Alberta

Parents in every province—not just Alberta—deserve as much school choice as possible

From the Fraser Institute

Not only does Alberta have a fully funded separate (Catholic) school system, it also provides between 60 and 70 per cent operational funding to accredited independent schools. In addition, Alberta is the only province in Canada to allow fully funded charter schools. And Alberta subsidizes homeschooling parents.

This week, the Smith government in Alberta will likely pass Bill 27, which requires schools to get signed permission from parents or guardians prior to any lessons on human sexuality, gender identity or sexual orientation.

It’s a sensible move. The government is proactively ensuring that students are in these classes because their parents want them there. Given the sensitive nature of these topics, for everyone’s sake it makes sense to ensure parental buy-in at the outset.

Unfortunately, many school trustees don’t agree. A recent resolution passed by the Alberta School Boards Association (ASBA) calls on the Smith government to maintain the status quo where parents are assumed to have opted in to these lessons unless they contact the school and opt their children out. Apparently, the ASBA thinks parents can’t be trusted to make the right decisions for their children on this issue.

This ASBA resolution is, in fact, a good example of the reflexive opposition by government school trustees to parental rights. They don’t want parents to take control of their children’s education, especially in sensitive areas. Fortunately, the Alberta government rebuffed ASBA’s demands and this attempt to abolish Bill 27 will likely fall on deaf ears.

However, there’s an even better safeguard available to Alberta parents—school choice. Out of all Canadian provinces, Alberta offers the most school choice. Not only does Alberta have a fully funded separate (Catholic) school system, it also provides between 60 and 70 per cent operational funding to accredited independent schools. In addition, Alberta is the only province in Canada to allow fully funded charter schools. And Alberta subsidizes homeschooling parents. Simply put, parents who are dissatisfied with the government school system have plenty of options—more than parents in any other province. This means Alberta parents can vote with their feet.

Things are quite different in other parts of the country. For example, Ontario and the four Atlantic provinces do not allow any provincial funding to follow students to independent schools. In other words, parents in these provinces who choose an independent school must pay the full cost themselves—while still paying taxes that fund government schools. And no province other than Alberta allows charter schools.

This is why it’s important to give parents as much school choice as possible. Given the tendency of government school boards to remove choices from parents, it’s important that all parents, including those with limited means, have other options available for their children.

Imagine if the owners of a large grocery store tried to impose their dietary preferences by removing all meat products and telling customers that the only way they could purchase meat is to make a special order. What would happen in that scenario? It depends on what other options are available. If this was the only grocery store in the community, customers would have no choice but to comply. However, if there were other stores, customers could simply shop elsewhere. Choice empowers people and limits the ability of one company to limit the choices of people who live in the community.

Think of government school boards as a monopolistic service provider like a grocery store. They often do everything possible to prevent parents from going anywhere else for their children’s education. Trusting them to do what’s best for parents and children is like assuming that the owners of a grocery store would always put the interests of their customers first and not their own self-interest. Monopolies are bad in the private sector and they’re bad in the education sector, too.

Clearly, it makes sense to require schools to get proactive consent from parents. This ensures maximum buy-in from parents for whatever courses their children take. It’s also important that Alberta remains a bastion of school choice. By making it easier for parents to choose from a variety of education options, Alberta puts power in the hands of parents, exactly where it belongs. Parents in other provinces should want that same power, too.

Alberta

The Canadian Energy Centre’s biggest stories of 2025

From the Canadian Energy Centre

Canada’s energy landscape changed significantly in 2025, with mounting U.S. economic pressures reinforcing the central role oil and gas can play in safeguarding the country’s independence.

Here are the Canadian Energy Centre’s top five most-viewed stories of the year.

5. Alberta’s massive oil and gas reserves keep growing – here’s why

The Northern Lights, aurora borealis, make an appearance over pumpjacks near Cremona, Alta., Thursday, Oct. 10, 2024. CP Images photo

Analysis commissioned this spring by the Alberta Energy Regulator increased the province’s natural gas reserves by more than 400 per cent, bumping Canada into the global top 10.

Even with record production, Alberta’s oil reserves – already fourth in the world – also increased by seven billion barrels.

According to McDaniel & Associates, which conducted the report, these reserves are likely to become increasingly important as global demand continues to rise and there is limited production growth from other sources, including the United States.

4. Canada’s pipeline builders ready to get to work

Canada could be on the cusp of a “golden age” for building major energy projects, said Kevin O’Donnell, executive director of the Mississauga, Ont.-based Pipe Line Contractors Association of Canada.

That eagerness is shared by the Edmonton-based Progressive Contractors Association of Canada (PCA), which launched a “Let’s Get Building” advocacy campaign urging all Canadian politicians to focus on getting major projects built.

“The sooner these nation-building projects get underway, the sooner Canadians reap the rewards through new trading partnerships, good jobs and a more stable economy,” said PCA chief executive Paul de Jong.

3. New Canadian oil and gas pipelines a $38 billion missed opportunity, says Montreal Economic Institute

Steel pipe in storage for the Trans Mountain Pipeline expansion in 2022. Photo courtesy Trans Mountain Corporation

In March, a report by the Montreal Economic Institute (MEI) underscored the economic opportunity of Canada building new pipeline export capacity.

MEI found that if the proposed Energy East and Gazoduq/GNL Quebec projects had been built, Canada would have been able to export $38 billion worth of oil and gas to non-U.S. destinations in 2024.

“We would be able to have more prosperity for Canada, more revenue for governments because they collect royalties that go to government programs,” said MEI senior policy analyst Gabriel Giguère.

“I believe everybody’s winning with these kinds of infrastructure projects.”

2. Keyera ‘Canadianizes’ natural gas liquids with $5.15 billion acquisition

Keyera Corp.’s natural gas liquids facilities in Fort Saskatchewan, Alta. Photo courtesy Keyera Corp.

In June, Keyera Corp. announced a $5.15 billion deal to acquire the majority of Plains American Pipelines LLP’s Canadian natural gas liquids (NGL) business, creating a cross-Canada NGL corridor that includes a storage hub in Sarnia, Ontario.

The acquisition will connect NGLs from the growing Montney and Duvernay plays in Alberta and B.C. to markets in central Canada and the eastern U.S. seaboard.

“Having a Canadian source for natural gas would be our preference,” said Sarnia mayor Mike Bradley.

“We see Keyera’s acquisition as strengthening our region as an energy hub.”

1. Explained: Why Canadian oil is so important to the United States

Enbridge’s Cheecham Terminal near Fort McMurray, Alberta is a key oil storage hub that moves light and heavy crude along the Enbridge network. Photo courtesy Enbridge

The United States has become the world’s largest oil producer, but its reliance on oil imports from Canada has never been higher.

Many refineries in the United States are specifically designed to process heavy oil, primarily in the U.S. Midwest and U.S. Gulf Coast.

According to the Alberta Petroleum Marketing Commission, the top five U.S. refineries running the most Alberta crude are:

- Marathon Petroleum, Robinson, Illinois (100% Alberta crude)

- Exxon Mobil, Joliet, Illinois (96% Alberta crude)

- CHS Inc., Laurel, Montana (95% Alberta crude)

- Phillips 66, Billings, Montana (92% Alberta crude)

- Citgo, Lemont, Illinois (78% Alberta crude)

Alberta

Alberta Next Panel calls for less Ottawa—and it could pay off

From the Fraser Institute

By Tegan Hill

Last Friday, less than a week before Christmas, the Smith government quietly released the final report from its Alberta Next Panel, which assessed Alberta’s role in Canada. Among other things, the panel recommends that the federal government transfer some of its tax revenue to provincial governments so they can assume more control over the delivery of provincial services. Based on Canada’s experience in the 1990s, this plan could deliver real benefits for Albertans and all Canadians.

Federations such as Canada typically work best when governments stick to their constitutional lanes. Indeed, one of the benefits of being a federalist country is that different levels of government assume responsibility for programs they’re best suited to deliver. For example, it’s logical that the federal government handle national defence, while provincial governments are typically best positioned to understand and address the unique health-care and education needs of their citizens.

But there’s currently a mismatch between the share of taxes the provinces collect and the cost of delivering provincial responsibilities (e.g. health care, education, childcare, and social services). As such, Ottawa uses transfers—including the Canada Health Transfer (CHT)—to financially support the provinces in their areas of responsibility. But these funds come with conditions.

Consider health care. To receive CHT payments from Ottawa, provinces must abide by the Canada Health Act, which effectively prevents the provinces from experimenting with new ways of delivering and financing health care—including policies that are successful in other universal health-care countries. Given Canada’s health-care system is one of the developed world’s most expensive universal systems, yet Canadians face some of the longest wait times for physicians and worst access to medical technology (e.g. MRIs) and hospital beds, these restrictions limit badly needed innovation and hurt patients.

To give the provinces more flexibility, the Alberta Next Panel suggests the federal government shift tax points (and transfer GST) to the provinces to better align provincial revenues with provincial responsibilities while eliminating “strings” attached to such federal transfers. In other words, Ottawa would transfer a portion of its tax revenues from the federal income tax and federal sales tax to the provincial government so they have funds to experiment with what works best for their citizens, without conditions on how that money can be used.

According to the Alberta Next Panel poll, at least in Alberta, a majority of citizens support this type of provincial autonomy in delivering provincial programs—and again, it’s paid off before.

In the 1990s, amid a fiscal crisis (greater in scale, but not dissimilar to the one Ottawa faces today), the federal government reduced welfare and social assistance transfers to the provinces while simultaneously removing most of the “strings” attached to these dollars. These reforms allowed the provinces to introduce work incentives, for example, which would have previously triggered a reduction in federal transfers. The change to federal transfers sparked a wave of reforms as the provinces experimented with new ways to improve their welfare programs, and ultimately led to significant innovation that reduced welfare dependency from a high of 3.1 million in 1994 to a low of 1.6 million in 2008, while also reducing government spending on social assistance.

The Smith government’s Alberta Next Panel wants the federal government to transfer some of its tax revenues to the provinces and reduce restrictions on provincial program delivery. As Canada’s experience in the 1990s shows, this could spur real innovation that ultimately improves services for Albertans and all Canadians.

-

Business10 hours ago

Business10 hours agoICYMI: Largest fraud in US history? Independent Journalist visits numerous daycare centres with no children, revealing massive scam

-

Daily Caller2 days ago

Daily Caller2 days agoWhile Western Nations Cling to Energy Transition, Pragmatic Nations Produce Energy and Wealth

-

Daily Caller2 days ago

Daily Caller2 days agoUS Halts Construction of Five Offshore Wind Projects Due To National Security

-

Alberta2 days ago

Alberta2 days agoAlberta Next Panel calls for less Ottawa—and it could pay off

-

Bruce Dowbiggin1 day ago

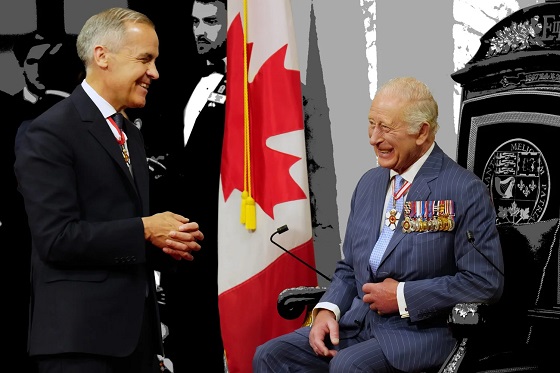

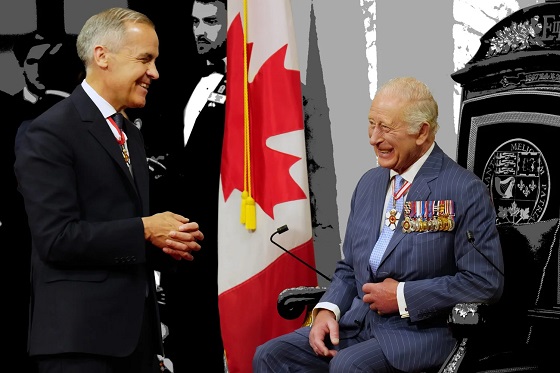

Bruce Dowbiggin1 day agoBe Careful What You Wish For In 2026: Mark Carney With A Majority

-

Energy2 days ago

Energy2 days agoWhy Japan wants Western Canadian LNG

-

Business2 days ago

Business2 days agoMainstream media missing in action as YouTuber blows lid off massive taxpayer fraud

-

Business2 days ago

Business2 days agoLand use will be British Columbia’s biggest issue in 2026