nominal terms), reduce them or eliminate them entirely with a concordant reduction in federal taxes. By reducing (or eliminating) the pool of cash tied to the strings of the CHA, provinces would have greater freedom to pursue reform policies they consider to be in the best interests of their residents without federal intervention.

After more than four decades of effectively mandating failing health policy, it’s high time to remove ambiguity and minimize uncertainty—and the potential for politically motivated interpretations—in the CHA. If Prime Minister Carney wants Canadians to finally have a world-class health-care system then can be proud of, he should allow the provinces to choose their own set of universal health-care policies. The first step is to fix, rather than defend, the 40-year-old legislation holding the provinces back.

Alberta

COWBOY UP! Pierre Poilievre Promises to Fight for Oil and Gas, a Stronger Military and the Interests of Western Canada

Fr0m Energy Now

As Calgarians take a break from the incessant news of tariff threat deadlines and global economic challenges to celebrate the annual Stampede, Conservative party leader Pierre Poilievre gave them even more to celebrate.

Poilievre returned to Calgary, his hometown, to outline his plan to amplify the legitimate demands of Western Canada and not only fight for oil and gas, but also fight for the interests of farmers, for low taxes, for decentralization, a stronger military and a smaller federal government.

Speaking at the annual Conservative party BBQ at Heritage Park in Calgary (a place Poilievre often visited on school trips growing up), he was reminded of the challenges his family experienced during the years when Trudeau senior was Prime Minister and the disastrous effect of his economic policies.

“I was born in ’79,” Poilievre said. “and only a few years later, Pierre Elliott Trudeau would attack our province with the National Energy Program. There are still a few that remember it. At the same time, he hammered the entire country with money printing deficits that gave us the worst inflation and interest rates in our history. Our family actually lost our home, and we had to scrimp and save and get help from extended family in order to get our little place in Shaughnessy, which my mother still lives in.”

This very personal story resonated with many in the crowd who are now experiencing an affordability crisis that leaves families struggling and young adults unable to afford their first house or condo. Poilievre said that the experience was a powerful motivator for his entry into politics. He wasted no time in proposing a solution – build alliances with other provinces with mutual interests, and he emphasized the importance of advocating for provincial needs.

“Let’s build an alliance with British Columbians who want to ship liquefied natural gas out of the Pacific Coast to Asia, and with Saskatchewanians, Newfoundlanders and Labradorians who want to develop their oil and gas and aren’t interested in having anyone in Ottawa cap how much they can produce. Let’s build alliances with Manitobans who want to ship oil in the port of Churchill… with Quebec and other provinces that want to decentralize our country and get Ottawa out of our business so that provinces and people can make their own decisions.”

Poilievre heavily criticized the federal government’s spending and policies of the last decade, including the increase in government costs, and he highlighted the negative impact of those policies on economic stability and warned of the dangers of high inflation and debt. He advocated strongly for a free-market economy, advocating for less government intervention, where businesses compete to impress customers rather than impress politicians. He also addressed the decade-long practice of blocking and then subsidizing certain industries. Poilievre referred to a famous quote from Ronald Reagan as the modus operandi of the current federal regime.

“The Government’s view of the economy could be summed up in a few short phrases. If anything moves, tax it. If it keeps moving, regulate it. And if it stops moving, subsidize it.”

The practice of blocking and then subsidizing is merely a ploy to grab power, according to Poilievre, making industry far too reliant on government control.

“By blocking you from doing something and then making you ask the government to help you do it, it makes you reliant. It puts them at the center of all power, and that is their mission…a full government takeover of our economy. There’s a core difference between an economy controlled by the government and one controlled by the free market. Businesses have to clamour to please politicians and bureaucrats. In a free market (which we favour), businesses clamour to impress customers. The idea is to put people in charge of their economic lives by letting them have free exchange of work for wages, product for payment and investment for interest.”

Poilievre also said he plans to oppose any ban on gas-powered vehicles, saying, “You should be in the driver’s seat and have the freedom to decide.” This is in reference to the Trudeau-era plan to ban the sale of gas-powered cars by 2035, which the Carney government has said they have no intention to change, even though automakers are indicating that the targets cannot be met. He also intends to oppose the Industrial Carbon tax, Bill C-69 the Impact Assessment Act, Bill C-48 the Oil tanker ban, the proposed emissions cap which will cap energy production, as well as the single-use plastics ban and Bill C-11, also known as the Online Streaming Act and the proposed “Online Harms Act,” also known as Bill C-63. Poilievre closed with rallying thoughts that had a distinctive Western flavour.

“Fighting for these values is never easy. Change, as we’ve seen, is not easy. Nothing worth doing is easy… Making Alberta was hard. Making Canada, the country we love, was even harder. But we don’t back down, and we don’t run away. When things get hard, we dust ourselves off, we get back in the saddle, and we gallop forward to the fight.”

Cowboy up, Mr. Poilievre.

Maureen McCall is an energy professional who writes on issues affecting the energy industry.

-

Crime2 days ago

Crime2 days agoNews Jeffrey Epstein did not have a client list, nor did he kill himself, Trump DOJ, FBI claim

-

COVID-192 days ago

COVID-192 days agoFDA requires new warning on mRNA COVID shots due to heart damage in young men

-

Bruce Dowbiggin1 day ago

Bruce Dowbiggin1 day agoEau Canada! Join Us In An Inclusive New National Anthem

-

Indigenous1 day ago

Indigenous1 day agoInternal emails show Canadian gov’t doubted ‘mass graves’ narrative but went along with it

-

Business1 day ago

Business1 day agoCarney’s new agenda faces old Canadian problems

-

Crime1 day ago

Crime1 day agoEyebrows Raise as Karoline Leavitt Answers Tough Questions About Epstein

-

Alberta1 day ago

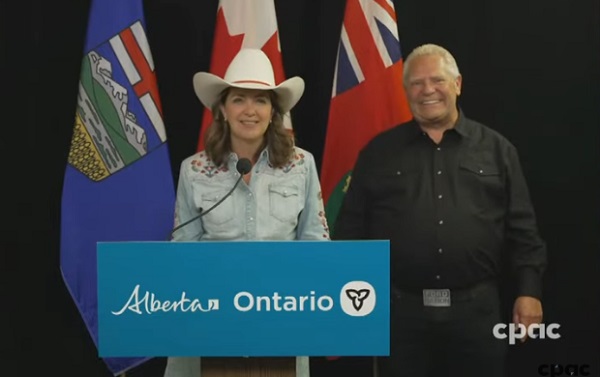

Alberta1 day agoAlberta and Ontario sign agreements to drive oil and gas pipelines, energy corridors, and repeal investment blocking federal policies

-

Alberta1 day ago

Alberta1 day agoCOWBOY UP! Pierre Poilievre Promises to Fight for Oil and Gas, a Stronger Military and the Interests of Western Canada